Best Insurance In Texas

In the vast landscape of insurance providers in Texas, the quest for the best coverage can be a daunting task. With a myriad of options available, from health and life insurance to auto and home policies, it's crucial to navigate the market wisely. This guide aims to provide an in-depth analysis of the top insurance companies in Texas, offering insights into their policies, customer service, and overall performance to help you make an informed decision.

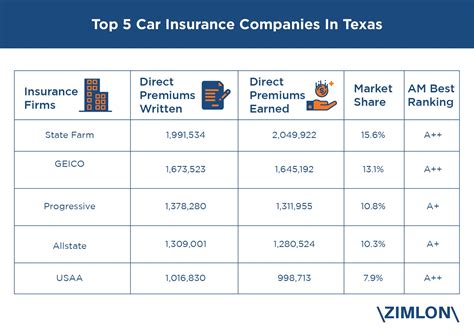

Unveiling the Top Insurance Companies in Texas

Texas, with its diverse population and unique geographical challenges, presents a varied insurance landscape. From established national providers to regional specialists, the market is competitive and consumer-centric. Let’s delve into the key players, their offerings, and what sets them apart.

State Farm: A Trusted Name in Texas Insurance

State Farm is a stalwart in the Texas insurance scene, offering a comprehensive suite of policies tailored to the unique needs of the Lone Star State. Their auto insurance plans are particularly notable, providing extensive coverage options and competitive rates. State Farm also excels in home insurance, offering customizable plans that cater to the state’s diverse housing landscape, from coastal properties to rural ranches.

State Farm's customer service is a standout feature. With a network of local agents across Texas, they provide personalized service and quick response times. Their online and mobile platforms are user-friendly, offering convenient policy management and claims filing. Additionally, State Farm's Good Neighbor image is reinforced by their community involvement and sponsorship of local events and charities.

| Insurance Type | State Farm's Coverage Highlights |

|---|---|

| Auto Insurance | Comprehensive coverage, accident forgiveness, and discounted rates for safe driving. |

| Home Insurance | Flexible policies for various property types, including unique dwellings and high-value homes. |

| Life Insurance | Term and permanent life insurance plans with optional riders for additional coverage. |

| Health Insurance | Individual and family health plans with a wide range of network providers. |

Allstate: Empowering Texans with Insurance Solutions

Allstate is another powerhouse in the Texas insurance market, known for its innovative approach to coverage and customer engagement. Their auto insurance plans are a key strength, offering a range of discounts for safe driving and loyalty, as well as specialized coverage for unique driving needs.

Allstate's home insurance policies are equally impressive, providing coverage for a wide range of property types and offering additional protection against Texas-specific risks like hail and wind damage. Their Claim Satisfaction Guarantee ensures a hassle-free claims process, adding to their appeal among Texas homeowners.

Allstate's Digital Locker feature is a unique offering, allowing policyholders to digitally store important documents and photos of their belongings, aiding in the claims process and providing peace of mind.

| Insurance Type | Allstate's Key Features |

|---|---|

| Auto Insurance | Customizable coverage, accident forgiveness, and safe driving rewards. |

| Home Insurance | Comprehensive coverage for various risks, including Texas-specific hazards, with a claims satisfaction guarantee. |

| Life Insurance | Term and permanent life insurance with living benefits and riders for additional protection. |

| Health Insurance | Flexible health plans with a focus on wellness and preventative care, offering various network options. |

USAA: Serving Texas Military Families

USAA is a unique player in the Texas insurance market, dedicated to serving military families and veterans. With a strong focus on auto insurance, USAA offers competitive rates and comprehensive coverage tailored to the unique needs of military personnel, including deployment discounts and specialized roadside assistance.

Their home insurance policies are equally robust, providing coverage for military housing and offering additional protection against Texas-specific risks. USAA's commitment to the military community extends beyond insurance, with various financial and lifestyle benefits for members.

USAA's Member Network is a standout feature, allowing policyholders to share experiences and provide feedback, enhancing the overall insurance experience. Their digital platforms are highly rated for ease of use and functionality, offering a seamless experience for policy management and claims filing.

| Insurance Type | USAA's Key Benefits |

|---|---|

| Auto Insurance | Competitive rates, comprehensive coverage, and specialized benefits for military personnel. |

| Home Insurance | Customizable policies for military housing, with additional coverage for Texas-specific risks. |

| Life Insurance | Term and whole life insurance with living benefits and riders, offering flexible payment options. |

| Health Insurance | Comprehensive health plans with a focus on military families, including TRICARE supplements. |

Geico: The Gecko’s Texas Presence

Geico, with its iconic mascot, has made a significant impact in the Texas insurance market. Their focus on auto insurance is a key strength, offering competitive rates and a range of discounts for safe driving and policy bundling. Geico’s Emergency Deployment Coverage is a unique offering for military members, providing additional protection during deployments.

In home insurance, Geico offers customizable policies that cater to Texas homeowners, including coverage for unique risks like hurricanes and wildfires. Their online platform is particularly user-friendly, allowing for quick policy quotes and management, and a streamlined claims process.

Geico's Mobile App is a standout feature, offering policyholders convenient access to their accounts, digital ID cards, and a range of tools for managing their insurance needs on the go.

| Insurance Type | Geico's Key Advantages |

|---|---|

| Auto Insurance | Competitive rates, a range of discounts, and specialized coverage for military deployments. |

| Home Insurance | Customizable policies for Texas homes, including coverage for unique risks, with a user-friendly digital platform. |

| Life Insurance | Term and whole life insurance with living benefits, offering flexible payment options and accelerated death benefit riders. |

| Health Insurance | Individual and family health plans with a focus on affordability and a wide range of network providers. |

Texas Farm Bureau Insurance: A Local Favorite

Texas Farm Bureau Insurance is a prominent player in the Texas insurance market, particularly among rural communities. Their auto insurance plans are a key strength, offering comprehensive coverage and competitive rates, with a focus on the unique needs of rural drivers.

In home insurance, Texas Farm Bureau provides specialized coverage for rural properties, including farms and ranches. Their policies are tailored to Texas-specific risks, offering additional protection against hail, wind, and wildfire damage. The company's commitment to the local community is evident in its sponsorship of various agricultural events and initiatives.

Texas Farm Bureau's Member Benefits program is a unique offering, providing policyholders with discounts and perks at various local businesses, adding value to their insurance experience.

| Insurance Type | Texas Farm Bureau's Unique Features |

|---|---|

| Auto Insurance | Comprehensive coverage, competitive rates, and specialized policies for rural drivers. |

| Home Insurance | Customizable policies for rural properties, including farms and ranches, with additional coverage for Texas-specific risks. |

| Life Insurance | Term and whole life insurance with living benefits, offering flexible payment options and a range of riders. |

| Health Insurance | Individual and family health plans with a focus on rural communities, offering various network options. |

What are the key factors to consider when choosing an insurance company in Texas?

+

When selecting an insurance company in Texas, consider the following factors: Coverage Options - Ensure the provider offers comprehensive coverage for your specific needs. Customer Service - Look for companies with a strong reputation for responsive and helpful customer service. Policy Cost - Compare rates to find competitive pricing without sacrificing coverage. Claims Process - Research the claims process and reputation for timely and fair settlements. Company Reputation - Check for financial stability and customer satisfaction ratings.

Are there any insurance companies that specialize in Texas-specific risks like hurricanes or wildfires?

+

Yes, several insurance companies in Texas offer specialized coverage for Texas-specific risks like hurricanes and wildfires. These companies typically provide additional protection and resources to help policyholders prepare for and recover from such events. It’s important to compare these policies to ensure they meet your specific needs and budget.

How can I get the best rates on insurance in Texas?

+

To get the best rates on insurance in Texas, consider the following strategies: Shop Around - Compare quotes from multiple providers to find the most competitive rates. Bundle Policies - Many companies offer discounts when you bundle multiple insurance types (e.g., auto and home). Safe Practices - Maintain a good driving record and take measures to protect your home, which can lead to discounts. Review Regularly - Periodically review your policies to ensure you’re not overinsured or paying for unnecessary coverage.

What sets State Farm apart from other insurance companies in Texas?

+

State Farm is distinguished in the Texas insurance market for its comprehensive suite of policies tailored to the state’s unique needs. They offer extensive coverage options, competitive rates, and a strong network of local agents who provide personalized service. State Farm’s commitment to community involvement and sponsorship of local events also sets them apart.

Is it better to buy insurance from a national provider or a local company in Texas?

+

The choice between a national provider and a local company in Texas depends on your specific needs and preferences. National providers often offer a wider range of coverage options and may have more resources for complex claims. Local companies, on the other hand, can provide more personalized service and may have a deeper understanding of Texas-specific risks and regulations. It’s recommended to compare both types of providers to find the best fit for your situation.