Car Insurances In Texas

Texas, the second-most populous state in the United States, is known for its diverse landscape, from bustling cities like Houston and Dallas to the wide-open spaces of the Texas Hill Country and the Rio Grande Valley. With a vast network of highways and interstates, cars are a primary mode of transportation for many Texans, making car insurance an essential aspect of daily life. Understanding the unique characteristics of car insurance in Texas is crucial for residents and visitors alike.

A Comprehensive Overview of Car Insurance in Texas

Car insurance in Texas operates within a specific regulatory framework that shapes the coverage options and requirements for policyholders. Texas follows a tort system, which means that if you are at fault in an accident, your liability coverage will be responsible for paying damages to the other party. This system differs from no-fault states, where each driver’s insurance covers their own losses regardless of who is at fault.

Mandatory Minimum Coverage

Texas has set minimum liability insurance requirements that all drivers must meet to legally operate a vehicle on public roads. These minimums are as follows:

- Bodily Injury Liability: 30,000 per person, 60,000 per accident

- Property Damage Liability: $25,000

These limits are relatively low compared to many other states, which is why many insurance experts recommend purchasing higher coverage limits to adequately protect yourself financially in the event of an accident.

Optional Coverage Types

In addition to the mandatory liability coverage, Texas drivers have the option to purchase several other types of car insurance coverage to enhance their protection:

- Collision Coverage: Pays for damage to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: Covers non-collision-related incidents like theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you’re involved in an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Medical Payments Coverage: Similar to PIP, this coverage pays for medical expenses for you and your passengers after an accident.

Unique Considerations for Texas Drivers

Texas has a few unique regulations and factors that impact car insurance:

- TexasSure Program: This program is designed to ensure that drivers are carrying valid insurance. Random license plate number checks are conducted, and if a vehicle is found to be uninsured, the registered owner may face penalties.

- High-Risk Drivers: Texas maintains a list of non-standard or high-risk drivers. If you are considered high-risk due to multiple violations or accidents, you may be required to obtain an SR-22 certificate, which proves that you have the minimum liability coverage.

- Natural Disasters: Texas is prone to various natural disasters like hurricanes, tornadoes, and hail storms. Comprehensive coverage is especially important to protect against these events.

Factors Influencing Car Insurance Rates in Texas

Car insurance rates in Texas can vary significantly depending on several factors. Understanding these influences can help drivers make informed decisions about their coverage and potentially save money.

Location-Based Rates

Insurance rates can differ greatly between cities and regions within Texas. Urban areas like Houston, Dallas, and San Antonio often have higher rates due to increased traffic, congestion, and the higher likelihood of accidents and claims. On the other hand, more rural areas may have lower rates, but they might also have fewer coverage options and providers.

| City | Average Annual Premium |

|---|---|

| Houston | $1,500 |

| Dallas | $1,450 |

| San Antonio | $1,380 |

| Austin | $1,350 |

| El Paso | $1,250 |

Driver Profile and History

Your personal driving history and demographic information play a significant role in determining your insurance rates. Factors such as age, gender, credit score, and driving record (including tickets, accidents, and claims) can all impact your premiums. Younger drivers, especially males under 25, often face the highest rates due to their higher perceived risk.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can also affect your insurance rates. Sports cars and luxury vehicles typically have higher premiums due to their cost to repair or replace. Additionally, the purpose for which you use your vehicle (commuting, pleasure, business, etc.) can influence rates. Those who drive frequently or for business purposes may pay more.

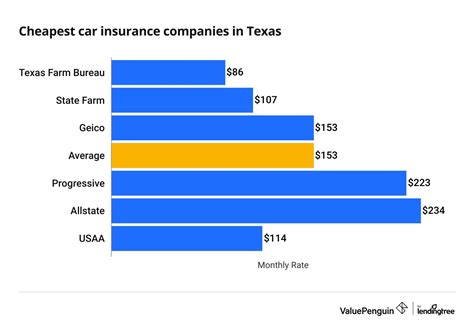

Insurance Company and Discounts

The insurance company you choose can make a significant difference in your rates. Texas has numerous insurance providers, both national and local, offering a wide range of coverage options and price points. Shopping around and comparing quotes is essential to finding the best deal. Additionally, many companies offer discounts for things like safe driving records, multiple policy bundles, and safety features in your vehicle.

Tips for Saving on Car Insurance in Texas

Navigating the complex world of car insurance can be challenging, but there are strategies to help Texas drivers save money on their policies while maintaining adequate coverage.

Shop Around and Compare Quotes

Due to the competitive nature of the insurance market in Texas, rates can vary significantly between providers. Using online quote comparison tools or working with an insurance broker can help you quickly assess different options and find the best deal for your needs.

Understand Your Coverage Needs

Take the time to assess your personal risk profile and determine the appropriate level of coverage. While the state minimums are a starting point, many drivers benefit from higher liability limits and additional coverage types to protect against specific risks they may face.

Take Advantage of Discounts

Many insurance companies offer a variety of discounts to policyholders. Common discounts include:

- Multi-Policy Discounts: Bundling your car insurance with other policies like home or renters insurance can lead to significant savings.

- Safe Driver Discounts: Maintaining a clean driving record for a certain period often qualifies you for reduced rates.

- Good Student Discounts: Full-time students under 25 with a certain GPA may be eligible for lower premiums.

- Safety Feature Discounts: Vehicles equipped with anti-theft devices, airbags, and other safety features may qualify for discounts.

Consider Usage-Based Insurance (UBI)

Some insurance providers offer UBI programs that use telematics devices to monitor your driving habits. These programs can provide discounts for safe driving behaviors, and they may be a good option for those who drive infrequently or have a proven track record of safe driving.

Future Trends and Innovations in Texas Car Insurance

The car insurance landscape in Texas is continually evolving, influenced by technological advancements, changing consumer preferences, and shifts in the regulatory environment. Here are some key trends and innovations to watch:

Telematics and Usage-Based Insurance

UBI programs are gaining traction, allowing insurance companies to offer personalized rates based on an individual’s actual driving behavior. This technology has the potential to benefit safe drivers by offering lower premiums.

Increased Automation and Digital Services

Insurance companies are investing in digital platforms and automation to streamline the insurance process. This includes online quote comparisons, digital policy management, and faster claims processing. These innovations enhance convenience and efficiency for policyholders.

Expansion of Alternative Risk Transfer (ART) Options

ART options like captive insurance and risk retention groups are becoming more popular for businesses with vehicle fleets. These alternatives allow companies to customize their insurance coverage and potentially reduce costs.

Integration of Connected Car Technology

As more vehicles become connected, insurance companies are exploring ways to leverage this data. Connected car technology could provide real-time insights into driving behavior, vehicle performance, and maintenance needs, potentially influencing insurance rates and coverage options.

Focus on Preventative Measures and Driver Education

Insurance companies and regulatory bodies are increasingly prioritizing preventative measures to reduce accidents and claims. This includes promoting driver education programs, incentivizing the use of advanced driver-assistance systems (ADAS), and encouraging safer driving behaviors through discounts and rewards.

What is the average cost of car insurance in Texas?

+The average cost of car insurance in Texas varies depending on several factors, including location, driving history, and the coverage chosen. On average, Texans pay around 1,400 per year for car insurance, but rates can range from 1,000 to $2,000 or more.

Are there any unique laws or regulations regarding car insurance in Texas?

+Yes, Texas has a few notable laws and regulations. One is the TexasSure program, which conducts random license plate checks to ensure drivers have valid insurance. Texas also has a list of high-risk drivers who may need to obtain an SR-22 certificate.

What are some common discounts available for car insurance in Texas?

+Common discounts in Texas include multi-policy discounts, safe driver discounts, good student discounts, and discounts for safety features in your vehicle. Some companies also offer usage-based insurance programs that can provide savings for safe driving behaviors.

How can I find the best car insurance rates in Texas?

+To find the best rates, compare quotes from multiple insurance providers. Use online quote comparison tools or work with an insurance broker. Also, consider your coverage needs and take advantage of any applicable discounts to lower your premiums.