Insurance Rates For Car

Understanding insurance rates for cars is essential for any vehicle owner. The cost of car insurance can vary significantly, influenced by a multitude of factors. In this comprehensive guide, we will delve into the intricacies of insurance rates, exploring the key elements that impact them and providing valuable insights to help you navigate the world of automotive insurance with confidence.

The Complex Web of Insurance Rates

Insurance rates for cars are determined by a complex interplay of variables, each contributing to the overall cost of your policy. From your personal information and driving history to the type of vehicle you own and the geographical location you reside in, numerous factors come into play. Let’s explore these elements in detail and uncover the secrets behind insurance rates.

Personal Factors: The Impact of Your Profile

Your personal information and demographics play a significant role in determining insurance rates. Insurers consider various aspects, including your age, gender, marital status, and even your credit score. For instance, young drivers, particularly those under 25, often face higher insurance premiums due to their perceived risk. Similarly, gender and marital status can influence rates, with insurers analyzing historical data to assess potential risks.

Your driving record is another crucial factor. A clean driving history, free from accidents and traffic violations, can lead to lower insurance rates. On the other hand, a history of accidents, especially those resulting in injuries or significant property damage, can significantly increase your insurance premiums. Insurers carefully examine your record to assess your level of risk and set rates accordingly.

| Demographic Factor | Impact on Insurance Rates |

|---|---|

| Age | Younger drivers often pay higher rates due to higher risk. |

| Gender | Historical data analysis may influence rates. |

| Marital Status | Married individuals may receive lower rates. |

| Credit Score | A higher credit score can lead to lower insurance costs. |

Vehicle Characteristics: The Role of Your Car

The type of vehicle you own is another critical factor in determining insurance rates. Insurers consider various aspects of your car, including its make, model, year, and even the safety features it possesses. High-performance sports cars and luxury vehicles often carry higher insurance costs due to their increased risk of accidents and higher repair costs.

The safety features of your car can also impact insurance rates. Vehicles equipped with advanced safety technologies, such as collision avoidance systems and lane departure warnings, may qualify for lower insurance premiums. These features reduce the risk of accidents and subsequent claims, making them more attractive to insurers.

| Vehicle Factor | Impact on Insurance Rates |

|---|---|

| Make and Model | Some makes and models are associated with higher risks and costs. |

| Year of Manufacture | Older vehicles may have lower insurance rates due to depreciation. |

| Safety Features | Advanced safety technologies can lead to reduced insurance costs. |

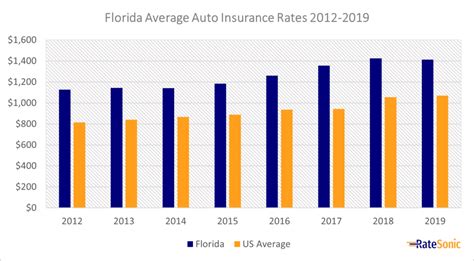

Geographical Location: Regional Differences in Rates

Your geographical location is a significant determinant of insurance rates. Insurance premiums can vary greatly from one region to another, influenced by factors such as traffic density, crime rates, and the cost of living. Areas with higher population densities and increased traffic volume often result in higher insurance costs due to the elevated risk of accidents.

The crime rate in your area is another consideration. Higher crime rates can lead to an increased risk of vehicle theft or vandalism, prompting insurers to charge higher premiums. Additionally, the cost of living in your region can impact insurance rates, as higher-cost areas may have more expensive labor and parts, driving up repair costs and, consequently, insurance premiums.

Usage and Coverage: Customizing Your Policy

The way you use your vehicle and the level of coverage you choose can significantly impact your insurance rates. Insurers offer various coverage options, including liability, collision, comprehensive, and additional add-ons. The more coverage you select, the higher your insurance premiums are likely to be.

If you primarily use your car for personal commuting, your insurance rates may be lower compared to those who use their vehicles for business or commercial purposes. Insurers assess the risk associated with different types of usage and adjust rates accordingly. Additionally, the frequency and duration of your trips can also influence insurance costs.

Strategies to Reduce Insurance Rates

While insurance rates are influenced by numerous factors beyond your control, there are strategies you can employ to potentially reduce your premiums. Here are some practical tips to consider:

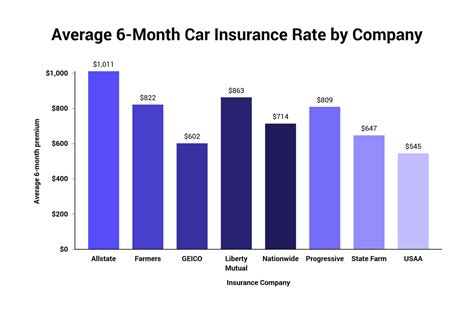

- Shop Around and Compare Quotes: Obtain quotes from multiple insurers to compare rates and find the most competitive option.

- Bundle Policies: Insure your home and car with the same provider to potentially qualify for bundle discounts.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your insurance rates as low as possible.

- Choose a Safer Vehicle: Opt for a vehicle with advanced safety features to potentially reduce insurance costs.

- Adjust Your Coverage: Review your coverage needs regularly and consider adjusting your policy to strike a balance between adequate protection and cost-effectiveness.

The Future of Insurance Rates

As technology continues to advance, the insurance industry is also evolving. Insurers are leveraging data analytics and telematics to gather more precise information about drivers and their habits. This shift towards usage-based insurance, or pay-as-you-drive models, could potentially revolutionize the way insurance rates are determined.

With usage-based insurance, drivers can provide real-time data about their driving habits, such as mileage, speed, and acceleration. This information allows insurers to assess individual risk more accurately and offer personalized insurance rates. While this technology is still in its early stages, it holds the promise of fairer and more customized insurance pricing in the future.

The Rise of Telematics and Usage-Based Insurance

Telematics devices, often installed in vehicles, collect and transmit driving data to insurance companies. This data can include information on acceleration, braking patterns, and even the time of day you drive. By analyzing this data, insurers can gain insights into your driving behavior and adjust your insurance rates accordingly.

Usage-based insurance models reward safe drivers with lower premiums, as they pose a lower risk to insurers. Conversely, drivers with risky driving habits may see their insurance rates increase. This pay-as-you-drive approach provides an incentive for drivers to adopt safer driving practices, ultimately leading to safer roads and potentially lower insurance costs for responsible drivers.

How do insurance companies determine rates for different age groups?

+Insurance companies analyze historical data to assess the risk associated with different age groups. Younger drivers, particularly those under 25, are often considered higher-risk due to their lack of driving experience and higher propensity for accidents. As a result, they typically face higher insurance rates. However, rates can vary based on individual driving records and other factors.

Can safety features in my car lower my insurance rates?

+Yes, advanced safety features in your car can potentially reduce your insurance rates. Insurers recognize that vehicles equipped with collision avoidance systems, lane departure warnings, and other safety technologies pose a lower risk of accidents. As a result, you may qualify for lower premiums when insuring a vehicle with such features.

How do insurers determine rates for different geographical locations?

+Insurers consider various factors when determining rates for different geographical locations. These factors include traffic density, crime rates, and the cost of living in the area. Higher population densities and increased traffic volume often result in higher insurance rates due to the elevated risk of accidents. Similarly, areas with higher crime rates may see higher premiums due to the increased risk of vehicle theft or vandalism.