Cheapest Insurance In California

Finding the cheapest insurance in California is a complex task that requires a thorough understanding of the state's insurance landscape, personal factors, and a strategic approach. With a population of nearly 40 million, California has a diverse range of insurance providers, plans, and rates, making it crucial for individuals to navigate this market effectively to secure the best deals.

Understanding California’s Insurance Market

California, known for its vibrant economy and diverse population, has a highly competitive insurance market. This competition often drives down prices, offering residents a range of affordable options. However, the key to unlocking these deals lies in understanding the unique dynamics of the state’s insurance sector.

One of the critical factors influencing insurance rates in California is the state's stringent regulations. These regulations, while designed to protect consumers, can sometimes lead to higher premiums. For instance, California's Insurance Fair Conduct Act ensures policyholders are treated fairly by insurance companies, but it also means that insurers must adhere to stricter guidelines, which can impact their profitability and, consequently, the premiums they charge.

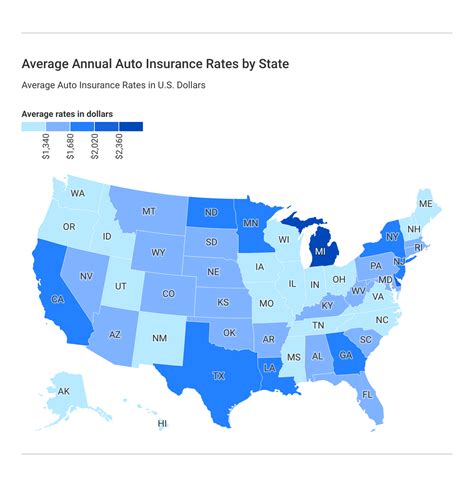

The Impact of Demographics and Location

California’s diverse demographics play a significant role in determining insurance rates. Urban areas like Los Angeles, San Francisco, and San Diego often have higher insurance costs due to factors like higher population density, increased traffic, and a greater risk of natural disasters. Conversely, more rural areas may offer lower rates, but these come with their own set of considerations, such as limited access to specialized healthcare or increased travel distances for emergencies.

| City | Average Annual Insurance Premium |

|---|---|

| Los Angeles | $1,850 |

| San Francisco | $2,100 |

| San Diego | $1,600 |

| Sacramento | $1,500 |

| Fresno | $1,200 |

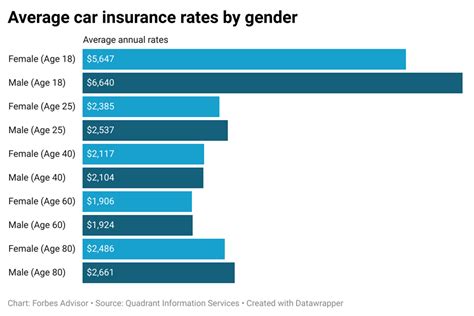

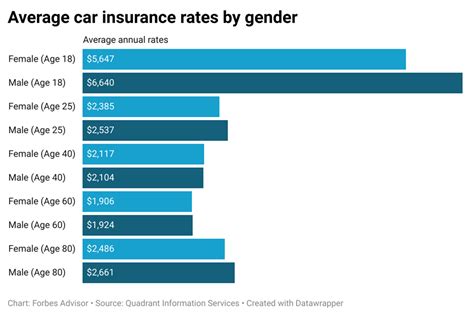

Apart from location, individual factors such as age, gender, driving record, and credit score also significantly impact insurance rates. Younger drivers, for example, are often considered high-risk due to their lack of driving experience, leading to higher premiums. Similarly, individuals with a history of traffic violations or accidents may face steeper insurance costs.

Navigating California’s Insurance Landscape

To find the cheapest insurance in California, it’s essential to adopt a strategic approach. Here are some key steps to consider:

Compare Multiple Providers

California’s insurance market is vast, with numerous providers offering competitive rates. By comparing quotes from multiple insurers, you can identify the most cost-effective options for your specific needs. Online insurance marketplaces and comparison websites can be invaluable tools for this task, providing a comprehensive overview of available plans and rates.

Understand Your Coverage Needs

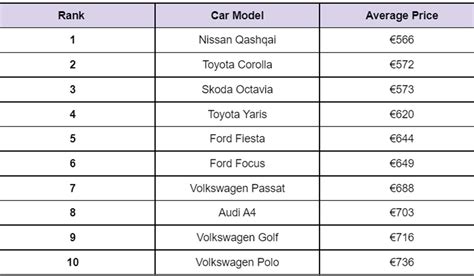

Different insurance policies offer varying levels of coverage. It’s crucial to understand your specific needs to avoid overpaying for coverage you don’t require. For instance, if you own an older vehicle, you might consider dropping collision coverage, which can significantly reduce your premium. However, this decision should be made carefully, balancing your financial capacity with the potential risks.

Explore Discounts and Incentives

Insurance providers in California often offer a range of discounts and incentives to attract customers. These can include multi-policy discounts (bundling your auto and home insurance, for example), safe driver discounts, loyalty discounts, and even discounts for specific professions or affiliations. By taking advantage of these offers, you can significantly reduce your insurance costs.

Consider High Deductibles

Opting for a higher deductible can lead to lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you essentially agree to bear more financial responsibility in the event of a claim, which can result in significant savings on your insurance policy.

The Role of Technology in Affordable Insurance

The rise of digital technology has revolutionized the insurance industry, making it easier for consumers to access affordable coverage. Online insurance platforms and mobile apps have streamlined the process of comparing quotes, applying for coverage, and managing policies. These digital tools often provide real-time quotes, allowing users to quickly identify the most cost-effective options.

Telematics and Usage-Based Insurance

Telematics, the technology that tracks driving behavior, has introduced a new era in auto insurance. Usage-based insurance, or pay-as-you-drive (PAYD) insurance, uses telematics to monitor driving habits, offering discounts to safe drivers. This technology rewards responsible driving, providing an opportunity for individuals to significantly reduce their insurance costs.

Online Policy Management

Online policy management platforms have transformed the way insurance is administered. These platforms allow policyholders to manage their policies, make payments, and file claims digitally, often with 24⁄7 accessibility. This convenience not only saves time but can also lead to cost savings, as many insurers offer discounts for paperless billing and online policy management.

Future Trends in Affordable Insurance

The insurance landscape in California is continually evolving, driven by technological advancements, regulatory changes, and shifting consumer needs. Here are some trends that are likely to impact the availability of affordable insurance in the state:

Regulatory Changes

California’s insurance regulations are subject to periodic updates, which can impact insurance rates. For instance, the recent focus on climate change and natural disaster resilience may lead to changes in property insurance regulations, potentially influencing premiums. Keeping abreast of these regulatory changes can help individuals anticipate and adapt to potential shifts in insurance costs.

The Rise of Insurtech

Insurtech, the intersection of insurance and technology, is transforming the insurance industry. Insurtech startups are leveraging innovative technologies, such as artificial intelligence and machine learning, to offer more personalized and efficient insurance products. These companies often focus on providing affordable coverage, leveraging technology to streamline processes and reduce costs.

The Sharing Economy

The rise of the sharing economy, facilitated by platforms like Airbnb and Uber, is influencing the insurance industry. These platforms often require insurance coverage, leading to the development of specialized insurance products to meet these needs. As the sharing economy continues to grow, it’s likely that we’ll see more innovative insurance solutions emerge, potentially offering affordable coverage for this new sector.

Conclusion

Finding the cheapest insurance in California requires a comprehensive understanding of the state’s insurance market, personal factors, and emerging trends. By adopting a strategic approach, leveraging technology, and staying informed about industry developments, individuals can navigate California’s competitive insurance landscape to secure the most affordable coverage for their needs.

What is the average cost of insurance in California?

+The average cost of insurance in California varies depending on the type of insurance and personal factors. For auto insurance, the average annual premium is around 1,500, but this can range from 1,000 to $2,500 or more based on location, driving record, and other factors.

How can I reduce my insurance costs in California?

+There are several strategies to reduce insurance costs in California. These include comparing quotes from multiple providers, understanding your coverage needs, exploring discounts and incentives, considering higher deductibles, and leveraging technology for online policy management and usage-based insurance.

Are there any government programs to help with insurance costs in California?

+Yes, California offers several government-backed insurance programs to assist residents with their insurance costs. For example, the California Low Cost Auto Insurance Program (CLCA) provides low-cost auto insurance to eligible drivers. The state also has programs for health insurance, such as Medi-Cal and Covered California, which offer affordable health coverage options.