Insurance Prices Cars

In the world of automotive insurance, the cost of coverage is a complex puzzle influenced by a multitude of factors. From the make and model of your vehicle to your driving history and personal details, insurance premiums can vary greatly. This article aims to delve into the intricacies of insurance pricing for cars, shedding light on the key elements that impact the cost of protection on the road.

The Role of Vehicle Characteristics in Insurance Pricing

The type of car you drive is a fundamental factor in determining insurance costs. Insurance providers carefully assess a vehicle’s characteristics, including its make, model, and year of manufacture. For instance, sports cars and luxury vehicles often attract higher insurance premiums due to their higher repair costs and increased likelihood of theft. On the other hand, family sedans and compact cars are generally considered more economical to insure.

Safety Features and Insurance Discounts

The presence of advanced safety features in a vehicle can significantly impact insurance pricing. Many insurance companies offer discounts for vehicles equipped with modern safety technologies such as lane departure warning systems, automatic emergency braking, and adaptive cruise control. These features not only enhance driver and passenger safety but also reduce the likelihood of accidents, leading to potential savings on insurance premiums.

| Safety Feature | Discount Percentage |

|---|---|

| Anti-Lock Braking System (ABS) | 5% |

| Electronic Stability Control (ESC) | 10% |

| Advanced Airbag Systems | 7% |

| Blind Spot Monitoring | 8% |

Vehicle Usage and Insurance Rates

The purpose for which a vehicle is used can also influence insurance costs. For instance, a car primarily used for business purposes or as a taxi may face higher insurance rates due to increased exposure to risks. On the contrary, a vehicle used only for personal commuting or occasional leisure trips may be considered a lower risk, resulting in more affordable insurance premiums.

The Impact of Driver Profile on Insurance Pricing

Beyond vehicle characteristics, insurance providers closely examine the driver’s profile to assess the level of risk associated with their driving behavior. This includes factors such as age, gender, driving experience, and location.

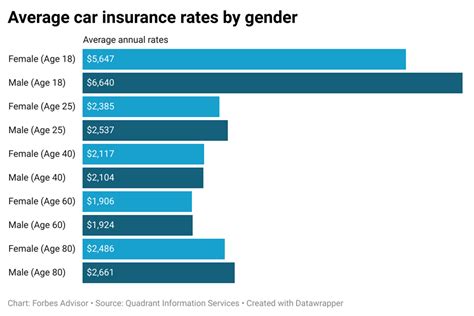

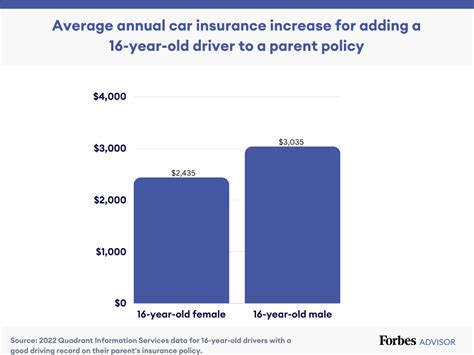

Age and Gender Considerations

Statistically, younger drivers, particularly those under the age of 25, are often considered higher risk by insurance companies due to their lack of experience and higher propensity for accidents. As a result, insurance premiums for this demographic tend to be significantly higher. Similarly, gender can also play a role, with some insurance providers offering slightly lower rates for female drivers, based on historical data suggesting they may be involved in fewer accidents.

| Age Group | Average Premium Increase |

|---|---|

| 16-20 years | 50% |

| 21-25 years | 30% |

| 26-35 years | 15% |

| 36+ years | 5% |

Driving Experience and Insurance Rates

The more years of driving experience an individual has, the lower their insurance premiums are likely to be. This is because experienced drivers are generally considered to be more adept at navigating the roads and avoiding accidents. Insurance providers often offer discounts to drivers who have maintained a clean driving record for several years, as this is an indicator of responsible and safe driving behavior.

Location and Insurance Costs

The geographical location where a vehicle is registered and primarily used can significantly impact insurance rates. This is due to variations in factors such as traffic density, crime rates, and weather conditions, all of which can influence the risk of accidents and vehicle theft. For instance, urban areas with heavy traffic and high crime rates may attract higher insurance premiums compared to rural areas with lower traffic volumes and reduced crime.

Understanding Insurance Coverage Options

Insurance providers offer a range of coverage options, and the level of coverage chosen can greatly impact the overall cost of insurance. Comprehensive coverage, which provides protection for a wide range of scenarios including theft, vandalism, and natural disasters, typically carries a higher premium compared to basic liability coverage, which only covers damages caused to others in an accident.

Comprehensive vs. Liability Coverage

While comprehensive coverage offers extensive protection, it is often more expensive. On the other hand, liability coverage is more affordable but provides limited protection, covering only the costs associated with damages caused to others. It is essential for drivers to carefully consider their needs and budget when choosing the appropriate level of coverage.

| Coverage Type | Average Premium |

|---|---|

| Comprehensive Coverage | $1200 per year |

| Liability Coverage | $800 per year |

Optional Add-ons and Their Impact

In addition to standard coverage options, insurance providers offer a range of optional add-ons that can further customize insurance policies. These add-ons, such as roadside assistance, rental car coverage, and gap insurance, can enhance the policy’s benefits but also increase the overall cost. It is crucial for drivers to carefully assess their needs and potential risks before opting for additional coverage.

The Role of Claims History in Insurance Pricing

A driver’s claims history is a critical factor in determining insurance premiums. Insurance providers closely examine the number and severity of claims made by a policyholder to assess their risk profile. Multiple claims, especially those resulting from at-fault accidents, can significantly increase insurance premiums. Conversely, a clean claims history can lead to lower rates over time, as it demonstrates a reduced risk of future accidents.

The Impact of At-Fault Accidents

At-fault accidents, where the policyholder is deemed responsible for the incident, can have a significant impact on insurance premiums. These accidents not only increase the cost of insurance but may also result in a loss of any no-claims discount the policyholder had previously accrued. It is therefore crucial for drivers to exercise caution and responsible driving behavior to avoid such incidents.

The Benefits of a Clean Claims History

Maintaining a clean claims history is not only beneficial for peace of mind but can also lead to substantial savings on insurance premiums. Many insurance providers offer no-claims discounts, which reduce the cost of insurance for policyholders who have not made any claims over a specified period, typically one year. These discounts can accumulate over time, making insurance more affordable for responsible drivers.

The Future of Insurance Pricing: Technological Advancements

The insurance industry is undergoing significant transformation with the advent of new technologies. One notable development is the use of telematics, which involves installing a small device in a vehicle to track driving behavior. This technology provides insurance providers with real-time data on factors such as speed, braking, and cornering, allowing them to offer personalized insurance rates based on an individual’s actual driving habits.

Telematics and Pay-as-You-Drive Insurance

Telematics-based insurance, also known as pay-as-you-drive or usage-based insurance, is gaining popularity due to its ability to offer personalized rates. This type of insurance uses telematics data to assess an individual’s driving behavior, rewarding safe drivers with lower premiums. Conversely, those with riskier driving habits may face higher insurance costs.

| Driving Behavior | Average Premium Adjustment |

|---|---|

| Safe Driving (Avoids harsh acceleration, braking, and cornering) | 10% discount |

| Moderate Risk (Average driving behavior) | No adjustment |

| High Risk (Frequent harsh driving behavior) | 15% increase |

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and advanced data analytics are also revolutionizing the insurance industry. These technologies enable insurance providers to analyze vast amounts of data, including vehicle and driver characteristics, historical claims data, and even social media behavior, to more accurately assess risk and price insurance policies.

Conclusion

The cost of car insurance is influenced by a multitude of factors, from vehicle characteristics and driver profile to coverage options and claims history. As the insurance industry continues to evolve with technological advancements, drivers can expect more personalized and data-driven insurance pricing. By understanding these factors and making informed choices, individuals can navigate the complex world of insurance pricing and find the most suitable coverage at the best possible rate.

How often should I review my insurance coverage and premiums?

+It is advisable to review your insurance coverage and premiums annually, or whenever your circumstances change significantly. This ensures that your policy remains adequate and that you are not overpaying for unnecessary coverage.

Can I negotiate my insurance premiums with providers?

+While insurance premiums are largely determined by set algorithms, you can negotiate with providers by discussing your specific needs and circumstances. You may also explore discounts for multiple policies (e.g., bundling car and home insurance) or for loyalty and good driving behavior.

What steps can I take to lower my insurance premiums?

+There are several strategies to reduce insurance premiums. These include choosing a higher deductible, maintaining a clean driving record, utilizing safety features in your vehicle, and shopping around for the best rates from different providers.