Healthcare Insurance Broker

Healthcare insurance is a vital aspect of modern healthcare systems, providing individuals and families with financial protection and access to essential medical services. In this complex industry, healthcare insurance brokers play a crucial role, acting as intermediaries between insurance companies and consumers. With their expertise and guidance, brokers ensure that individuals and businesses secure suitable health coverage tailored to their unique needs. This comprehensive guide aims to delve into the world of healthcare insurance brokers, exploring their role, services, and the impact they have on ensuring accessible and affordable healthcare for all.

Understanding the Role of Healthcare Insurance Brokers

Healthcare insurance brokers are licensed professionals who specialize in navigating the intricate landscape of health insurance options. They serve as trusted advisors, assisting individuals, families, and businesses in selecting the most appropriate health coverage plans. Brokers bring a wealth of knowledge about various insurance carriers, policy features, and benefits, enabling them to match clients with the best-suited plans. Their expertise goes beyond simply recommending plans; they provide comprehensive guidance, ensuring clients understand the intricacies of their chosen coverage.

The primary objective of healthcare insurance brokers is to empower their clients to make informed decisions about their healthcare needs. By assessing individual and group requirements, brokers tailor their advice to ensure the most suitable and cost-effective coverage. They provide a personalized approach, taking into account factors such as pre-existing conditions, family size, and specific healthcare needs. Additionally, brokers stay updated on the ever-changing insurance landscape, ensuring their clients are aware of any new developments or policy changes that may impact their coverage.

Key Responsibilities and Services of Healthcare Insurance Brokers

Healthcare insurance brokers offer a range of essential services to their clients, including:

- Plan Comparison and Recommendation: Brokers analyze a wide array of insurance plans, comparing features, benefits, and costs. They present their clients with a tailored selection of plans, explaining the advantages and potential drawbacks of each option.

- Policy Enrollment and Management: Brokers guide their clients through the entire enrollment process, ensuring smooth and efficient completion of paperwork. They also provide ongoing support, assisting with any policy changes or updates as needed.

- Claims Support: In the event of a claim, brokers offer invaluable assistance, ensuring their clients understand the claims process and helping to resolve any potential issues that may arise.

- Education and Advocacy: Brokers educate their clients about their healthcare coverage, empowering them to make the most of their benefits. They also advocate on behalf of their clients, ensuring they receive the necessary care and support from insurance providers.

- Renewal and Review: Brokers actively manage policy renewals, reviewing existing plans to ensure they continue to meet their clients' evolving needs. They provide recommendations for any necessary adjustments to coverage.

By offering these comprehensive services, healthcare insurance brokers become trusted partners in their clients' healthcare journeys, ensuring peace of mind and financial security.

The Benefits of Working with a Healthcare Insurance Broker

Engaging the services of a healthcare insurance broker offers numerous advantages, making the process of securing health coverage more accessible and beneficial. Here are some key benefits:

Expertise and Knowledge

Healthcare insurance brokers possess in-depth knowledge of the insurance industry and its complexities. They stay abreast of the latest regulations, policy changes, and market trends, ensuring their clients receive up-to-date and accurate information. With their expertise, brokers can navigate the vast array of insurance options, identifying the most suitable plans for their clients’ unique circumstances.

Personalized Guidance

Brokers offer a highly personalized approach, taking the time to understand their clients’ individual needs, preferences, and budget constraints. They provide tailored advice, considering factors such as age, health status, family composition, and desired level of coverage. This personalized guidance ensures clients receive coverage that aligns perfectly with their specific requirements.

Time and Effort Savings

The process of researching and comparing health insurance plans can be time-consuming and overwhelming for individuals. Healthcare insurance brokers streamline this process, saving their clients valuable time and effort. Brokers handle the legwork, allowing clients to focus on their daily lives while still securing the best possible coverage.

Cost Savings and Value for Money

Brokers have access to a wide range of insurance plans and carriers, enabling them to identify the most cost-effective options for their clients. They can negotiate better rates and terms, ensuring their clients receive maximum value for their insurance premiums. Additionally, brokers can help clients understand and maximize their benefits, avoiding unnecessary expenses.

Claim Assistance and Advocacy

When it comes to filing claims, healthcare insurance brokers provide invaluable support. They guide their clients through the claims process, ensuring a smooth and efficient experience. Brokers also advocate for their clients, addressing any potential issues or disputes that may arise during the claims process. This level of support can be crucial in ensuring timely and appropriate reimbursement.

| Benefit | Description |

|---|---|

| Expertise | In-depth knowledge of insurance industry, regulations, and trends. |

| Personalized Guidance | Tailored advice based on individual needs and preferences. |

| Time Savings | Streamlined process, saving clients time and effort. |

| Cost Savings | Access to cost-effective plans and better rates. |

| Claim Assistance | Support and advocacy during the claims process. |

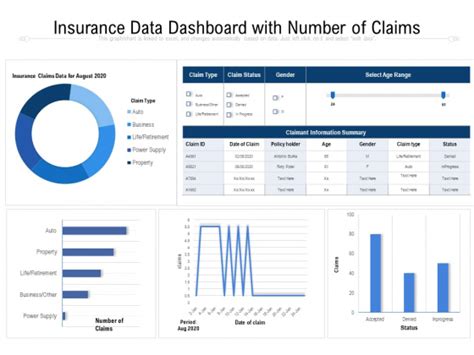

Healthcare Insurance Brokers: A Case Study

To illustrate the impact and value of healthcare insurance brokers, let’s explore a real-life case study. Meet Sarah, a self-employed graphic designer who recently moved to a new city. Sarah, like many self-employed individuals, faces the challenge of securing suitable health coverage on her own.

Sarah’s Journey with a Healthcare Insurance Broker

Sarah reached out to a local healthcare insurance broker, seeking guidance on her health insurance options. The broker, with extensive knowledge of the local market, presented Sarah with a range of plans that suited her budget and needs. They explained the differences between various plans, including deductibles, copays, and coverage limits, ensuring Sarah understood the implications of each option.

With the broker's assistance, Sarah enrolled in a plan that provided comprehensive coverage for her specific healthcare needs. The broker also helped Sarah understand the benefits of preventive care and how to maximize her coverage for routine check-ups and screenings. As a result, Sarah felt confident and reassured about her health coverage.

A few months later, Sarah required surgery for a pre-existing condition. The broker supported her throughout the process, guiding her on the necessary steps to ensure the procedure was covered by her insurance. They also assisted with any questions or concerns Sarah had, providing timely and accurate information. With the broker's advocacy, Sarah received the necessary care and support, ensuring a smooth and successful surgical experience.

Impact and Outcome

Working with a healthcare insurance broker made a significant difference in Sarah’s journey. The broker’s expertise and personalized guidance allowed Sarah to secure a plan that provided the coverage she needed, without breaking her budget. The broker’s support during Sarah’s surgical experience demonstrated the value of having an advocate in the often complex world of healthcare insurance.

Sarah's story highlights the crucial role of healthcare insurance brokers in ensuring individuals like her can access the right healthcare coverage. By providing expert guidance and support, brokers empower their clients to navigate the healthcare system with confidence and peace of mind.

The Future of Healthcare Insurance Brokers

As the healthcare industry continues to evolve, the role of healthcare insurance brokers remains integral to ensuring accessible and affordable healthcare. With increasing complexity in insurance plans and the rise of consumer-driven healthcare, brokers will continue to play a vital role in guiding individuals and businesses toward suitable coverage.

Emerging Trends and Opportunities

The future of healthcare insurance brokerage holds several exciting trends and opportunities. One notable trend is the increasing focus on wellness and preventive care. Brokers will play a key role in educating their clients about the importance of preventive measures and how to maximize their coverage for such services. This shift towards wellness-focused insurance aligns with the broader healthcare industry’s emphasis on preventative care.

Additionally, the rise of digital technology and online platforms presents new avenues for healthcare insurance brokers to engage with their clients. Brokers can leverage these digital tools to provide more efficient and personalized services, such as online enrollment processes, digital policy management, and real-time claim support. These technological advancements will enhance the overall client experience, making the process of securing health coverage more accessible and convenient.

Addressing Challenges and Opportunities for Growth

While the future holds promise for healthcare insurance brokers, they also face certain challenges. One notable challenge is the potential impact of healthcare reform and policy changes. Brokers must stay informed and adaptable to navigate any changes in regulations, ensuring they can continue to provide accurate and reliable advice to their clients. Additionally, brokers will need to address the evolving needs of their clients, especially as the workforce becomes more diverse and the gig economy expands.

To address these challenges and capitalize on growth opportunities, healthcare insurance brokers should focus on continuous education and professional development. Staying abreast of industry trends, regulatory changes, and advancements in technology will enable brokers to provide the most up-to-date and relevant advice to their clients. Additionally, building strong relationships with insurance carriers and staying connected with industry networks can provide brokers with valuable insights and resources to enhance their services.

Conclusion

Healthcare insurance brokers are essential players in the healthcare industry, ensuring individuals and businesses have access to the right health coverage. With their expertise, personalized guidance, and support, brokers empower their clients to make informed decisions about their healthcare needs. As the industry evolves, the role of healthcare insurance brokers remains crucial, offering a human touch and expert knowledge in a complex and ever-changing landscape.

By understanding the value and impact of healthcare insurance brokers, individuals and businesses can make more confident and strategic choices about their health coverage. With the right broker by their side, they can navigate the healthcare system with ease, securing the financial protection and access to care that they deserve.

How do I choose a reputable healthcare insurance broker?

+When selecting a healthcare insurance broker, consider their qualifications, experience, and industry reputation. Look for brokers with proper licensing and certifications. Read reviews and seek recommendations from trusted sources. Interview potential brokers to assess their knowledge, communication skills, and ability to understand your specific needs.

Can a broker help me with my existing health insurance plan?

+Absolutely! Brokers can provide valuable guidance and support even if you already have a health insurance plan. They can review your current plan, assess its suitability, and recommend any necessary adjustments or alternatives to better meet your evolving needs.

Are there any additional fees for using a healthcare insurance broker’s services?

+The fee structure for healthcare insurance brokers varies. Some brokers work on a commission basis, earning a percentage of the premium paid for the plan they help you enroll in. Others may charge a flat fee for their services. It’s important to discuss fees and payment arrangements upfront with your broker to ensure transparency.