Insurance Triple Aaa

In today's complex world, insurance plays a pivotal role in safeguarding individuals and businesses against unforeseen risks and financial losses. Among the myriad of insurance providers, AAA stands out as a trusted and reliable entity, offering a comprehensive suite of services to its members. This article delves into the depths of AAA's insurance offerings, exploring their unique features, benefits, and impact on policyholders.

The Evolution of AAA Insurance

The American Automobile Association, popularly known as AAA, has a rich history dating back to the early 20th century. Originally founded to cater to the needs of automobile enthusiasts, AAA has evolved into a formidable force in the insurance industry. Over the years, they have expanded their services to include a wide range of insurance products, catering to the diverse needs of their members.

AAA's journey into the insurance realm began with a focus on automobile insurance, offering coverage for car owners. However, their commitment to providing comprehensive protection led them to branch out into other areas, such as home, life, and health insurance. This strategic expansion allowed AAA to become a one-stop shop for all insurance needs, making it convenient for members to manage their policies.

One of AAA's key strengths lies in its understanding of the unique challenges faced by its members. With a deep-rooted connection to the automotive industry, AAA has developed insurance products that address specific concerns of car owners, such as roadside assistance, collision coverage, and rental car reimbursement. This tailored approach has not only garnered the trust of millions of members but has also positioned AAA as a leader in the insurance market.

AAA’s Insurance Products: A Comprehensive Overview

AAA’s insurance portfolio is extensive, offering a diverse range of products to cater to the varying needs of its members. Let’s explore some of their key offerings:

Automobile Insurance

At the core of AAA’s insurance offerings is their automobile insurance, designed to provide comprehensive coverage for vehicles. AAA’s auto insurance policies include standard features such as liability, collision, and comprehensive coverage. However, what sets AAA apart is their focus on customization. Members can choose from a wide range of optional coverages, including rental car reimbursement, gap insurance, and roadside assistance.

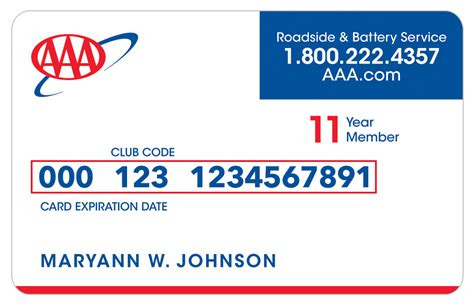

AAA's roadside assistance service, a hallmark of their automobile insurance, provides members with peace of mind. Whether it's a flat tire, a dead battery, or a vehicle that won't start, AAA's roadside assistance team is just a call away. This service is particularly valuable for long-distance travelers or those living in remote areas.

In addition to standard coverages, AAA offers innovative features like usage-based insurance (UBI). UBI policies, also known as pay-as-you-drive insurance, use telematics technology to track driving behavior and offer discounts based on safe driving habits. This approach not only incentivizes safer driving but also allows members to save on their insurance premiums.

Home Insurance

AAA’s home insurance policies are tailored to protect members’ homes and personal belongings. These policies cover a wide range of perils, including fire, theft, and natural disasters. AAA’s home insurance goes beyond the basics, offering additional coverages such as personal liability, identity theft protection, and coverage for high-value items like jewelry or artwork.

For homeowners, AAA offers unique benefits such as disaster response services. In the event of a covered loss, AAA's disaster response team can assist with emergency repairs, temporary housing arrangements, and even help with the insurance claims process. This level of support ensures that homeowners can get back on their feet quickly after a devastating event.

AAA's home insurance policies also cater to the needs of renters. Renters insurance provides coverage for personal belongings, liability protection, and additional living expenses in the event of a covered loss. With AAA's renters insurance, individuals can have peace of mind knowing their belongings are protected, even if they don't own their own home.

Life Insurance

AAA’s life insurance offerings provide members with financial protection and security. Life insurance policies from AAA come in various forms, including term life, whole life, and universal life insurance. These policies are designed to meet the diverse needs of individuals and families, offering coverage for a specified period or for the insured’s entire life.

AAA's term life insurance policies offer affordability and flexibility. Members can choose the coverage amount and term length that best suits their needs. This type of insurance is ideal for those seeking temporary coverage or for individuals who want to protect their families during specific life stages, such as raising children or paying off a mortgage.

Whole life and universal life insurance policies from AAA provide permanent coverage and accumulate cash value over time. These policies offer stability and can be used as a financial planning tool, providing a death benefit to beneficiaries and offering the potential for growth through cash value accumulation.

Health Insurance

AAA’s health insurance offerings focus on providing members with access to quality healthcare services. Their health insurance plans typically include coverage for medical, surgical, and hospital expenses. Additionally, AAA offers supplemental health insurance products, such as dental, vision, and prescription drug coverage, to enhance overall healthcare protection.

AAA's health insurance plans often feature a wide network of healthcare providers, ensuring members have access to quality care when and where they need it. Some plans also include wellness programs and discounts on health-related services, encouraging members to take a proactive approach to their health and well-being.

The Benefits of AAA Insurance

AAA’s insurance offerings come with a host of benefits that set them apart from traditional insurance providers. Let’s explore some of the key advantages:

Comprehensive Coverage

AAA’s insurance policies are designed to provide comprehensive protection. Whether it’s automobile, home, life, or health insurance, AAA offers a wide range of coverages to ensure members are adequately protected against various risks. This all-encompassing approach gives members the peace of mind that comes with knowing they have the right coverage for their unique circumstances.

Customization and Flexibility

One of the standout features of AAA’s insurance products is their customization options. Members can tailor their policies to meet their specific needs, adding or removing coverages as required. This level of flexibility ensures that members only pay for the coverage they truly need, making AAA’s insurance offerings cost-effective and personalized.

Member Discounts and Perks

As a member-based organization, AAA offers a range of discounts and perks to its members. These benefits extend beyond insurance and include discounts on travel, entertainment, and even everyday purchases. AAA members can save on hotel stays, car rentals, and even dining experiences, making membership even more valuable.

Roadside Assistance and Emergency Services

AAA’s roadside assistance service is a cornerstone of their automobile insurance offerings. Members can rely on AAA’s dedicated team for assistance in various situations, whether it’s a flat tire or a mechanical breakdown. This service is available 24⁄7, ensuring members can get back on the road quickly and safely.

In addition to roadside assistance, AAA provides emergency services for home and health insurance. This includes disaster response for homeowners and access to healthcare services for members with health insurance plans. These emergency services demonstrate AAA's commitment to supporting members through challenging times.

Impact and Future Outlook

AAA’s insurance offerings have had a significant impact on the lives of its members. By providing comprehensive and affordable insurance solutions, AAA has empowered individuals and businesses to protect themselves against financial risks. The customization and flexibility of AAA’s insurance products have allowed members to tailor their coverage to their specific needs, making insurance more accessible and effective.

Looking ahead, AAA is well-positioned to continue its growth and innovation in the insurance industry. With a strong focus on member satisfaction and a commitment to staying abreast of industry trends, AAA is likely to expand its product offerings and enhance its services. The organization's ability to adapt to changing market dynamics and technological advancements ensures that it will remain a trusted and reliable provider for years to come.

As the insurance landscape evolves, AAA's dedication to its members and its commitment to providing exceptional service will undoubtedly play a pivotal role in shaping the future of the industry. With a rich history and a forward-thinking approach, AAA is poised to continue delivering value and protection to its members, solidifying its position as a leader in the insurance market.

Frequently Asked Questions

How can I become a AAA member and benefit from their insurance offerings?

+Becoming a AAA member is a straightforward process. You can visit the AAA website or contact your local AAA branch to explore membership options. Membership typically involves an annual fee, which grants you access to a range of benefits, including insurance discounts and perks.

What sets AAA’s automobile insurance apart from other providers?

+AAA’s automobile insurance stands out for its focus on customization and member benefits. Members can choose from a wide range of optional coverages, including roadside assistance, which is a unique and valuable feature. Additionally, AAA’s usage-based insurance policies offer discounts for safe driving, making insurance more affordable.

How does AAA’s home insurance compare to traditional home insurance policies?

+AAA’s home insurance policies offer comprehensive coverage for homeowners and renters. They include standard perils such as fire and theft, but also offer additional coverages like personal liability and identity theft protection. AAA’s disaster response services provide an extra layer of support, ensuring members receive assistance during challenging times.

What are the key advantages of AAA’s life insurance policies?

+AAA’s life insurance policies provide financial protection and security to members and their families. The flexibility to choose between term life, whole life, and universal life insurance allows individuals to select the coverage that best suits their needs and budget. AAA’s life insurance policies offer peace of mind and can be a crucial part of financial planning.

In conclusion, AAA’s insurance offerings provide a comprehensive and tailored approach to protection. With a focus on member satisfaction and a commitment to innovation, AAA has established itself as a trusted provider in the insurance industry. Whether it’s automobile, home, life, or health insurance, AAA’s products and services are designed to meet the diverse needs of its members, offering peace of mind and financial security.