Mutual Of Omaha Medical Insurance

Mutual of Omaha, a prominent player in the health insurance industry, offers a comprehensive range of medical insurance plans designed to cater to diverse needs and requirements. With a rich history spanning over a century, Mutual of Omaha has established itself as a trusted provider, offering innovative and reliable healthcare coverage solutions. This article delves into the intricacies of Mutual of Omaha's medical insurance, exploring its offerings, benefits, and impact on individuals and families across the United States.

Understanding Mutual of Omaha’s Medical Insurance Portfolio

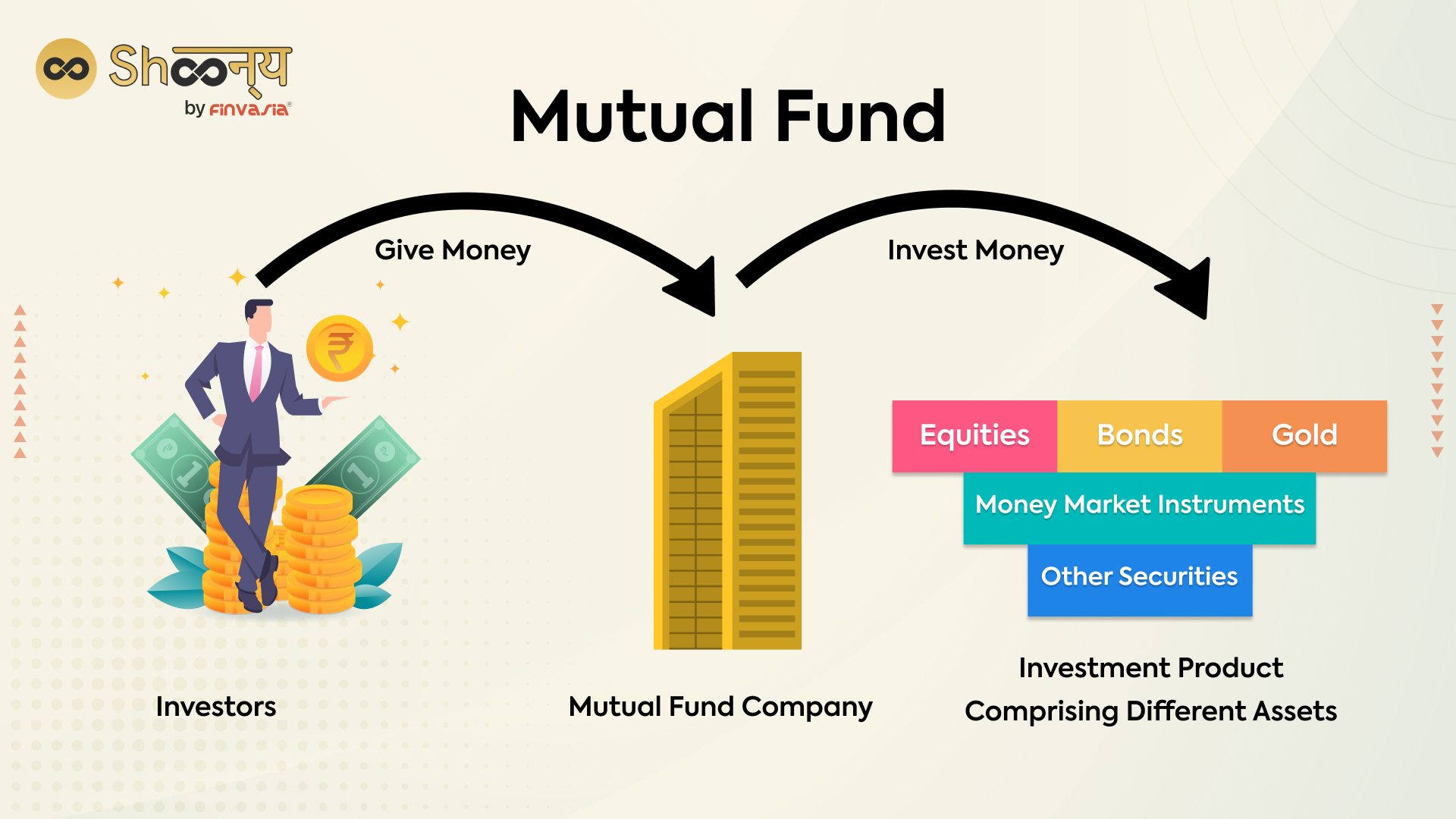

Mutual of Omaha’s medical insurance portfolio is a comprehensive collection of health plans tailored to meet the varying needs of its diverse customer base. The company offers a wide array of options, ensuring that individuals and families can find a plan that aligns with their specific healthcare requirements and financial capabilities.

Individual and Family Plans

Mutual of Omaha recognizes that every person’s healthcare needs are unique. Their individual and family plans are designed with flexibility in mind, offering coverage options that can be customized to suit different lifestyles and health situations. Whether it’s a young professional seeking basic coverage or a family requiring more extensive medical benefits, Mutual of Omaha’s plans provide a range of deductibles, copays, and coverage limits to choose from.

For instance, the Classic Choice plan offers a more traditional approach, providing comprehensive coverage for a wide range of medical services, including hospital stays, doctor visits, and prescription medications. On the other hand, the Value Choice plan is tailored for those seeking cost-effective coverage, with lower premiums and higher deductibles, making it an attractive option for those who prioritize affordability.

Medicare Supplement Plans

Mutual of Omaha also specializes in Medicare Supplement plans, designed to fill the gaps left by original Medicare coverage. These plans, often referred to as Medigap, offer additional financial protection for Medicare beneficiaries, covering expenses such as co-pays, deductibles, and services not covered by Medicare Part A and Part B.

One of their popular Medicare Supplement plans is the Plan G, which provides extensive coverage, including all Medicare Part A and Part B deductibles and co-insurance. Additionally, it covers services like skilled nursing care, emergency care, and foreign travel exchange, making it a comprehensive choice for those seeking extensive medical coverage.

Group Health Insurance Plans

For employers seeking to provide healthcare benefits to their employees, Mutual of Omaha offers a range of group health insurance plans. These plans are tailored to meet the specific needs of businesses, ensuring that employees receive the necessary coverage while also considering the employer’s budget and goals.

The Group Health Advantage plan, for example, offers a flexible approach, allowing employers to choose from a menu of benefits, including prescription drug coverage, dental and vision care, and mental health services. This plan is designed to attract and retain top talent while also controlling healthcare costs for businesses.

| Plan Type | Key Features |

|---|---|

| Individual Plans | Customizable coverage, varying deductibles and copays |

| Medicare Supplement Plans | Fills gaps in original Medicare coverage, covers deductibles and co-insurance |

| Group Health Plans | Flexible benefits, tailored to employer needs, includes prescription, dental, and mental health coverage |

Benefits and Features of Mutual of Omaha Medical Insurance

Mutual of Omaha’s medical insurance plans offer a plethora of benefits and features that set them apart in the healthcare insurance landscape. These advantages not only provide comprehensive coverage but also aim to enhance the overall healthcare experience for individuals and families.

Comprehensive Coverage

One of the standout features of Mutual of Omaha’s medical insurance is its commitment to providing comprehensive coverage. Whether it’s through their individual plans, Medicare Supplement plans, or group health insurance offerings, the company ensures that its policyholders have access to a wide range of medical services. This includes everything from routine check-ups and preventative care to more specialized treatments and procedures.

For instance, their Essential Health Benefits package covers ten essential categories, as mandated by the Affordable Care Act (ACA). These categories include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, laboratory services, preventive and wellness services, and pediatric services, including oral and vision care.

Affordable Premiums and Flexible Payment Options

Mutual of Omaha understands that healthcare costs can be a significant financial burden. To alleviate this, they offer affordable premiums and flexible payment options, ensuring that their plans are accessible to a wide range of individuals and families.

The company provides a premium calculator on its website, allowing potential policyholders to estimate their monthly premiums based on their age, location, and desired coverage level. Additionally, Mutual of Omaha offers various payment plans, including monthly, quarterly, or annual payments, giving policyholders the flexibility to choose a payment schedule that aligns with their financial situation.

Network of Providers

A key advantage of Mutual of Omaha’s medical insurance is its extensive network of healthcare providers. The company has established partnerships with a vast array of medical professionals, hospitals, and healthcare facilities across the United States. This ensures that policyholders have access to a wide range of high-quality healthcare services, regardless of their location.

Mutual of Omaha's provider network includes in-network discounts, meaning policyholders can save on their out-of-pocket expenses when they utilize these providers. Additionally, the company provides a provider search tool on its website, allowing policyholders to easily locate healthcare professionals and facilities within their network.

Wellness Programs and Preventative Care

Mutual of Omaha recognizes the importance of preventative care and wellness programs in maintaining good health and reducing long-term healthcare costs. As such, many of their medical insurance plans include coverage for preventative services and offer access to various wellness initiatives.

For example, their Wellness Rewards program incentivizes policyholders to maintain a healthy lifestyle by offering discounts on premiums for those who meet certain wellness criteria. This program encourages activities like regular exercise, healthy eating, and participation in wellness challenges, promoting a culture of health and wellness among policyholders.

| Benefit | Description |

|---|---|

| Comprehensive Coverage | Covers a wide range of medical services, including routine check-ups, specialized treatments, and essential health benefits. |

| Affordable Premiums | Offers competitive rates and flexible payment options to ensure accessibility for a diverse range of policyholders. |

| Extensive Provider Network | Provides access to a vast network of healthcare professionals and facilities, offering in-network discounts and convenient provider search tools. |

| Wellness Programs | Incentivizes policyholders to maintain healthy lifestyles through programs like Wellness Rewards, promoting preventative care and long-term health. |

The Impact of Mutual of Omaha’s Medical Insurance

Mutual of Omaha’s medical insurance plans have had a significant impact on the lives of individuals and families across the United States. By providing comprehensive coverage, affordable premiums, and a wide range of benefits, the company has played a pivotal role in ensuring that people have access to quality healthcare when they need it most.

Improved Access to Healthcare

One of the most notable impacts of Mutual of Omaha’s medical insurance is the improved access to healthcare it provides. With a focus on affordability and comprehensive coverage, the company has made healthcare more accessible to a broader population. This is particularly beneficial for individuals and families who may have previously struggled to afford adequate healthcare coverage.

For instance, their Medicare Supplement plans have been a lifeline for many seniors, filling the gaps in original Medicare coverage and providing the financial support needed to access necessary medical services. Similarly, their group health insurance plans have enabled employers to offer valuable healthcare benefits to their employees, ensuring that workers and their families have access to the care they need.

Enhanced Financial Protection

Mutual of Omaha’s medical insurance plans provide enhanced financial protection for policyholders. By covering a wide range of medical expenses, including hospital stays, doctor visits, prescription medications, and more, the company alleviates the financial burden that often accompanies unexpected medical needs.

For example, their individual plans offer a variety of coverage options, allowing policyholders to choose a plan that aligns with their specific needs and budget. This flexibility ensures that individuals can select a plan that provides adequate protection without straining their finances.

Promoting Preventative Care and Healthy Lifestyles

Mutual of Omaha’s focus on preventative care and healthy lifestyles is another notable impact of their medical insurance plans. By encouraging policyholders to prioritize their health and well-being, the company is helping to reduce the incidence of chronic diseases and costly medical interventions.

Their Wellness Rewards program, for instance, incentivizes policyholders to adopt healthier habits by offering discounts on premiums. This program not only promotes individual well-being but also contributes to a culture of health and wellness within the community, potentially leading to long-term cost savings for both policyholders and the healthcare system as a whole.

Frequently Asked Questions (FAQ)

What types of medical insurance plans does Mutual of Omaha offer?

+

Mutual of Omaha offers a range of medical insurance plans, including individual and family plans, Medicare Supplement plans, and group health insurance plans. These plans are designed to cater to the diverse needs of individuals, families, and businesses, providing comprehensive coverage, affordable premiums, and a wide network of healthcare providers.

How can I find a doctor or healthcare provider in Mutual of Omaha’s network?

+

Mutual of Omaha provides a convenient provider search tool on its website. Policyholders can simply enter their location and the type of healthcare professional they’re looking for, and the tool will generate a list of in-network providers in their area. This ensures easy access to high-quality healthcare services.

Are there any discounts or incentives for healthy lifestyle choices with Mutual of Omaha’s plans?

+

Yes, Mutual of Omaha recognizes the importance of healthy lifestyles and offers incentives through its Wellness Rewards program. Policyholders can earn discounts on their premiums by meeting certain wellness criteria, such as regular exercise, healthy eating, and participation in wellness challenges. This program promotes preventative care and long-term health.

In conclusion, Mutual of Omaha’s medical insurance plans offer a comprehensive and accessible approach to healthcare coverage. With a focus on affordability, flexibility, and comprehensive benefits, the company has become a trusted provider for individuals, families, and businesses across the United States. By offering a wide range of plans and innovative programs, Mutual of Omaha is not only ensuring that people have access to quality healthcare but also promoting a culture of health and wellness.