State Of Georgia Department Of Insurance

The State of Georgia's Department of Insurance is a vital regulatory body that plays a crucial role in overseeing the insurance industry within the state. With a rich history spanning decades, the department has evolved to meet the changing needs of its citizens and the insurance landscape. This article aims to delve into the intricacies of the Georgia Department of Insurance, shedding light on its functions, services, and impact on the state's residents and businesses.

History and Mission of the Georgia Department of Insurance

The Georgia Department of Insurance was established with a mission to protect the rights and interests of insurance consumers while fostering a competitive and stable insurance market. Over the years, it has adapted to the dynamic nature of the insurance industry, implementing regulations and initiatives to ensure fairness, transparency, and consumer protection.

With its headquarters in Atlanta, the heart of Georgia's business and financial sector, the department is strategically positioned to serve both urban and rural communities across the state. Its reach extends to every corner of Georgia, ensuring that insurance services are accessible and regulated uniformly.

Regulatory Functions and Consumer Protection

At the core of the Georgia Department of Insurance’s mandate is the regulation of insurance companies, agents, and brokers operating within the state. This involves a comprehensive range of responsibilities, including:

- License and oversight of insurance companies: The department ensures that insurance providers meet stringent financial and operational standards to protect policyholders.

- License and education of insurance professionals: Agents and brokers must undergo rigorous training and examinations to obtain their licenses, ensuring they provide accurate and ethical advice to consumers.

- Enforcement of insurance laws: The department investigates and takes action against fraudulent or unethical practices, ensuring that insurance providers adhere to state and federal regulations.

- Consumer education and advocacy: The Georgia Department of Insurance provides valuable resources and guidance to help consumers make informed decisions about their insurance needs.

One of the department's key initiatives is the creation of an accessible and user-friendly online platform. This platform serves as a one-stop shop for consumers, offering a wealth of information on insurance products, companies, and consumer rights. It also provides a convenient channel for filing complaints and seeking assistance in resolving insurance-related disputes.

Insurance Products and Coverage

The Georgia Department of Insurance oversees a diverse range of insurance products, catering to the varied needs of its residents and businesses. Some of the key insurance categories regulated by the department include:

Auto Insurance

The state mandates that all vehicle owners carry liability insurance to cover damages caused to others in an accident. The department ensures that auto insurance policies comply with state requirements and offers guidance on choosing the right coverage options.

Homeowners Insurance

With Georgia’s diverse climate and potential for natural disasters, homeowners insurance is a crucial aspect of financial protection. The department regulates these policies, helping homeowners understand their coverage options and rights.

Health Insurance

Access to affordable and comprehensive health insurance is a priority for many Georgians. The department plays a critical role in overseeing health insurance plans, ensuring compliance with the Affordable Care Act and providing resources for consumers to navigate the healthcare system.

Life Insurance

Life insurance policies are an essential component of financial planning for many families. The Georgia Department of Insurance regulates these policies, ensuring that they meet state standards and providing guidance on choosing the right coverage.

Industry Insights and Innovations

The Georgia Department of Insurance actively engages with industry experts and stakeholders to stay abreast of the latest trends and innovations in the insurance sector. This collaboration ensures that the department’s regulations and initiatives remain relevant and effective in a rapidly evolving industry.

One notable initiative is the department's focus on promoting insurance literacy among Georgians. Through educational campaigns and partnerships with community organizations, the department aims to empower residents with the knowledge to make informed insurance decisions.

Performance and Impact Analysis

The impact of the Georgia Department of Insurance’s work is far-reaching, affecting the lives and businesses of millions of Georgians. By regulating the insurance industry, the department ensures a stable and competitive market, benefiting consumers with a wide range of insurance options and affordable premiums.

Through its enforcement actions and consumer protection initiatives, the department has saved consumers millions of dollars in fraudulent and unethical practices. Additionally, its educational efforts have empowered residents to make better-informed choices, leading to improved insurance coverage and financial security.

The department's focus on innovation and technology has also streamlined insurance processes, making it easier for consumers to access information and services. This digital transformation has enhanced efficiency and accessibility, particularly in rural areas where physical access to insurance services may be limited.

Future Outlook and Emerging Trends

As the insurance industry continues to evolve, the Georgia Department of Insurance is poised to adapt and address emerging trends and challenges. Some key areas of focus for the department include:

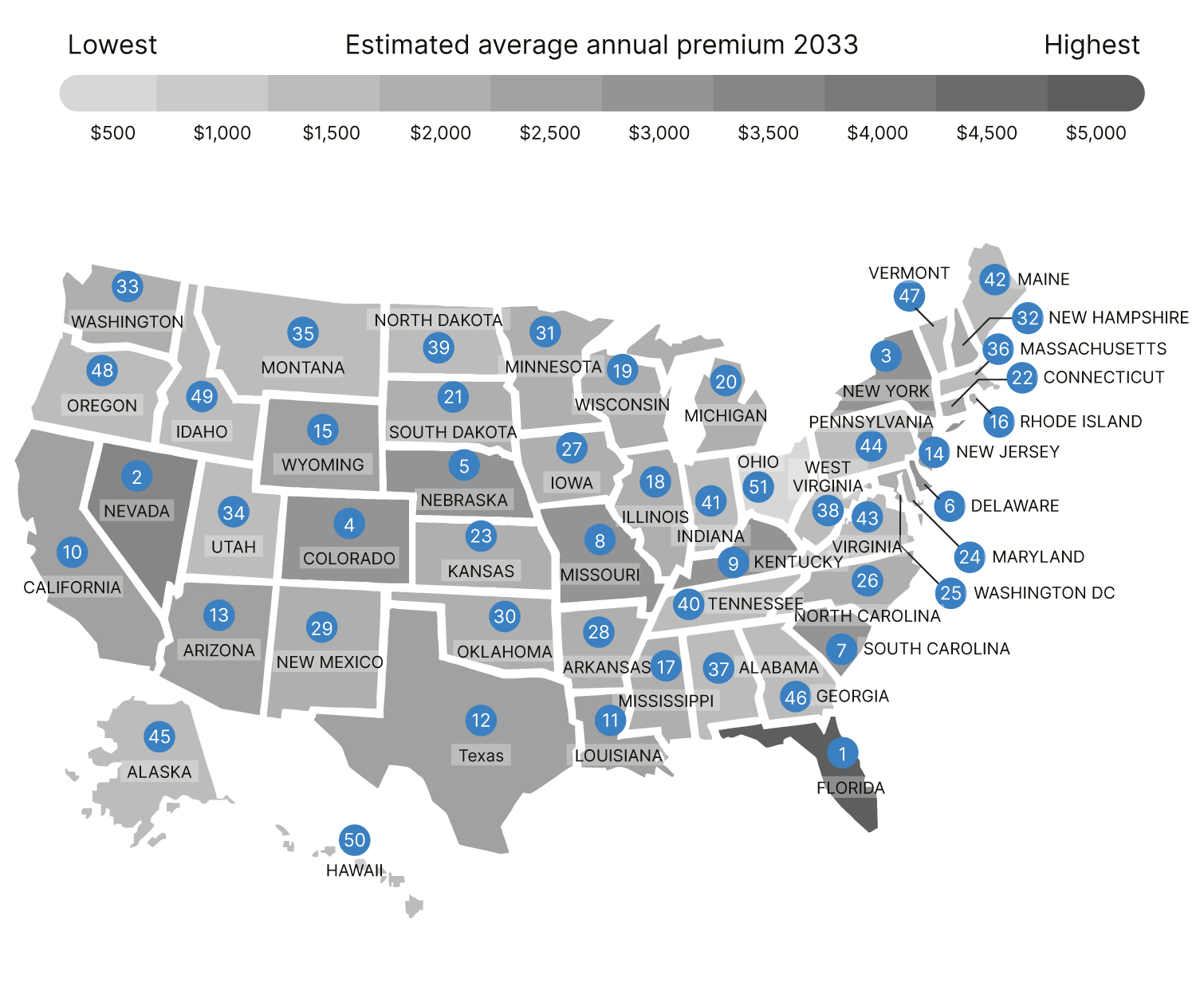

- Climate change and natural disasters: With Georgia's vulnerability to hurricanes, tornadoes, and other extreme weather events, the department is exploring ways to enhance insurance coverage and support for affected communities.

- Healthcare access and affordability: The department is committed to continuing its efforts to make healthcare insurance more accessible and affordable, particularly for low-income households and those with pre-existing conditions.

- Insurance technology (InsurTech): The rapid advancement of technology in the insurance sector presents both opportunities and challenges. The department aims to support innovative InsurTech solutions while ensuring consumer protection and data privacy.

Collaborative Partnerships

The Georgia Department of Insurance recognizes the value of collaboration in addressing complex insurance issues. It actively engages with other state and federal regulatory bodies, as well as industry associations and consumer advocacy groups, to share best practices and develop coordinated responses to emerging challenges.

In conclusion, the State of Georgia Department of Insurance stands as a cornerstone of consumer protection and industry regulation within the state. Through its dedicated efforts, the department ensures a fair, stable, and accessible insurance market, empowering Georgians to make informed decisions and secure their financial well-being.

What are the key responsibilities of the Georgia Department of Insurance?

+The department’s primary responsibilities include licensing and overseeing insurance companies, educating and licensing insurance professionals, enforcing insurance laws, and advocating for consumer rights and education.

How does the department protect consumers?

+The department investigates and takes action against fraudulent practices, provides resources for consumers to understand their rights, and offers assistance in resolving insurance-related disputes.

What insurance products does the department regulate?

+The department oversees a range of insurance products, including auto, homeowners, health, and life insurance.