Online Insurance Company

The insurance industry is undergoing a significant transformation with the rise of digital technologies, and at the forefront of this revolution are online insurance companies. These digital-first entities are reshaping the way consumers interact with their insurance providers, offering convenience, flexibility, and a host of innovative features that traditional insurers often struggle to match. This article explores the world of online insurance companies, delving into their unique value propositions, the challenges they face, and their potential to redefine the future of insurance.

The Rise of Online Insurance: A Digital Disruption

The concept of online insurance companies, often referred to as insurtechs, is a relatively recent phenomenon, yet their impact on the industry has been profound. By leveraging technology, these companies have streamlined the insurance experience, making it more accessible and tailored to the modern consumer’s needs. Here’s a closer look at what sets them apart.

Seamless Digital Experience

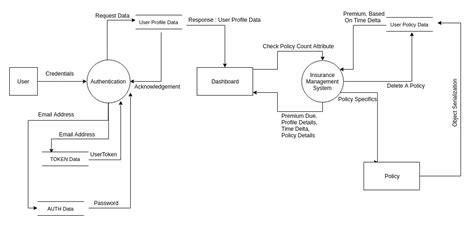

At the core of online insurance companies’ appeal is their ability to offer a fully digital, end-to-end insurance journey. From policy acquisition to claims management, everything can be done online, often through intuitive, user-friendly platforms. This convenience is particularly appealing to younger generations who expect seamless digital interactions in all aspects of their lives.

For instance, consider PolicyGenius, an online insurance marketplace. PolicyGenius allows users to compare various insurance products, from life insurance to car insurance, all in one place. Their platform provides clear, detailed information about each policy, helping users make informed decisions without the need for multiple consultations or paperwork.

Personalized Insurance Solutions

Online insurance companies excel at delivering personalized insurance experiences. Using advanced data analytics and machine learning, these platforms can offer tailored coverage options based on individual customer profiles. This level of customization ensures that customers only pay for the coverage they need, making insurance more affordable and relevant.

Take Lemonade, an online insurer that specializes in renters and homeowners insurance. Lemonade's AI-powered platform assesses risk factors unique to each customer, such as the number of pets, home security features, and previous claims history, to provide personalized quotes. This approach has made Lemonade a favorite among millennials who appreciate the simplicity and customization of their insurance plans.

Innovative Use of Technology

Online insurance companies are at the forefront of technological innovation in the industry. They utilize advanced technologies like artificial intelligence, blockchain, and the Internet of Things (IoT) to enhance their services. For example, some insurers are developing smart home devices that can detect and prevent potential hazards, reducing the risk of claims and offering customers peace of mind.

| Insurtech | Technological Innovation |

|---|---|

| Oscar Health | AI-powered virtual health assistant for personalized health guidance and care coordination. |

| Root Insurance | Mobile app that uses telematics to offer fairer car insurance rates based on individual driving behavior. |

| Next Insurance | Blockchain-based platform for small business insurance, offering efficient claims processing and transparent pricing. |

Challenges and Opportunities

While online insurance companies bring a wealth of benefits to the market, they also face unique challenges that can impact their growth and sustainability.

Regulatory and Legal Hurdles

The insurance industry is heavily regulated, and online insurers must navigate a complex web of state and federal regulations. Compliance with these rules can be costly and time-consuming, particularly for smaller startups. Additionally, the dynamic nature of technology can sometimes outpace the speed of regulatory changes, creating uncertainty and potential legal pitfalls.

Building Trust and Brand Recognition

In an industry where trust is paramount, online insurance companies must work hard to establish their credibility and build a strong brand identity. Customers often prefer traditional insurers due to their established reputation and long-standing presence in the market. However, online insurers can leverage their technological advantages and innovative products to gain the trust of a new generation of insurance consumers.

Data Privacy and Security

With the extensive use of digital technologies, online insurance companies handle vast amounts of sensitive customer data. Protecting this data from cyber threats and ensuring its ethical use is a critical challenge. A single data breach or privacy violation can damage an insurer’s reputation and lead to significant financial losses.

The Future of Online Insurance

Despite the challenges, the future looks bright for online insurance companies. Their innovative approaches and customer-centric focus position them well to capitalize on the ongoing digital transformation of the insurance industry. Here’s a glimpse into what we can expect in the coming years.

Expanded Product Offerings

Online insurers are likely to expand their product portfolios beyond traditional insurance lines. We can anticipate the emergence of new insurance products tailored to the unique needs of the digital age, such as cyber insurance, digital asset protection, and insurance for emerging technologies like drones and autonomous vehicles.

Enhanced Customer Engagement

With advancements in AI and machine learning, online insurance companies will continue to enhance their customer engagement strategies. Expect to see more personalized insurance recommendations, proactive risk management advice, and innovative ways to connect with customers, such as through social media or interactive mobile apps.

Partnerships and Collaborations

To overcome some of the challenges mentioned earlier, online insurers may increasingly partner with established traditional insurers or other tech-savvy entities. These collaborations can help online insurers access established distribution channels, gain regulatory expertise, and enhance their technological capabilities, ultimately strengthening their market position.

What are the benefits of choosing an online insurance company over a traditional insurer?

+

Online insurance companies offer several advantages, including a fully digital, seamless experience; personalized insurance solutions tailored to individual needs; and innovative use of technology. They often provide more transparent pricing and faster, more efficient claims processing, making insurance more accessible and convenient.

Are online insurance companies more affordable than traditional insurers?

+

Online insurance companies can offer more affordable rates due to their efficient, tech-driven operations and personalized coverage options. However, the affordability of a policy can vary based on individual risk profiles and the specific insurance needs of the customer.

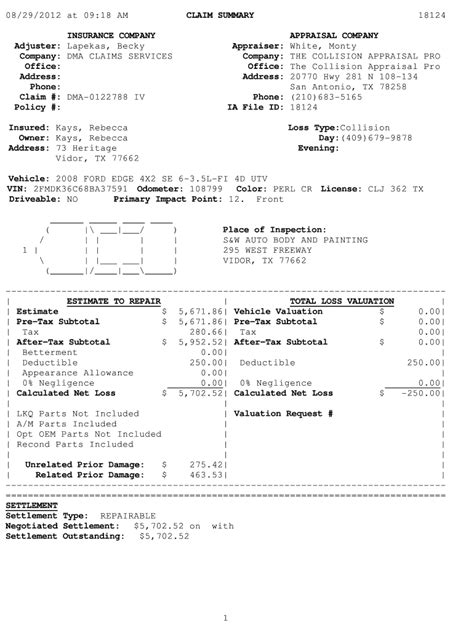

How do online insurance companies handle claims and customer service inquiries?

+

Online insurance companies typically handle claims and customer service through digital channels, often via dedicated apps or online portals. They aim to provide fast, efficient service, sometimes with the assistance of AI-powered chatbots or virtual assistants. However, many also offer traditional methods of communication, such as phone support or email, for customers who prefer those options.

What steps are online insurance companies taking to ensure data privacy and security?

+

Online insurance companies invest heavily in robust cybersecurity measures to protect customer data. This includes encryption technologies, multi-factor authentication, regular security audits, and staff training on data privacy best practices. They also comply with relevant data privacy regulations, such as GDPR or CCPA, to ensure the ethical and secure handling of customer information.