Affordable Full Coverage Insurance

Finding affordable full coverage insurance is a top priority for many vehicle owners. Full coverage insurance offers comprehensive protection, providing peace of mind and financial security in the event of accidents, natural disasters, or other unforeseen circumstances. While the desire for comprehensive coverage is universal, the cost can often be a significant concern, especially for those on a tight budget. This comprehensive guide aims to demystify the process of securing affordable full coverage insurance, offering insights, tips, and strategies to help you make informed decisions and potentially save money.

Understanding Full Coverage Insurance

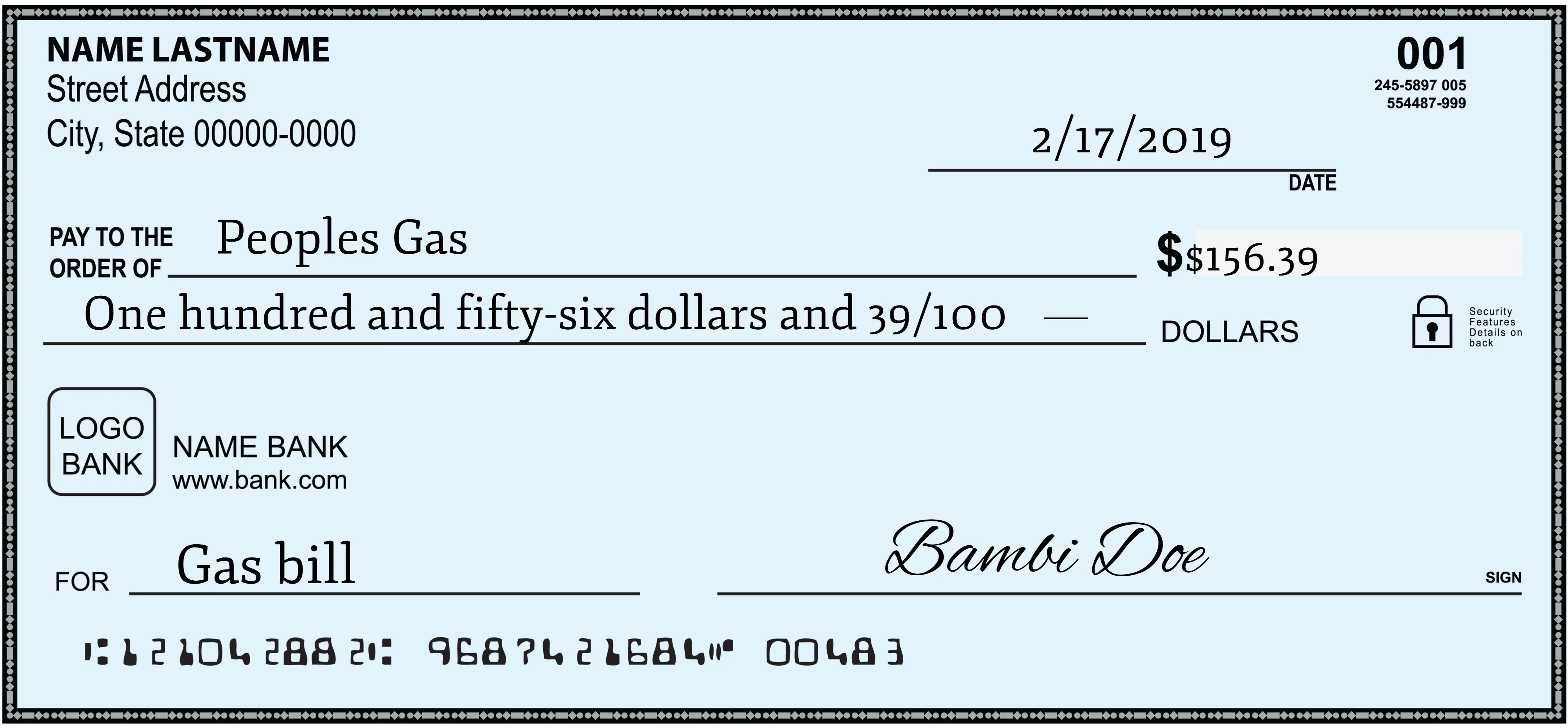

Full coverage insurance, also known as comprehensive car insurance, is a policy that combines two primary types of coverage: collision coverage and comprehensive coverage. Collision coverage provides protection for damage to your vehicle resulting from accidents, regardless of fault. On the other hand, comprehensive coverage safeguards against damage caused by non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals.

By opting for full coverage insurance, you gain the assurance that your vehicle is protected against a wide range of potential hazards. However, it's essential to note that the cost of full coverage insurance can vary significantly based on factors like the make and model of your vehicle, your driving history, and the level of coverage you choose.

Factors Affecting Full Coverage Insurance Rates

- Vehicle Type and Value: Insurers consider the make, model, and age of your vehicle when determining rates. Generally, newer and more expensive vehicles tend to have higher insurance premiums.

- Driving History: Your driving record plays a crucial role. A clean driving history with no accidents or violations can lead to more favorable insurance rates.

- Coverage Level: The level of coverage you choose directly impacts your premium. Higher coverage limits will result in higher costs.

- Location: The area where you live and drive your vehicle can affect your insurance rates. Urban areas with higher crime rates or a history of severe weather conditions may result in increased premiums.

- Demographics: Factors such as age, gender, and marital status can also influence insurance rates. Young drivers, for instance, are often considered higher risk and may face higher premiums.

Understanding these factors is the first step towards securing affordable full coverage insurance. By being aware of how these variables impact your rates, you can make informed decisions to potentially lower your insurance costs.

Strategies for Affordable Full Coverage Insurance

While full coverage insurance offers invaluable peace of mind, finding ways to reduce the associated costs is essential for many vehicle owners. Here are some effective strategies to help you secure affordable full coverage insurance:

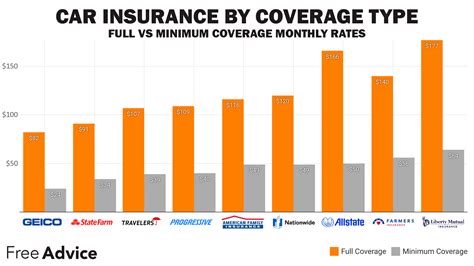

Shop Around and Compare Quotes

One of the most effective ways to find affordable full coverage insurance is by shopping around and comparing quotes from multiple insurers. Insurance rates can vary significantly between providers, so obtaining quotes from at least three different companies is advisable. Online comparison tools can streamline this process, allowing you to quickly gather and compare quotes.

When comparing quotes, ensure you're comparing policies with similar coverage levels and deductibles. This ensures an accurate assessment of the best value for your insurance needs.

Utilize Discounts and Rewards

Insurance companies often offer a range of discounts and rewards to attract and retain customers. Common discounts include those for safe driving records, vehicle safety features, multi-policy bundles, and loyalty. Some insurers also provide discounts for specific professions or affiliations, such as military service or membership in certain organizations.

When obtaining quotes, inquire about the discounts available and ensure you meet the eligibility criteria. By taking advantage of these discounts, you can significantly reduce your insurance premiums.

Consider Higher Deductibles

Opting for a higher deductible can lead to lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to a higher deductible, you assume more financial responsibility in the event of a claim, which can result in reduced insurance costs.

However, it's crucial to ensure you can afford the higher deductible in the event of a claim. Carefully consider your financial situation and choose a deductible that aligns with your ability to pay.

Bundle Policies

Bundling multiple insurance policies with the same insurer is a common strategy to reduce costs. For instance, if you have home insurance and auto insurance, combining them with the same provider can often result in significant savings. Insurers often offer multi-policy discounts to encourage customers to bundle their policies.

Before bundling, compare the bundled rate with the cost of individual policies to ensure it's a financially sound decision.

Improve Your Driving Record

Your driving record is a critical factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to more favorable insurance rates. Conversely, a history of accidents or traffic violations can result in higher premiums.

If you have a less-than-perfect driving record, consider taking defensive driving courses or other safe driving programs. These can help improve your driving skills and potentially lead to reduced insurance rates.

Maintain a Good Credit Score

Believe it or not, your credit score can impact your insurance rates. Many insurers use credit-based insurance scores to assess the risk associated with insuring a driver. Generally, drivers with higher credit scores are considered lower risk and may qualify for more favorable insurance rates.

Improving your credit score can be a long-term strategy to reduce your insurance costs. Regularly review your credit report, address any errors, and work towards maintaining a healthy credit profile.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach where your insurance premium is based on your actual driving behavior. Insurers use telematics devices or smartphone apps to track factors like mileage, driving habits, and even the times of day you drive.

By demonstrating safe and responsible driving habits, you can potentially lower your insurance costs. Usage-based insurance is an excellent option for drivers who may not drive frequently or who have excellent driving records.

The Future of Affordable Full Coverage Insurance

The insurance industry is constantly evolving, and new technologies and trends are shaping the future of affordable full coverage insurance. Here’s a glimpse into what we can expect in the coming years:

Advanced Telematics and Data Analytics

Telematics devices and data analytics are becoming increasingly sophisticated, allowing insurers to gather more accurate and detailed information about drivers’ behavior. This data can be used to develop more precise risk assessment models, leading to more tailored and potentially more affordable insurance options.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are revolutionizing the insurance industry. These technologies can analyze vast amounts of data, identify patterns, and make predictions with greater accuracy. This can lead to more efficient claims processing and risk assessment, potentially reducing insurance costs for consumers.

Autonomous Vehicles and Their Impact

The rise of autonomous vehicles is expected to have a significant impact on the insurance industry. As self-driving cars become more prevalent, the number of accidents and claims may decrease, leading to lower insurance premiums. However, the introduction of autonomous vehicles also brings new risks and challenges that insurers will need to address.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by enhancing security, transparency, and efficiency. Smart contracts, for instance, can automate certain insurance processes, reducing administrative costs and potentially lowering premiums for consumers.

Collaborative Insurance Models

Collaborative insurance models, such as peer-to-peer insurance, are gaining traction. These models allow individuals to pool resources and share risks, potentially reducing the need for traditional insurance providers. While still in its early stages, this trend could offer more affordable insurance options in the future.

Conclusion

Securing affordable full coverage insurance is a multifaceted process that requires careful consideration of various factors. By understanding the components of full coverage insurance, shopping around for the best rates, and implementing cost-saving strategies, you can make informed decisions to protect your vehicle without breaking the bank.

Stay informed about the latest trends and technologies shaping the insurance industry, as they may offer even more opportunities for affordable coverage in the future. Remember, finding the right balance between comprehensive protection and affordability is key to ensuring your peace of mind on the road.

What is the average cost of full coverage insurance?

+The average cost of full coverage insurance varies widely based on factors like location, vehicle type, and driving history. As of [current year], the average annual premium for full coverage insurance in the United States is around 1,674, but it can range from 1,000 to $3,000 or more.

How can I lower my full coverage insurance premiums?

+There are several strategies to lower your full coverage insurance premiums. These include shopping around for quotes, taking advantage of discounts, considering higher deductibles, bundling policies, improving your driving record, and maintaining a good credit score.

What is usage-based insurance, and how can it help me save money?

+Usage-based insurance, or pay-as-you-drive insurance, is an innovative approach where your insurance premium is based on your actual driving behavior. By demonstrating safe and responsible driving habits, you can potentially lower your insurance costs. It’s an excellent option for drivers who may not drive frequently or who have excellent driving records.

How do my driving record and credit score impact my insurance rates?

+Your driving record and credit score are crucial factors in determining your insurance rates. A clean driving record with no accidents or violations can lead to more favorable insurance rates. Similarly, a higher credit score is often associated with lower insurance premiums as it indicates a lower risk profile.