Car Insurance Inquiry

In today's fast-paced world, car insurance is an essential aspect of vehicle ownership, offering peace of mind and financial protection to drivers and their vehicles. With the ever-increasing number of vehicles on the road, the need for comprehensive car insurance coverage has become more critical than ever. This article aims to provide an in-depth exploration of car insurance, covering its types, benefits, factors influencing premiums, and real-world examples to help you make informed decisions about your vehicle's protection.

Understanding Car Insurance

Car insurance is a contract between an individual (the policyholder) and an insurance company. It provides financial protection against physical damage or bodily injury resulting from traffic accidents and other vehicle-related risks. It also covers liability that could arise from an accident, including legal fees and settlement costs.

Types of Car Insurance

There are several types of car insurance policies, each offering different levels of coverage:

- Liability Coverage: This is the most basic form of car insurance, covering bodily injury and property damage caused by the policyholder to others in an accident. It does not cover the policyholder’s vehicle or injuries.

- Collision Coverage: This type of insurance covers damage to the policyholder’s vehicle in the event of a collision with another vehicle or object, regardless of fault. It is often required when financing or leasing a vehicle.

- Comprehensive Coverage: Comprehensive insurance provides protection against damage caused by incidents other than collisions, such as theft, vandalism, fire, and natural disasters. It covers a wide range of non-collision-related risks.

- Personal Injury Protection (PIP): PIP covers medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Factors Influencing Car Insurance Premiums

The cost of car insurance, known as the premium, can vary significantly depending on several factors. Understanding these factors can help policyholders make informed decisions and potentially reduce their insurance costs.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how you use it (e.g., daily commute, leisure, business), can impact your insurance rates. Generally, newer and more expensive vehicles tend to have higher premiums.

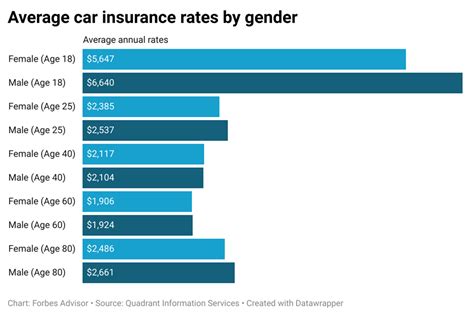

- Driver Profile: Your driving record, age, gender, and location play a significant role in determining your insurance premium. Younger drivers, especially males, often face higher premiums due to their perceived higher risk on the road. Additionally, your driving history, including any accidents or traffic violations, can affect your rates.

- Coverage and Deductibles: The level of coverage you choose (liability, collision, comprehensive, etc.) and the deductibles you select (the amount you pay out of pocket before the insurance kicks in) directly impact your premium. Higher deductibles usually result in lower premiums.

- Insurance Company and Policy Terms: Different insurance companies offer various policy options and pricing structures. It’s essential to compare quotes from multiple providers to find the best coverage and price for your needs.

- Discounts and Bundles: Many insurance companies offer discounts for various reasons, such as good driving records, safe vehicle features, multiple policy bundles (e.g., car and home insurance), or loyalty programs. Bundling multiple policies with the same insurer can often result in significant savings.

| Discount Type | Description |

|---|---|

| Good Driver Discount | Offered to drivers with a clean driving record, free of accidents and violations. |

| Safe Vehicle Discount | Given for vehicles equipped with advanced safety features like anti-lock brakes or collision avoidance systems. |

| Multi-Policy Discount | Provided when you bundle multiple insurance policies, such as car and home insurance, with the same insurer. |

| Loyalty Discount | Rewarding long-term customers who have been with the insurer for several years. |

Real-World Examples of Car Insurance Claims

Let’s explore a few real-world scenarios to better understand how car insurance works and its potential benefits.

Scenario 1: Collision with Another Vehicle

Imagine you’re driving on a busy highway when another vehicle suddenly cuts in front of you, causing you to collide with it. In this situation, your collision insurance would cover the damage to your vehicle, regardless of who was at fault. If the other driver was found to be at fault, their liability insurance would cover the cost of repairs to your car. If they had insufficient or no insurance, your uninsured motorist coverage would step in to cover the costs.

Scenario 2: Vandalism and Theft

Suppose your car is vandalized while parked in a public parking lot, with the windows shattered and some interior components damaged. In this case, your comprehensive insurance would cover the cost of repairs. Additionally, if your vehicle were stolen, comprehensive insurance would also cover the replacement cost, less your deductible.

Scenario 3: Medical Expenses After an Accident

In a more severe accident, you and your passengers sustain injuries that require medical attention. Your personal injury protection (PIP) coverage would cover the medical expenses for you and your passengers, regardless of who was at fault in the accident. This coverage ensures that you and your loved ones receive the necessary medical care without worrying about immediate financial burdens.

Future of Car Insurance: Technological Innovations

The car insurance industry is evolving rapidly with technological advancements. Here are some key trends to watch:

- Telematics and Usage-Based Insurance (UBI): Telematics devices installed in vehicles can track driving behavior, including speed, acceleration, and braking. UBI policies use this data to offer personalized premiums based on an individual’s driving habits. This technology incentivizes safer driving and can lead to lower insurance costs for responsible drivers.

- Artificial Intelligence and Machine Learning: AI and machine learning are being used to improve claims processing, fraud detection, and risk assessment. These technologies can analyze large amounts of data to identify patterns and make more accurate predictions, enhancing the overall efficiency of the insurance process.

- Connected Car Technology: With the increasing connectivity of vehicles, insurance companies can leverage data from connected car systems to offer more tailored coverage. This data can provide insights into vehicle performance, driver behavior, and potential risks, allowing for more precise risk assessment and pricing.

- Blockchain Technology: Blockchain’s secure and transparent nature can revolutionize the car insurance industry by streamlining claims processing, reducing fraud, and improving data sharing between insurers, customers, and other stakeholders.

Conclusion

Car insurance is a crucial aspect of responsible vehicle ownership, providing financial protection and peace of mind. By understanding the different types of coverage, factors influencing premiums, and real-world examples of claims, you can make informed decisions about your car insurance. Additionally, keeping up with technological innovations in the industry can help you stay ahead of the curve and potentially save on insurance costs.

Frequently Asked Questions

How do I choose the right car insurance coverage for my needs?

+

When selecting car insurance coverage, consider your vehicle’s value, your financial situation, and the level of risk you’re comfortable with. For instance, if you have an older vehicle with a low resale value, you might opt for liability-only coverage. However, if you have a newer, more expensive car, you may want to consider comprehensive coverage to protect your investment. Additionally, assess your personal risk tolerance and budget to determine the right balance of coverage and deductibles.

What are some common mistakes people make when choosing car insurance?

+

Some common mistakes include selecting the cheapest option without considering the coverage provided, assuming all policies are the same, and neglecting to review and update their coverage regularly. It’s crucial to understand the specifics of your policy, ensure it aligns with your needs, and keep it up-to-date as your circumstances change.

How can I reduce my car insurance premiums?

+

To lower your car insurance premiums, consider increasing your deductible, maintaining a clean driving record, taking advantage of available discounts (e.g., good driver, safe vehicle, multi-policy), and shopping around for the best rates. Additionally, newer technologies like usage-based insurance (UBI) can offer personalized premiums based on your driving behavior, potentially leading to significant savings.