Auto Insurance Us

Auto insurance is an essential aspect of vehicle ownership in the United States, providing financial protection and peace of mind to drivers across the country. With a vast and diverse landscape of roads, from the bustling streets of New York City to the scenic highways of California, understanding the intricacies of auto insurance is crucial. This comprehensive guide delves into the world of auto insurance in the US, exploring its importance, key components, and the unique factors that influence coverage and premiums.

The Significance of Auto Insurance in the US

In the United States, auto insurance is not just a legal requirement but a vital safeguard for drivers and their vehicles. With a population of over 331 million people and an estimated 276 million registered vehicles as of 2020, the roads are a bustling environment where accidents can occur. Auto insurance serves as a financial safety net, offering coverage for a wide range of scenarios, including collisions, natural disasters, theft, and liability claims.

The significance of auto insurance extends beyond individual protection. It plays a crucial role in maintaining the overall safety and stability of the transportation system. By ensuring that drivers are financially prepared for unforeseen incidents, auto insurance promotes responsible driving behaviors and helps mitigate the potential financial burdens associated with vehicle-related accidents.

Understanding the Key Components of Auto Insurance

Auto insurance policies in the US are tailored to meet the diverse needs of drivers and their vehicles. These policies typically consist of several key components, each designed to provide specific types of coverage. Here’s a breakdown of the fundamental components of auto insurance:

Liability Coverage

Liability coverage is a cornerstone of auto insurance policies. It provides financial protection in the event that the policyholder is found at fault for an accident that causes bodily injury or property damage to others. This coverage is essential as it helps cover the costs of medical expenses, vehicle repairs, and other associated damages.

Liability coverage typically comes in two forms: bodily injury liability and property damage liability. Bodily injury liability covers the costs associated with injuries sustained by others in an accident, including medical treatment, rehabilitation, and potential legal fees. Property damage liability, on the other hand, covers the costs of repairing or replacing damaged property, such as other vehicles, fences, or structures.

Collision Coverage

Collision coverage is an optional component of auto insurance that provides protection for the policyholder’s vehicle in the event of a collision with another vehicle or object. This coverage is particularly beneficial when the policyholder is at fault for the accident, as it helps cover the costs of repairing or replacing their own vehicle.

Collision coverage typically comes into play when the damages exceed the policyholder's deductible, which is the amount they agree to pay out of pocket before the insurance coverage kicks in. Deductibles can vary based on the policy and the individual's preference, with higher deductibles often resulting in lower premiums.

Comprehensive Coverage

Comprehensive coverage is another optional component of auto insurance that provides protection against damages caused by events other than collisions. This coverage includes a wide range of scenarios, such as theft, vandalism, natural disasters (e.g., hail, floods, wildfires), and even damage caused by animals.

Comprehensive coverage is especially valuable for drivers who wish to protect their vehicles from a broad spectrum of potential risks. It ensures that they are financially prepared for unexpected events that may cause significant damage to their vehicles, helping to minimize the financial burden of repairs or replacement.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage are vital components of auto insurance policies, providing financial assistance for medical expenses and lost wages resulting from an accident. These coverages are designed to help policyholders and their passengers cover the costs of medical treatment, rehabilitation, and other related expenses, regardless of who is at fault for the accident.

PIP coverage varies by state, with some states requiring it as a mandatory component of auto insurance policies. It typically includes not only medical expenses but also other benefits such as lost wages, funeral expenses, and even child care costs. Medical Payments coverage, on the other hand, is more limited in scope and covers only medical expenses up to a specified limit.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an essential component of auto insurance, providing protection for policyholders when they are involved in an accident with a driver who either has no insurance or insufficient insurance coverage. This coverage is crucial as it helps cover the costs of medical treatment, vehicle repairs, and other associated expenses when the at-fault driver is unable to provide adequate financial compensation.

UM/UIM coverage is especially valuable in states with high rates of uninsured or underinsured drivers. It ensures that policyholders are not left financially burdened in the event of an accident caused by an irresponsible driver. This coverage typically includes both bodily injury and property damage protection, providing a safety net for policyholders and their passengers.

Factors Influencing Auto Insurance Premiums

Auto insurance premiums in the US are influenced by a multitude of factors, each playing a role in determining the cost of coverage. Understanding these factors is essential for drivers seeking affordable and comprehensive insurance policies. Here’s an in-depth look at the key factors that impact auto insurance premiums:

Driving History

One of the most significant factors influencing auto insurance premiums is the policyholder’s driving history. Insurance companies carefully evaluate an individual’s driving record, including any accidents, traffic violations, and claims made in the past. A clean driving record with no accidents or violations typically results in lower premiums, as it indicates a lower risk of future accidents.

Conversely, a history of accidents, especially those involving significant damage or injuries, can lead to higher premiums. Insurance companies view individuals with a history of accidents as higher-risk drivers, and they adjust premiums accordingly. Similarly, multiple traffic violations, such as speeding tickets or driving under the influence (DUI) convictions, can also result in increased premiums, as these behaviors suggest a higher likelihood of future accidents.

Vehicle Type and Usage

The type of vehicle an individual drives and its intended usage are important factors in determining auto insurance premiums. Insurance companies consider various aspects of a vehicle, including its make, model, year, and safety features. Vehicles that are more expensive to repair or replace, such as luxury cars or sports cars, often come with higher insurance premiums.

Additionally, the intended usage of the vehicle plays a role in premium calculation. Insurance companies differentiate between personal use, business use, and commercial use. Vehicles used for business or commercial purposes may be subject to higher premiums due to the increased risk of accidents and the potential for higher liability claims.

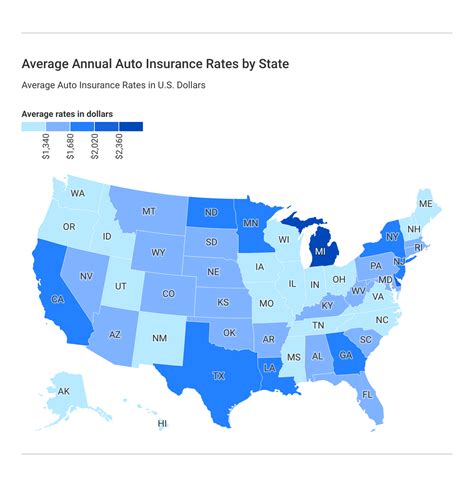

Location and Geographical Factors

The policyholder’s location and geographical factors significantly influence auto insurance premiums. Insurance companies consider the risk associated with different regions, taking into account factors such as crime rates, traffic density, and weather conditions.

Areas with higher crime rates, such as urban centers, often have higher insurance premiums due to the increased risk of vehicle theft or vandalism. Similarly, regions with dense traffic and a higher incidence of accidents may also result in higher premiums. Weather conditions, particularly in areas prone to natural disasters like hurricanes or floods, can also impact insurance rates, as these events can lead to increased claims for damage.

Credit Score

An individual’s credit score is another factor that insurance companies use to assess their insurance risk. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims. Individuals with higher credit scores are often viewed as more responsible and financially stable, which can lead to lower insurance premiums.

Conversely, individuals with lower credit scores may face higher insurance premiums. Insurance companies believe that individuals with lower credit scores are more likely to file claims and may be less likely to pay their premiums on time. As a result, these individuals are considered higher-risk customers, and their insurance premiums reflect this assessment.

Age and Gender

Age and gender are factors that insurance companies consider when determining auto insurance premiums. Statistical data shows that younger drivers, particularly those under the age of 25, tend to be involved in more accidents and file more insurance claims. As a result, insurance companies often charge higher premiums for younger drivers, especially those with limited driving experience.

Gender is another factor that can influence insurance premiums, although the impact varies by state and insurance company. In some states, insurance companies are prohibited from using gender as a rating factor, while in others, it may play a role in premium calculation. Generally, male drivers, especially young males, are considered higher-risk drivers and may face slightly higher premiums compared to female drivers.

Marital Status

Marital status is a factor that insurance companies use to assess insurance risk and determine premiums. Studies have shown that married individuals tend to have lower accident rates and file fewer insurance claims compared to single individuals. As a result, insurance companies often offer lower premiums to married policyholders, as they are perceived as lower-risk customers.

Additionally, insurance companies may offer discounts or package deals to married couples who combine their auto insurance policies. This practice, known as "multi-car" or "multi-policy" discounts, rewards policyholders for bundling their insurance needs, making it more cost-effective for families to insure multiple vehicles.

Education and Occupation

Education and occupation are factors that insurance companies consider when assessing insurance risk and determining premiums. Individuals with higher levels of education, particularly those with college degrees, are often viewed as more responsible and financially stable, which can lead to lower insurance premiums.

Similarly, certain occupations are associated with lower accident rates and fewer insurance claims. For example, individuals in professions such as teaching, law enforcement, or the military may be eligible for insurance discounts due to their perceived lower risk of involvement in accidents. Insurance companies may offer these discounts as a way to attract and retain policyholders in these occupations.

Policy Coverage and Deductibles

The level of coverage and deductibles chosen by the policyholder significantly impact auto insurance premiums. Comprehensive and collision coverage, while providing broader protection, typically result in higher premiums. On the other hand, opting for higher deductibles can lead to lower premiums, as the policyholder agrees to pay a larger portion of the costs in the event of a claim.

Policyholders must carefully consider their coverage needs and financial situation when selecting their policy. While higher coverage limits and lower deductibles provide greater financial protection, they come at a cost. It's important to strike a balance between adequate coverage and affordable premiums to ensure that the policy meets the policyholder's needs without straining their budget.

Auto Insurance Regulations and Laws in the US

Auto insurance regulations and laws vary across the United States, with each state implementing its own set of requirements and guidelines. These regulations aim to ensure that drivers are adequately insured and that insurance companies operate fairly and transparently. Here’s an overview of the key auto insurance regulations and laws in the US:

Mandatory Insurance Requirements

All states in the US have mandatory insurance requirements for vehicle owners and drivers. These requirements vary from state to state, with some states mandating only liability coverage, while others require a broader range of coverages, including collision, comprehensive, and personal injury protection (PIP) coverage.

The mandatory insurance requirements are designed to ensure that drivers have the financial means to cover the costs of accidents they may cause. By requiring liability coverage, states aim to protect the victims of accidents, ensuring they can receive compensation for their injuries and property damage.

No-Fault Insurance Laws

Several states in the US have adopted no-fault insurance laws, which modify the traditional liability system. In a no-fault system, drivers are required to carry personal injury protection (PIP) coverage as part of their auto insurance policy. This coverage provides financial protection for medical expenses and lost wages resulting from an accident, regardless of who is at fault.

No-fault insurance laws aim to streamline the claims process and reduce the number of lawsuits resulting from accidents. By providing immediate coverage for medical expenses and lost wages, these laws ensure that injured parties can receive prompt financial assistance without the need for lengthy legal proceedings.

Uninsured Motorist Laws

Uninsured motorist laws are in place to protect policyholders when they are involved in an accident with an uninsured or underinsured driver. These laws vary by state, with some states requiring uninsured/underinsured motorist (UM/UIM) coverage as a mandatory component of auto insurance policies, while others make it an optional coverage.

UM/UIM coverage provides financial protection for policyholders in the event that the at-fault driver is unable to provide adequate compensation for the damages caused. It ensures that policyholders are not left financially burdened when involved in an accident with an irresponsible driver.

Insurance Fraud and Penalties

Insurance fraud is a serious offense that carries significant penalties in the US. Insurance companies and law enforcement agencies work together to combat fraud, which can take various forms, including falsifying information on insurance applications, staging accidents, or exaggerating the extent of damages to receive higher compensation.

Penalties for insurance fraud can include fines, imprisonment, and the revocation of insurance coverage. Insurance companies have the right to deny claims and terminate policies if they suspect or uncover fraud. Additionally, individuals convicted of insurance fraud may face difficulties obtaining future insurance coverage and may be required to disclose their conviction when applying for insurance.

Rate Regulation and Consumer Protection

State insurance departments play a crucial role in regulating the auto insurance industry and protecting consumers. They ensure that insurance companies operate fairly and transparently, and they have the authority to review and approve insurance rates. This rate regulation helps prevent excessive premiums and ensures that insurance companies provide adequate coverage at reasonable prices.

Consumer protection is a key focus of insurance regulations. Insurance companies are required to provide clear and concise policy documents, explaining the terms and conditions of coverage. Additionally, they must handle claims fairly and promptly, ensuring that policyholders receive the benefits they are entitled to under their policies. State insurance departments oversee these practices and investigate complaints to ensure that consumers are treated fairly.

Auto Insurance Claims and the Claims Process

The auto insurance claims process is a crucial aspect of insurance policies, providing policyholders with the means to seek compensation for damages and losses resulting from accidents. Understanding the claims process and the steps involved is essential for ensuring a smooth and efficient resolution of claims.

Filing an Auto Insurance Claim

When an accident occurs, the first step is to notify the insurance company as soon as possible. Policyholders should provide accurate and detailed information about the accident, including the date, time, location, and any relevant details about the incident. It’s important to collect and document as much information as possible, including photographs of the accident scene, vehicle damage, and any injuries sustained.

Policyholders should also gather the contact information of any involved parties, including their names, addresses, and insurance information. If there are witnesses to the accident, it's beneficial to obtain their statements and contact details as well. This information will be crucial for the insurance company to assess the claim and determine liability.

Claim Investigation and Assessment

Once a claim is filed, the insurance company initiates an investigation to assess the extent of the damages and determine liability. This process may involve reviewing the policyholder’s statement, gathering additional information from witnesses or involved parties, and conducting an inspection of the vehicle and any other damaged property.

During the investigation, the insurance company may request additional documentation, such as police reports, medical records, or repair estimates. It's important for policyholders to cooperate fully with the investigation and provide all the necessary information to facilitate a timely and accurate assessment of the claim.

Determining Liability and Coverage

After the investigation, the insurance company will determine liability and assess the coverage available under the policy. This process involves reviewing the policy terms and conditions, as well as applicable state laws and regulations. The insurance company will determine whether the policyholder is entitled to coverage for the damages and losses sustained in the accident.

In cases where the policyholder is at fault, the insurance company will assess the coverage limits and deductibles applicable to the claim. If the damages exceed the policy limits, the policyholder may be responsible for covering the excess costs. On the other hand, if the at-fault driver is uninsured or underinsured, the policyholder's uninsured/underinsured motorist (UM/UIM) coverage may come into play, providing financial protection for the policyholder.

Resolving the Claim

Once liability and coverage have been determined, the insurance company will work towards resolving the claim. This may involve negotiating a settlement with the policyholder or the involved parties, paying out the claim, or denying the claim if it is found to be invalid or outside the scope of coverage.

Policyholders should carefully review the settlement offer and ensure that it adequately covers their damages and losses. If they disagree with the offer or feel that it is insufficient, they have the right to seek further negotiation or, in some cases, pursue legal action. It's important for policyholders to understand their rights and options during the claims process to ensure that they receive fair and appropriate compensation.

Tips for Choosing the Right Auto Insurance Policy

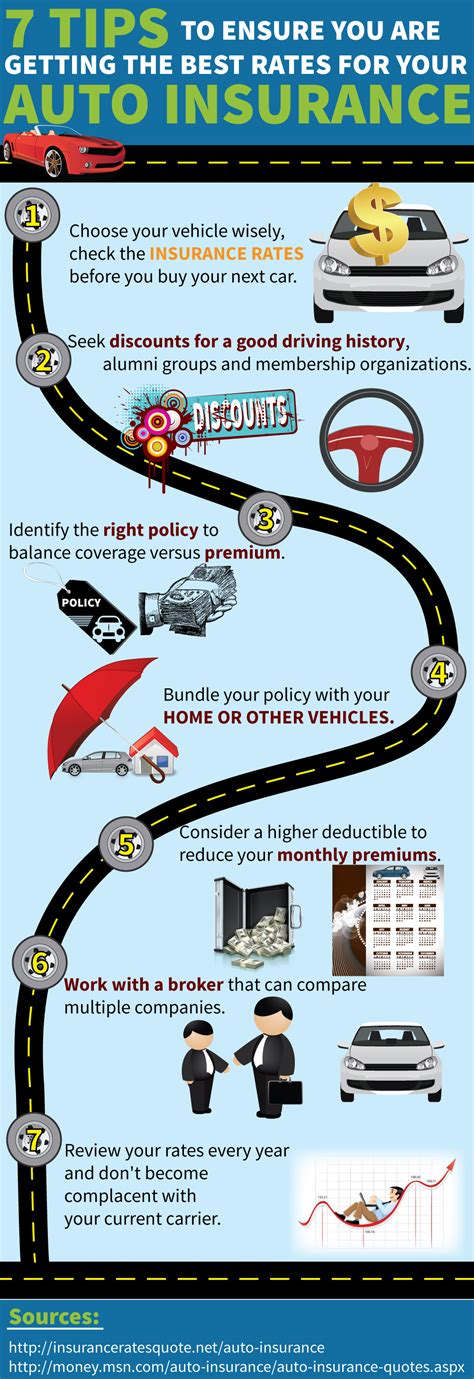

Selecting the right auto insurance policy is a crucial decision that can significantly impact a driver’s financial well-being and peace of mind. With a multitude of insurance providers and policy options available, it’s essential to carefully evaluate the various factors and make an informed choice. Here are some valuable tips to help drivers choose the right auto insurance policy:

Research and Compare Providers

Conduct thorough research to identify reputable