Missouri State Insurance

When it comes to protecting yourself and your loved ones, insurance plays a crucial role. Missouri, known for its diverse landscapes and vibrant cities, offers a range of insurance options to cater to its residents' needs. In this comprehensive guide, we will delve into the world of Missouri State Insurance, exploring its intricacies, benefits, and how it ensures a secure future for its citizens.

Understanding Missouri State Insurance: A Comprehensive Overview

Missouri State Insurance encompasses a wide array of coverage options, designed to safeguard individuals, families, and businesses from various risks and uncertainties. From auto and health insurance to property and life coverage, the state’s insurance landscape is tailored to meet the diverse needs of its residents.

The Missouri Department of Commerce and Insurance, often referred to as the Missouri Insurance Department, plays a pivotal role in regulating and overseeing the insurance industry within the state. Their primary objectives include ensuring fair practices, protecting consumers, and fostering a stable insurance market.

Auto Insurance in Missouri: Navigating the Roads Safely

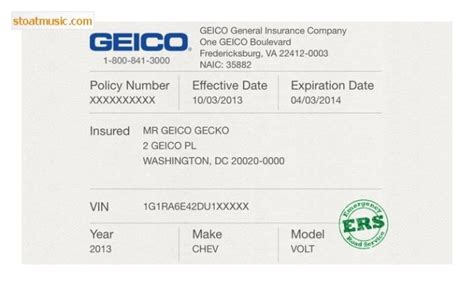

Auto insurance is a fundamental aspect of personal protection in Missouri. The state mandates that all vehicle owners carry liability insurance to cover potential damages arising from accidents. However, Missouri also offers a wide range of optional coverages to provide additional peace of mind.

For instance, comprehensive coverage protects against non-collision incidents like theft, vandalism, and natural disasters. Collision coverage, on the other hand, safeguards against damages resulting from collisions with other vehicles or objects. Additionally, uninsured/underinsured motorist coverage provides protection in the event of an accident with a driver who lacks sufficient insurance.

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers bodily injury and property damage caused to others. |

| Comprehensive Coverage | Protects against theft, vandalism, and natural disasters. |

| Collision Coverage | Covers damages from collisions with other vehicles or objects. |

| Uninsured/Underinsured Motorist Coverage | Provides protection if involved in an accident with an uninsured or underinsured driver. |

Health Insurance: Prioritizing Wellness in Missouri

Health insurance is an essential aspect of overall well-being, and Missouri residents have access to a variety of options to choose from. The state actively promotes access to affordable health coverage, ensuring that individuals and families can obtain the medical care they need without financial strain.

Missouri offers both individual and family health insurance plans, with various levels of coverage and cost. These plans typically include essential health benefits such as ambulatory patient services, emergency care, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, and more.

Additionally, Missouri participates in the federal Health Insurance Marketplace, allowing residents to compare and enroll in qualified health plans during the annual Open Enrollment Period. Those who qualify may also be eligible for premium tax credits and cost-sharing reductions to make health insurance more affordable.

Property Insurance: Protecting Your Missouri Assets

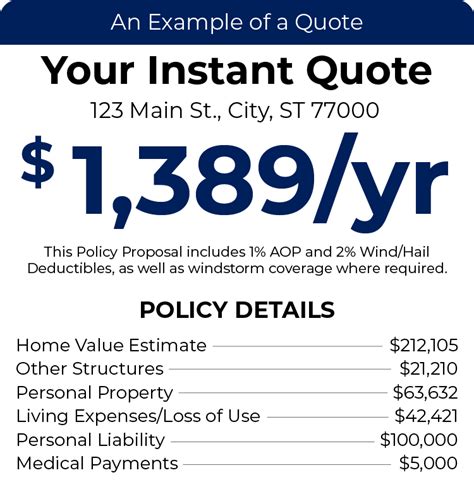

Property insurance is vital for safeguarding your Missouri home, business, or other valuable assets. This type of insurance provides coverage for damages or losses resulting from various perils, including fire, theft, vandalism, and natural disasters like tornadoes or floods.

When it comes to home insurance, Missouri residents have the option to choose from a range of policies tailored to their specific needs. These policies typically cover the structure of the home, as well as personal belongings, with additional coverage available for liabilities and living expenses in the event of a covered loss.

For businesses, property insurance is equally crucial. It protects against financial losses due to damage or destruction of commercial properties, equipment, inventory, and other assets. Business owners in Missouri can customize their insurance policies to include coverage for specific risks, such as business interruption, cyber liability, or employee dishonesty.

Life Insurance: Securing Your Missouri Legacy

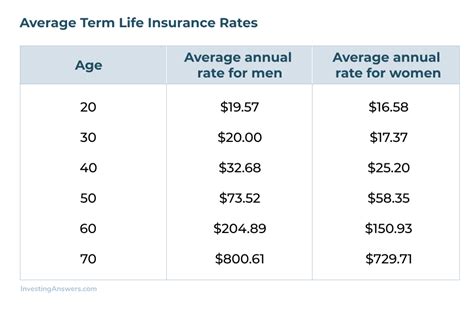

Life insurance is a vital component of financial planning, ensuring that your loved ones are protected and provided for in the event of your passing. Missouri offers a range of life insurance options, catering to different needs and preferences.

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It is ideal for individuals seeking temporary coverage to protect their families during their working years. Whole life insurance, on the other hand, provides lifelong coverage and accumulates cash value over time, making it a popular choice for long-term financial planning.

Missouri residents can also explore other life insurance options, such as universal life insurance, which offers flexible premium payments and adjustable coverage amounts, or variable life insurance, which allows for investment-linked policy growth.

The Benefits of Missouri State Insurance

Missouri State Insurance offers a multitude of benefits to its residents, providing peace of mind and financial security. Here are some key advantages:

- Comprehensive Coverage: Missouri's insurance policies are designed to offer a wide range of coverage options, ensuring that individuals, families, and businesses are protected against various risks.

- Affordability: The state actively promotes affordable insurance options, making it easier for residents to obtain the coverage they need without straining their finances.

- Customizable Policies: Whether it's auto, health, property, or life insurance, Missouri residents can tailor their policies to suit their specific needs and preferences.

- Regulatory Oversight: The Missouri Insurance Department plays a vital role in overseeing the insurance industry, ensuring fair practices, and protecting consumers' rights.

- Access to Resources: Missouri provides various resources and support to help residents navigate the insurance landscape, including educational materials, consumer guides, and assistance with claims.

Missouri’s Insurance Landscape: A Look at Key Statistics

To better understand the scope and impact of Missouri State Insurance, let’s take a look at some key statistics:

| Insurance Type | Number of Policies (approx.) | Average Premium (approx.) |

|---|---|---|

| Auto Insurance | 3 million | $800 - $1,200 annually |

| Health Insurance | 2.5 million | Varies based on plan and coverage |

| Property Insurance | 1.5 million | $1,000 - $2,000 annually |

| Life Insurance | 1.2 million | $500 - $1,500 annually |

Future Implications and Trends in Missouri State Insurance

As the insurance landscape continues to evolve, Missouri is poised to adapt and meet the changing needs of its residents. Here are some key trends and future implications to consider:

Digital Transformation

The insurance industry in Missouri is embracing digital technologies to enhance customer experiences and streamline processes. From online policy management to digital claims submission, the digital transformation is making insurance more accessible and efficient.

Health Insurance Innovation

With a focus on preventive care and personalized medicine, Missouri’s health insurance landscape is expected to see innovations in coverage options. This may include an increased emphasis on wellness programs, telemedicine, and flexible plan designs to meet the diverse needs of residents.

Climate Resilience

Given Missouri’s vulnerability to natural disasters like tornadoes and floods, the state is likely to see an increased focus on climate resilience in its insurance policies. This may involve the development of innovative coverage options and risk management strategies to protect residents and businesses against climate-related risks.

Emerging Risks and Coverage

As new technologies and industries emerge, so do new risks. Missouri’s insurance sector is likely to adapt and offer coverage for emerging risks, such as cyber liability, drone usage, and autonomous vehicle insurance.

Consumer Education and Awareness

To empower residents to make informed insurance decisions, Missouri is likely to continue its efforts in consumer education. This may involve providing accessible resources, hosting workshops, and promoting awareness campaigns to ensure residents understand their coverage options and rights.

Conclusion

Missouri State Insurance is a vital component of the state’s overall well-being, offering residents a comprehensive range of coverage options to protect their health, assets, and future. With regulatory oversight, customizable policies, and a focus on affordability, Missouri ensures that its residents can navigate life’s uncertainties with confidence and security.

As the insurance landscape continues to evolve, Missouri remains committed to adapting and innovating to meet the changing needs of its residents. By staying informed and proactive, Missourians can make the most of their insurance options and secure a brighter future for themselves and their loved ones.

How can I find the best auto insurance rates in Missouri?

+To find the best auto insurance rates in Missouri, it’s recommended to compare quotes from multiple insurers. Factors such as your driving history, age, location, and the type of vehicle you own can impact your rates. Consider using online comparison tools or consulting with insurance agents to explore your options and find the most competitive rates.

What are the essential coverages for health insurance in Missouri?

+Essential health benefits in Missouri include ambulatory patient services, emergency care, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, and more. These benefits are mandated by the Affordable Care Act and are included in most health insurance plans offered in the state.

How can I protect my business against cyber risks in Missouri?

+To protect your business against cyber risks in Missouri, consider investing in cyber liability insurance. This type of coverage can help protect your business from financial losses resulting from data breaches, cyber attacks, and other online threats. Consult with an insurance agent to assess your business’s specific risks and tailor a policy to meet your needs.