What Does Home Insurance Cover

Home insurance is an essential safeguard for homeowners, offering financial protection against various risks and unexpected events. This comprehensive policy is designed to provide coverage for your home, its contents, and the people who reside within it. Understanding the extent of your home insurance coverage is crucial to ensure you're adequately protected and prepared for any unforeseen circumstances.

The Basics of Home Insurance Coverage

At its core, home insurance, often referred to as property insurance, aims to shield homeowners from the financial burden that can arise from damage to their property. This coverage typically includes the structure of your home, as well as its contents, offering a safety net in the event of unforeseen incidents like fires, storms, or burglaries.

However, it's important to note that the scope of coverage can vary significantly based on the type of policy you choose and the specific terms outlined in your insurance contract. Here's a detailed breakdown of what home insurance typically covers and what it might exclude.

Dwelling Coverage

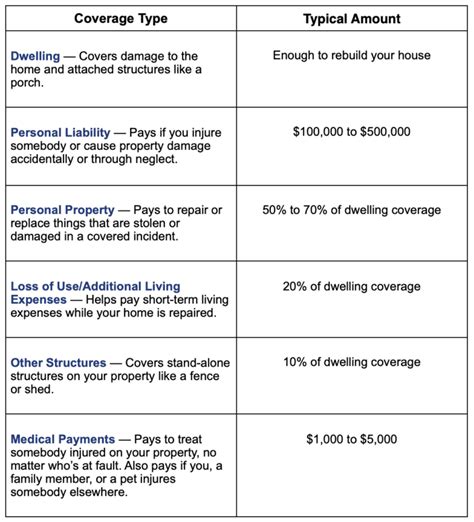

This is the cornerstone of your home insurance policy, providing coverage for the physical structure of your home, including walls, roofs, floors, and permanent fixtures. It ensures that in the event of a covered loss, the cost of repairing or rebuilding your home is covered, up to the policy limits.

For instance, if your home is damaged by a natural disaster such as a hurricane or an act of nature like a fallen tree, dwelling coverage will kick in to help cover the costs of repairs or rebuilding. Here's a real-world example: if a hailstorm damages your roof, dwelling coverage would typically cover the cost of replacing it, ensuring your home remains protected and structurally sound.

Personal Property Coverage

Home insurance policies also extend to the contents of your home, including your personal belongings like furniture, appliances, clothing, and electronics. This coverage provides financial assistance to replace or repair these items if they are damaged or destroyed due to a covered peril.

Consider a scenario where your home is burglarized, and your jewelry and electronics are stolen. Personal property coverage would come into play, offering financial compensation to help you replace these items, helping you get back on your feet and restore your sense of security.

Liability Coverage

An often-overlooked but crucial aspect of home insurance is liability coverage. This aspect of your policy protects you if someone is injured on your property or if your actions off your property cause injury or property damage to someone else.

Imagine a visitor slips and falls on your icy driveway, sustaining injuries. Liability coverage would step in to help cover the medical expenses and potential legal fees associated with this incident, providing a crucial layer of protection for you as the homeowner.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, additional living expenses coverage kicks in. This coverage helps to pay for temporary housing, meals, and other necessary expenses until your home is repaired or rebuilt.

For example, if a fire renders your home unsafe and you need to stay in a hotel while repairs are made, additional living expenses coverage would cover these costs, ensuring you have a place to stay and the necessary resources to maintain your daily routine.

Optional Coverages

Beyond the standard coverages, home insurance policies often offer a range of optional or add-on coverages to tailor your protection to your specific needs. These might include:

- Flood Insurance: While standard home insurance policies typically exclude coverage for flood damage, you can purchase separate flood insurance to protect your home and belongings in the event of flooding.

- Earthquake Insurance: Similar to flood insurance, earthquake coverage is often not included in standard policies but can be purchased separately to provide protection against earthquake-related damage.

- Identity Theft Coverage: This coverage helps reimburse you for expenses incurred due to identity theft, such as legal fees, lost wages, and credit monitoring services.

- Personal Injury Coverage: This covers legal fees and damages if you are sued for libel, slander, or other personal injury claims.

It's important to carefully review your policy and discuss any optional coverages with your insurance provider to ensure you have the protection you need.

Exclusions and Limitations

While home insurance offers a wide range of coverage, it’s crucial to understand what it doesn’t cover. Common exclusions in home insurance policies include:

- Normal Wear and Tear: Home insurance does not cover the natural deterioration of your home or its contents over time.

- Earth Movement: Damage caused by earthquakes, landslides, or sinkholes is often excluded, unless you have purchased separate coverage.

- Floods: Flood damage is typically not covered by standard home insurance policies.

- Nuclear Hazards: Damage caused by nuclear reaction, radiation, or radioactive contamination is usually excluded.

- Intentional Acts: Damage caused by your intentional acts or those of your family members is not covered.

- War and Terrorism: Damage resulting from war, including undeclared war, civil war, insurrection, rebellion, revolution, or nuclear, biological, chemical, or radioactive weapons is often excluded.

It's essential to carefully review your policy and discuss any concerns or questions with your insurance provider to ensure you understand the limitations of your coverage.

The Importance of Home Insurance

Home insurance is a critical component of financial planning for homeowners. It provides peace of mind, knowing that you’re protected against a wide range of potential risks. From natural disasters to accidents and liability claims, home insurance offers a safety net to help you rebuild and recover.

Moreover, home insurance can also play a crucial role in your overall financial health. By providing coverage for your home and its contents, it helps maintain your equity and protects your investment. In the event of a total loss, home insurance can ensure you're able to rebuild and start anew, without the devastating financial impact that an uninsured loss can bring.

In conclusion, home insurance is a comprehensive solution that offers protection, peace of mind, and financial stability for homeowners. By understanding the extent of your coverage and taking advantage of optional add-ons, you can ensure you're fully protected against the unexpected.

Frequently Asked Questions

What is the typical process for filing a home insurance claim?

+Filing a home insurance claim typically involves the following steps: 1. Contact your insurance company as soon as possible to report the incident. 2. Provide detailed information about the loss, including photos or videos of the damage. 3. Your insurance company will assign an adjuster to evaluate the claim and determine the extent of the damage. 4. Once the claim is approved, you’ll receive payment to cover the costs of repairs or replacements, up to your policy limits.

How can I choose the right home insurance policy for my needs?

+Choosing the right home insurance policy involves considering several factors, including the value of your home, the cost of rebuilding, and the level of coverage you require. It’s important to carefully review policy details, including coverage limits, deductibles, and exclusions. Additionally, consulting with an insurance professional can help you tailor your policy to your specific needs and ensure you’re adequately protected.

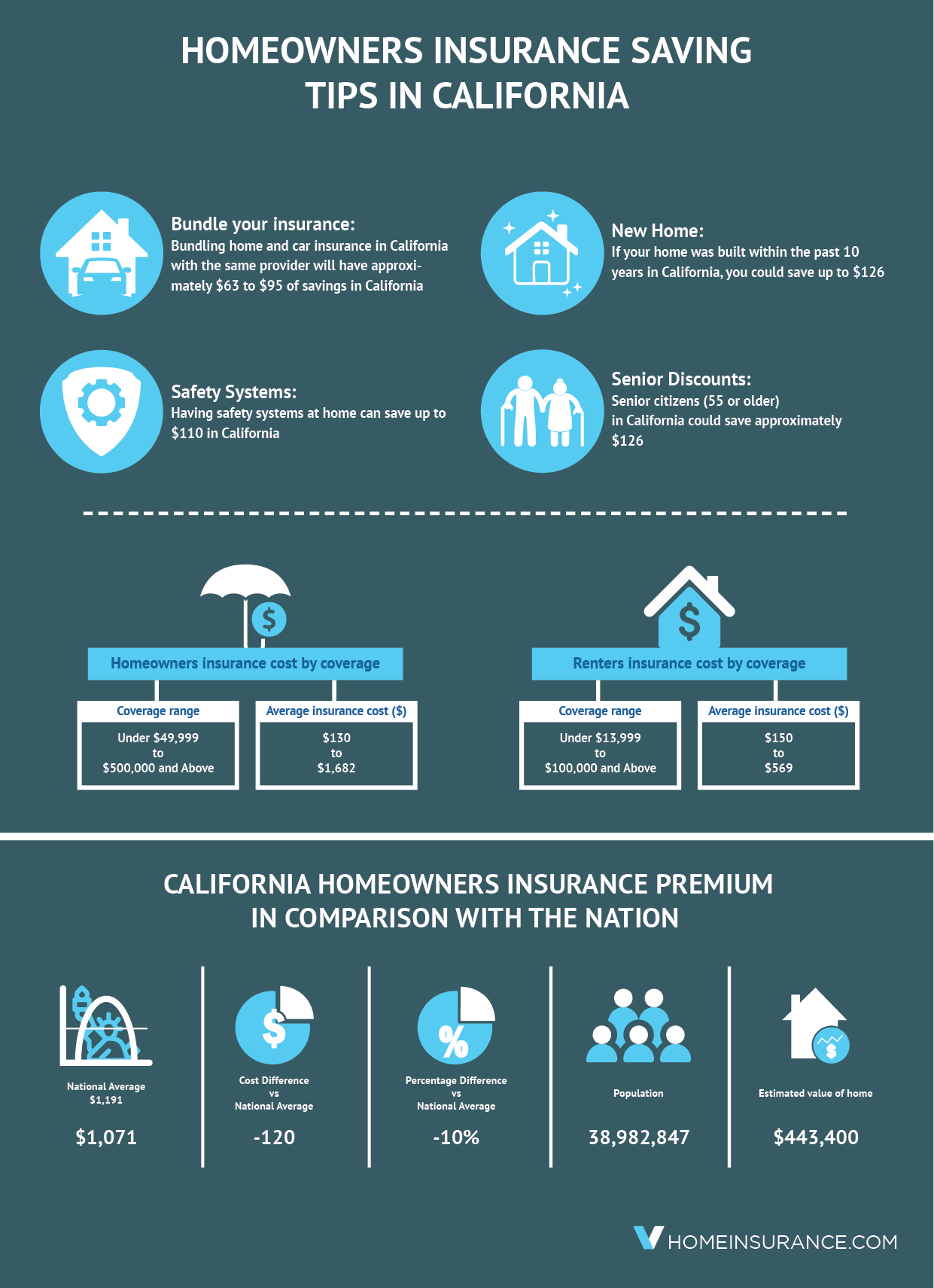

Are there any discounts available for home insurance policies?

+Yes, many insurance companies offer discounts on home insurance policies. These may include discounts for bundling your home and auto insurance, safety features like burglar alarms or fire extinguishers, loyalty discounts for long-term customers, and claims-free discounts for homeowners who haven’t filed any claims in a certain period. It’s always worth inquiring about available discounts when shopping for home insurance.

What should I do if my home insurance claim is denied?

+If your home insurance claim is denied, it’s important to first understand the reason for the denial. Your insurance company should provide a clear explanation. If you believe the denial is unjustified, you can request a review of the decision or seek an independent assessment. You may also consider legal advice or mediation to resolve the dispute. It’s crucial to act promptly and keep detailed records of all communications.