Supplemental Insurance Plan

In today's complex healthcare landscape, understanding the intricacies of supplemental insurance plans is crucial. These plans are designed to bridge the gap in coverage, offering individuals and families added financial protection and peace of mind. As we delve into the world of supplemental insurance, we'll uncover the key features, benefits, and real-world applications that make these plans an essential consideration for comprehensive healthcare management.

Unraveling Supplemental Insurance: A Comprehensive Overview

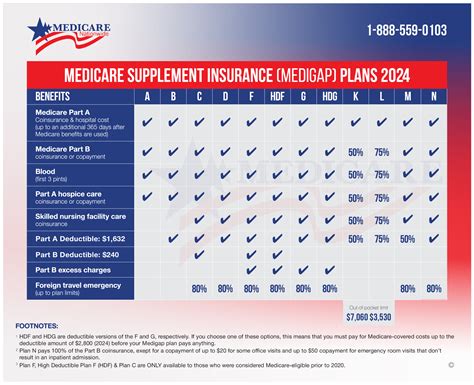

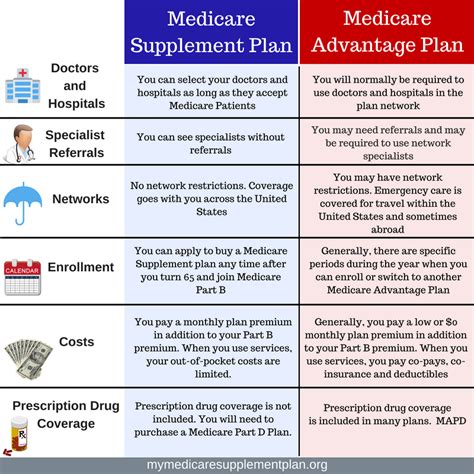

Supplemental insurance, also known as ancillary insurance, is a type of coverage that supplements, or adds to, your primary health insurance plan. It’s an additional layer of protection designed to cover expenses that your primary insurance might not fully cover, such as deductibles, copayments, and out-of-pocket maximums. These plans are tailored to provide financial assistance for specific healthcare needs, ensuring that individuals can access the care they require without facing overwhelming financial burdens.

Key Features of Supplemental Insurance Plans

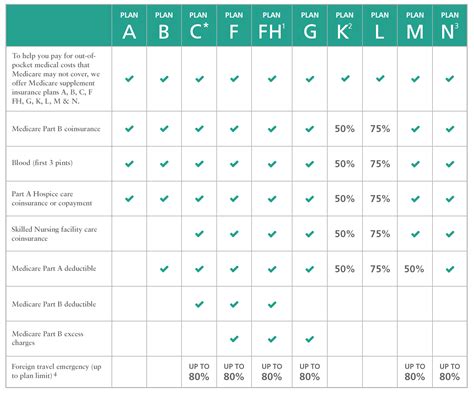

Supplemental insurance plans offer a range of features tailored to meet diverse healthcare needs. Here’s a breakdown of some key components:

- Coverage for Specific Expenses: These plans often cover a wide range of expenses, including hospital stays, surgical procedures, prescription medications, and even daily living expenses during extended illnesses.

- Cash Benefits: Many supplemental plans provide cash payments directly to the policyholder, giving them flexibility in managing their healthcare expenses. These cash benefits can be particularly useful for covering non-medical costs associated with illness or injury.

- Critical Illness Coverage: Some plans offer specific coverage for critical illnesses like cancer, stroke, or heart attacks. This coverage provides a lump-sum payment upon diagnosis, allowing individuals to focus on treatment and recovery without immediate financial concerns.

- Accident Insurance: Supplemental accident insurance provides coverage for injuries sustained in accidents, offering benefits for medical expenses and even income replacement in certain cases.

- Dental and Vision Coverage: Many supplemental plans include dental and vision benefits, ensuring comprehensive coverage for eye exams, eyeglasses, and dental procedures, which are often not covered by traditional health insurance.

| Plan Type | Coverage Highlights |

|---|---|

| Hospital Indemnity | Provides daily or per-admission benefits for hospital stays, helping cover out-of-pocket costs. |

| Accidental Death and Dismemberment (AD&D) | Offers benefits in the event of an accident resulting in death or dismemberment, providing financial support for dependents. |

| Critical Illness | Provides a lump-sum payment upon diagnosis of a covered critical illness, offering financial relief for treatment and recovery. |

The Benefits of Supplemental Insurance: Real-World Applications

Supplemental insurance plans offer a multitude of benefits that extend beyond financial protection. Here’s a closer look at how these plans can make a difference in real-life scenarios:

- Peace of Mind During Hospital Stays: Hospital indemnity plans provide a daily allowance for each day of hospitalization, ensuring that individuals have the financial support they need during extended stays. This benefit can cover the cost of daily necessities, medications, and even specialized treatments, reducing the financial strain during a challenging time.

- Financial Support for Critical Illnesses: Critical illness coverage offers a significant advantage by providing a lump-sum payment upon diagnosis. This payment can be used to cover the costs of specialized treatments, travel for medical care, and even to alleviate the financial burden on the family during a difficult period. It ensures that individuals can focus on their health without the added stress of managing unexpected expenses.

- Assistance with Dental and Vision Care: Dental and vision benefits in supplemental plans bridge the gap in coverage for essential eye and dental care. These benefits ensure that individuals can access regular check-ups, prescription eyewear, and necessary dental procedures without incurring significant out-of-pocket costs.

- Accident Protection: Supplemental accident insurance provides a safety net in the event of an accident. It covers medical expenses related to the accident and, in some cases, provides income replacement benefits, ensuring financial stability during recovery.

Performance Analysis and Expert Insights

The performance of supplemental insurance plans is closely tied to their ability to provide comprehensive coverage and ease financial burdens for policyholders. Here’s an in-depth analysis of key performance indicators and expert insights on the effectiveness of these plans:

Coverage and Claim Satisfaction

A critical aspect of supplemental insurance is its ability to deliver on promised coverage. According to industry data, supplemental plans have consistently shown high claim satisfaction rates. Policyholders report a strong sense of security and satisfaction with the coverage provided, especially in cases of unexpected medical events or critical illnesses. The flexibility and specificity of these plans ensure that individuals receive the financial support they need when it matters most.

Financial Protection and Peace of Mind

One of the primary goals of supplemental insurance is to provide financial protection and peace of mind. Experts in the field highlight the importance of this aspect, especially for individuals and families with specific healthcare needs. By covering a wide range of expenses, from hospital stays to critical illness treatments, supplemental plans offer a comprehensive safety net. This financial protection allows policyholders to make informed decisions about their healthcare without the fear of overwhelming costs.

Tailored Solutions for Diverse Needs

Supplemental insurance plans are designed with flexibility in mind, allowing individuals to choose coverage that aligns with their unique healthcare requirements. This tailored approach ensures that policyholders receive the specific benefits they need, whether it’s coverage for chronic conditions, accident protection, or assistance with daily living expenses during extended illnesses. Experts emphasize the value of this customization, as it enables individuals to create a comprehensive healthcare plan that suits their lifestyle and budget.

Future Implications and Industry Trends

As the healthcare landscape continues to evolve, the role of supplemental insurance is expected to grow in significance. Here’s a glimpse into the future of this industry and its potential impact:

Expanding Coverage Options

Industry experts predict that supplemental insurance providers will continue to innovate and expand their coverage options. This may include the development of new plans tailored to specific demographics or healthcare trends. For instance, plans targeting the growing senior population could offer enhanced coverage for age-related health concerns, providing a vital safety net for this vulnerable group.

Integration with Primary Insurance

The future of supplemental insurance may involve closer integration with primary health insurance plans. This could take the form of bundled packages, where primary and supplemental coverage are offered together, ensuring a seamless and comprehensive healthcare solution. Such integration could simplify the insurance landscape for consumers, making it easier to navigate and understand their coverage options.

Digital Transformation and Convenience

The digital revolution is set to play a significant role in the future of supplemental insurance. Providers are expected to invest in digital platforms and mobile apps, making it easier for policyholders to access their benefits and manage their coverage. This shift towards digital convenience could enhance the overall customer experience, allowing individuals to quickly and efficiently manage their healthcare and insurance needs.

How do supplemental insurance plans differ from primary health insurance?

+Supplemental insurance plans are designed to complement primary health insurance by covering expenses that primary plans may not fully cover, such as deductibles, copayments, and out-of-pocket maximums. They provide an additional layer of financial protection and can be tailored to specific healthcare needs.

What are the key benefits of having a supplemental insurance plan?

+Supplemental insurance plans offer a range of benefits, including coverage for specific expenses like hospital stays and surgical procedures, cash benefits for flexible spending, critical illness coverage for lump-sum payments, and accident insurance for injury-related expenses. These plans provide financial support and peace of mind during times of medical need.

Are there any limitations or exclusions in supplemental insurance plans?

+Yes, like any insurance plan, supplemental insurance policies may have certain limitations and exclusions. It’s essential to carefully review the policy documents to understand what is and isn’t covered. Common exclusions may include pre-existing conditions, certain elective procedures, and specific types of accidents or illnesses.