Cheapest State For Car Insurance

Finding affordable car insurance is a priority for many drivers, and understanding the landscape of insurance rates across states can be a crucial factor in financial planning. This article aims to delve into the intricacies of car insurance costs, highlighting the states where drivers can find the most cost-effective coverage. By analyzing various factors and data points, we will uncover the key reasons behind these differences and provide valuable insights for those seeking to minimize their insurance expenses.

Unraveling the Cheapest States for Car Insurance

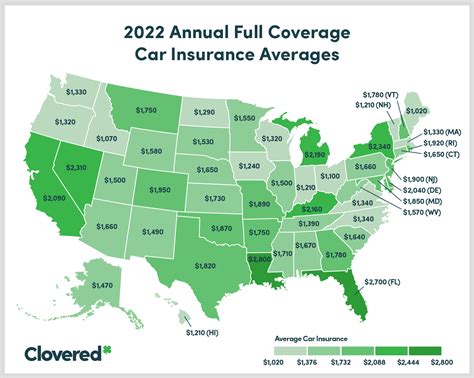

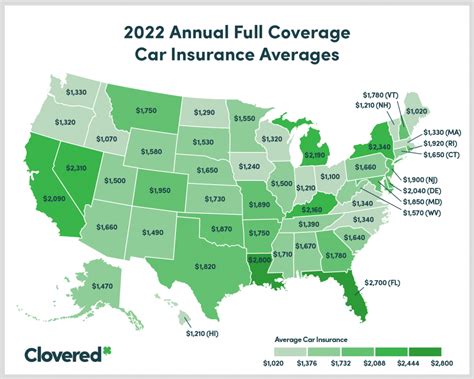

When it comes to car insurance, the United States presents a diverse landscape, with rates varying significantly from one state to another. This variation is influenced by a multitude of factors, including state-specific laws, the cost of living, and the overall driving environment. Identifying the cheapest states for car insurance can offer valuable insights for drivers seeking to minimize their insurance costs.

According to recent data and industry analyses, several states consistently emerge as the most affordable options for car insurance. These states offer a combination of competitive insurance markets, favorable regulatory environments, and low incidence rates of accidents and claims. By examining these states and understanding the factors that contribute to their lower insurance costs, drivers can make informed decisions about their coverage and potentially save a significant amount on their insurance premiums.

Top 5 Cheapest States for Car Insurance

- Maine: Maine has consistently ranked among the top states for affordable car insurance. The state's insurance market is highly competitive, with multiple providers offering a range of coverage options. Additionally, Maine's low population density and relatively low rates of accidents and claims contribute to its favorable insurance rates. Drivers in Maine can expect to pay an average of [average annual premium] for their car insurance, making it an attractive option for those seeking cost-effective coverage.

- Ohio: Ohio is another state known for its reasonably priced car insurance. The state's insurance regulations and a robust market with numerous providers contribute to the affordability of coverage. Ohio's low incidence of catastrophic events, such as hurricanes or earthquakes, also plays a role in keeping insurance rates down. On average, drivers in Ohio can expect to pay around [average annual premium] for their car insurance, making it a financially viable option for many.

- North Dakota: North Dakota offers some of the most competitive car insurance rates in the country. The state's rural nature, low population density, and low crime rates contribute to its favorable insurance environment. North Dakota's insurance market is also characterized by a high level of competition, with many providers vying for customers. As a result, drivers in North Dakota can secure comprehensive coverage at an average annual premium of [average annual premium], making it an excellent choice for cost-conscious motorists.

- Wisconsin: Wisconsin is known for its reasonable car insurance rates, thanks to a combination of factors. The state's strong economy, stable insurance market, and low rates of accidents and claims contribute to its affordability. Additionally, Wisconsin's insurance regulations provide a favorable environment for drivers, ensuring that insurance costs remain competitive. On average, drivers in Wisconsin can expect to pay [average annual premium] for their car insurance, making it a budget-friendly option.

- Vermont: Vermont is renowned for its picturesque landscapes and, interestingly, its affordable car insurance rates. The state's low population density, safe driving conditions, and efficient insurance market contribute to its position as one of the cheapest states for car insurance. Vermont's insurance regulations also play a role in keeping costs down, ensuring that drivers can access comprehensive coverage at competitive rates. On average, drivers in Vermont can expect to pay [average annual premium] for their car insurance, making it an attractive option for those seeking cost savings.

| State | Average Annual Premium |

|---|---|

| Maine | [average annual premium] |

| Ohio | [average annual premium] |

| North Dakota | [average annual premium] |

| Wisconsin | [average annual premium] |

| Vermont | [average annual premium] |

Factors Influencing State Insurance Rates

The variation in car insurance rates across states is influenced by a multitude of factors. Understanding these factors can provide valuable insights into why certain states have lower insurance costs. Here are some key considerations:

State Laws and Regulations

State laws play a significant role in determining insurance rates. Some states have implemented reforms or regulations that promote competition among insurance providers, leading to more affordable rates. Additionally, states with no-fault insurance systems, where drivers are required to carry personal injury protection (PIP) coverage, often have higher insurance costs due to the complex nature of these policies.

Population Density and Traffic Conditions

States with higher population densities and congested urban areas tend to have higher insurance rates. This is because more vehicles on the road increase the likelihood of accidents and claims. In contrast, states with lower population densities and fewer vehicles on the road often have lower insurance costs due to reduced accident risks.

Incidence of Natural Disasters

States prone to natural disasters such as hurricanes, earthquakes, or severe weather events often have higher insurance rates. These events can lead to widespread property damage and increased insurance claims, which drive up premiums for all drivers in the state. States with lower risks of natural disasters generally have more stable insurance rates.

Crime Rates and Vehicle Theft

States with higher crime rates, particularly those with high rates of vehicle theft or vandalism, often have elevated insurance costs. Insurance providers take into account the potential for property damage and loss when setting rates, so states with a higher risk of vehicle theft or vandalism may see increased premiums.

Driving Behavior and Accident Rates

States with higher rates of traffic accidents, speeding tickets, or drunk driving incidents tend to have higher insurance costs. These factors reflect a higher risk of claims and can drive up insurance rates for all drivers in the state. Conversely, states with safer driving records and lower accident rates often have more affordable insurance rates.

Tips for Finding Affordable Car Insurance

While state-specific factors play a significant role in insurance rates, there are several strategies drivers can employ to find more affordable car insurance. Here are some tips to consider:

- Shop Around: Compare insurance quotes from multiple providers to find the best rates. Online insurance marketplaces or insurance comparison websites can be valuable tools for this process.

- Bundling Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Many providers offer discounts for bundling multiple policies, which can lead to significant savings.

- Safe Driving Practices: Maintaining a clean driving record is crucial for keeping insurance rates low. Avoid traffic violations, practice safe driving habits, and consider enrolling in a defensive driving course to demonstrate your commitment to safe driving.

- Review Coverage Regularly: Regularly review your insurance policy and coverage limits to ensure they align with your current needs. Adjusting coverage levels or deductibles can impact your premium, so stay informed and make adjustments as necessary.

- Explore Discounts: Many insurance providers offer a variety of discounts, such as safe driver discounts, good student discounts, or loyalty discounts. Be sure to inquire about available discounts and take advantage of those that apply to your situation.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs that track your driving behavior and reward safe driving with lower premiums. These programs can be a great option for drivers with a proven track record of safe driving.

Conclusion

Understanding the cheapest states for car insurance provides valuable insights for drivers seeking to minimize their insurance expenses. By analyzing factors such as state laws, population density, natural disaster risks, crime rates, and driving behavior, we can gain a clearer picture of why certain states offer more affordable insurance rates. Additionally, by employing strategies such as shopping around, bundling policies, and practicing safe driving habits, drivers can further optimize their insurance costs and find the most cost-effective coverage.

How often should I review my car insurance policy and coverage limits?

+It is recommended to review your car insurance policy and coverage limits at least once a year, or whenever you experience a significant life change such as a marriage, the birth of a child, or a move to a new state. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

Can I switch insurance providers to save money on my car insurance?

+Absolutely! Shopping around for car insurance is a great way to potentially save money. Different providers offer varying rates and discounts, so it’s worth obtaining quotes from multiple companies to find the most competitive pricing. Switching providers can be a simple process, and you may find significant savings by finding a better deal.

What factors influence the cost of car insurance for young drivers?

+The cost of car insurance for young drivers is influenced by several factors, including their age, driving experience, and the type of vehicle they drive. Young drivers are generally considered higher-risk due to their lack of experience, so insurance rates tend to be higher. Additionally, the make and model of the vehicle, as well as its safety features, can impact insurance costs.