Life Term Insurance Rates

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their families. One of the key factors that influence the cost of life insurance is the term for which the policy is purchased. Life term insurance rates can vary significantly based on several factors, and understanding these rates is crucial for making informed decisions about your financial future.

Understanding Life Term Insurance Rates

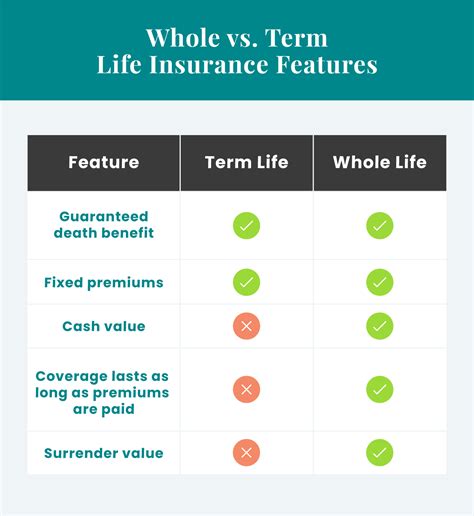

Life term insurance is a type of coverage that offers protection for a specific period, known as the “term.” Unlike permanent life insurance, which provides coverage for the insured’s entire life, term insurance policies have a defined duration, such as 10, 20, or 30 years. During this term, the policyholder pays regular premiums, and in the event of their death within the coverage period, the beneficiaries receive a predetermined sum, known as the death benefit.

The cost of life term insurance is determined by a variety of factors, and these rates can fluctuate over time. Here, we delve into the key aspects that influence life term insurance rates and provide insights to help you navigate this complex yet crucial financial decision.

Age and Health Factors

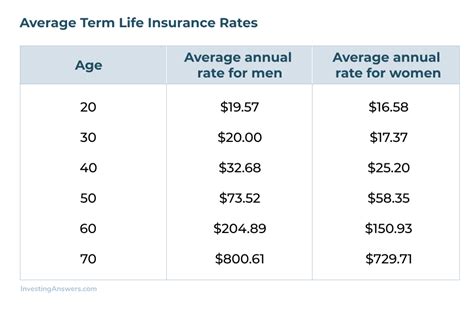

One of the most significant determinants of life term insurance rates is the age and health of the policyholder. Insurance companies assess an individual’s health and lifestyle to evaluate their risk profile. Younger individuals are generally considered lower-risk, as they are less likely to develop serious health conditions or engage in hazardous activities. As a result, they often enjoy more affordable rates.

For instance, consider the case of Emily, a 30-year-old non-smoker with no significant health issues. When she applies for a 20-year term life insurance policy, her premium is estimated to be $300 annually based on her age and health status. In contrast, John, a 55-year-old with a history of high blood pressure and smoking, might pay $1,200 annually for the same term and coverage amount.

| Age | Health Status | Annual Premium |

|---|---|---|

| 30 | Non-Smoker, No Health Issues | $300 |

| 55 | Smoker, High Blood Pressure | $1,200 |

This table illustrates the stark difference in premiums based on age and health. It's evident that younger and healthier individuals benefit from significantly lower rates.

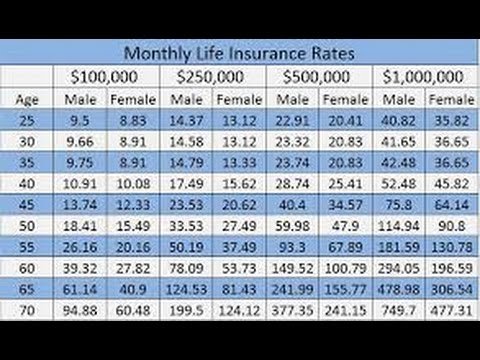

Coverage Amount and Term Length

The amount of coverage you choose and the length of the term also play a pivotal role in determining your insurance rates. Generally, higher coverage amounts and longer terms result in higher premiums. Insurance companies assess the potential financial risk associated with paying out larger sums over extended periods.

Let's take the example of David, who is seeking a 30-year term life insurance policy. If he opts for a $500,000 coverage, his annual premium might be around $450. However, if he increases the coverage to $1,000,000, the premium could jump to $900 annually, reflecting the increased risk and payout potential.

| Coverage Amount | Term Length | Annual Premium |

|---|---|---|

| $500,000 | 30 years | $450 |

| $1,000,000 | 30 years | $900 |

As this table shows, the premium nearly doubles when the coverage amount is doubled, highlighting the impact of coverage choices on insurance rates.

Lifestyle and Occupation Factors

Your lifestyle and occupation can also influence your life term insurance rates. Insurance companies often consider factors such as hobbies, travel habits, and occupational risks. For example, individuals who engage in extreme sports or have hazardous occupations may face higher premiums due to the increased risk of injury or death.

Imagine Sarah, an avid skydiver, who applies for a 10-year term life insurance policy. Given the inherent risks associated with skydiving, her insurance company may charge a 20% premium surcharge, bringing her annual premium to $600 instead of the standard rate of $500 for her age and health.

Gender and Smoking Status

Insurance rates can also vary based on gender and smoking status. Historically, men have been charged higher premiums due to statistical data showing a higher risk of premature death. However, this gap has been narrowing in recent years as more women enter the workforce and adopt lifestyles similar to men.

Additionally, smoking is a significant risk factor. Smokers typically pay higher premiums compared to non-smokers, as smoking increases the likelihood of health complications and reduces life expectancy. Quitting smoking can lead to reduced premiums over time as the health risks diminish.

Medical Underwriting and Rating Classes

Most life insurance policies require medical underwriting, which involves a thorough evaluation of the applicant’s health history and current health status. This process can include medical exams, health questionnaires, and reviews of medical records. The results of this underwriting process determine the applicant’s rating class, which directly impacts their insurance rates.

Rating classes are categories that insurance companies use to assess an individual's risk level. Common rating classes include Preferred Plus, Preferred, Standard Plus, Standard, and Substandard. Individuals with healthier lifestyles and fewer health risks are typically placed in the Preferred or Preferred Plus categories, resulting in lower premiums.

For instance, Michael, a 40-year-old with a clean bill of health, might be classified as Preferred Plus, leading to an annual premium of $250 for a 20-year term life insurance policy. On the other hand, Lisa, who has a history of diabetes, might fall into the Standard category, resulting in a premium of $550 annually for the same policy.

| Rating Class | Annual Premium |

|---|---|

| Preferred Plus | $250 |

| Standard | $550 |

Competitive Market and Shopping Around

The life insurance market is highly competitive, and insurance companies offer a range of rates and coverage options. It’s essential to shop around and compare quotes from multiple providers to ensure you’re getting the best deal. Online comparison tools and insurance brokers can be valuable resources for finding competitive rates.

Additionally, keep in mind that insurance companies periodically review and adjust their rates. It's a good practice to review your policy and premiums every few years to ensure you're still getting the best value. You might find that switching providers or renegotiating your coverage can lead to significant savings.

Future Implications and Considerations

When considering life term insurance, it’s crucial to think long-term and assess your future financial needs. Here are some key considerations:

- Financial Obligations: Evaluate your current and future financial responsibilities, such as mortgage payments, education funds for children, and retirement planning. Ensure your life insurance coverage aligns with these obligations.

- Inflation: Keep in mind that the cost of living and financial needs typically increase over time due to inflation. Consider purchasing a policy with an inflation protection rider to ensure your coverage keeps pace with rising costs.

- Conversion Options: Some term life insurance policies offer the option to convert to permanent life insurance without a medical exam. This can be beneficial if your financial situation or health status changes, allowing you to maintain coverage without the need for a new policy.

- Rider Options: Explore the various rider options available with your policy, such as accidental death benefit riders, waiver of premium riders, or long-term care riders. These additions can enhance your coverage and provide additional financial protection.

Conclusion

Understanding the factors that influence life term insurance rates is essential for making informed decisions about your financial future. By considering your age, health, coverage amount, term length, lifestyle, occupation, and shopping around for competitive rates, you can find a policy that provides the protection you need at a price you can afford.

Remember, life insurance is a long-term investment in your financial security and the well-being of your loved ones. Take the time to research and compare options, and don't hesitate to seek professional advice to ensure you're making the right choice for your unique circumstances.

Frequently Asked Questions

Can I lock in a low rate for life term insurance, regardless of future health changes?

+

Yes, you can secure a guaranteed level premium for the entire term of your policy. This means your rates won’t increase due to age or health changes during the policy period. However, it’s important to note that the premium will typically increase if you choose to renew your policy after the initial term.

Are there any alternatives to term life insurance that offer similar benefits?

+

Yes, there are alternatives like whole life or universal life insurance that provide permanent coverage and cash value accumulation. These policies tend to be more expensive upfront but offer lifelong coverage and the potential for investment growth. It’s essential to weigh the pros and cons of each type based on your specific needs and financial goals.

How often should I review and update my life insurance policy?

+

It’s recommended to review your life insurance policy every few years or whenever there’s a significant change in your life, such as marriage, birth of a child, purchasing a home, or retirement planning. Regular reviews ensure your coverage remains adequate and aligned with your evolving financial responsibilities.

Can I add my spouse or children to my life insurance policy as beneficiaries?

+

Yes, you can designate your spouse, children, or other dependents as beneficiaries on your life insurance policy. This ensures that in the event of your death, your loved ones will receive the death benefit, providing them with financial support and security.

What happens if I miss a premium payment on my life term insurance policy?

+

Missing a premium payment can have serious consequences. Most policies offer a grace period, typically 30 days, during which you can make the overdue payment without penalty. If the grace period expires without payment, your policy may lapse, and you’ll need to reapply, potentially facing higher rates or being denied coverage.