Cheap California Insurance

Introduction: Unraveling the Complexities of Insurance in the Golden State

In the vast landscape of California, where dreams are pursued and diverse lifestyles thrive, understanding insurance can be a daunting task. From coastal cities to the inland valleys, the Golden State’s residents face unique challenges when it comes to securing affordable coverage. This comprehensive guide aims to demystify the world of insurance, providing an insightful journey through the various options available to Californians seeking cost-effective protection.

California, with its diverse climate, sprawling cities, and vibrant communities, presents a complex insurance landscape. From auto insurance navigating the bustling streets of Los Angeles to health insurance covering the active lifestyles of San Diego, and homeowners insurance protecting the dream homes of Silicon Valley, the challenge lies in finding the right coverage at the right price.

This article delves into the heart of these insurance complexities, offering a detailed analysis of the factors influencing affordability, the key players in the California insurance market, and the strategies individuals and businesses can employ to secure the best deals. By exploring real-world examples and providing actionable insights, we aim to empower Californians to make informed decisions, ensuring they can protect what matters most without breaking the bank.

Auto Insurance: Exploring Cost-Effective Options on California’s Roads

Understanding the California Auto Insurance Market

California’s auto insurance market is a dynamic environment, shaped by a unique combination of factors including diverse demographics, strict state regulations, and a history of insurance reforms. This section delves into the specifics of the market, examining the key trends and influences that impact auto insurance rates.

Key Factors Affecting Auto Insurance Rates:

- Traffic Density and Accident Rates: California’s busy roads and high population density contribute to a higher risk of accidents, which can impact insurance rates.

- State Regulations: California’s strict insurance laws, such as the requirement for liability coverage, influence the cost of policies.

- Weather and Natural Disasters: The state’s susceptibility to earthquakes, wildfires, and floods adds an element of risk that insurers consider.

- Demographics: The diverse population of California, with varying driving behaviors and accident histories, plays a role in insurance pricing.

Strategies for Affordable Auto Insurance:

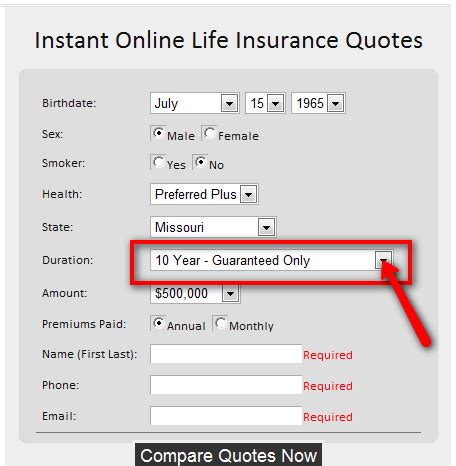

- Compare Multiple Quotes: Obtaining quotes from various insurers is crucial. Online comparison tools can provide a quick and efficient way to assess different options.

- Utilize Discounts: Insurers often offer discounts for safe driving records, loyalty, and bundling multiple policies. Research and inquire about available discounts.

- Consider Usage-Based Insurance: For low-mileage drivers, usage-based insurance programs can provide significant savings by tracking actual driving behavior.

- Review Coverage Levels: Assess your needs and adjust coverage levels accordingly. Higher deductibles can lower premiums, but ensure you have adequate liability protection.

Health Insurance: Balancing Coverage and Cost in California

The Complexity of California’s Health Insurance Landscape

California’s health insurance market is characterized by its size, diversity, and ongoing efforts to expand access and control costs. This section explores the unique aspects of the market, including the role of the state’s insurance exchange, Covered California, and the impact of federal and state healthcare reforms.

Key Challenges and Opportunities:

- Affordability and Access: California has made significant strides in expanding healthcare access, but challenges remain, particularly for low-income individuals and those with pre-existing conditions.

- Market Competition: The presence of multiple insurers in the state creates a competitive environment, which can drive down prices and improve coverage options.

- State Initiatives: California’s innovative programs, such as the Medi-Cal expansion and the Healthy California initiative, aim to enhance affordability and coverage.

Strategies for Affordable Health Insurance:

- Explore Covered California: The state’s insurance exchange, Covered California, offers a range of plans with financial assistance for eligible individuals. It’s a valuable resource for comparing options and securing subsidies.

- Assess Your Needs: Evaluate your healthcare needs and choose a plan that provides adequate coverage without unnecessary extras. High-deductible plans with Health Savings Accounts (HSAs) can be cost-effective for some.

- Employer-Sponsored Insurance: If available, employer-sponsored health insurance often provides comprehensive coverage at a group rate, which can be more affordable than individual plans.

- Stay Informed: Keep abreast of healthcare reforms and initiatives that may impact your coverage and costs. Understanding your rights and options is essential.

Homeowners Insurance: Protecting Your California Dream at a Reasonable Cost

Navigating California’s Unique Homeowners Insurance Market

California’s homeowners insurance market is influenced by the state’s diverse geography, natural disaster risks, and a history of insurance challenges. This section provides an in-depth look at the factors that impact homeowners insurance rates and the strategies available to secure affordable coverage.

Key Considerations for Homeowners Insurance:

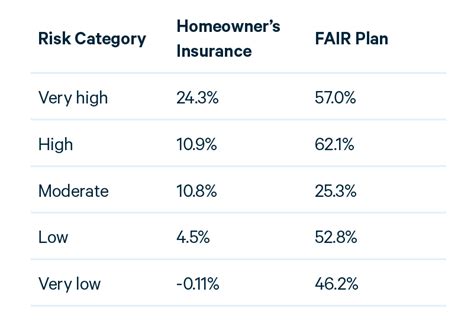

- Natural Disaster Risks: California’s susceptibility to earthquakes, wildfires, and floods is a significant factor in insurance costs. Understanding these risks and taking mitigation measures can impact your premiums.

- Home Value and Location: The value of your home and its location play a crucial role in determining insurance rates. Higher-value homes and those in high-risk areas will generally have higher premiums.

- Coverage Options: Different coverage levels and policy types (e.g., HO-3, HO-5) offer varying levels of protection. Choose a policy that suits your needs without over-insuring.

Strategies for Affordable Homeowners Insurance:

- Shop Around: Compare quotes from multiple insurers. Online tools and insurance brokers can streamline this process.

- Bundle Policies: Bundling your homeowners insurance with other policies, such as auto insurance, can result in significant savings.

- Review Deductibles: Higher deductibles can lower premiums, but ensure you can afford the out-of-pocket expense in the event of a claim.

- Take Mitigation Measures: Implementing safety and disaster-prevention measures, such as fire-resistant roofing or earthquake retrofits, can qualify you for insurance discounts and potentially lower your premiums.

Business Insurance: Tailoring Coverage for California’s Diverse Businesses

Tailoring Insurance Solutions for California’s Business Landscape

California’s diverse business environment, ranging from tech startups to agricultural enterprises, presents a unique challenge when it comes to insurance. This section explores the specific needs of California businesses and the strategies available to secure comprehensive coverage at competitive rates.

Understanding Business Insurance Needs:

- Liability Risks: California’s strict liability laws mean businesses must be vigilant about protecting themselves from potential lawsuits. General liability insurance is a crucial component of any business insurance portfolio.

- Industry-Specific Risks: Different industries face unique risks. For example, tech startups may need cyber liability insurance, while agricultural businesses may require crop insurance.

- Employee Protection: For businesses with employees, worker’s compensation insurance is mandatory in California, ensuring coverage for on-the-job injuries.

Strategies for Affordable Business Insurance:

- Risk Management: Implementing robust risk management strategies can reduce the likelihood of claims and lower insurance costs. This includes regular safety audits, employee training, and implementing industry best practices.

- Insurance Brokers: Working with an insurance broker who specializes in California businesses can be beneficial. They can tailor policies to your specific needs and often have access to competitive rates.

- Bundle Policies: Similar to personal insurance, bundling multiple business policies can result in savings. Consider combining general liability, property, and business interruption insurance.

- Review Coverage Annually: Business needs and risks can change rapidly. Conduct an annual review of your insurance coverage to ensure it remains adequate and cost-effective.

Conclusion: Empowering Californians with Affordable Insurance Solutions

In the complex world of insurance, Californians face a unique set of challenges and opportunities. From navigating the state’s diverse auto insurance market to balancing coverage and cost in health insurance, the path to affordable protection is often fraught with complexity. However, with the right knowledge and strategies, it is possible to secure comprehensive insurance coverage at a reasonable cost.

This guide has provided an in-depth look at the key factors influencing insurance rates in California, along with practical strategies for individuals and businesses to navigate these challenges. By understanding the market, comparing options, and implementing cost-saving measures, Californians can protect their assets, their health, and their livelihoods without incurring excessive insurance costs.

Remember, insurance is an essential component of financial security, and the right coverage can provide peace of mind. Stay informed, shop around, and tailor your insurance to your unique needs. With these strategies in mind, you can confidently navigate California’s insurance landscape and secure the protection you deserve.

FAQ

How can I find the best auto insurance rates in California?

+To find the best auto insurance rates in California, it’s important to compare quotes from multiple insurers. Utilize online comparison tools and consider factors such as your driving history, the make and model of your vehicle, and the level of coverage you require. Additionally, explore discounts for safe driving, loyalty, or bundling multiple policies.

What are some ways to reduce health insurance costs in California?

+Reducing health insurance costs in California involves assessing your healthcare needs and choosing a plan that suits your requirements without unnecessary extras. Explore Covered California for subsidized plans and consider high-deductible plans with Health Savings Accounts (HSAs) if they align with your financial strategy.

Are there any tips for lowering homeowners insurance premiums in earthquake-prone areas of California?

+In earthquake-prone areas of California, you can potentially lower your homeowners insurance premiums by taking mitigation measures. This includes retrofitting your home to meet current seismic standards, installing earthquake valves on gas lines, and considering an earthquake insurance endorsement or a separate policy.

How can small businesses in California find affordable business insurance?

+Small businesses in California can find affordable business insurance by implementing robust risk management strategies, working with insurance brokers who specialize in small businesses, and considering bundling multiple policies. Additionally, staying informed about industry-specific risks and mandatory coverages is crucial.