Car Insurance Carriers

Welcome to a comprehensive guide on understanding the world of car insurance carriers and how they operate. In this article, we will delve into the intricacies of the insurance industry, shedding light on the key players, their offerings, and the impact they have on policyholders. With a focus on the United States market, we aim to provide an insightful and detailed analysis, ensuring you leave with a solid understanding of this crucial aspect of vehicle ownership.

The Landscape of Car Insurance Carriers in the US

The US car insurance market is a highly competitive and diverse landscape, characterized by a range of insurance providers, from major national carriers to regional and niche insurers. These carriers offer a variety of coverage options, catering to the diverse needs of American drivers. Understanding this landscape is crucial for drivers, as it empowers them to make informed decisions when choosing an insurance policy.

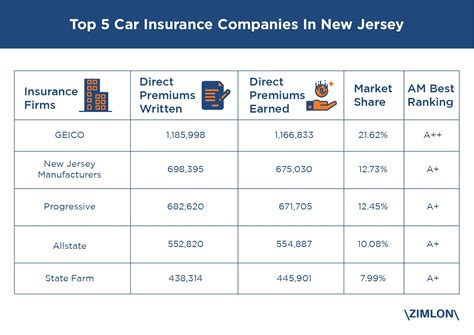

At the forefront of the US car insurance market are the major national carriers, such as State Farm, GEICO, and Progressive. These companies have established themselves as industry leaders, offering comprehensive coverage and innovative features to a vast array of drivers across the nation. Their extensive reach and robust financial backing make them a popular choice for many policyholders.

Complementing the major players are regional insurance carriers, which typically operate within specific states or regions. These carriers often have a deep understanding of the local market, offering specialized coverage tailored to the unique needs and regulations of their specific area. Their localized focus allows them to provide more personalized service and competitive rates for regional drivers.

In addition to these established carriers, the market also accommodates niche insurance providers, which cater to specific demographics or vehicle types. These niche carriers might specialize in insuring high-risk drivers, classic car enthusiasts, or even ride-share drivers. By focusing on these specific segments, they can offer specialized coverage and competitive rates that may not be available from larger, more generalized carriers.

Understanding Coverage Options

Car insurance carriers in the US offer a spectrum of coverage options to meet the diverse needs of drivers. These options can be broadly categorized into the following:

- Liability Coverage: This is the most basic form of car insurance, covering bodily injury and property damage claims made against the policyholder. It is mandatory in most states and protects the insured from financial loss in the event of an at-fault accident.

- Collision Coverage: This optional coverage pays for damage to the insured vehicle resulting from a collision, regardless of fault. It provides financial protection for the policyholder in the event of an accident involving another vehicle or object.

- Comprehensive Coverage: This coverage goes beyond collision, protecting against damage from non-collision incidents such as theft, vandalism, weather-related events, and animal collisions. It provides a more comprehensive level of protection for the insured vehicle.

- Personal Injury Protection (PIP): Also known as no-fault insurance, PIP covers medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident. It provides a safety net for policyholders, ensuring they can access necessary medical care and financial support after an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. It ensures the insured has financial protection even when involved with an uninsured or underinsured driver.

These coverage options can be customized and combined to create a personalized insurance policy that meets the specific needs of the policyholder. Car insurance carriers often offer additional endorsements and add-ons, such as rental car coverage, gap insurance, and roadside assistance, further tailoring the policy to individual requirements.

| Carrier | Average Annual Premium (2023) | Coverage Highlights |

|---|---|---|

| State Farm | $1,382 | Offers a range of discounts, including safe driver and loyalty discounts. Provides comprehensive coverage with optional add-ons like rideshare and pet injury coverage. |

| GEICO | $1,295 | Known for competitive rates and a wide range of coverage options. Offers discounts for military members, federal employees, and safe driving. Provides emergency services and roadside assistance. |

| Progressive | $1,569 | Provides flexible payment options and a unique Name Your Price tool. Offers coverage for a variety of vehicles, including classic cars and motorcycles. Provides roadside assistance and gap coverage. |

| Allstate | $1,717 | Offers customizable coverage with a range of discounts. Provides accident forgiveness and safe driving bonuses. Offers additional services like identity protection and travel planning. |

| Esurance | $1,425 | Known for its digital-first approach and simplified insurance process. Offers discounts for safe driving, multi-policy, and driving safety features. Provides 24/7 customer support and easy claims processing. |

The Impact of Technology on Car Insurance Carriers

The digital revolution has had a profound impact on the car insurance industry, transforming the way carriers operate and interact with their customers. The rise of telematics and usage-based insurance (UBI) has enabled carriers to offer more personalized and data-driven coverage options.

Telematics devices, installed in vehicles, track driving behavior and provide real-time data on factors such as speed, acceleration, and braking. This data is used by insurance carriers to assess risk and offer more accurate and personalized premiums. Drivers who exhibit safe driving behaviors can benefit from lower premiums, incentivizing safer driving practices.

Usage-based insurance takes this a step further, offering insurance policies that are priced based on the actual usage of the vehicle. Carriers can monitor miles driven, time of day, and even the locations where the vehicle is driven. This allows for a more dynamic and accurate assessment of risk, leading to potentially lower premiums for drivers who use their vehicles less frequently or drive in safer conditions.

The integration of technology has also streamlined the insurance process, from quote comparisons to claims processing. Online platforms and mobile apps have made it easier for drivers to shop for insurance, compare policies, and manage their coverage. Carriers have also embraced digital tools to enhance customer service, providing 24/7 support, easy claims reporting, and efficient claim settlement processes.

The Future of Car Insurance Carriers

As we look ahead, the future of car insurance carriers is likely to be shaped by ongoing technological advancements and evolving consumer expectations. The rise of autonomous vehicles and connected car technologies is set to transform the risk landscape, potentially impacting the way carriers assess and price policies.

Autonomous vehicles, with their advanced safety features and reduced accident rates, could lead to a decrease in insurance premiums over time. Carriers will need to adapt their underwriting and pricing models to account for the changing risk profile associated with these vehicles. Additionally, the data generated by connected car technologies will provide carriers with even more insights into driving behavior, allowing for more precise risk assessment and potentially further personalized coverage options.

Furthermore, the increasing focus on sustainability and environmental concerns is likely to influence the car insurance industry. Carriers may explore new coverage options and incentives to promote eco-friendly driving practices and the adoption of electric vehicles. This could include discounts for low-emission vehicles or coverage plans that support sustainable driving behaviors.

In conclusion, the world of car insurance carriers is a dynamic and evolving landscape, offering a range of coverage options to meet the diverse needs of American drivers. With the ongoing integration of technology and the promise of autonomous vehicles, the future of car insurance carriers looks set to be an exciting and innovative space, continually adapting to meet the changing needs and expectations of policyholders.

How do I choose the right car insurance carrier for me?

+Choosing the right car insurance carrier involves considering several factors. First, assess your specific coverage needs and budget. Research and compare quotes from multiple carriers to find the best fit. Look for carriers with a strong financial stability rating and positive customer service reputation. Additionally, consider any unique coverage options or discounts that may be relevant to your situation, such as discounts for safe driving, multi-policy, or vehicle-specific coverages.

What are some common discounts offered by car insurance carriers?

+Car insurance carriers offer a variety of discounts to policyholders. Common discounts include safe driver discounts, multi-policy discounts (bundling car insurance with other types of insurance), loyalty discounts for long-term customers, good student discounts for young drivers with good grades, and discounts for vehicles equipped with safety features. Some carriers also offer discounts for military members, federal employees, and safe driving behaviors monitored through telematics devices.

How do car insurance carriers determine my premium?

+Car insurance carriers use a combination of factors to determine your premium. These factors include your driving record, the type and value of your vehicle, your location and zip code, your age and gender, the level of coverage you choose, and any additional discounts or endorsements you add to your policy. Carriers may also use data from telematics devices or usage-based insurance programs to assess your driving behavior and risk profile.