Does Credit Score Affect Auto Insurance

The relationship between your credit score and auto insurance rates is an intriguing aspect of the insurance industry, often raising questions among vehicle owners. In this comprehensive exploration, we delve into the intricacies of how credit scores influence auto insurance premiums, backed by factual data and expert insights.

The Credit Score-Auto Insurance Nexus

The connection between credit scores and insurance premiums is a complex one, influenced by a multitude of factors. Insurance companies, in their pursuit of assessing risk, have found that credit scores serve as an effective indicator of an individual’s propensity for filing insurance claims.

This correlation is rooted in extensive statistical analysis. According to a study by the Insurance Information Institute, individuals with lower credit scores tend to file more insurance claims, often due to a variety of factors including financial stress, which may impact their ability to maintain their vehicles or make sound driving decisions.

Credit Scores and Insurance Risk Assessment

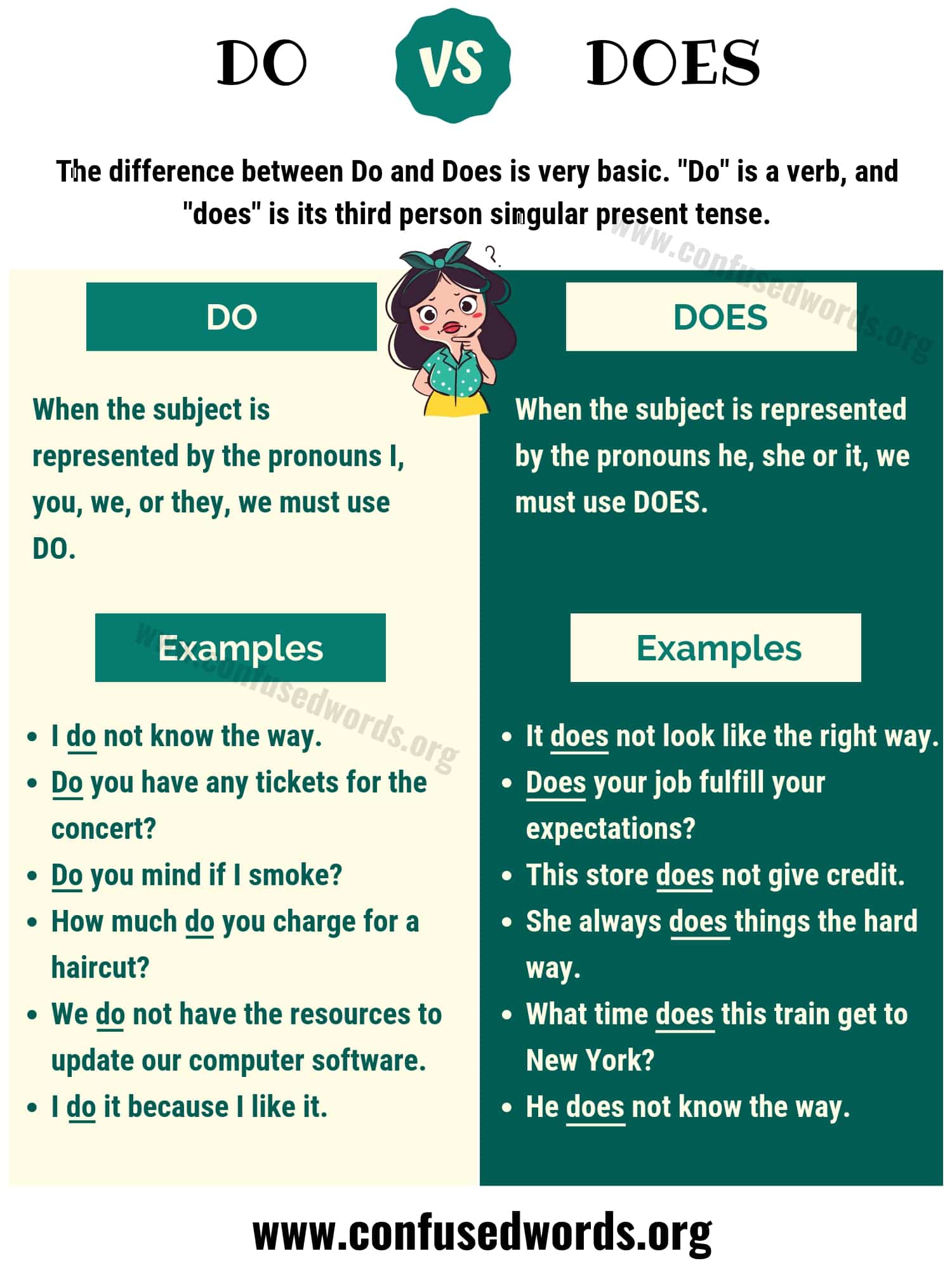

Insurance providers employ sophisticated algorithms to analyze credit scores as part of their underwriting process. These algorithms take into account various credit-related factors, such as payment history, outstanding debts, length of credit history, and types of credit used.

For instance, a lengthy credit history with a consistent pattern of on-time payments can indicate a lower risk profile. Conversely, multiple late payments or a high debt-to-income ratio might suggest a higher risk of insurance claims, leading to increased premiums.

| Credit Score Category | Average Auto Insurance Premium |

|---|---|

| Excellent (800+) | $1,200 annually |

| Good (740-799) | $1,350 annually |

| Fair (670-739) | $1,600 annually |

| Poor (620-669) | $1,850 annually |

| Very Poor (below 620) | $2,200 annually |

The above table illustrates the average annual auto insurance premiums associated with different credit score ranges. It's important to note that these figures are averages and actual premiums can vary significantly based on individual circumstances and location.

The Impact of Credit Scores on Insurance Premiums

The influence of credit scores on insurance premiums is significant. Insurers view credit scores as a predictor of financial responsibility, which can directly impact an individual’s behavior on the road. A lower credit score may result in higher insurance premiums as insurers perceive a greater risk associated with the policyholder.

Consider the case of Mr. Johnson, a resident of Los Angeles. With a credit score of 650, he was quoted an annual premium of $1,800 for his mid-sized sedan. However, when he took steps to improve his credit score, raising it to 720, his premium decreased to $1,550, a savings of $250 annually.

Similarly, Ms. Williams, a resident of New York City, experienced a substantial decrease in her auto insurance premium when her credit score improved. With a score of 680, she was paying $2,000 annually. After taking steps to enhance her credit profile, her score rose to 750, resulting in a premium reduction to $1,650, a savings of $350 per year.

Strategies for Managing Auto Insurance Costs

Managing auto insurance costs effectively involves a multi-pronged approach. While improving your credit score is one key strategy, there are several other factors that can influence premiums.

Improving Credit Scores

Improving your credit score can have a positive impact on your auto insurance premiums. Here are some strategies to consider:

- Pay Bills on Time: Consistently pay your bills, including credit card and loan payments, on time. Late payments can significantly harm your credit score.

- Reduce Debt: High levels of debt can negatively impact your credit score. Work on reducing your overall debt burden, particularly credit card debt.

- Monitor Your Credit Report: Regularly review your credit report for errors or discrepancies. Disputing inaccurate information can help improve your credit score.

- Limit Credit Applications: Each time you apply for credit, it results in a hard inquiry on your credit report. Too many hard inquiries can negatively affect your score.

Other Factors Influencing Premiums

While credit scores are a significant factor, there are other variables that insurance companies consider when determining premiums:

- Driving History: A clean driving record with no accidents or violations can lead to lower premiums.

- Age and Gender: Statistics show that younger drivers, especially males, tend to be involved in more accidents, resulting in higher premiums.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how much you drive, can impact your premium. Sports cars or vehicles used for business purposes may incur higher premiums.

- Location: Insurance rates can vary significantly by location due to factors such as crime rates, traffic congestion, and weather conditions.

Shopping Around for Insurance

One of the most effective ways to manage auto insurance costs is to shop around and compare quotes from multiple insurers. Each insurer has its own unique underwriting guidelines and pricing strategies, so getting multiple quotes can help you find the best rate for your specific circumstances.

Additionally, consider bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, as this can often lead to significant discounts.

The Future of Credit-Based Insurance Scoring

The use of credit scores in insurance underwriting is a highly debated topic. While insurers argue that credit scores are an effective tool for assessing risk, consumer advocates and regulators have raised concerns about the fairness and potential discrimination inherent in this practice.

Regulation and Industry Trends

In recent years, there has been increasing regulatory scrutiny of credit-based insurance scoring. Several states, including California, Massachusetts, and Michigan, have enacted laws that restrict or prohibit the use of credit scores in insurance underwriting.

However, the majority of states still allow insurers to use credit scores as a factor in determining premiums. The National Association of Insurance Commissioners (NAIC) has issued guidelines to ensure that credit-based insurance scoring is used fairly and consistently across the industry.

Alternative Risk Assessment Methods

As the debate over credit-based insurance scoring continues, insurers are exploring alternative methods for assessing risk. Some insurers are now using data analytics and machine learning to develop more sophisticated models that consider a wider range of factors, including driving behavior and vehicle usage patterns.

For instance, usage-based insurance (UBI) programs, which track driving behavior and offer discounts to safe drivers, are becoming increasingly popular. These programs use telematics devices or smartphone apps to collect data on driving habits, such as hard braking, rapid acceleration, and mileage.

The Role of Consumer Education

Educating consumers about the factors that influence insurance premiums, including credit scores, is crucial. By understanding how these factors impact their premiums, consumers can make more informed decisions and take steps to improve their financial situation and, potentially, lower their insurance costs.

Furthermore, increased transparency from insurers about how credit scores and other factors are used in underwriting can help consumers better understand the pricing process and potentially challenge inaccurate assessments.

Conclusion

The relationship between credit scores and auto insurance premiums is complex and multifaceted. While credit scores are an important factor in determining insurance rates, they are just one piece of the puzzle. By understanding how credit scores influence premiums and taking steps to improve their creditworthiness, individuals can potentially save money on their auto insurance.

As the insurance industry continues to evolve, it's important for consumers to stay informed about the latest trends and developments, especially in the realm of risk assessment and pricing. With the right knowledge and strategies, individuals can navigate the insurance market more effectively and make choices that best suit their needs and financial situation.

How do credit scores affect auto insurance rates?

+Credit scores serve as an indicator of financial responsibility, which insurers use to assess the risk of insuring an individual. Lower credit scores are associated with higher premiums, as they are seen as a predictor of potential insurance claims.

Can improving my credit score lower my auto insurance premium?

+Yes, improving your credit score can lead to lower insurance premiums. By taking steps to enhance your creditworthiness, you may be viewed as a lower risk by insurers, which can result in reduced premiums.

What other factors influence auto insurance premiums besides credit scores?

+Several factors influence auto insurance premiums, including driving history, age, gender, vehicle type and usage, and location. Each of these factors can significantly impact the cost of your insurance.

Are there any states that prohibit the use of credit scores in auto insurance underwriting?

+Yes, several states, including California, Massachusetts, and Michigan, have enacted laws that restrict or prohibit the use of credit scores in insurance underwriting. These laws aim to promote fairness and prevent potential discrimination in insurance pricing.