Whole Life Insurance With Aarp

The insurance industry is a vast and intricate web, offering a multitude of options to cater to diverse needs. Among the myriad of choices, whole life insurance stands out as a unique and comprehensive solution, especially when considered through the lens of AARP, a trusted organization known for its commitment to enhancing the lives of older adults.

In this in-depth exploration, we will delve into the intricacies of whole life insurance, understanding its essence, its advantages, and how it aligns with the offerings of AARP. By the end of this journey, you will possess a nuanced understanding of this financial tool and its potential role in your long-term financial planning.

Understanding Whole Life Insurance

Whole life insurance, often referred to as permanent life insurance, is a type of coverage that provides a death benefit to beneficiaries and accumulates cash value over time. This distinguishes it from term life insurance, which only provides coverage for a specified period and does not build cash value.

The key features of whole life insurance include:

- Guaranteed Death Benefit: The policy guarantees payment to beneficiaries upon the insured's death, regardless of when it occurs.

- Cash Value Accumulation: A portion of the premium goes towards building cash value within the policy, which can be borrowed against or withdrawn.

- Level Premiums: Premiums remain the same throughout the policy, offering stability and predictability.

- Lifetime Coverage: As the name suggests, whole life insurance provides coverage for the insured's entire life, assuming premiums are paid as required.

The structure of whole life insurance makes it an appealing choice for those seeking long-term financial security and peace of mind. It is often used to cover final expenses, provide an inheritance, or even generate supplemental income in retirement.

AARP’s Role in Whole Life Insurance

AARP, formerly known as the American Association of Retired Persons, is a non-profit, non-partisan organization dedicated to empowering people as they age. With a membership of over 38 million, AARP offers a range of benefits and services, including insurance products, to enhance the lives of its members.

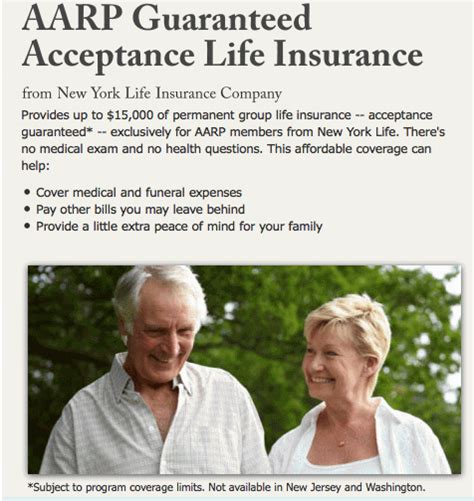

When it comes to whole life insurance, AARP has partnered with well-known insurance carriers to offer exclusive plans to its members. These plans are designed to provide comprehensive coverage while leveraging the trust and reputation that AARP has built over the years.

Key advantages of considering whole life insurance through AARP include:

- Competitive Rates: AARP negotiates group rates with insurance carriers, often resulting in lower premiums for members.

- Simplified Application Process: AARP plans may offer streamlined application processes, making it easier and quicker to secure coverage.

- Reputable Partners: AARP partners with established insurance carriers, ensuring reliable and trusted coverage.

- Additional Benefits: AARP members may be eligible for additional perks and discounts, enhancing the overall value of the policy.

The Benefits of Whole Life Insurance

Whole life insurance offers a host of benefits that make it an attractive option for many individuals and families. Here’s a deeper look at some of these advantages:

Financial Security for Beneficiaries

The primary purpose of life insurance is to provide financial security to loved ones in the event of the insured’s death. Whole life insurance guarantees this security, ensuring that beneficiaries receive a specified sum upon the insured’s passing. This can be particularly crucial for families relying on the insured’s income or for covering expenses such as funeral costs or outstanding debts.

Cash Value Accumulation

One of the unique features of whole life insurance is its capacity to build cash value. A portion of the premium goes towards this cash value, which grows over time. This cash value can be borrowed against or withdrawn, providing a financial safety net during times of need. It can be used for various purposes, such as covering emergency expenses, funding a child’s education, or supplementing retirement income.

Flexible Payment Options

Whole life insurance policies typically offer flexible payment options. Insured individuals can choose to pay premiums annually, semi-annually, quarterly, or even monthly, depending on their financial situation and preferences. This flexibility ensures that the policy remains accessible and affordable for a wide range of individuals.

Long-Term Financial Planning

Whole life insurance is a valuable tool for long-term financial planning. By providing a guaranteed death benefit and accumulating cash value, it offers a stable foundation for future financial security. This can be especially beneficial for those who wish to leave a legacy or ensure financial stability for their families beyond their lifetime.

Tax Benefits

Whole life insurance policies can offer tax advantages. The cash value within the policy grows on a tax-deferred basis, meaning that gains are not taxed until they are withdrawn or used. Additionally, the death benefit is typically tax-free, providing beneficiaries with a substantial sum without incurring tax liabilities.

Performance Analysis of Whole Life Insurance

When considering whole life insurance, it’s crucial to evaluate its performance and understand how it can fit into your financial portfolio. Here’s a breakdown of some key performance indicators:

Return on Investment

Whole life insurance policies offer a guaranteed return on investment in the form of the death benefit. However, the cash value accumulation within the policy can provide additional returns. While the growth of cash value is not as aggressive as some investment vehicles, it is consistent and stable, making it a reliable long-term investment option.

Policy Flexibility

One of the standout features of whole life insurance is its flexibility. Policyholders can adjust their coverage levels, add riders, or even use the cash value to pay premiums. This flexibility allows individuals to customize their policy to meet changing needs and priorities.

Cost Efficiency

Whole life insurance policies can be more cost-efficient than term life insurance over the long term. While premiums for whole life insurance remain level, term life insurance premiums increase as the insured ages. This makes whole life insurance a more affordable option for long-term coverage.

Guaranteed Coverage

Whole life insurance provides a guarantee that the policy will remain in force as long as premiums are paid. This is a significant advantage, especially for those with health concerns or who may face difficulty securing coverage in the future. With whole life insurance, individuals can rest assured that their coverage is secure.

Evidence-Based Future Implications

The future of whole life insurance looks promising, particularly when viewed through the lens of evolving financial landscapes and changing societal needs.

As the world of finance becomes increasingly complex, the simplicity and reliability of whole life insurance make it an attractive option. Its ability to provide guaranteed coverage, build cash value, and offer flexible payment options positions it well to meet the diverse needs of individuals and families.

Furthermore, with the rising costs of healthcare and the growing importance of financial planning for retirement, whole life insurance can play a pivotal role in ensuring long-term financial security. It can serve as a reliable backup for emergency expenses, a source of supplemental income in retirement, or a means to leave a substantial legacy for future generations.

In a world where financial uncertainties abound, whole life insurance offers a beacon of stability and peace of mind. Its potential to provide a financial safety net and its alignment with the trusted AARP brand make it an option worth considering for those seeking comprehensive financial protection.

Conclusion

Whole life insurance, particularly when considered through the lens of AARP, presents a compelling case for long-term financial planning. Its unique features, such as guaranteed death benefits, cash value accumulation, and flexible payment options, make it a versatile and reliable tool for securing the financial future of yourself and your loved ones.

As you navigate the complex world of insurance, remember that whole life insurance is not a one-size-fits-all solution. It is essential to evaluate your specific needs, financial situation, and long-term goals before making a decision. Consulting with a financial advisor or insurance professional can provide valuable guidance tailored to your unique circumstances.

In the end, whole life insurance with AARP offers a blend of security, flexibility, and financial stability that can be a cornerstone of your financial plan. It is a decision that can provide peace of mind, knowing that you and your loved ones are protected for the long haul.

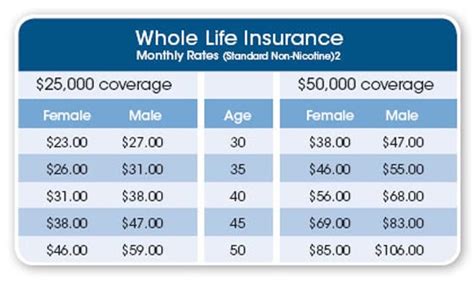

How much does whole life insurance cost through AARP?

+The cost of whole life insurance through AARP can vary based on several factors, including age, health, and the amount of coverage desired. Generally, younger individuals in good health can expect more affordable premiums. It’s recommended to obtain a quote tailored to your specific circumstances to get an accurate estimate.

Can I borrow against the cash value of my whole life insurance policy?

+Yes, one of the benefits of whole life insurance is the ability to borrow against the cash value of the policy. This can provide a source of emergency funds or be used for various financial needs. However, it’s important to note that any outstanding loans will reduce the death benefit and may incur interest charges.

Are there any restrictions on how I can use the cash value of my whole life insurance policy?

+The cash value of a whole life insurance policy can be used for a variety of purposes, including covering emergency expenses, funding education, or supplementing retirement income. However, it’s important to consult with a financial advisor to ensure that you are making the most appropriate use of these funds based on your specific financial goals and situation.