Find The Best But Cheap Auto Insurance

Securing affordable car insurance without compromising on quality is a priority for many vehicle owners. This comprehensive guide aims to help you navigate the world of auto insurance, uncovering the best options that offer both economic value and reliable coverage.

Understanding Your Auto Insurance Needs

Before delving into the search for the cheapest auto insurance, it's crucial to first assess your specific requirements. Every driver has unique needs, and understanding these is key to making an informed decision. Consider factors like your driving history, the type of vehicle you own, and the level of coverage you desire.

For instance, if you have a clean driving record with no accidents or traffic violations, you might qualify for lower insurance premiums. On the other hand, drivers with a history of accidents or moving violations may need to focus on companies that offer discounts for safe driving courses or telematics programs.

Assessing Your Coverage Requirements

The type of car insurance coverage you need depends on several factors, including your state's legal requirements, the value of your vehicle, and your personal financial situation. Here's a breakdown of common coverage types to help you determine your needs:

- Liability Coverage: This is the most basic type of auto insurance, covering damages you cause to others' property or injuries you cause to others. It's required by law in most states.

- Collision Coverage: This covers damage to your vehicle in the event of a collision, regardless of fault. It's particularly beneficial if you own a newer or more expensive vehicle.

- Comprehensive Coverage: Comprehensive insurance protects against damages caused by non-collision events like theft, vandalism, natural disasters, or animal collisions.

- Personal Injury Protection (PIP): PIP, also known as no-fault insurance, covers medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you're involved in an accident with a driver who doesn't have insurance or enough insurance to cover the damages.

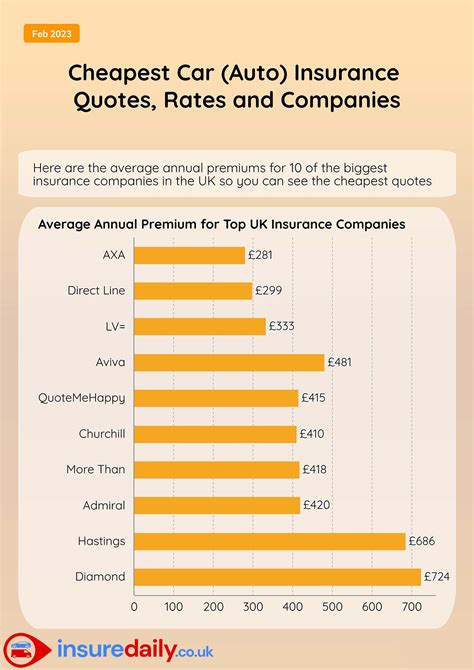

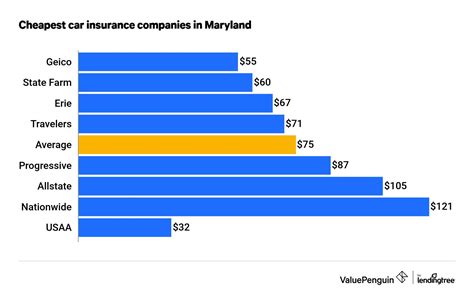

Comparing Auto Insurance Providers

Once you've determined your insurance needs, it's time to compare different providers to find the best cheap auto insurance. Several factors come into play when choosing an insurance company, including:

Company Reputation and Financial Strength

Opting for a reputable auto insurance company ensures that you're dealing with a stable, reliable entity. Look for companies with a solid financial standing, as this indicates their ability to pay out claims promptly. Check ratings from reputable agencies like AM Best, Moody's, or Standard & Poor's.

For instance, companies like State Farm, GEICO, and Progressive consistently rank highly for financial strength and customer satisfaction. These companies offer competitive rates while maintaining a strong track record of paying out claims.

Coverage Options and Customization

The best cheap auto insurance policies should offer a range of coverage options to cater to different driver needs. Look for companies that provide customizable policies, allowing you to choose the coverage types and limits that fit your situation. Some insurers, like Allstate and Nationwide, offer a wide array of coverage options, from standard liability to specialized endorsements for classic cars or ridesharing.

| Insurance Company | Coverage Options |

|---|---|

| State Farm | Personalized auto policies, rideshare insurance, mechanical breakdown coverage |

| GEICO | Standard liability, comprehensive, collision, medical payments, rental car coverage |

| Progressive | Customizable coverage, gap insurance, roadside assistance |

Discounts and Savings Opportunities

One of the best ways to find cheap auto insurance is by taking advantage of discounts. Many insurance companies offer a range of discounts to attract new customers and reward loyal policyholders. Common discounts include:

- Multi-Policy Discounts: Combining your auto insurance with other policies like homeowners or renters insurance often results in savings.

- Good Driver Discounts: Insurers often reward drivers with clean records by offering significant discounts.

- Safe Vehicle Discounts: If your car has safety features like anti-lock brakes or airbags, you may qualify for lower premiums.

- Pay-in-Full Discounts: Some companies offer discounts for paying your annual premium in full rather than in monthly installments.

- Telematics Discounts: Companies like Allstate and Nationwide provide discounts for safe driving habits, determined by a tracking device or smartphone app.

Online Quoting and Policy Management

In today's digital age, many insurance companies offer online quoting tools that allow you to get an auto insurance quote in just a few minutes. These tools often provide accurate estimates based on your specific circumstances, making it easy to compare rates from multiple providers.

Additionally, online policy management platforms offer convenience and efficiency. You can make policy changes, add or remove drivers, and pay your premiums directly from your computer or mobile device. Leading insurers like Progressive and Esurance have robust online platforms that make policy management a breeze.

Utilizing Insurance Comparison Websites

Insurance comparison websites are a valuable resource when searching for cheap auto insurance. These platforms allow you to enter your information once and receive quotes from multiple insurers, making it easier to find the best deal. Some popular comparison sites include:

- Insurance.com: Provides quotes from top insurers and offers a simple, user-friendly interface.

- The Zebra: Offers detailed information on policies and companies, along with an easy-to-use quote tool.

- Compare.com: Allows you to compare quotes from multiple providers and provides educational resources on insurance topics.

Understanding Auto Insurance Quotes

When you receive an auto insurance quote, it's essential to understand what's included and how it's calculated. Insurance companies use various factors to determine your premium, including your driving record, the type of car you drive, your age and gender, and the coverage limits you select.

For instance, if you're a young driver with a history of accidents, your quotes will likely be higher than those of an older, more experienced driver with a clean record. Similarly, driving a high-performance sports car will result in higher premiums than driving a standard sedan.

Factors Affecting Your Premium

Several factors can impact the cost of your auto insurance premium. Here are some of the most common considerations:

- Driving Record: A clean driving record can lead to lower premiums, while accidents, violations, and DUIs can significantly increase your rates.

- Vehicle Type: The make, model, and year of your car can affect your premium. Sports cars and luxury vehicles often cost more to insure than standard cars.

- Coverage Limits: The higher your coverage limits, the more your insurance will cost. Balancing the right amount of coverage with your budget is crucial.

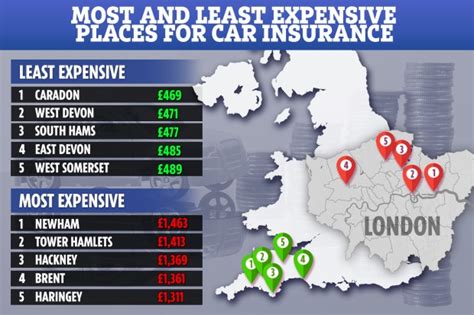

- Location: Your geographic location plays a role in determining your premium. Areas with higher crime rates or more frequent accidents may have higher insurance costs.

- Credit Score: In many states, insurance companies can consider your credit score when determining your premium. A higher credit score may result in lower rates.

Shopping for Cheap Auto Insurance: A Step-by-Step Guide

Now that you understand the key considerations when shopping for cheap auto insurance, let's walk through a step-by-step guide to help you find the best policy for your needs.

Step 1: Assess Your Insurance Needs

Start by evaluating your specific insurance needs. Consider your budget, the value of your vehicle, and any legal requirements in your state. Decide on the level of coverage you desire, whether it's basic liability or more comprehensive protection.

Step 2: Research Insurance Companies

Research different insurance companies to find those that offer the coverage you need at a competitive price. Look for companies with a strong financial standing and positive customer reviews. Check their coverage options, discounts, and online services to ensure they meet your expectations.

Step 3: Use Online Quoting Tools

Utilize online quoting tools provided by insurance companies or comparison websites. Enter your information to receive quotes from multiple providers. Compare the quotes, paying attention to the coverage details and any additional benefits or discounts offered.

Step 4: Consider Bundle Discounts

If you have other insurance needs, such as homeowners or renters insurance, consider bundling your policies with the same provider. Many companies offer significant discounts for customers who bundle multiple policies, which can lead to substantial savings.

Step 5: Review Policy Details

Before finalizing your decision, carefully review the policy details. Ensure that the coverage limits, deductibles, and terms align with your needs. Verify that any discounts you qualify for are reflected in the policy.

Step 6: Shop Around and Negotiate

Don't settle for the first quote you receive. Shop around and compare quotes from multiple insurers. If you find a better deal elsewhere, don't hesitate to negotiate with your current provider. Many companies are willing to match or beat competitors' rates to retain your business.

Step 7: Maintain a Good Driving Record

One of the best ways to keep your auto insurance premiums low is by maintaining a clean driving record. Avoid accidents and traffic violations, and consider taking defensive driving courses, which can often lead to insurance discounts.

The Future of Auto Insurance: Technological Innovations

The auto insurance industry is evolving rapidly, driven by technological advancements. These innovations are transforming the way insurance is priced, purchased, and managed, offering new opportunities for cost savings and improved customer experiences.

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are revolutionizing the way auto insurance is priced. These technologies allow insurers to track driving behavior in real-time, providing more accurate risk assessments. Drivers who exhibit safe driving habits can qualify for lower premiums, while those with riskier driving patterns may pay higher rates.

For instance, Progressive offers its Snapshot program, which uses a small device plugged into your car's diagnostic port to track your driving habits. Based on your performance, you can receive discounts on your insurance premium.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are being used to streamline the insurance claims process, improve underwriting accuracy, and personalize insurance offerings. These technologies can analyze vast amounts of data to identify patterns and make predictions, helping insurers offer more tailored policies and faster claim resolutions.

Blockchain Technology

Blockchain technology, known for its use in cryptocurrencies, is also making inroads into the insurance industry. By providing a secure, transparent, and tamper-proof ledger, blockchain can enhance trust and efficiency in insurance transactions. It can be used to streamline claim processing, automate policy administration, and facilitate peer-to-peer insurance models.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry is focused on enhancing the customer experience. Insurers are investing in mobile apps, online portals, and chatbots to provide customers with 24/7 access to their policy information, claim status, and other services. This shift towards digital channels offers convenience and efficiency, allowing customers to manage their insurance needs on their terms.

Frequently Asked Questions

How can I get cheap auto insurance with a bad driving record?

+While a bad driving record can make finding cheap auto insurance challenging, it’s not impossible. Consider shopping around for companies that specialize in high-risk drivers or those that offer discounts for safe driving courses. You can also explore usage-based insurance programs, which may provide lower rates if you demonstrate improved driving habits.

Are there any downsides to usage-based insurance programs?

+Usage-based insurance programs can be a great way to save on auto insurance, but they’re not for everyone. These programs rely on monitoring your driving behavior, which some may see as an invasion of privacy. Additionally, if you’re a less-than-perfect driver, you may end up paying more with these programs than with traditional insurance.

What is the average cost of auto insurance in the US?

+The average cost of auto insurance in the US varies significantly depending on factors like your location, driving history, and the type of vehicle you drive. According to the Insurance Information Institute, the national average annual premium for auto insurance in 2022 was $1,674. However, this is just an average, and your personal rate could be higher or lower based on your specific circumstances.

Can I get cheap auto insurance if I’m a young driver?

+Finding cheap auto insurance as a young driver can be challenging due to the higher risk associated with this demographic. However, you can explore options like adding yourself to a parent’s policy (if they have a good driving record), taking a defensive driving course, or opting for a usage-based insurance program. These strategies may help you secure more affordable coverage.

What are some common mistakes to avoid when shopping for auto insurance?

+Some common mistakes to avoid when shopping for auto insurance include not comparing enough quotes, failing to understand the coverage you’re purchasing, and neglecting to take advantage of available discounts. Additionally, be cautious of choosing the cheapest policy without considering the insurer’s reputation and financial strength.