Home And Car Insurance Bundles

In today's fast-paced world, convenience and cost-effectiveness are paramount. When it comes to insurance, bundling your home and car insurance policies can offer a range of benefits that go beyond simply saving money. This comprehensive guide will explore the ins and outs of home and car insurance bundles, shedding light on how they work, the advantages they bring, and the factors to consider when making this important financial decision.

Understanding Home and Car Insurance Bundles

A home and car insurance bundle, also known as a multi-policy or package deal, is an insurance product that combines your home and auto insurance policies under one provider. Instead of purchasing separate policies from different companies, you can opt for a single provider that offers both types of coverage. This approach streamlines your insurance needs, making it easier to manage and understand your coverage.

Bundling your insurance policies is a strategic move that many homeowners and car owners are adopting. It offers a simplified approach to insurance, allowing you to enjoy the benefits of comprehensive coverage without the hassle of dealing with multiple providers.

How Do Home and Car Insurance Bundles Work?

When you bundle your home and car insurance, you’re essentially purchasing two policies from the same insurance company. The provider will assess your unique needs and provide tailored coverage for both your home and vehicle. Here’s a breakdown of how the process typically works:

- Risk Assessment: The insurance company will evaluate your specific circumstances, including the value of your home, the location, the type of vehicle you own, and your driving history. This assessment helps determine the appropriate level of coverage for each policy.

- Policy Creation: Based on the risk assessment, the insurer will create customized policies for your home and car. These policies will outline the coverage limits, deductibles, and any additional benefits or exclusions.

- Single Premium: Instead of paying separate premiums for your home and car insurance, you'll receive a single, bundled premium. This premium will reflect the combined cost of both policies, often with a discount applied for choosing to bundle.

- Claims Process: In the event of a claim, you'll only need to interact with one insurance provider. This simplifies the claims process, as you won't need to navigate different systems or policies. The insurer will handle both home and auto claims, making it more efficient and less stressful for you.

Advantages of Bundling Your Home and Car Insurance

Bundling your home and car insurance policies offers a range of advantages that can significantly enhance your insurance experience. Let’s delve into the key benefits:

1. Cost Savings

One of the most appealing aspects of insurance bundles is the potential for substantial cost savings. Insurance companies often provide discounts when you choose to bundle your policies. These discounts can range from 5% to 25% or more, depending on the provider and your specific circumstances.

By bundling, you can reduce the overall cost of your insurance premiums. This is particularly beneficial for those who own multiple vehicles or have extensive home insurance needs. The discounts can add up, making insurance more affordable and providing better value for your money.

| Policy Type | Average Annual Premium |

|---|---|

| Home Insurance | $1,200 |

| Car Insurance | $1,000 |

| Bundled Premium | $1,800 (with a 20% discount) |

As illustrated in the table above, by bundling your home and car insurance, you can save a significant amount compared to purchasing separate policies. These savings can be reinvested into other financial goals or used to enhance your lifestyle.

2. Simplified Insurance Management

Managing multiple insurance policies from different providers can be cumbersome and time-consuming. With a bundle, you’ll enjoy the convenience of having a single point of contact for all your insurance needs. This simplifies the process of renewing policies, making changes, or filing claims.

Instead of juggling multiple insurance providers, billing dates, and policy details, you'll have a centralized system. This makes it easier to keep track of your coverage, understand your benefits, and ensure that your policies are up-to-date.

3. Tailored Coverage

When you bundle your home and car insurance, the provider can offer more tailored coverage. By assessing your specific needs and circumstances, they can create a customized package that addresses your unique risks. This ensures that you’re not overpaying for coverage you don’t need or lacking protection in critical areas.

For example, if you own a classic car or have a high-value home, the insurer can include specialized coverage to address these specific needs. This level of customization ensures that your assets are adequately protected.

4. Enhanced Customer Service

Bundling your insurance policies often leads to improved customer service. When you have a single provider, they have a deeper understanding of your overall insurance needs. This can result in more personalized and efficient service, as the insurer is familiar with your history and unique situation.

Additionally, having a dedicated agent or representative for both your home and car insurance can make it easier to resolve issues or clarify policy details. The provider may also offer additional perks, such as priority claims processing or dedicated customer support lines for bundle customers.

5. Additional Benefits and Perks

Many insurance companies offer exclusive benefits and perks to customers who choose to bundle their policies. These can include:

- Loyalty Rewards: Insurance providers may reward your loyalty by offering additional discounts or benefits over time.

- Enhanced Coverage: Bundles often include additional coverage options, such as rental car coverage or identity theft protection, at no extra cost.

- Discounted Services: You may receive discounts on other insurance-related services, such as roadside assistance or home security systems.

- Travel Benefits: Some providers offer travel insurance or rental car discounts when you bundle your policies.

Factors to Consider Before Bundling

While bundling your home and car insurance can offer numerous benefits, it’s essential to consider a few key factors before making the switch. Here are some considerations to keep in mind:

1. Shop Around for the Best Deal

Before committing to a bundle, it’s wise to shop around and compare quotes from multiple insurance providers. While bundles often come with discounts, it’s important to ensure that you’re getting the best overall value. Compare the bundled premium with the cost of separate policies to determine the most cost-effective option.

Consider using online insurance comparison tools or seeking the assistance of an insurance broker who can provide multiple quotes and help you find the best deal.

2. Assess Your Individual Needs

Every homeowner and car owner has unique needs and circumstances. Before bundling, take the time to assess your specific requirements. Consider factors such as the value of your home, the number of vehicles you own, and any specialized coverage needs. Ensure that the bundled policy can accommodate these needs without compromising on essential coverage.

3. Read the Fine Print

When reviewing insurance policies, it’s crucial to read the fine print carefully. Pay attention to the coverage limits, deductibles, and any exclusions or limitations. Ensure that the bundled policy provides adequate coverage for both your home and car, and that it aligns with your expectations.

Look out for any hidden fees or restrictions that may impact the overall value of the bundle. Understanding the terms and conditions is essential to making an informed decision.

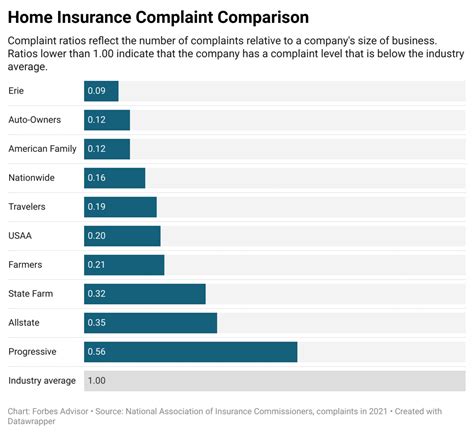

4. Consider Long-Term Commitments

Bundling your insurance policies often involves a long-term commitment. While it can be beneficial in the short term, ensure that the provider you choose is reputable and has a track record of excellent service. Consider the stability and financial strength of the insurance company to minimize the risk of future issues.

Performance Analysis: Real-World Examples

To better understand the impact of bundling, let’s explore some real-world examples of how it has benefited homeowners and car owners. These case studies highlight the tangible advantages of choosing a bundled insurance approach.

Case Study 1: The Smith Family

The Smith family, consisting of two parents and two teenage children, recently decided to bundle their home and car insurance policies. They owned a single-family home valued at $500,000 and had two vehicles: a sedan and an SUV. By bundling their policies, they achieved the following results:

- Cost Savings: The Smith family saved 15% on their annual insurance premiums, amounting to $600 in savings.

- Simplified Management: With a single provider, they found it easier to manage their insurance, especially when it came to policy renewals and making updates.

- Customized Coverage: The insurance company tailored their policy to include coverage for their teenage drivers, providing peace of mind for the entire family.

Case Study 2: Mr. Johnson’s Classic Car

Mr. Johnson, a passionate car enthusiast, owned a classic car worth $100,000. He wanted specialized coverage to protect his prized possession. By bundling his home and car insurance, he was able to:

- Secure Specialized Coverage: The insurance company offered a customized policy that included agreed-value coverage for his classic car, ensuring he received the full value in case of a total loss.

- Discounted Premium: Despite the specialized coverage, Mr. Johnson enjoyed a 10% discount on his bundled premium, resulting in significant cost savings.

- Efficient Claims Process: When Mr. Johnson needed to file a claim for a minor accident, the streamlined claims process made it quick and hassle-free.

Future Implications and Industry Trends

The trend of bundling home and car insurance policies is expected to continue and evolve in the coming years. As consumers seek more convenient and cost-effective insurance solutions, insurance providers are likely to enhance their bundle offerings.

Here are some future implications and industry trends to watch out for:

1. Increased Personalization

Insurance companies are investing in data analytics and technology to offer even more personalized insurance bundles. This means that future bundles may be tailored to individual lifestyles, risk profiles, and preferences, providing a highly customized insurance experience.

2. Digital Integration

The insurance industry is embracing digital transformation. Bundled insurance policies are likely to become more accessible and manageable through mobile apps and online platforms. This digital integration will further streamline the insurance experience, making it more convenient for policyholders.

3. Innovative Coverage Options

As the insurance industry evolves, we can expect to see innovative coverage options within bundles. This may include expanded liability coverage, enhanced cybersecurity protection, or specialized coverage for emerging technologies, such as electric vehicles or smart home systems.

4. Competitive Discounts

To remain competitive, insurance providers may offer even more attractive discounts for bundled policies. These discounts could be tied to loyalty programs, long-term commitments, or the adoption of safe driving practices, incentivizing customers to choose bundled insurance.

Conclusion

Bundling your home and car insurance policies is a strategic decision that offers a range of benefits. From cost savings and simplified management to tailored coverage and enhanced customer service, the advantages are significant. By carefully considering your needs and shopping around for the best deal, you can make an informed choice that aligns with your insurance goals.

As the insurance industry continues to evolve, we can expect even more innovative and personalized bundle options. Staying informed about these developments will help you make the most of your insurance decisions and ensure that your assets are protected effectively.

Can I bundle my insurance policies if I already have separate providers for my home and car insurance?

+Yes, it’s possible to switch to a bundled policy even if you currently have separate providers. Contact your preferred insurance company to discuss your options and obtain a quote for a bundled policy. They can guide you through the process of transferring your existing policies and provide information on any potential savings or benefits.

Are there any downsides to bundling my home and car insurance policies?

+While bundling offers numerous advantages, there are a few potential downsides to consider. One potential drawback is that you may be limited in your choice of providers. Additionally, if you experience issues with your insurance company, resolving them may be more challenging since you’re dealing with a single provider for both policies. However, these downsides can often be mitigated by carefully researching and selecting a reputable insurance company.

How often should I review and update my bundled insurance policies?

+It’s a good practice to review your insurance policies annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and aligned with your needs. Regular reviews allow you to stay informed about any changes in coverage, premiums, or discounts, helping you make informed decisions about your insurance.