Car Insurances In Florida

Florida, known for its sunny beaches and vibrant culture, is also a state where car insurance plays a crucial role in the lives of its residents. With a diverse range of landscapes, from bustling cities to picturesque coastal towns, Florida offers unique driving experiences and challenges. In this comprehensive guide, we delve into the world of car insurance in Florida, exploring the key aspects, challenges, and opportunities that make it an essential topic for every driver in the Sunshine State.

Understanding the Landscape of Car Insurance in Florida

Car insurance is a legal requirement in Florida, ensuring that drivers are protected financially in the event of accidents, theft, or other unforeseen circumstances. The state’s unique characteristics, including its high population density, frequent severe weather events, and diverse demographics, contribute to a dynamic and complex insurance landscape. Understanding the specific regulations, coverage options, and pricing structures is essential for Florida drivers to make informed decisions and navigate the insurance market effectively.

Key Features and Regulations of Florida Car Insurance

Florida has implemented several distinctive regulations and requirements to ensure a comprehensive insurance system. Here are some key features:

- No-Fault Insurance: Florida operates under a no-fault insurance system, which means that drivers' own insurance policies cover their medical expenses and lost wages up to a certain limit, regardless of who is at fault in an accident. This system aims to expedite the claims process and reduce litigation.

- Personal Injury Protection (PIP): Every Florida driver is required to carry Personal Injury Protection coverage, which provides compensation for medical bills and other related expenses after an accident. PIP coverage is a critical component of Florida's no-fault system.

- Property Damage Liability: This coverage is mandatory and protects drivers from claims related to property damage they may cause in an accident. It covers the cost of repairing or replacing damaged property, ensuring financial protection for both the policyholder and the affected party.

- Bodily Injury Liability: Bodily Injury Liability coverage is also mandatory in Florida. It provides financial protection to policyholders in cases where they are held legally responsible for injuries caused to others in an accident. This coverage is crucial for ensuring peace of mind and financial stability.

- Uninsured/Underinsured Motorist Coverage: Florida law requires drivers to carry uninsured/underinsured motorist coverage, which protects policyholders in the event of an accident with a driver who has no insurance or insufficient insurance coverage.

Optional Coverages and Add-Ons

In addition to the mandatory coverages, Florida drivers have the option to enhance their insurance policies with various add-ons and optional coverages, such as:

- Collision Coverage: This optional coverage pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects against non-accident-related incidents, including theft, vandalism, natural disasters, and other unforeseen events.

- Rental Car Reimbursement: This add-on provides coverage for rental car expenses if your vehicle is being repaired or is declared a total loss.

- Gap Insurance: Gap insurance covers the difference between the actual cash value of your vehicle and the remaining balance on your loan or lease, providing financial protection in case of a total loss.

Factors Influencing Car Insurance Rates in Florida

Car insurance rates in Florida are influenced by a multitude of factors, including personal characteristics, vehicle specifics, and location-based considerations. Here’s an overview of the key factors that impact insurance premiums:

Personal Factors

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance rates due to their perceived higher risk of involvement in accidents. Gender is also a factor, with some insurance providers offering discounts for female drivers.

- Driving Record: A clean driving record with no accidents or violations can lead to lower insurance rates. Conversely, a history of accidents, traffic violations, or DUI convictions can significantly increase insurance costs.

- Credit Score: In Florida, insurance providers are allowed to use credit-based insurance scores to determine rates. A good credit score can result in lower premiums, while a poor credit score may lead to higher costs.

Vehicle Factors

- Vehicle Type and Age: The make, model, and age of your vehicle play a significant role in insurance rates. Sports cars and luxury vehicles often command higher premiums due to their higher repair costs and increased risk of theft. Newer vehicles may also be more expensive to insure.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and collision avoidance systems, may be eligible for insurance discounts. These features reduce the risk of accidents and injuries, leading to potential cost savings.

Location-Based Factors

- Geographic Region: Different regions within Florida have varying insurance rates. Coastal areas, for instance, may face higher premiums due to the risk of hurricane damage. Urban areas with higher population densities and increased traffic congestion may also see elevated insurance costs.

- Crime Rate: Areas with higher crime rates, particularly those with a history of vehicle theft or vandalism, tend to have higher insurance premiums. Insurance providers consider the risk of theft and other crimes when setting rates.

Navigating the Florida Insurance Market

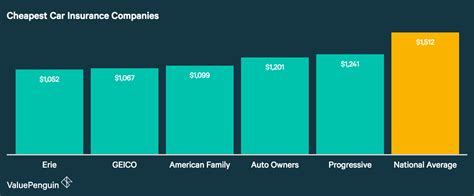

With a diverse range of insurance providers offering various coverage options and pricing structures, navigating the Florida insurance market can be daunting. Here are some tips to help you find the best car insurance policy for your needs:

Compare Multiple Quotes

Obtain quotes from multiple insurance providers to compare coverage options and prices. Online comparison tools and insurance brokers can be valuable resources for gathering quotes from various companies.

Understand Your Coverage Needs

Assess your specific coverage requirements based on your driving habits, vehicle type, and personal circumstances. Consider the mandatory coverages and explore optional add-ons that align with your needs and budget.

Review Your Policy Regularly

Insurance needs and circumstances can change over time. Regularly review your policy to ensure it continues to meet your requirements. Consider updating your coverage or exploring new providers if your needs evolve or if you find more competitive rates elsewhere.

Take Advantage of Discounts

Insurance providers often offer a variety of discounts, such as safe driver discounts, multi-policy discounts, and loyalty discounts. Inquire about these discounts when obtaining quotes and ensure you’re taking advantage of any applicable savings.

Real-World Examples and Case Studies

To illustrate the impact of various factors on insurance rates, let’s examine a few real-world examples:

Example 1: Young Driver with a Clean Record

Sarah, a 22-year-old college student, recently purchased her first car. With a clean driving record and excellent academic performance, she is eligible for a good student discount. By shopping around and comparing quotes, Sarah finds an insurance policy with a reputable provider, offering comprehensive coverage for $1,200 annually.

Example 2: Middle-Aged Driver with a Traffic Violation

John, a 45-year-old professional, has a solid driving record but recently received a speeding ticket. Due to this violation, his insurance rates have increased. By maintaining a good driving record for the next year and taking a defensive driving course, John is able to negotiate a lower premium with his insurance provider, bringing his annual insurance cost down to $850.

Example 3: Older Driver with a Luxury Vehicle

Emily, a 60-year-old retiree, owns a luxury sedan. Given her age and the value of her vehicle, she opts for comprehensive coverage with a low deductible. By leveraging her excellent credit score and safe driving history, Emily secures an insurance policy with a premium of $1,500 annually.

Future Trends and Innovations in Florida Car Insurance

The car insurance industry in Florida is continually evolving, driven by technological advancements and changing consumer needs. Here are some future trends and innovations to watch for:

- Telematics and Usage-Based Insurance: Telematics technology, which tracks driving behavior and habits, is gaining traction in Florida. Usage-based insurance policies offer personalized premiums based on individual driving patterns, rewarding safe drivers with lower rates.

- Digital Transformation: Insurance providers are investing in digital platforms and mobile apps to enhance the customer experience. From policy management to claims processing, digital transformation is streamlining the insurance journey for Florida drivers.

- Advanced Risk Assessment: Insurers are leveraging data analytics and artificial intelligence to assess risk more accurately. This advanced risk assessment can lead to more precise pricing structures and tailored coverage options for Florida drivers.

Conclusion: Embracing a Secure Driving Future in Florida

Florida’s dynamic car insurance landscape requires drivers to stay informed and proactive. By understanding the key regulations, coverage options, and factors influencing rates, Florida drivers can make well-informed decisions to secure the best insurance coverage for their needs. As the industry continues to innovate, embracing technology and advanced risk assessment, Florida’s drivers can look forward to a future of enhanced protection and personalized insurance solutions.

What is the average cost of car insurance in Florida?

+

The average cost of car insurance in Florida varies depending on various factors such as age, driving record, vehicle type, and coverage limits. However, as of recent data, the average annual premium for car insurance in Florida is around $1,500.

Are there any discounts available for Florida car insurance policies?

+

Yes, Florida insurance providers offer a range of discounts to policyholders. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts. It’s worth inquiring with insurance providers to explore the available savings.

How can I lower my car insurance premiums in Florida?

+

To lower your car insurance premiums in Florida, consider the following strategies: shop around for quotes from multiple providers, maintain a clean driving record, improve your credit score, and explore discounts such as safe driver or multi-policy discounts. Additionally, opting for higher deductibles can reduce your premium costs.

What happens if I don’t have car insurance in Florida?

+

Driving without car insurance in Florida is illegal and can result in significant penalties. If caught, you may face fines, license suspension, and even vehicle impoundment. It’s crucial to maintain valid insurance coverage to comply with state laws and protect yourself financially in case of accidents.