Cash Value Of Life Insurance Policy

Life insurance is a vital financial tool that provides a safety net for individuals and their loved ones. Among the various types of life insurance policies, the cash value option offers unique benefits and opportunities. This article delves into the intricacies of cash value life insurance, exploring its advantages, how it works, and the factors that contribute to its overall cash value. By understanding the mechanics and potential of this policy, individuals can make informed decisions to secure their financial future.

Unveiling the Power of Cash Value Life Insurance

Cash value life insurance is a policy that not only provides traditional death benefits but also offers a savings component. This dual-purpose nature makes it an attractive option for those seeking both protection and the potential for financial growth. The cash value accumulates over time, providing policyholders with access to funds that can be used for various financial goals, such as retirement planning, funding education, or covering unexpected expenses.

How Cash Value Life Insurance Works

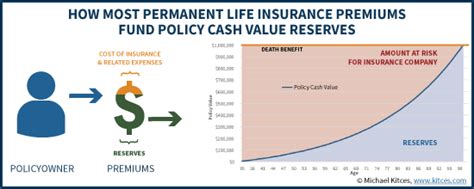

At its core, cash value life insurance operates by allocating a portion of the premium payments towards the death benefit and another portion towards building cash value. This cash value grows over time due to interest accrual and can be accessed through policy loans or withdrawals. The growth of the cash value is influenced by several factors, including the policy’s design, the insurer’s investment strategy, and the overall market conditions.

One of the key advantages of cash value life insurance is its flexibility. Policyholders can adjust their premium payments within certain limits, allowing for greater control over their financial strategy. Additionally, the cash value can be used as collateral for loans, providing a source of funds without the need to surrender the policy.

Factors Influencing Cash Value

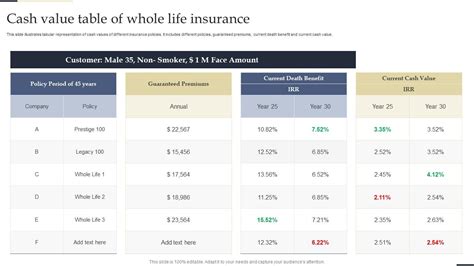

The growth of the cash value in a life insurance policy is influenced by several critical factors. Firstly, the type of policy plays a significant role. Whole life insurance policies typically offer a guaranteed cash value growth, while variable life insurance policies allow for higher potential growth but also carry more risk due to market fluctuations.

The premium payments and the timing of those payments also impact the cash value. Policyholders who consistently pay their premiums on time and maintain the policy over the long term are more likely to see substantial cash value accumulation. Additionally, the interest rate applied to the cash value can vary, with higher rates leading to faster growth.

| Policy Type | Average Cash Value Growth |

|---|---|

| Whole Life | 3-4% annually (guaranteed) |

| Variable Life | Varies based on market performance, potential for higher growth |

Furthermore, the policy's design and features can impact the cash value. For instance, some policies may offer accelerated benefit riders, which allow for early access to a portion of the death benefit in case of a critical illness or accident. These riders can impact the overall cash value and should be considered when evaluating a policy's potential.

Maximizing the Benefits of Cash Value

To make the most of a cash value life insurance policy, policyholders should carefully consider their financial goals and the policy’s terms. Here are some strategies to maximize the benefits:

- Maintain consistent premium payments to ensure steady cash value growth.

- Consider the policy's surrender value, which represents the cash value that can be accessed without penalty.

- Evaluate the policy's loan provisions and understand the implications of policy loans on the overall cash value and death benefit.

- Review the policy's investment options (if applicable) and consider the potential risks and rewards of different investment strategies.

- Stay informed about market conditions and consult with financial advisors to make informed decisions regarding policy adjustments.

The Future of Cash Value Life Insurance

As the financial landscape evolves, so too does the role of cash value life insurance. With increasing life expectancies and changing retirement needs, the flexibility and potential for growth offered by these policies become even more valuable. Insurers are continuously innovating, introducing new policy features and investment options to meet the diverse needs of policyholders.

Furthermore, the rise of technology and digital platforms has made it easier for policyholders to manage and monitor their cash value life insurance policies. Online portals and mobile apps provide real-time access to policy information, allowing individuals to stay informed and make timely decisions.

Looking ahead, the integration of artificial intelligence and machine learning in the insurance industry is expected to further enhance the efficiency and accuracy of cash value calculations. These advancements will empower policyholders with more precise projections and insights into their policy's performance.

Potential Future Trends

- Increased focus on personalized policy options to cater to individual financial goals.

- Development of innovative riders and benefits to address specific needs, such as long-term care or disability coverage.

- Enhanced digital tools for policy management and real-time monitoring.

- Integration of sustainable and ethical investment options within cash value policies.

- Collaborative efforts between insurers and fintech companies to offer more seamless and intuitive policy experiences.

Conclusion

Cash value life insurance policies offer a unique blend of financial protection and savings potential. By understanding the factors that influence cash value growth and adopting strategic approaches to policy management, individuals can harness the full power of these policies. As the financial landscape continues to evolve, cash value life insurance remains a resilient and adaptable tool for securing financial stability and achieving long-term goals.

How does the cash value in a life insurance policy grow over time?

+The cash value in a life insurance policy grows through a combination of factors, including interest accrual, premium payments, and the insurer’s investment strategy. Whole life policies typically offer a guaranteed cash value growth, while variable life policies provide the potential for higher growth but also carry market-related risks.

Can I access the cash value in my life insurance policy without surrendering it?

+Yes, many life insurance policies allow policyholders to access the cash value through policy loans or withdrawals. This provides flexibility and a source of funds without the need to surrender the policy.

What are the tax implications of accessing the cash value in a life insurance policy?

+The tax implications can vary depending on the method of accessing the cash value. Policy loans are typically not taxable as long as the policy remains in force. Withdrawals, on the other hand, may be taxable, and policyholders should consult with tax professionals to understand the specific implications.