Where Can I Buy Medical Insurance

Navigating the World of Medical Insurance: A Comprehensive Guide

Finding the right medical insurance is a crucial step towards ensuring your health and financial well-being. With a wide range of options available, it's important to understand where to begin your search and how to make informed decisions. In this comprehensive guide, we will explore the various avenues to purchase medical insurance, providing you with the knowledge to navigate this essential aspect of healthcare coverage.

Understanding Your Options: The Different Channels for Purchasing Medical Insurance

The healthcare industry has evolved, offering multiple avenues to acquire medical insurance policies. Let's delve into these options, exploring the benefits and considerations of each.

1. Direct Purchase from Insurance Carriers

One of the most traditional methods of obtaining medical insurance is by directly approaching insurance carriers. These carriers, also known as insurance companies, offer a variety of plans tailored to individual needs. You can visit their official websites, where comprehensive information about their policies, coverage details, and pricing is readily available. This approach allows for a direct and personalized interaction with the insurer, enabling you to ask questions and seek clarifications.

Key Considerations:

- Plan Flexibility: Insurance carriers often provide a wide range of plan options, allowing you to choose the one that best fits your health needs and budget.

- Expert Guidance: Representatives from insurance carriers can offer professional advice, helping you understand the nuances of different policies.

- Transparency: By dealing directly with the carrier, you have access to detailed information about the policy, ensuring a transparent transaction.

2. Online Insurance Marketplaces

The digital age has brought forth a new era of convenience in purchasing medical insurance. Online insurance marketplaces, often government-backed, provide a centralized platform where multiple insurance carriers showcase their plans. These marketplaces, such as Healthcare.gov in the United States, offer a user-friendly interface, allowing individuals to compare policies, assess their eligibility for subsidies, and enroll in a plan that suits their requirements.

Benefits of Online Marketplaces:

- Comparison Tools: Marketplaces provide sophisticated comparison tools, making it easier to evaluate and contrast different insurance plans.

- Subsidy Eligibility: These platforms often assess your income and family size, determining if you qualify for subsidies or tax credits to reduce your insurance costs.

- Convenience: Accessible from the comfort of your home, online marketplaces eliminate the need for physical visits to insurance offices.

3. Brokerage Firms and Agents

Brokerage firms and independent insurance agents serve as intermediaries between insurance carriers and consumers. These professionals have extensive knowledge of the insurance industry and can provide personalized recommendations based on your specific needs. They often have access to a wide range of insurance carriers, allowing them to present a diverse set of options.

Advantages of Brokerage Firms and Agents:

- Expertise: Brokers and agents are well-versed in the intricacies of insurance policies, ensuring you receive accurate and reliable advice.

- Personalized Service: They work closely with you, understanding your unique circumstances, and providing tailored recommendations.

- Negotiation: Brokers may negotiate with insurance carriers on your behalf, potentially securing better rates or additional benefits.

4. Employer-Sponsored Group Plans

If you are employed, your workplace may offer medical insurance as part of your benefits package. Employer-sponsored group plans often provide cost-effective coverage, as the employer typically contributes a significant portion of the premium. These plans are convenient, as the enrollment process is streamlined, and you may not need to undergo extensive medical underwriting.

Considerations for Group Plans:

- Cost Savings: Group plans often have lower premiums compared to individual policies.

- Convenience: Enrollment is often simplified, with the employer guiding you through the process.

- Limited Choice: While cost-effective, group plans may offer fewer options compared to individual plans.

5. State-Specific High-Risk Pools

Some states in the United States operate high-risk pools, which are insurance programs designed to provide coverage for individuals with pre-existing medical conditions who may have difficulty obtaining affordable coverage through traditional means. These pools aim to ensure that everyone has access to healthcare, regardless of their health status.

Key Points about High-Risk Pools:

- Eligibility: Individuals with pre-existing conditions who are unable to secure coverage elsewhere may be eligible for these pools.

- Cost: Premiums in high-risk pools are often higher than traditional insurance plans.

- State-Specific: These programs vary by state, so it's important to research the options available in your state.

Assessing Your Needs and Making an Informed Decision

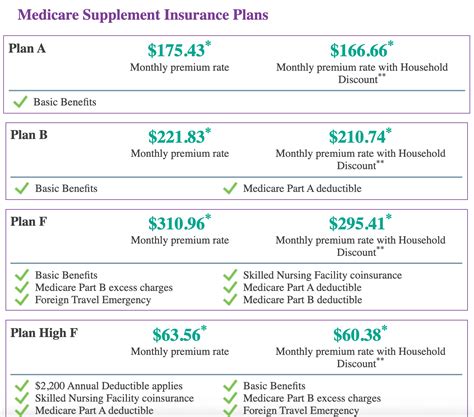

When considering where to purchase medical insurance, it's crucial to evaluate your unique circumstances and requirements. Factors such as your health status, age, income, and family situation can significantly influence the type of insurance plan that suits you best. Here's a concise breakdown to help guide your decision-making process:

| Considerations | Key Factors |

|---|---|

| Health Status | If you have pre-existing conditions, consider plans with comprehensive coverage and explore state-specific high-risk pools. |

| Age | Young adults may opt for basic plans with lower premiums, while older individuals might prioritize plans with extensive coverage. |

| Income | Evaluate your budget and explore options for subsidies or tax credits to make insurance more affordable. |

| Family Size | Family plans often provide better value, ensuring comprehensive coverage for all family members. |

Additionally, it's important to research and compare different insurance carriers and their policies. Look for reviews and ratings to ensure you're choosing a reputable and reliable provider. Don't hesitate to seek professional advice from insurance brokers or agents who can offer personalized guidance based on your specific needs.

Conclusion: Empowering Your Healthcare Journey

Navigating the world of medical insurance can be complex, but with the right knowledge and resources, you can make informed decisions to protect your health and financial well-being. Whether you choose to purchase insurance directly from carriers, explore online marketplaces, engage brokerage firms, or utilize employer-sponsored plans, the key lies in understanding your options and tailoring your choice to your unique circumstances. Remember, healthcare coverage is an essential aspect of your overall financial planning, and with the right approach, you can ensure a healthier and more secure future.

What is the best option for me if I have a pre-existing medical condition?

+If you have a pre-existing medical condition, it’s important to explore state-specific high-risk pools or consider purchasing insurance through an online marketplace, where you may be eligible for subsidies or special enrollment periods.

Are there any tax benefits associated with medical insurance?

+Yes, depending on your income and family size, you may qualify for tax credits or subsidies to reduce the cost of your insurance premiums. It’s advisable to consult a tax professional or utilize online tools to assess your eligibility.

Can I switch my medical insurance plan mid-year?

+Switching insurance plans mid-year is typically possible only during open enrollment periods or if you experience a qualifying life event, such as marriage, birth of a child, or loss of other coverage. It’s important to understand the rules and guidelines for your specific plan.