Boat Insurance Near Me

Boat insurance is an essential consideration for boat owners and enthusiasts, providing peace of mind and financial protection against various risks and potential losses. Whether you own a yacht, a powerboat, or a small recreational vessel, having the right insurance coverage is crucial. This article aims to guide you through the process of finding suitable boat insurance near you, covering the key aspects to consider and offering expert insights to ensure you make an informed decision.

Understanding Your Boat Insurance Needs

Before diving into the search for boat insurance, it's important to assess your specific needs and requirements. Boat insurance policies can vary greatly, and understanding your unique circumstances is the first step toward finding the right coverage. Consider the following factors:

Boat Type and Size

Different types of boats, such as sailboats, motorboats, or personal watercraft, may have distinct insurance needs. Additionally, the size of your boat plays a significant role in determining the scope and cost of your insurance policy. Larger boats often require more comprehensive coverage due to their higher replacement and repair costs.

Usage and Location

How and where you use your boat can influence the type of insurance you need. For instance, if you frequently travel long distances or navigate through rough waters, you may require additional coverage for emergency assistance or towing services. Moreover, the location where you primarily operate your boat can impact the risk factors and, consequently, the insurance premiums.

Value and Replacement Cost

Assessing the actual cash value and replacement cost of your boat is crucial. This information helps determine the appropriate coverage limits and ensures that your boat is adequately insured. It's important to regularly review and update your boat's value, especially after significant upgrades or modifications.

Liability and Legal Requirements

Boat owners should be aware of the liability risks associated with boating. Insurance policies typically include liability coverage, which protects you in case of accidents or injuries caused to others. Understanding the legal requirements and limits in your region is essential to ensure you meet the necessary standards.

Personal Preferences and Additional Coverage

Consider your personal preferences and the specific coverage you desire. Some boat owners may prioritize comprehensive coverage, including protection against theft, vandalism, or natural disasters. Others might opt for more tailored policies that cover specific risks, such as racing or commercial activities.

Researching Boat Insurance Providers

Once you have a clear understanding of your insurance needs, it's time to explore the available options in your area. Here are some steps to help you research and compare boat insurance providers effectively:

Online Research and Reviews

Start by conducting online research to identify reputable boat insurance companies operating in your region. Look for companies that specialize in marine insurance and have a strong track record of providing reliable coverage. Read reviews and testimonials from other boat owners to gain insights into their experiences and the level of service provided.

Local Brokers and Agents

Engaging with local insurance brokers or agents can be highly beneficial. These professionals have in-depth knowledge of the local market and can offer personalized advice based on your specific needs. They can also provide valuable insights into the reputation and reliability of different insurance providers.

Comparing Policies and Quotes

Obtain multiple quotes from different insurance providers to compare coverage options and premiums. Ensure that you're comparing policies with similar coverage limits and deductibles to make an accurate assessment. Pay attention to the exclusions and limitations outlined in each policy to understand the potential gaps in coverage.

Customized Coverage Options

Inquire about customized coverage options that align with your specific needs. Many insurance providers offer flexible policies that can be tailored to include additional coverage for specialized equipment, personal belongings, or unique boating activities. Ensure that the policy provides adequate protection for your boat's unique features and your intended usage.

Claims Process and Customer Service

Research the claims process and customer service reputation of each insurance provider. A smooth and efficient claims process is essential when you need to make a claim. Look for providers with a proven track record of prompt and fair claim settlements. Additionally, consider the availability and accessibility of customer support, especially during emergencies.

Assessing the Fine Print and Policy Details

When comparing boat insurance policies, it's crucial to carefully review the fine print and understand the policy details. Here's what to look for:

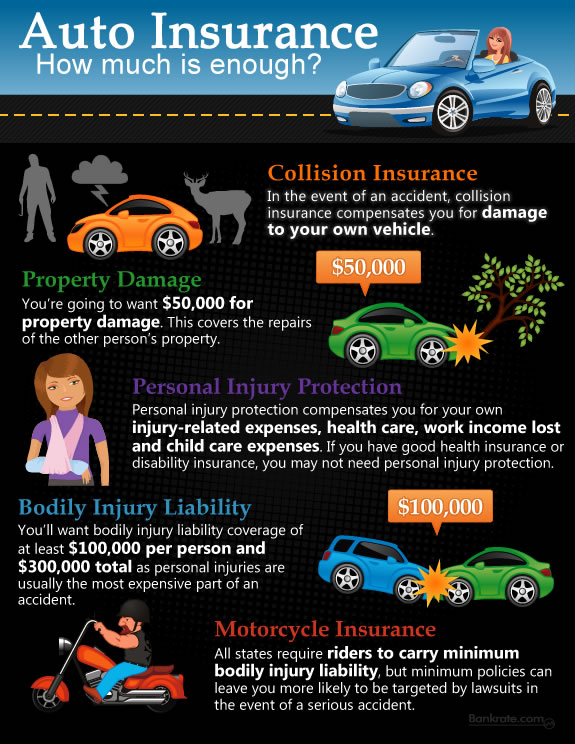

Coverage Limits and Deductibles

Examine the coverage limits for different aspects of your policy, including property damage, bodily injury, and personal property. Ensure that the limits align with your boat's value and the potential risks you may encounter. Additionally, consider the deductibles, as higher deductibles can result in lower premiums but may require a larger out-of-pocket expense in the event of a claim.

Policy Exclusions and Limitations

Carefully review the exclusions and limitations outlined in the policy. Common exclusions may include damage caused by wear and tear, mechanical breakdowns, or certain types of natural disasters. Understanding these exclusions is crucial to ensure you're not left with unexpected gaps in coverage.

Additional Benefits and Perks

Look for policies that offer additional benefits or perks beyond the standard coverage. These may include emergency assistance services, rental coverage for temporary replacements, or coverage for personal belongings on board. Such benefits can provide added convenience and protection during unforeseen circumstances.

Renewal and Cancellation Terms

Review the renewal and cancellation terms to understand the process and potential fees involved. Some policies may have automatic renewal clauses, while others may require a notice period for cancellation. It's important to be aware of these terms to avoid any surprises or unnecessary expenses when managing your insurance coverage.

Obtaining and Managing Your Boat Insurance Policy

Once you've selected the most suitable boat insurance provider and policy, it's time to obtain and manage your coverage effectively:

Secure Your Policy and Make Payments

Complete the necessary paperwork and provide accurate information to obtain your boat insurance policy. Make timely payments to ensure uninterrupted coverage. Many insurance providers offer convenient payment options, including online portals or automatic payments, to simplify the process.

Keep Your Policy Up-to-Date

Regularly review and update your policy to reflect any changes in your boat's value, usage, or location. Inform your insurance provider about significant upgrades, modifications, or changes in your boating activities to ensure your coverage remains adequate. Failure to do so may result in gaps in coverage or unexpected costs.

Understand Your Coverage and Exclusions

Familiarize yourself with the coverage and exclusions outlined in your policy. Understand the specific circumstances and scenarios where your insurance provider will provide coverage and those where it may not. This knowledge will help you make informed decisions and avoid potential pitfalls.

Utilize Policy Benefits and Services

Take advantage of the benefits and services offered by your insurance provider. For instance, if your policy includes emergency assistance, know how to access these services quickly and efficiently. Similarly, if you have rental coverage, understand the process for obtaining temporary replacements during repairs or maintenance.

Stay Informed and Educated

Stay updated on boating regulations, safety guidelines, and best practices in your region. Many insurance providers offer educational resources or workshops to help boat owners improve their boating skills and reduce the risk of accidents. By staying informed, you can not only enhance your boating experience but also potentially reduce insurance premiums.

Frequently Asked Questions (FAQ)

What is the average cost of boat insurance?

+

The average cost of boat insurance can vary significantly depending on factors such as the type and size of your boat, your location, and the coverage limits you choose. Generally, policies can range from a few hundred to several thousand dollars annually. It’s essential to obtain quotes from multiple providers to find the best coverage at a competitive price.

How often should I review my boat insurance policy?

+

It’s recommended to review your boat insurance policy annually or whenever there are significant changes to your boat, usage, or location. Regular reviews ensure that your coverage remains adequate and up-to-date, allowing you to make necessary adjustments as your needs evolve.

Can I bundle my boat insurance with other policies for discounts?

+

Yes, many insurance providers offer the option to bundle your boat insurance with other policies, such as homeowners or auto insurance, to potentially save on premiums. Bundling can provide additional convenience and cost-effectiveness, especially if you already have existing policies with the same provider.

What should I do if I need to make a claim on my boat insurance policy?

+

In the event of a claim, contact your insurance provider as soon as possible and provide them with all the necessary details and documentation. Follow their instructions and cooperate fully during the claims process. Keep a record of all communications and be prepared to provide additional information or evidence as requested.

Are there any discounts available for boat insurance policies?

+

Yes, several discounts may be available for boat insurance policies. These can include discounts for experienced boat owners, safe boating courses, multiple policy bundles, and even loyalty discounts for long-term customers. It’s worth inquiring with your insurance provider to see if you qualify for any of these discounts.