Affordable House Insurance

In today's economic landscape, ensuring the protection of your most valuable asset, your home, is paramount. Affordable house insurance offers a critical safeguard, providing peace of mind and financial security against unforeseen circumstances. This article delves into the intricacies of obtaining affordable home insurance, exploring the factors that influence premiums, the various coverage options available, and strategies to secure the best value for your insurance dollar.

Understanding the Landscape of Affordable House Insurance

The concept of affordable house insurance is a multifaceted one, encompassing a range of variables that influence the cost and coverage of your policy. From the geographical location of your home to the construction materials used, every detail plays a role in determining the price and scope of your insurance plan.

Location, Location, Location: The Impact of Geography

One of the most significant factors affecting the cost of house insurance is the location of your home. Insurers consider a variety of geographical elements when assessing risk, including crime rates, proximity to natural disaster-prone areas, and even the local economy. For instance, a home located in an area with a high incidence of burglaries or natural disasters like hurricanes or earthquakes may face higher insurance premiums.

Consider the case of John, a homeowner in a coastal region prone to hurricanes. Despite his home's resilience against these storms, his insurance premiums remain high due to the inherent risk associated with the area. On the other hand, Mary, a homeowner in a low-crime, inland area, enjoys lower premiums due to the reduced risk profile of her location.

Construction and Maintenance: The Key to Lower Premiums

The materials used in the construction of your home and the overall condition of the property are crucial factors in determining insurance affordability. Insurers favor homes built with durable materials and those that have been well-maintained over time. For instance, a home constructed with brick or stone may be viewed as less risky than one built primarily with wood, given the former’s greater resistance to fire and other hazards.

Additionally, regular maintenance and updates can significantly impact your insurance costs. Keeping your home in good repair, with updated electrical and plumbing systems, for example, can reduce the likelihood of costly claims and, consequently, lower your insurance premiums. It's a win-win situation, as you not only enhance the safety and value of your home but also potentially reduce your insurance expenses.

The Coverage Conundrum: Finding the Right Balance

Choosing the right coverage for your home is a delicate balance between comprehensive protection and affordability. While it’s tempting to opt for the most extensive coverage available, it’s important to tailor your policy to your specific needs and budget. Over-insuring can lead to unnecessary expenses, while under-insuring may leave you vulnerable in the event of a claim.

When selecting coverage, consider the unique aspects of your home and your personal financial situation. For instance, if you live in an area prone to flooding, you may want to prioritize flood insurance as part of your overall coverage. On the other hand, if your home is in a safe, low-risk area, you might be able to opt for a more basic policy with a higher deductible, saving you money on premiums.

Strategies for Securing Affordable House Insurance

Navigating the complex world of house insurance can be challenging, but with the right strategies, you can secure an affordable and comprehensive policy. Here are some expert tips to guide you on your journey to finding the best house insurance for your needs.

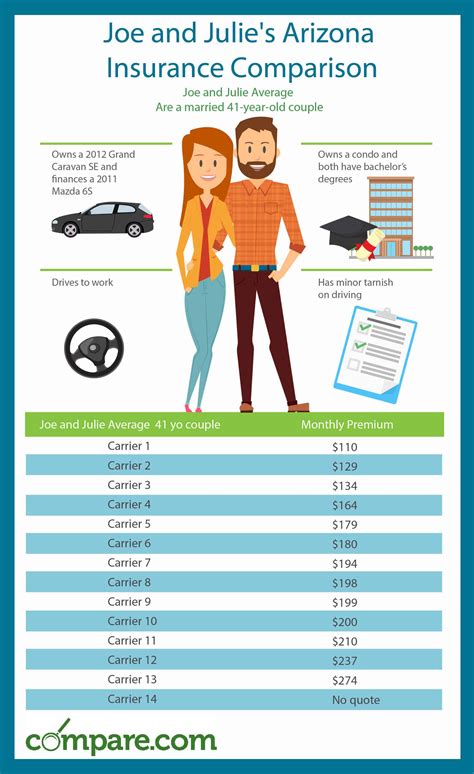

Shop Around and Compare

The insurance market is vast and competitive, with numerous providers offering a range of policies. It’s crucial to shop around and compare quotes from different insurers to find the best deal. Online comparison tools can be a valuable resource, allowing you to quickly and easily assess a variety of options.

When comparing quotes, pay attention to the fine print. Ensure you're comparing policies with similar coverage levels to make an accurate assessment of the best value. Don't be afraid to negotiate with insurers; many are willing to offer discounts or customize policies to meet your specific needs.

Leverage Discounts and Bundles

Insurance providers often offer a variety of discounts and bundle options that can significantly reduce your premiums. Some common discounts include multi-policy discounts (when you bundle your home and auto insurance with the same provider), loyalty discounts for long-term customers, and safety discounts for homes equipped with security systems or fire prevention measures.

Bundling your insurance policies can be a smart strategy to save money. By combining your home and auto insurance, for example, you may be eligible for a substantial discount. Additionally, some insurers offer discounts for certain professions or memberships, so it's worth exploring these options to see if you qualify.

Improve Your Home’s Safety and Security

Investing in your home’s safety and security not only protects your property but can also lead to substantial savings on your insurance premiums. Insurers often offer discounts for homes equipped with certain safety features, such as fire alarms, sprinkler systems, and burglar alarms.

Upgrading your home's security can be a cost-effective way to reduce your insurance costs. For instance, installing a monitored security system can not only deter potential intruders but also qualify you for insurance discounts. Similarly, ensuring your home is well-maintained and up-to-date with the latest safety standards can enhance your home's resilience against various hazards, thereby reducing your insurance risks.

The Importance of Regular Policy Reviews

House insurance is not a one-time purchase; it’s an ongoing commitment that requires regular reviews and adjustments to ensure you’re always getting the best value. As your home and personal circumstances change, so too should your insurance policy.

Life Changes and Insurance Updates

Major life events, such as marriage, the birth of a child, or retirement, can significantly impact your insurance needs. It’s crucial to review your policy whenever you experience a significant life change to ensure your coverage remains adequate and up-to-date. For instance, the birth of a child may prompt you to increase your liability coverage to protect against potential accidents or injuries on your property.

Similarly, as you age and your financial situation changes, you may want to adjust your coverage to reflect your new circumstances. Retirement, for example, may lead you to downsize your home, in which case you'd want to adjust your insurance coverage accordingly. Regular policy reviews ensure that you're never over-insured or under-insured, providing the peace of mind that comes with having the right coverage at the right price.

Stay Informed About Market Changes

The insurance market is dynamic, with premiums and coverage options constantly evolving. It’s essential to stay informed about market trends and changes that could impact your policy. Regularly reviewing industry news and keeping up with insurance-related publications can help you stay ahead of the curve and make informed decisions about your coverage.

Being proactive about market changes can also lead to significant savings. For instance, if you become aware of a new discount or incentive offered by your insurer, you can quickly take advantage of it to reduce your premiums. Similarly, if market conditions change and certain coverage options become more affordable, you can adjust your policy to take advantage of these new opportunities.

Conclusion: Navigating the Affordable House Insurance Landscape

Affordable house insurance is a critical investment for any homeowner, offering financial protection and peace of mind. By understanding the factors that influence insurance premiums, such as location and construction, and adopting strategic approaches to coverage and policy management, you can secure an affordable and comprehensive insurance plan.

Remember, the key to finding affordable house insurance is to stay informed, shop around, and tailor your coverage to your unique needs. Regular policy reviews and a proactive approach to managing your insurance can help you stay ahead of the curve, ensuring you always have the right coverage at the right price. With the right strategy and a bit of research, affordable house insurance is within reach for every homeowner.

How often should I review my house insurance policy?

+It’s recommended to review your house insurance policy at least once a year, or whenever you experience a significant life change that may impact your coverage needs. Regular reviews ensure your policy remains up-to-date and provides the right level of protection for your home and personal circumstances.

Can I negotiate my house insurance premiums?

+Absolutely! Many insurance providers are open to negotiation, especially if you’re a loyal customer or if you bundle multiple policies with them. Don’t hesitate to discuss your options and negotiate the best deal for your insurance needs.

What are some common discounts available for house insurance?

+Common discounts for house insurance include multi-policy discounts, loyalty discounts, safety discounts (for homes with security systems or fire prevention measures), and profession or membership discounts. It’s worth exploring these options to see if you qualify for any savings.