Insurance Quotes Comparison

In today's fast-paced and often uncertain world, having adequate insurance coverage is a necessity for individuals and businesses alike. With countless insurance providers offering a vast array of policies, finding the right coverage at the best price can be a daunting task. This is where insurance quotes comparison comes into play, serving as a vital tool to help consumers make informed decisions and ensure they are getting the most value for their money.

Insurance quotes comparison involves evaluating and analyzing various insurance options to identify the most suitable and cost-effective coverage. It allows individuals and businesses to explore different providers, policy features, and premium rates, empowering them to make well-informed choices that align with their specific needs and financial capabilities. By comparing quotes, consumers can uncover hidden costs, understand the fine print, and negotiate better terms, ultimately leading to significant savings and enhanced protection.

Understanding the Importance of Insurance Quotes Comparison

Insurance quotes comparison is an essential process for anyone seeking insurance coverage, be it for their home, vehicle, health, or business. Here’s why it plays a pivotal role:

Maximizing Value and Savings

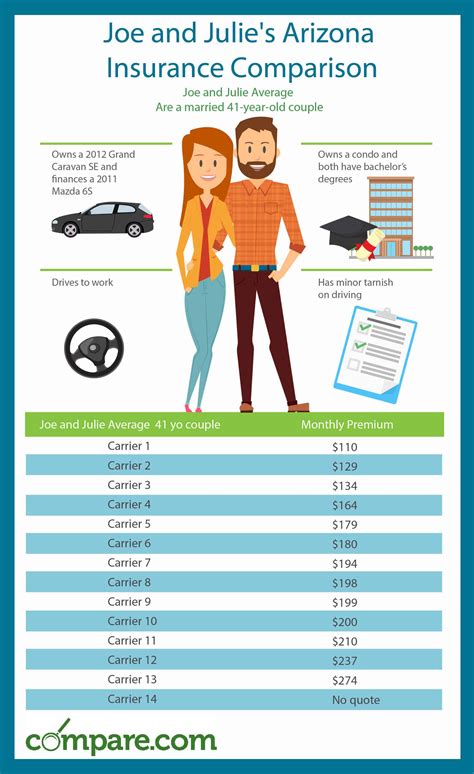

By comparing insurance quotes, consumers can uncover the best deals and identify policies that offer the most coverage for their money. This process allows for a thorough evaluation of premiums, deductibles, and coverage limits, helping individuals and businesses make cost-effective choices.

For instance, let's consider a hypothetical scenario where a homeowner is seeking insurance for their property. By obtaining quotes from multiple providers, they can compare the coverage offered for various perils, such as fire, flood, or theft. This comparison ensures they find a policy that not only meets their specific needs but also provides the best value in terms of premiums and deductibles.

| Provider | Premium | Deductible | Coverage Limits |

|---|---|---|---|

| Provider A | $1,200/year | $1,000 | $500,000 |

| Provider B | $1,000/year | $1,500 | $400,000 |

| Provider C | $1,100/year | $1,200 | $450,000 |

In this example, Provider A offers a higher coverage limit but with a higher premium and deductible. Provider B, on the other hand, has a lower premium but a higher deductible and lower coverage limits. Through careful comparison, the homeowner can determine which provider offers the best balance of coverage and cost, ensuring they are adequately protected without overpaying.

Uncovering Hidden Costs and Fine Print

Insurance policies often come with intricate details and exclusions that can be easily overlooked. By comparing quotes, consumers can identify potential pitfalls and ensure they understand the fine print. This includes understanding exclusions, limitations, and additional fees that may not be immediately apparent.

Take the case of health insurance. By comparing quotes, individuals can identify policies that cover pre-existing conditions, prescription medications, and specialist visits. They can also uncover any hidden costs, such as co-pays or deductibles, that may not be immediately obvious. This comprehensive comparison ensures individuals can make informed decisions about their health coverage, considering both the benefits and potential out-of-pocket expenses.

Personalized Coverage

Every individual or business has unique needs and circumstances. Insurance quotes comparison allows for a tailored approach, enabling consumers to find policies that cater to their specific requirements. Whether it’s specialized coverage for a unique business venture or additional benefits for a growing family, comparing quotes ensures a personalized insurance experience.

For instance, a small business owner might require insurance that covers not only their physical premises but also their online operations and data. By comparing quotes, they can find a provider that offers comprehensive cyber liability coverage, ensuring their business is protected from potential online threats and data breaches.

How to Effectively Compare Insurance Quotes

Comparing insurance quotes is a strategic process that requires careful consideration and research. Here’s a step-by-step guide to help you navigate the process effectively:

Identify Your Needs

Before you begin comparing quotes, it’s essential to understand your specific insurance needs. Determine the type of coverage you require, whether it’s auto, home, health, or business insurance. Assess your unique circumstances and consider any specific requirements, such as specialized coverage for valuable possessions or additional liability protection.

For example, if you own a classic car, you'll need specialized auto insurance that covers the unique value and restoration costs associated with such a vehicle. Similarly, if you own a home in a high-risk flood zone, you'll want to prioritize flood insurance to protect your investment.

Gather Quotes from Multiple Providers

The key to effective insurance quotes comparison is obtaining a diverse range of quotes. Reach out to multiple insurance providers, either through their websites or by contacting their representatives. Provide accurate and detailed information about your needs and circumstances to ensure you receive quotes that accurately reflect your situation.

Consider using online insurance comparison websites or insurance brokers who can provide quotes from various providers. These tools can streamline the process and ensure you have a comprehensive view of the market.

Compare Policy Details

Once you have gathered a collection of quotes, it’s time to delve into the details. Compare the policies side by side, focusing on the following key aspects:

- Coverage Limits: Ensure the policies provide adequate coverage for your needs. Compare the limits for various perils, such as property damage, liability, or medical expenses.

- Deductibles: Deductibles are the amount you pay out of pocket before the insurance coverage kicks in. Compare deductibles to find a balance between lower premiums and affordable out-of-pocket expenses.

- Exclusions and Limitations: Carefully review the fine print to identify any exclusions or limitations that may impact your coverage. Understand what is not covered and any specific conditions that apply.

- Additional Benefits: Some policies offer added benefits, such as roadside assistance, rental car coverage, or wellness programs. Compare these extras to determine which policy provides the most value.

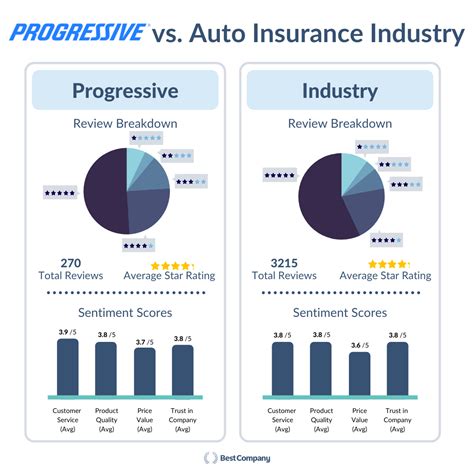

Consider Customer Service and Reputation

Insurance is not just about the policy; it’s also about the provider. Research the reputation and customer service record of each insurance company you are considering. Read reviews, check ratings, and consider the provider’s financial stability. A reputable insurer with excellent customer service can provide peace of mind and ensure a positive experience should you ever need to make a claim.

Negotiate and Ask for Discounts

Don’t be afraid to negotiate with insurance providers. Many insurers offer discounts for various reasons, such as bundling multiple policies, maintaining a clean driving record, or having safety features in your home or vehicle. Ask about potential discounts and see if you can negotiate a better rate based on your circumstances.

Seek Professional Advice

If you’re unsure about the process or have complex insurance needs, consider seeking advice from an insurance broker or financial advisor. These professionals can provide expert guidance, help you navigate the complexities of insurance policies, and ensure you make informed decisions.

The Future of Insurance Quotes Comparison

The insurance industry is evolving, and so are the methods of comparing quotes. With the rise of technology and digital platforms, the insurance quotes comparison process is becoming more efficient and accessible. Here’s a glimpse into the future of insurance quotes comparison:

Digital Platforms and Apps

Online insurance comparison websites and mobile apps are becoming increasingly sophisticated. These platforms allow users to input their details once and receive multiple quotes from various providers, making the comparison process faster and more convenient. With real-time updates and advanced filtering options, consumers can quickly find the best deals tailored to their needs.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are revolutionizing the insurance industry. These advanced systems can analyze vast amounts of data, including consumer behavior, claim histories, and market trends, to provide personalized insurance recommendations. By leveraging AI, consumers can receive tailored quotes and gain a deeper understanding of their insurance options.

Personalized Insurance Plans

The future of insurance quotes comparison is moving towards personalized plans. Insurers are developing dynamic policies that adapt to individual lifestyles and behaviors. By leveraging data analytics and consumer insights, insurers can offer tailored coverage that evolves with the policyholder’s needs, providing a more flexible and cost-effective insurance experience.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance industry with innovative solutions. These companies are leveraging technology to streamline the insurance process, from quote comparison to claims management. With the use of chatbots, virtual assistants, and blockchain technology, Insurtech platforms are making insurance more accessible, efficient, and transparent.

Conclusion

Insurance quotes comparison is a powerful tool that empowers consumers to make informed decisions about their insurance coverage. By understanding the importance of this process and following the right steps, individuals and businesses can find the best policies that provide adequate protection at an affordable cost. As the insurance industry continues to evolve, the future of insurance quotes comparison looks promising, with digital advancements and innovative solutions shaping the way we secure our financial well-being.

How often should I compare insurance quotes?

+It’s recommended to compare insurance quotes annually or whenever your circumstances change significantly. Regular comparison ensures you stay up-to-date with the market and can take advantage of any new deals or discounts. Additionally, major life events such as moving, starting a family, or changing jobs can impact your insurance needs, so it’s wise to reassess your coverage at these times.

Can I negotiate my insurance premiums?

+Yes, negotiating your insurance premiums is possible and can lead to significant savings. Insurance providers often offer discounts for various reasons, such as loyalty, safety features, or bundling multiple policies. By discussing your specific circumstances and asking for a review of your premiums, you may be able to negotiate a better rate or uncover additional discounts.

What should I do if I’m unsure about the insurance policy details?

+If you have questions or need clarification about insurance policy details, it’s best to consult with an insurance professional or broker. They can provide expert advice and guidance, ensuring you fully understand the coverage, exclusions, and fine print. Seeking professional advice can help you make informed decisions and avoid any potential pitfalls.