Car Insurance Average Cost

Understanding the average cost of car insurance is essential for any vehicle owner. With numerous factors influencing insurance premiums, it's crucial to delve into the specifics to navigate the complex world of automotive insurance effectively. This comprehensive guide aims to provide an in-depth analysis, offering valuable insights and strategies to help you make informed decisions when it comes to car insurance.

Unveiling the Average Cost of Car Insurance

The average cost of car insurance in the United States varies significantly, influenced by a multitude of factors. As of [Most Recent Data], the average annual premium for a standard auto insurance policy stood at approximately $1,674. However, this figure is just an average, and the true cost can range widely, often dependent on your unique circumstances and the specific coverage you require.

Breaking down the average cost further, we find that the median premium is slightly lower, at around $1,592 annually. This median value suggests that half of all insured drivers pay less than this amount, while the other half pay more. It's important to note that these averages are calculated based on a standard policy, which typically includes liability coverage, collision coverage, and comprehensive coverage. Additional coverages or specific endorsements can further influence the cost of your insurance.

| Type of Coverage | Average Premium |

|---|---|

| Liability Only | $500 - $1,000 annually |

| Standard Policy (Liability, Collision, Comprehensive) | $1,500 - $2,000 annually |

| Full Coverage (Additional Endorsements) | $2,500 - $3,500 annually |

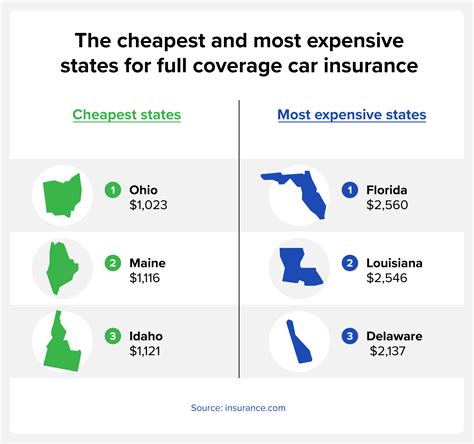

When examining car insurance costs, it's essential to consider the regional variations. Insurance rates can differ significantly across states due to factors such as traffic density, accident rates, and local laws. For instance, the average annual premium in California is approximately $1,430, while in Michigan, it can reach as high as $2,645. These disparities highlight the importance of understanding the specific insurance landscape in your state.

Factors Influencing Car Insurance Premiums

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. These factors can be broadly categorized into personal, vehicle-related, and regional factors. Let’s explore each category in detail.

Personal Factors

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance premiums due to their perceived higher risk of accidents. Gender can also be a factor, with some insurers charging slightly higher rates for male drivers.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance costs. Conversely, a history of accidents or moving violations may result in higher premiums.

- Credit Score: Surprisingly, your credit score can impact your insurance premium. Insurers often use credit-based insurance scores to assess risk, with higher scores generally leading to lower premiums.

Vehicle-Related Factors

- Vehicle Type: The make, model, and age of your vehicle play a significant role. Sports cars and luxury vehicles, for instance, often carry higher insurance costs due to their increased risk of theft or higher repair costs.

- Vehicle Usage: How you use your vehicle can impact your insurance rates. If you drive fewer miles annually or primarily use your vehicle for pleasure rather than commuting, you may qualify for lower rates.

- Safety Features: Vehicles equipped with advanced safety features like lane departure warnings, adaptive cruise control, or automatic emergency braking may be eligible for insurance discounts.

Regional Factors

- State Laws: Each state has its own set of laws and regulations governing insurance, which can influence the cost. For example, states with no-fault insurance laws generally have higher premiums.

- Population Density: Areas with higher population density often have more congested roads and a higher risk of accidents, leading to increased insurance costs.

- Weather and Natural Disasters: Regions prone to severe weather conditions or natural disasters may face higher insurance rates due to the increased risk of damage or accidents.

Strategies to Lower Your Car Insurance Costs

While the average cost of car insurance may seem daunting, there are several strategies you can employ to potentially reduce your premiums. Here are some effective approaches to consider:

Shopping Around for the Best Deal

One of the most straightforward ways to potentially lower your insurance costs is by comparing quotes from multiple insurers. Each insurer uses its own proprietary formula to calculate premiums, and rates can vary significantly. By obtaining quotes from at least three to five insurers, you can identify the most competitive rates for your specific circumstances.

Utilizing Discounts

Insurers often offer a wide range of discounts to attract and retain customers. These discounts can significantly reduce your premium. Some common discounts include:

- Multi-Policy Discount: Insuring multiple vehicles or combining your auto insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings.

- Safe Driver Discount: Maintaining a clean driving record for a certain period, often three to five years, can qualify you for a safe driver discount.

- Good Student Discount: If you're a student under 25 with a good academic record, you may be eligible for a discount. This incentive encourages young drivers to focus on their studies and maintain safe driving habits.

- Loyalty Discount: Some insurers reward long-term customers with loyalty discounts, so staying with the same insurer for an extended period can pay off.

- Safety Features Discount: As mentioned earlier, vehicles equipped with advanced safety features may qualify for discounts. Be sure to inform your insurer about any such features in your vehicle.

Choosing the Right Coverage

Understanding your coverage needs and selecting the appropriate coverage limits can help you strike a balance between affordability and protection. While it’s important to have adequate coverage, overinsuring can lead to unnecessary expenses. Assess your financial situation and risk tolerance to determine the right coverage limits for liability, collision, and comprehensive coverage.

Improving Your Driving Habits

Your driving behavior can significantly impact your insurance rates. By adopting safer driving habits, you can potentially reduce the risk of accidents and violations, which in turn can lead to lower premiums. Here are some tips to consider:

- Avoid aggressive driving behaviors like speeding, sudden braking, or frequent lane changes.

- Stay focused on the road and avoid distractions like using your phone or eating while driving.

- Maintain a safe following distance to reduce the risk of rear-end collisions.

- Regularly check your vehicle's maintenance to ensure it's in optimal condition, reducing the likelihood of unexpected breakdowns.

The Future of Car Insurance: Technological Innovations and Their Impact

The insurance industry is undergoing significant transformations, driven by technological advancements and changing consumer behaviors. These changes are poised to impact the cost and availability of car insurance in the years to come. Let’s explore some of the key trends and their potential implications.

Telematics and Usage-Based Insurance

Telematics refers to the technology that allows insurers to track and analyze driving behavior in real-time. Usage-based insurance (UBI) programs leverage telematics data to offer personalized insurance rates based on an individual’s driving habits. These programs reward safe drivers with lower premiums and can provide a more accurate assessment of risk.

Connected Vehicles and Data Sharing

With the rise of connected vehicles, insurers now have access to an unprecedented amount of data. This data, which includes vehicle diagnostics, driving behavior, and even weather conditions, can be used to enhance risk assessment and potentially offer more tailored insurance products. However, concerns over data privacy and security remain, and insurers will need to navigate these challenges to maintain consumer trust.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the insurance industry by automating processes and improving accuracy. AI-powered systems can analyze vast amounts of data to identify patterns and trends, enabling insurers to make more informed decisions about risk assessment and pricing. ML algorithms can also improve fraud detection, further enhancing the efficiency of the insurance process.

Impact on Average Insurance Costs

While it’s difficult to predict the precise impact of these technological advancements on average insurance costs, they are likely to bring about significant changes. On the one hand, improved risk assessment and fraud detection could lead to more accurate pricing, potentially reducing costs for some policyholders. On the other hand, the increased use of technology and data sharing may also result in higher costs for insurers, which could be passed on to consumers.

As the insurance industry continues to evolve, it's crucial for consumers to stay informed about these changes and their potential implications. By understanding the factors that influence insurance costs and keeping abreast of emerging trends, you can make more informed decisions about your coverage and potentially benefit from the opportunities presented by technological advancements.

What is the average cost of car insurance for a young driver?

+The average cost of car insurance for a young driver can be significantly higher than for more experienced drivers. Factors such as age, gender, and driving history play a crucial role in determining premiums. On average, young drivers under 25 may pay upwards of $2,000 annually for insurance, with rates gradually decreasing as they gain more driving experience.

How can I lower my car insurance costs if I have a poor driving record?

+Improving your driving record is crucial to lowering your insurance costs. Start by avoiding any further accidents or violations. Additionally, consider taking a defensive driving course, which may qualify you for an insurance discount. Some insurers also offer programs that reward safe driving habits, so be sure to inquire about these options.

Are there any specific car models or makes that tend to have lower insurance costs?

+Certain car models and makes are known for their lower insurance costs due to factors like lower repair costs and lower theft rates. Compact cars and mid-size sedans often fall into this category. However, it’s important to note that insurance rates can vary significantly based on other factors, so it’s best to obtain quotes specific to your vehicle and circumstances.