Open Enrollment Health Insurance 2024

The annual Open Enrollment period for health insurance is a crucial time for individuals and families to evaluate their coverage options and make informed decisions about their healthcare plans for the upcoming year. This year, the Open Enrollment for 2024 is a significant opportunity to explore new possibilities and ensure access to quality healthcare. With the evolving healthcare landscape and changing insurance policies, understanding the process and available options is essential.

In this comprehensive guide, we will delve into the world of Open Enrollment for 2024, providing you with expert insights and a deep understanding of the key aspects. Whether you are a seasoned health insurance holder or new to the process, this article aims to empower you with the knowledge needed to navigate the Open Enrollment period successfully.

Understanding Open Enrollment: A Fundamental Overview

Open Enrollment is a designated period each year when individuals can enroll in a health insurance plan or make changes to their existing coverage without requiring a qualifying life event. This annual event is regulated by the Affordable Care Act (ACA) and is a crucial opportunity for individuals to assess their healthcare needs and ensure they have the right coverage to support their well-being.

During the Open Enrollment period, insurance companies offer a wide range of plans with varying levels of coverage, premiums, and deductibles. Individuals can compare these plans, assess their personal and family healthcare needs, and choose the most suitable option. It's important to note that failing to enroll during Open Enrollment typically means individuals will need to wait until the next period or qualify for a Special Enrollment Period due to specific life events.

The specific dates for Open Enrollment can vary by state and insurance marketplace. For the federal marketplace, Open Enrollment for 2024 will run from November 15, 2023, to December 15, 2023. However, some states operate their own marketplaces and may have different enrollment periods. It's crucial to check the specific dates for your state to ensure you don't miss the opportunity to enroll or make changes to your coverage.

Key Benefits of Open Enrollment

- Flexibility and Choice: Open Enrollment allows individuals to explore a variety of plans, providing flexibility to choose the one that best aligns with their healthcare needs and budget.

- Coverage Continuity: Enrolling during Open Enrollment ensures uninterrupted healthcare coverage, preventing gaps that could result in higher costs or limited access to care.

- Cost Savings: By comparing plans and selecting the most suitable option, individuals can potentially reduce their healthcare expenses and find more affordable coverage.

- Access to Comprehensive Care: Open Enrollment provides an opportunity to choose plans that offer a wide range of benefits, ensuring access to essential healthcare services and medications.

Navigating the Open Enrollment Process: A Step-by-Step Guide

To make the most of the Open Enrollment period, it’s essential to approach the process systematically. Here’s a step-by-step guide to help you navigate Open Enrollment for 2024 effectively:

Step 1: Assess Your Healthcare Needs

Start by evaluating your current and future healthcare needs. Consider factors such as your age, family size, chronic conditions, and regular medical expenses. Understanding your unique healthcare requirements is crucial for selecting the right plan.

Step 2: Research Available Plans

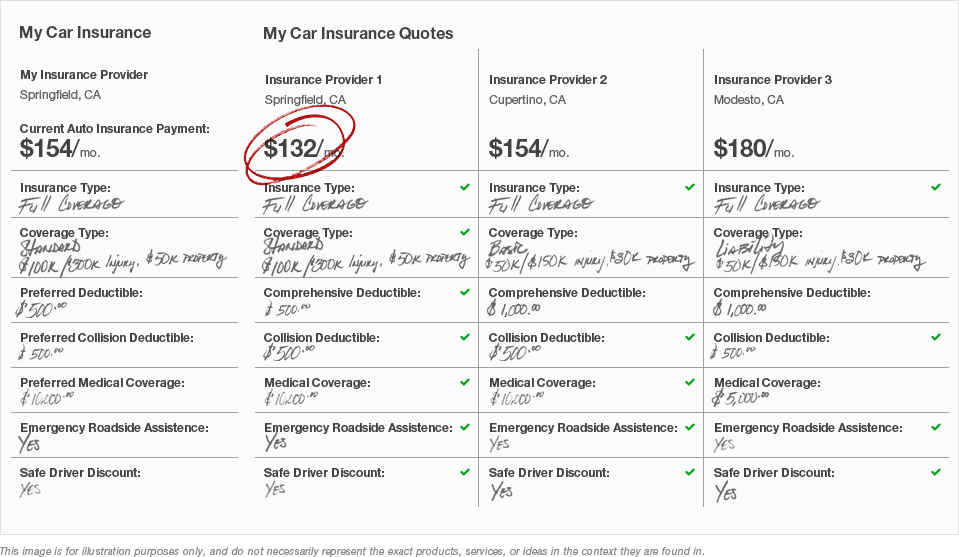

Explore the plans offered by different insurance providers. Compare the coverage, premiums, deductibles, and out-of-pocket costs. Consider the network of healthcare providers and facilities associated with each plan to ensure access to your preferred doctors and hospitals.

During your research, keep an eye out for plans that offer:

- Comprehensive Coverage: Look for plans that cover a wide range of services, including preventive care, specialist visits, and prescription medications.

- Cost-Effective Options: Compare premiums and deductibles to find plans that align with your budget while providing adequate coverage.

- Network Flexibility: Choose plans that offer a broad network of providers to ensure convenience and access to quality care.

Step 3: Evaluate Your Options

Once you have a list of potential plans, carefully evaluate each option. Consider the trade-offs between premiums, deductibles, and coverage. Assess the plan's benefits and limitations, and determine if it meets your specific healthcare needs.

Use online tools and resources provided by insurance marketplaces or government websites to help you compare plans side by side. These tools can simplify the evaluation process and make it easier to understand the differences between various options.

Step 4: Enroll or Make Changes

After assessing your needs and evaluating the available plans, it’s time to take action. If you’re enrolling for the first time, follow the steps provided by your chosen insurance marketplace or provider to complete the enrollment process.

If you already have a plan and want to make changes, review the specific rules and deadlines for your state or marketplace. Some changes, such as switching to a different plan, may require you to provide documentation or meet certain eligibility criteria. Ensure you understand the requirements and timelines to avoid any complications.

Step 5: Understand Your Coverage

Once you’ve enrolled or made changes to your plan, take the time to thoroughly understand your new coverage. Review the plan’s benefits summary, which outlines the covered services, exclusions, and limitations. Familiarize yourself with the plan’s network of providers and facilities to ensure you can access the care you need.

If you have any questions or concerns about your coverage, don't hesitate to reach out to your insurance provider or a licensed insurance agent. They can provide clarification and guidance to ensure you have a clear understanding of your plan.

Key Considerations for Open Enrollment 2024

As you prepare for Open Enrollment 2024, here are some additional factors to keep in mind:

Healthcare Reform and Policy Changes

The healthcare landscape is constantly evolving, and policy changes can impact the options available during Open Enrollment. Stay informed about any recent healthcare reforms or changes in insurance regulations that may affect your coverage choices. Keep an eye on news sources, government websites, and reputable healthcare organizations for updates.

Marketplace Options

In addition to the federal marketplace, many states operate their own insurance marketplaces. These state-based marketplaces may offer unique plans and benefits tailored to the specific needs of residents. Explore your state’s marketplace to uncover additional options that may be more suitable for your healthcare requirements.

Premium Assistance and Subsidies

For individuals and families with lower incomes, premium assistance and subsidies can significantly reduce the cost of health insurance. During Open Enrollment, be sure to check if you qualify for any financial assistance programs. These programs can make healthcare coverage more affordable and accessible.

Special Enrollment Periods

Outside of the Open Enrollment period, you may still be able to enroll in a health insurance plan if you experience a qualifying life event. These events can include losing job-based coverage, getting married, having a baby, or moving to a new state. Keep in mind that each qualifying event has specific rules and timelines, so stay informed and act promptly if you find yourself in a situation that triggers a Special Enrollment Period.

The Impact of Open Enrollment on Healthcare Access

Open Enrollment plays a critical role in ensuring that individuals and families have access to quality healthcare. By providing a designated period for enrollment and plan changes, Open Enrollment promotes continuity of coverage and prevents gaps that could lead to limited access to care.

Additionally, Open Enrollment encourages competition among insurance providers, driving them to offer more comprehensive and cost-effective plans. This competition benefits consumers by expanding their options and potentially lowering healthcare costs. As a result, Open Enrollment contributes to a more robust and accessible healthcare system, empowering individuals to take control of their well-being.

Expert Insights and Tips for a Successful Open Enrollment

As an industry expert, here are some valuable tips to enhance your Open Enrollment experience:

Start Early and Plan Ahead

Begin your research and planning well in advance of the Open Enrollment period. Give yourself ample time to thoroughly assess your healthcare needs, compare plans, and make informed decisions. Starting early also allows you to address any potential issues or questions that may arise during the enrollment process.

Utilize Online Tools and Resources

Take advantage of the wealth of online resources and tools provided by insurance marketplaces and government websites. These resources can simplify the comparison process, provide personalized recommendations, and offer valuable insights to guide your decision-making.

Seek Professional Advice

If you have complex healthcare needs or are unsure about your coverage options, consider seeking advice from a licensed insurance agent or healthcare professional. They can provide expert guidance tailored to your specific situation, ensuring you make the right choices during Open Enrollment.

Stay Informed and Educated

Stay up-to-date with the latest healthcare news and policy changes. Understanding the evolving landscape of healthcare and insurance can help you make more informed decisions and ensure you take advantage of any new opportunities or benefits.

Review Your Coverage Regularly

Even if you’re satisfied with your current plan, it’s important to review your coverage annually. Healthcare needs can change over time, and your plan may not always remain the best fit. Regularly assessing your coverage ensures you’re prepared for any unexpected healthcare events and allows you to make adjustments as needed.

The Future of Open Enrollment: Trends and Predictions

Looking ahead, the future of Open Enrollment is likely to be shaped by ongoing healthcare reforms and advancements in technology. Here are some trends and predictions to consider:

Digital Transformation

The digital transformation of healthcare is expected to continue, with an increasing emphasis on online enrollment and plan management. Insurance providers and marketplaces will likely enhance their digital platforms to provide a seamless and user-friendly experience, making it easier for individuals to enroll, manage their coverage, and access healthcare services.

Expanded Access and Equity

Efforts to improve healthcare access and equity are likely to gain momentum. Open Enrollment periods may be extended or made more flexible to accommodate a wider range of individuals, especially those with unique circumstances or limited access to information. Additionally, initiatives to simplify the enrollment process and provide language support will likely become more prevalent.

Focus on Preventive Care

With a growing emphasis on preventive care and wellness, insurance plans are expected to continue offering incentives and benefits that encourage healthy behaviors. This trend may lead to more comprehensive coverage for preventive services, such as wellness exams, vaccinations, and chronic disease management programs.

Integration of Telehealth Services

The integration of telehealth services into healthcare plans is likely to become more common. As technology advances and remote healthcare becomes more accepted, insurance providers may offer plans that include virtual visits and remote monitoring, providing convenient and cost-effective access to care.

Conclusion: Empowering Your Healthcare Journey

Open Enrollment is a powerful tool that empowers individuals to take control of their healthcare and make informed decisions about their coverage. By understanding the process, researching available plans, and making thoughtful choices, you can ensure access to quality healthcare that meets your unique needs.

As we approach Open Enrollment for 2024, stay informed, plan ahead, and take advantage of the opportunities available. With the right knowledge and preparation, you can navigate the Open Enrollment period successfully and secure the healthcare coverage that supports your well-being and peace of mind.

When is the Open Enrollment period for 2024 health insurance plans?

+The Open Enrollment period for 2024 health insurance plans typically runs from November 15, 2023, to December 15, 2023. However, it’s important to check the specific dates for your state or marketplace, as some may have different enrollment periods.

What happens if I miss the Open Enrollment period?

+If you miss the Open Enrollment period, you generally won’t be able to enroll in a new health insurance plan until the next Open Enrollment unless you qualify for a Special Enrollment Period due to certain life events. These events include losing job-based coverage, getting married, having a baby, or moving to a new state.

Can I change my health insurance plan during Open Enrollment?

+Yes, Open Enrollment is the designated period to make changes to your health insurance plan. You can switch to a different plan or make adjustments to your existing coverage. It’s important to understand the specific rules and deadlines for your state or marketplace when making changes.

How can I compare health insurance plans during Open Enrollment?

+Insurance marketplaces and government websites provide tools and resources to help you compare health insurance plans during Open Enrollment. These tools allow you to evaluate plans based on factors like coverage, premiums, deductibles, and network providers. Additionally, online resources and licensed insurance agents can offer guidance and personalized recommendations.

Are there any financial assistance programs available during Open Enrollment?

+Yes, individuals and families with lower incomes may qualify for premium assistance or subsidies during Open Enrollment. These programs can significantly reduce the cost of health insurance. It’s important to check your eligibility and explore the available financial assistance options to make healthcare coverage more affordable.