Compare My Auto Insurance

In the ever-evolving landscape of insurance services, the need for comprehensive coverage and cost-effective solutions is at the forefront of every driver's mind. With a plethora of options available, choosing the right auto insurance provider can be a daunting task. This article aims to provide an in-depth comparison of one such insurance platform, Compare My Auto Insurance, and shed light on its features, benefits, and how it stands out in the competitive market.

Introduction to Compare My Auto Insurance

Compare My Auto Insurance is an innovative online platform that revolutionizes the way drivers search for and compare auto insurance policies. Founded with the mission to simplify the insurance-hunting process, the platform has gained popularity among motorists seeking convenient and personalized insurance solutions. By leveraging advanced technology and a user-centric approach, Compare My Auto Insurance aims to empower drivers with the knowledge and tools to make informed decisions about their auto insurance.

The platform offers a seamless experience, allowing users to input their specific requirements and preferences, and then presents a tailored list of insurance options from a vast network of providers. This not only saves time but also ensures that drivers get the best value for their money. With a commitment to transparency and customer satisfaction, Compare My Auto Insurance has established itself as a trusted intermediary in the insurance industry.

Key Features and Benefits

Comprehensive Policy Comparison

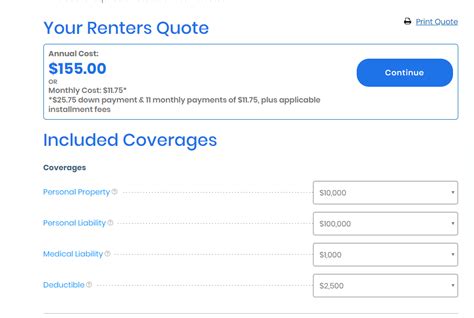

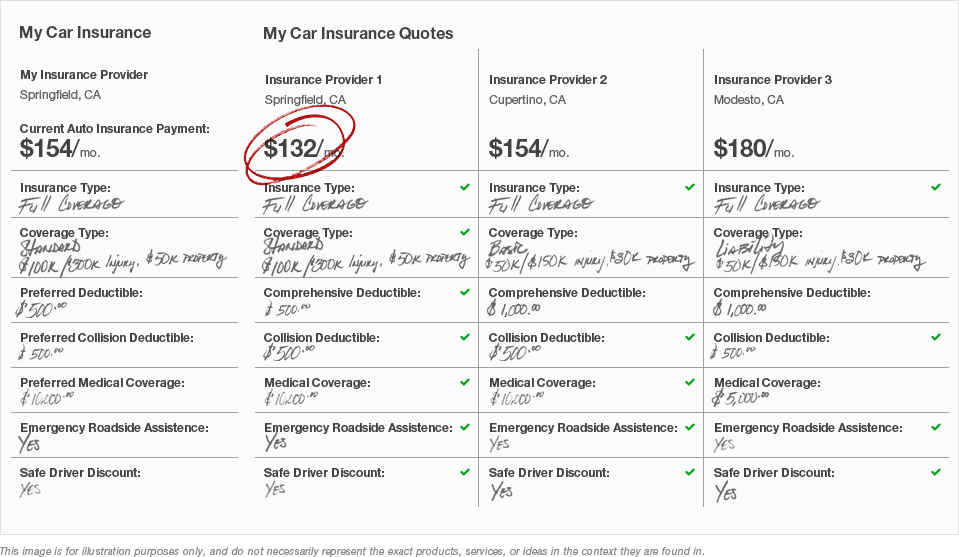

One of the standout features of Compare My Auto Insurance is its ability to provide a holistic view of various insurance policies. Users can compare not just prices, but also coverage limits, deductibles, and additional perks offered by different providers. This level of detail ensures that drivers can make an informed choice based on their unique needs and circumstances.

The platform's comprehensive comparison tool takes into account a range of factors, including the user's driving history, the make and model of their vehicle, and their desired level of coverage. By considering these variables, Compare My Auto Insurance generates accurate and personalized quotes, making it easier for drivers to find the perfect fit.

| Feature | Description |

|---|---|

| Policy Comparison | Offers an extensive comparison of insurance policies, including coverage limits, deductibles, and additional benefits. |

| Personalized Quotes | Generates tailored quotes based on individual needs, taking into account driving history and vehicle specifics. |

| Provider Network | Connects users with a wide range of insurance providers, ensuring a diverse selection of options. |

User-Friendly Interface

Compare My Auto Insurance prioritizes user experience, and this is evident in its intuitive and user-friendly interface. The platform is designed with simplicity in mind, making it accessible to drivers of all ages and technological backgrounds. The straightforward navigation and clear call-to-actions ensure a smooth journey from quote comparison to policy purchase.

The platform's user-centric approach is further reinforced by its commitment to providing educational resources. Compare My Auto Insurance offers a wealth of information and guides, helping drivers understand the intricacies of insurance policies and making them more confident in their decision-making process.

Wide Range of Insurance Providers

A major advantage of Compare My Auto Insurance is its extensive network of insurance providers. By partnering with a diverse range of companies, the platform ensures that users have access to a variety of options, catering to different budgets and coverage preferences. Whether you’re looking for comprehensive coverage or a more budget-friendly option, Compare My Auto Insurance has you covered.

This network of providers includes both established insurance giants and emerging startups, providing users with a comprehensive view of the market. The platform's ability to aggregate such a wide range of options in one place is a significant benefit, saving users the time and effort of researching multiple websites.

Personalized Recommendations

Compare My Auto Insurance goes beyond simple policy comparison by offering personalized recommendations. The platform’s advanced algorithm analyzes user preferences and behavior to suggest insurance policies that align with their specific needs. This level of customization ensures that drivers receive tailored advice, helping them make choices that best suit their circumstances.

Additionally, the platform's recommendation system takes into account user feedback and reviews, providing an added layer of trust and reliability. By considering real-world experiences, Compare My Auto Insurance can offer insights into the performance and reliability of different insurance providers, further enhancing the decision-making process.

Performance and Reliability

Accurate and Timely Quotes

Compare My Auto Insurance prides itself on providing accurate and timely quotes. The platform’s advanced quoting engine is designed to process a vast amount of data in real-time, ensuring that users receive precise estimates for their insurance needs. This level of precision is crucial in helping drivers make informed decisions and avoid any unpleasant surprises down the line.

Furthermore, the platform's commitment to speed ensures that users can quickly obtain quotes and compare policies, without having to wait for lengthy processing times. This efficiency is a key factor in the platform's success, as it allows drivers to save time and make prompt decisions regarding their insurance coverage.

Secure and Reliable Transactions

Security is a top priority for Compare My Auto Insurance. The platform employs state-of-the-art encryption and security protocols to safeguard user data and transactions. With the increasing prevalence of cyber threats, Compare My Auto Insurance understands the importance of maintaining a secure environment, ensuring that users can trust the platform with their personal information.

Additionally, the platform adheres to strict industry standards and regulations, further reinforcing its reliability. By maintaining a high level of security and compliance, Compare My Auto Insurance has earned the trust of its users, solidifying its position as a trusted intermediary in the insurance market.

Customer Support and Satisfaction

Compare My Auto Insurance places a strong emphasis on customer satisfaction and support. The platform offers a dedicated team of experts who are readily available to assist users with any queries or concerns they may have. Whether it’s understanding complex policy terms or navigating the insurance purchase process, the support team is equipped to provide timely and accurate guidance.

Furthermore, Compare My Auto Insurance actively encourages user feedback and reviews. By listening to its users and implementing their suggestions, the platform continuously improves its services, ensuring that it remains aligned with the evolving needs and expectations of the market.

Future Implications and Innovations

Expanding Provider Network

Compare My Auto Insurance is committed to expanding its provider network, continuously adding new insurance companies to its platform. This expansion ensures that users have access to an ever-growing range of options, catering to diverse needs and preferences. By partnering with a wider array of providers, the platform can offer an even more comprehensive comparison experience.

The addition of new providers also allows Compare My Auto Insurance to explore niche markets and cater to specialized insurance needs. Whether it's classic car insurance or coverage for high-risk drivers, the platform aims to become a one-stop shop for all insurance requirements, making it an invaluable resource for motorists.

Advanced Analytics and Insights

In an effort to enhance its services, Compare My Auto Insurance is investing in advanced analytics and data-driven insights. By leveraging machine learning and artificial intelligence, the platform aims to provide even more accurate and personalized recommendations. This technological innovation will enable the platform to offer tailored advice based on individual driving behavior and preferences.

Furthermore, the platform's analytics will help identify trends and patterns in the insurance market, allowing Compare My Auto Insurance to anticipate and adapt to changing consumer needs. This proactive approach ensures that the platform remains at the forefront of the industry, offering cutting-edge solutions to its users.

Integration with Emerging Technologies

Compare My Auto Insurance is embracing the future by integrating with emerging technologies. The platform is exploring partnerships with autonomous vehicle manufacturers and telematics providers to offer innovative insurance solutions. By leveraging the data generated by these technologies, Compare My Auto Insurance can develop dynamic insurance policies that adapt to the evolving landscape of transportation.

Additionally, the platform is investigating the potential of blockchain technology to enhance its security and transparency. By utilizing blockchain's decentralized nature, Compare My Auto Insurance can further protect user data and ensure the integrity of its transactions, solidifying its position as a trusted intermediary in the digital age.

How does Compare My Auto Insurance ensure accurate quotes?

+

Compare My Auto Insurance employs an advanced quoting engine that processes a vast amount of data in real-time. This ensures that users receive precise estimates for their insurance needs, taking into account various factors such as driving history and vehicle specifics.

What measures does the platform take to ensure user data security?

+

Security is a top priority for Compare My Auto Insurance. The platform utilizes state-of-the-art encryption and security protocols to safeguard user data and transactions. Additionally, it adheres to strict industry standards and regulations to maintain a secure environment for its users.

How does the platform’s recommendation system work?

+

The recommendation system is powered by an advanced algorithm that analyzes user preferences and behavior. It takes into account various factors, including driving history and coverage needs, to suggest insurance policies that align with individual requirements. Additionally, the system considers user feedback and reviews to provide reliable and trusted recommendations.