Liability Business Insurance Cost

Liability insurance is a critical component of any business's risk management strategy, offering protection against potential financial losses arising from legal claims and lawsuits. Understanding the cost of liability insurance is essential for businesses to effectively budget and ensure they have adequate coverage. This comprehensive guide explores the factors influencing the cost of liability business insurance, providing insights into the variables that can impact premium rates and strategies to optimize coverage while managing costs.

Understanding Liability Business Insurance Costs

The cost of liability insurance for businesses is determined by a range of factors, each playing a significant role in the overall premium calculation. These factors can be broadly categorized into intrinsic business characteristics, industry-specific considerations, and regional variations.

Intrinsic Business Factors

Several aspects inherent to a business can influence the cost of liability insurance. These include the nature of the business operations, with higher-risk activities typically attracting higher premiums. For instance, a construction company may face more substantial liability risks than a software development firm due to the physical nature of its work.

The size of the business also plays a role. Larger businesses often require more extensive coverage, which can lead to higher premiums. Additionally, the number of employees and the scope of their responsibilities can impact insurance costs. Businesses with a higher employee count or those engaged in more diverse activities may face increased liability risks.

The business's financial stability is another crucial factor. Insurers consider a business's financial health when setting premiums, as financially stable businesses are often seen as lower risk. A business's credit rating and financial history can therefore influence the cost of liability insurance.

Industry-Specific Considerations

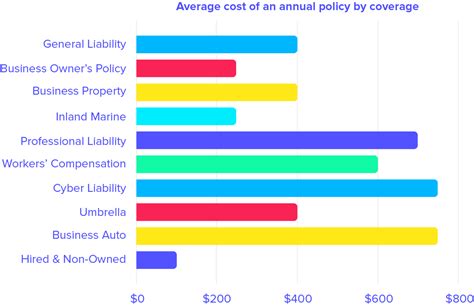

Different industries face unique liability risks, which can significantly impact insurance costs. For example, healthcare providers may face higher liability premiums due to the potential for medical malpractice claims, while manufacturers may encounter risks associated with product defects or workplace accidents.

The industry's historical claim frequency and severity are key factors that insurers consider. Industries with a higher incidence of claims or more severe claim outcomes may see higher insurance costs. This is particularly true for industries where the potential for catastrophic losses is significant, such as in the energy sector or chemical manufacturing.

Regional Variations

The cost of liability insurance can also vary significantly based on geographic location. Regional factors, such as local laws and regulations, weather conditions, and crime rates, can all impact insurance costs. For instance, businesses located in areas prone to natural disasters may face higher premiums to account for the increased risk of property damage or business interruption.

Furthermore, population density and traffic conditions can influence insurance costs, particularly for businesses that rely on transportation or have a large number of visitors. Higher population density can lead to increased liability risks, such as higher rates of workplace injuries or product liability claims.

Key Factors Influencing Liability Insurance Costs

Beyond the broad categories outlined above, several specific factors can significantly impact the cost of liability insurance for businesses.

Claim History

A business’s claim history is a critical factor in determining insurance costs. Insurers closely analyze a business’s past claims to assess its potential future risks. A history of frequent or severe claims can lead to higher premiums, as it indicates a higher likelihood of future claims.

On the other hand, businesses with a clean claim history may be rewarded with lower premiums. This is particularly true if the business has implemented effective risk management strategies to minimize the likelihood of future claims.

Coverage Limits and Deductibles

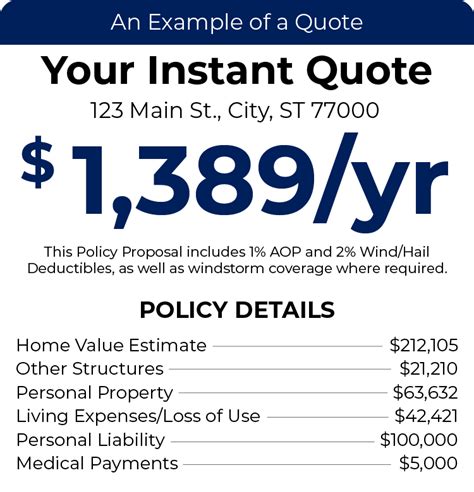

The coverage limits chosen by a business can significantly impact its insurance costs. Higher coverage limits typically result in higher premiums, as they provide greater protection in the event of a claim. However, businesses must carefully consider their risk exposure and financial capabilities when setting coverage limits to ensure they have adequate protection without incurring excessive costs.

Similarly, the deductible amount selected by a business can influence its insurance costs. A higher deductible typically results in lower premiums, as it reduces the insurer's potential financial exposure. However, businesses should carefully assess their financial capabilities and risk appetite when choosing a deductible, ensuring they can cover the deductible amount in the event of a claim.

Policy Terms and Conditions

The terms and conditions of a liability insurance policy can also impact its cost. Policies with more comprehensive coverage or additional endorsements may carry higher premiums. On the other hand, policies with stricter conditions or exclusions may offer lower premiums but provide less protection.

Businesses should carefully review the terms and conditions of their liability insurance policies to ensure they understand the scope of coverage and any potential limitations. This can help them make informed decisions about their insurance coverage and manage their costs effectively.

Strategies to Optimize Liability Insurance Costs

While the cost of liability insurance is influenced by various factors beyond a business’s control, there are strategies that businesses can employ to optimize their insurance costs and ensure they have adequate coverage.

Risk Management and Mitigation

Implementing effective risk management strategies can significantly reduce the likelihood of liability claims, thereby lowering insurance costs. This includes measures such as regular safety audits, employee training on risk awareness and prevention, and the implementation of robust internal control systems.

Additionally, businesses can consider risk transfer strategies, such as outsourcing high-risk activities to specialized contractors or subcontractors. By reducing their own exposure to risk, businesses can potentially lower their insurance costs.

Shopping Around and Negotiation

Comparing quotes from multiple insurance providers is essential to finding the most competitive rates. Businesses should shop around and obtain quotes from several insurers to ensure they are getting the best value for their insurance needs. This process can be time-consuming, but it is often well worth the effort in terms of cost savings.

Businesses should also consider negotiating their insurance premiums with insurers. While insurers typically have set rates, there may be room for negotiation, especially for businesses with a strong claim history or those implementing effective risk management strategies. Negotiating can help businesses secure more favorable terms and lower their insurance costs.

Bundling Insurance Policies

Businesses can often bundle their insurance policies to save on costs. By purchasing multiple insurance policies, such as liability, property, and business interruption insurance, from the same insurer, businesses may be eligible for multi-policy discounts. This can result in significant cost savings, particularly for businesses with complex insurance needs.

Reviewing and Adjusting Coverage

Regularly reviewing and adjusting insurance coverage is crucial to ensuring that a business’s insurance needs are adequately met while managing costs. As a business’s operations and risks evolve, its insurance coverage should also evolve to provide the right level of protection.

Businesses should periodically assess their insurance coverage to ensure it aligns with their current operations and risk profile. This may involve increasing coverage limits, adding new endorsements, or removing unnecessary coverage. By keeping their insurance coverage up-to-date, businesses can avoid gaps in coverage and unnecessary costs.

Future Implications and Trends in Liability Insurance

The landscape of liability insurance is constantly evolving, driven by changes in business practices, technological advancements, and societal trends. Understanding these future implications and trends can help businesses anticipate potential shifts in insurance costs and adjust their strategies accordingly.

Emerging Risks and Technological Advancements

The rise of new technologies and business models introduces emerging risks that can impact insurance costs. For instance, the increasing adoption of artificial intelligence (AI) and automation in various industries may lead to new liability risks, such as data breaches or algorithmic bias.

Businesses must stay abreast of these emerging risks and their potential impact on insurance costs. This may involve investing in additional insurance coverage or implementing new risk management strategies to mitigate these risks effectively.

Changing Regulatory Landscape

Changes in regulatory requirements can also significantly impact liability insurance costs. For example, new environmental regulations may require businesses to adopt more stringent pollution control measures, potentially increasing their liability risks and insurance costs.

Businesses should closely monitor regulatory changes that may impact their operations and liability risks. Staying informed about these changes can help businesses anticipate potential insurance cost increases and adjust their strategies to comply with new regulations while managing their insurance costs.

Digital Transformation and Cyber Risks

The ongoing digital transformation of businesses, driven by the rapid adoption of digital technologies, introduces new cyber risks. These risks, such as data breaches, ransomware attacks, and online fraud, can have significant financial implications for businesses.

As businesses become more reliant on digital technologies, the potential for cyber risks increases. This trend highlights the importance of investing in robust cyber security measures and appropriate cyber liability insurance coverage. By staying ahead of these risks, businesses can better protect themselves and manage their insurance costs effectively.

Environmental, Social, and Governance (ESG) Considerations

The growing focus on ESG considerations is influencing the insurance industry, including liability insurance. Insurers are increasingly incorporating ESG factors into their underwriting processes, as businesses with strong ESG practices are often seen as lower risk.

Businesses that prioritize ESG considerations may find that they are rewarded with lower insurance costs. This trend underscores the importance of businesses adopting sustainable and socially responsible practices not only for ethical reasons but also for potential financial benefits, including lower insurance premiums.

Conclusion

Understanding the cost of liability insurance is a critical aspect of effective business risk management. By considering the various factors that influence insurance costs and implementing strategies to optimize their coverage, businesses can effectively manage their liability risks while controlling their insurance expenses.

As the business landscape continues to evolve, staying informed about emerging risks, regulatory changes, and industry trends is essential. By staying ahead of these developments, businesses can ensure they have the right insurance coverage to protect their operations and manage their insurance costs effectively.

How often should businesses review their liability insurance coverage?

+Businesses should review their liability insurance coverage annually or whenever there are significant changes to their operations, risk profile, or legal environment. Regular reviews ensure that the insurance coverage remains adequate and aligned with the evolving needs of the business.

Can businesses reduce their liability insurance costs by increasing their deductibles?

+Yes, increasing the deductible can lower insurance premiums. However, businesses should carefully consider their financial capabilities and risk appetite before opting for a higher deductible. A higher deductible may result in cost savings, but it also means that the business will need to cover a larger portion of the costs in the event of a claim.

What are some common exclusions in liability insurance policies that businesses should be aware of?

+Common exclusions in liability insurance policies may include intentional acts, contract liabilities, pollution or environmental damage, and intellectual property claims. Businesses should carefully review their policies to understand the specific exclusions and ensure that their insurance coverage aligns with their unique risks and operations.