Usaa Auto Insurance Contact

USAA Auto Insurance offers comprehensive coverage and services to its members, and understanding how to reach them for assistance is crucial. In this article, we will delve into the various methods to contact USAA for auto insurance-related inquiries, ensuring a smooth and efficient process.

Multiple Channels for Efficient Communication

USAA provides a range of contact options to cater to different preferences and needs. Whether you prefer a quick phone call, the convenience of online chat, or the personal touch of a local office visit, USAA has you covered. Let’s explore these channels in detail.

Phone Support

For immediate assistance, USAA’s phone support is a go-to option. With dedicated phone lines for different auto insurance-related matters, you can connect with knowledgeable representatives who can address your queries promptly. Here’s a breakdown of the phone numbers:

| Service | Phone Number |

|---|---|

| General Auto Insurance Inquiries | (800) 531-8722 |

| Roadside Assistance | (800) 531-8222 |

| Claims Reporting | (800) 531-8000 |

| New Business | (800) 531-8722 |

| Member Services | (800) 531-8722 |

These phone numbers are available 24/7, ensuring you can reach out whenever the need arises. USAA's phone support is known for its efficiency and friendly staff, making it a preferred choice for many members.

Online Chat and Email

For those who prefer digital communication, USAA offers online chat and email support. You can access the online chat feature through their website, providing a real-time and convenient way to connect with a representative. Email support is also available for more detailed inquiries or follow-ups.

USAA's online chat and email services are accessible during business hours, typically Monday to Friday, 8 am to 8 pm CT. While not available 24/7 like phone support, these channels offer a more relaxed and asynchronous form of communication.

Local Office Visits

USAA maintains a network of local offices across the United States, providing members with the option to meet face-to-face for personalized assistance. These offices are staffed by knowledgeable professionals who can guide you through your auto insurance needs.

To find the nearest USAA office, you can use their online office locator tool, which provides addresses, contact details, and operating hours. This option is ideal for members who prefer a more traditional and personal approach to their insurance matters.

Mobile App and Website

USAA’s mobile app and website are powerful tools for managing your auto insurance. Through these platforms, you can access your policy details, make payments, file claims, and even report accidents. The app and website offer a user-friendly interface, making it convenient to handle insurance matters on the go.

Additionally, the USAA app and website provide a wealth of resources and articles related to auto insurance, helping you stay informed and make educated decisions.

Efficient Claims Process

In the event of an accident or incident, USAA’s claims process is designed to be as smooth and stress-free as possible. Here’s an overview of the steps involved:

- Report the Claim: You can report a claim through the USAA app, website, or by calling the dedicated claims number.

- Gather Information: Provide details about the incident, including photos and any relevant documentation.

- Assign an Adjuster: USAA will assign a dedicated adjuster to handle your claim, ensuring personalized attention.

- Claim Assessment: The adjuster will evaluate the claim, determine liability, and estimate the cost of repairs or damages.

- Repair or Settlement: Depending on the nature of the claim, USAA will facilitate repairs or provide a settlement offer.

- Finalization: Once repairs are completed or the settlement is accepted, the claim is finalized.

USAA's claims process is known for its efficiency and fair handling, ensuring members receive the support they need during challenging times.

Understanding Coverage and Policy Details

To make the most of your USAA auto insurance, it’s essential to understand the coverage options and policy details. Here are some key aspects to consider:

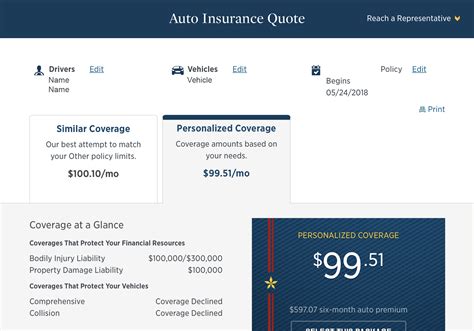

- Coverage Options: USAA offers a range of coverage options, including liability, collision, comprehensive, medical payments, and more. Tailor your policy to fit your specific needs.

- Policy Limits: Understand the policy limits for each coverage type. This includes the maximum amount USAA will pay for a claim, as well as any deductibles or co-pays.

- Discounts and Rewards: USAA provides various discounts and rewards programs, such as safe driving bonuses, multi-policy discounts, and loyalty rewards. Take advantage of these opportunities to save on your insurance premiums.

- Additional Services: USAA offers a range of additional services, including roadside assistance, rental car coverage, and accident forgiveness. These add-ons can enhance your coverage and provide peace of mind.

Making Policy Changes

As your life and circumstances change, it’s essential to review and update your auto insurance policy accordingly. USAA makes it easy to make policy changes through their online platform or by contacting a representative.

Common policy changes include adding or removing vehicles, updating personal information, changing coverage limits, or adjusting payment methods. USAA's team can guide you through the process, ensuring your policy remains up-to-date and aligned with your needs.

FAQs

How do I report a claim with USAA auto insurance?

+To report a claim, you can use the USAA app, website, or call the dedicated claims number. Provide details about the incident and any relevant documentation. USAA will assign an adjuster to handle your claim.

What are the office hours for local USAA branches?

+Local USAA branch hours vary depending on the location. You can use the online office locator tool to find the nearest branch and check its specific operating hours.

Can I make policy changes online with USAA?

+Yes, USAA provides an online platform where you can easily make policy changes, such as adding or removing vehicles, updating personal information, and adjusting coverage limits.

How can I save money on my USAA auto insurance premiums?

+USAA offers various discounts and rewards programs to help you save on your premiums. These include safe driving bonuses, multi-policy discounts, and loyalty rewards. Additionally, you can review your coverage limits and deductibles to find the right balance for your needs.

By utilizing the various contact options and understanding the ins and outs of your USAA auto insurance policy, you can ensure a seamless and stress-free experience. Remember, USAA is dedicated to providing exceptional service and support to its members, making them a trusted choice for auto insurance needs.