Car Insurance Rates Compare

Car insurance rates are a complex and ever-evolving landscape, with numerous factors influencing the cost of coverage. For drivers, understanding these rates and how they compare is essential for making informed decisions about their automotive insurance. In this comprehensive article, we delve into the world of car insurance rates, exploring the key variables that impact them, providing real-world examples, and offering insights to help drivers navigate this critical aspect of vehicle ownership.

The Complex World of Car Insurance Rates

Car insurance rates are not uniform; they vary significantly based on a multitude of factors. These factors can be broadly categorized into personal, vehicle-related, and geographic elements, each playing a unique role in determining the cost of coverage.

Personal Factors

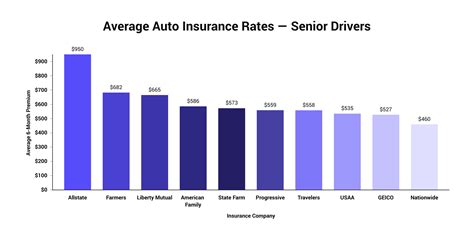

Your personal details, such as age, gender, marital status, and driving history, are key determinants of insurance rates. For instance, young drivers, especially males, tend to face higher premiums due to their perceived higher risk on the road. Additionally, a clean driving record with no accidents or violations can lead to substantial savings on insurance costs.

| Factor | Impact |

|---|---|

| Age | Younger drivers often pay more due to higher risk. |

| Gender | Statistically, males pay more, especially in certain age groups. |

| Marital Status | Married individuals often benefit from lower rates. |

| Driving History | Clean records lead to significant savings. |

Vehicle-Related Factors

The type of vehicle you drive also influences insurance rates. Car make and model, engine size, vehicle age, and safety features all come into play. Sports cars, for example, often command higher premiums due to their performance capabilities, while vehicles with advanced safety features might offer discounts.

| Factor | Impact |

|---|---|

| Car Make and Model | Certain makes and models are more expensive to insure. |

| Engine Size | Larger engines may result in higher premiums. |

| Vehicle Age | Older vehicles can be more cost-effective to insure. |

| Safety Features | Advanced safety systems can lead to discounts. |

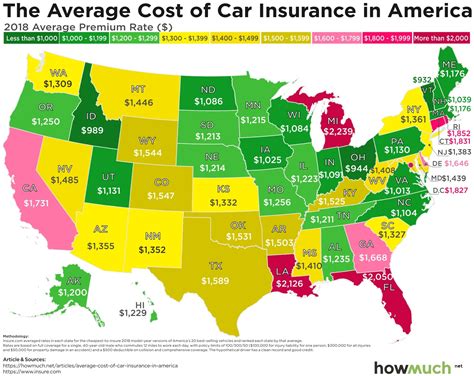

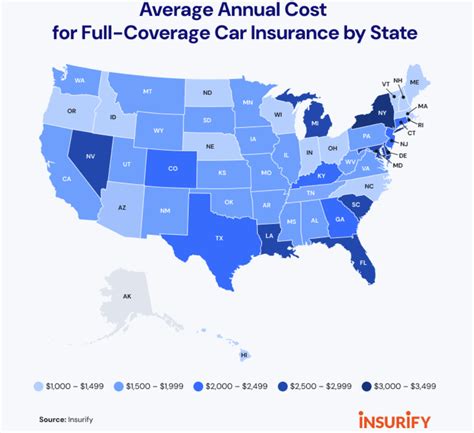

Geographic Factors

Where you live and drive has a significant impact on insurance rates. State regulations, local crime rates, weather conditions, and even population density all influence the cost of car insurance. High-population areas, for instance, often see higher premiums due to increased traffic and accident risks.

| Factor | Impact |

|---|---|

| State Regulations | Different states have varying insurance laws and requirements. |

| Local Crime Rates | Areas with higher crime may have increased insurance costs. |

| Weather Conditions | Frequent severe weather can impact insurance rates. |

| Population Density | Higher density areas often have higher insurance costs. |

Comparing Rates: Real-World Scenarios

Let’s explore some real-world scenarios to illustrate how these factors translate into actual insurance rates. We’ll consider two drivers, John and Sarah, and their experiences with car insurance.

John’s Story

John, a 25-year-old male, drives a 2018 Ford Mustang in New York City. He’s been involved in a couple of minor accidents in the past year and has a few speeding tickets on his record. Given his age, gender, driving history, and the high-risk nature of his vehicle, John’s insurance rates are $2,500 annually.

Sarah’s Story

Sarah, a 35-year-old married female, drives a 2015 Toyota Prius in Suburban Chicago. She has an impeccable driving record with no accidents or violations. Her vehicle is known for its safety features and fuel efficiency. Sarah’s insurance rates are $1,200 annually, a significant difference from John’s rates.

Comparative Analysis

The disparity in rates between John and Sarah highlights the impact of various factors. John’s age, gender, and driving history contribute to higher premiums, while Sarah’s age, marital status, and clean driving record lead to lower rates. Additionally, the type of vehicle and geographic location play significant roles in determining these costs.

Strategies for Managing Insurance Costs

While insurance rates are influenced by various factors, there are strategies drivers can employ to manage these costs effectively.

Improving Driving Record

A clean driving record is a significant factor in determining insurance rates. Avoiding accidents and violations can lead to substantial savings over time. Additionally, many insurance companies offer discounts for safe driving behaviors, such as completing defensive driving courses.

Choosing the Right Vehicle

The type of vehicle you drive has a direct impact on insurance costs. Opting for a vehicle with advanced safety features and a good safety record can often lead to lower premiums. Additionally, considering a vehicle’s maintenance and repair costs can further influence the overall financial picture.

Utilizing Discounts and Bundling

Many insurance companies offer a wide range of discounts, from multi-policy discounts (bundling car and home insurance) to loyalty discounts for long-term customers. Exploring these options can significantly reduce insurance costs.

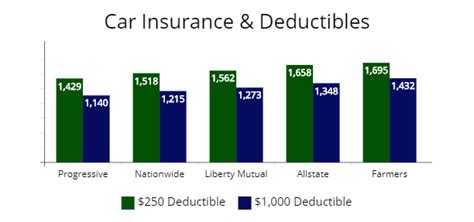

Comparing Providers

Insurance rates can vary significantly between providers. It’s essential to compare quotes from multiple companies to ensure you’re getting the best rate for your specific circumstances. Online tools and comparison websites can simplify this process.

The Future of Car Insurance Rates

The car insurance landscape is evolving, and several trends are shaping the future of insurance rates. These include the increasing use of telematics (using data from connected vehicles to assess driving behavior), pay-as-you-drive (PAYD) models, and usage-based insurance (UBI), which tailor premiums based on actual driving behavior and miles driven.

Additionally, the rise of autonomous vehicles and advanced driver-assistance systems (ADAS) is expected to significantly impact insurance rates in the coming years. As these technologies become more prevalent, the risk profile of driving is likely to change, potentially leading to more affordable insurance premiums.

Conclusion

Car insurance rates are a complex interplay of personal, vehicle, and geographic factors. Understanding these influences and how they translate into real-world scenarios is crucial for drivers looking to manage their insurance costs effectively. By staying informed, employing cost-saving strategies, and keeping an eye on emerging trends, drivers can navigate the world of car insurance with confidence and financial savvy.

How often should I review my car insurance rates?

+It’s recommended to review your insurance rates annually, as they can change based on various factors like age, location, and vehicle changes. Regular reviews ensure you’re getting the best deal and aren’t overpaying.

Can I get a discount for insuring multiple vehicles with the same provider?

+Yes, many insurance companies offer multi-car discounts. By insuring multiple vehicles with the same provider, you can often save a significant amount on your premiums.

What impact does my credit score have on car insurance rates?

+Your credit score can have a significant impact on your car insurance rates. Insurance companies often use credit-based insurance scores to assess risk, and a higher credit score can lead to lower premiums.