Comprehensive Household Insurance

Protecting your home and belongings is a crucial aspect of financial planning and risk management. In today's unpredictable world, a comprehensive household insurance policy can provide much-needed peace of mind. This article delves into the world of household insurance, exploring the key components, benefits, and considerations to help you make informed decisions when it comes to safeguarding your most valuable assets.

Understanding Household Insurance

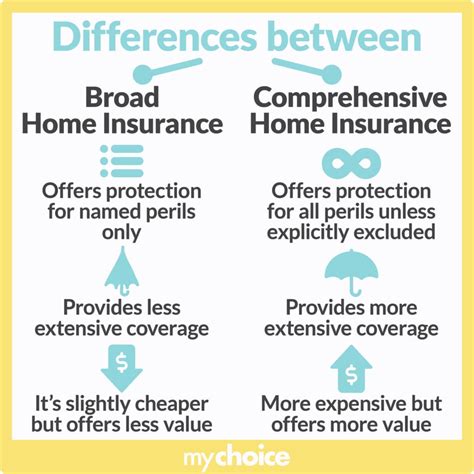

Household insurance, also known as home insurance or homeowners insurance, is a type of property insurance designed to protect homeowners and renters against losses and damages that may occur within their homes. It offers financial protection for the structure of the dwelling, personal belongings, and, in many cases, provides liability coverage for accidents or injuries that may happen on the insured property.

The primary purpose of household insurance is to mitigate the financial risks associated with owning or renting a home. Whether it's damage caused by natural disasters, theft, or accidental incidents, a robust insurance policy can help individuals and families recover and rebuild without bearing the full financial burden.

Key Components of a Comprehensive Policy

Dwelling Coverage

The cornerstone of any household insurance policy is dwelling coverage. This aspect of the policy provides protection for the physical structure of your home, including the walls, roof, foundation, and permanent fixtures. It covers damages resulting from a wide range of perils, such as fire, lightning, windstorms, hail, and vandalism.

Dwelling coverage is typically offered as a specific dollar amount, representing the estimated cost to rebuild your home if it were completely destroyed. It's essential to ensure that this coverage limit aligns with the actual replacement cost of your home to avoid underinsurance, which can lead to financial strain in the event of a total loss.

Personal Property Coverage

In addition to the structure itself, household insurance policies also cover the personal property within your home. This includes furniture, electronics, clothing, jewelry, and other valuable items. Personal property coverage reimburses you for the cost of replacing or repairing these items if they are lost, stolen, or damaged due to a covered peril.

It's important to note that personal property coverage often has limits and exclusions. For instance, high-value items like jewelry, artwork, or collectibles may require separate endorsements or riders to ensure they are adequately insured. Additionally, certain types of damage, such as those caused by floods or earthquakes, may require additional coverage beyond the standard policy.

Liability Protection

Liability coverage is a critical component of household insurance, offering protection against legal claims and lawsuits arising from accidents or injuries that occur on your property. This coverage can provide financial support for medical expenses, legal fees, and settlements or judgments if someone is injured on your premises.

Liability protection is particularly important for homeowners who frequently host guests or have regular visitors, as it can shield them from the financial consequences of an unexpected accident. It's advisable to review the liability limits included in your policy to ensure they are sufficient for your needs and circumstances.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, additional living expenses coverage steps in to provide financial assistance for temporary housing, meals, and other necessary expenses while your home is being repaired or rebuilt.

This coverage is especially beneficial for individuals who may not have the means to cover the costs of living elsewhere while their home is undergoing repairs. It ensures that policyholders can maintain their standard of living during a challenging and potentially disruptive time.

Customizing Your Policy: The Importance of Endorsements

While standard household insurance policies offer a solid foundation of protection, it’s crucial to consider your unique circumstances and potential risks. This is where endorsements or riders come into play, allowing you to customize your policy to meet your specific needs.

Flood and Earthquake Coverage

Standard household insurance policies typically do not cover damages caused by floods or earthquakes. These natural disasters can result in catastrophic losses, so it’s essential to assess your risk and consider adding flood insurance or earthquake coverage as separate endorsements.

Flood insurance is often provided through the National Flood Insurance Program (NFIP) or private insurers, while earthquake coverage may be offered as a rider or separate policy. Both options can provide vital financial protection in regions prone to these natural disasters.

High-Value Item Riders

If you own valuable items such as fine art, antiques, or expensive jewelry, the standard personal property coverage limits may not be sufficient. In such cases, high-value item riders can be added to your policy to ensure these items are adequately insured.

These riders provide additional coverage limits and specialized valuation methods for high-value items, ensuring that you receive fair compensation if these items are lost or damaged.

Water Backup and Sump Overflow Coverage

Water backup and sump overflow coverage is an important consideration for homeowners, as it provides protection against damage caused by water that backs up through drains, sewers, or sump pumps. This coverage can be crucial in preventing financial losses resulting from water-related incidents.

While standard policies may exclude or limit coverage for water backup, adding this endorsement ensures that you are protected against these specific types of damage.

Performance Analysis and Real-World Examples

Understanding the performance and effectiveness of household insurance policies is crucial in assessing their value. Real-world examples and case studies can provide valuable insights into how these policies respond in various scenarios.

For instance, consider the case of a homeowner whose home was damaged by a severe storm. The dwelling coverage in their policy helped them rebuild their home, while personal property coverage reimbursed them for the cost of replacing damaged furniture and electronics. Additionally, liability coverage stepped in when a guest slipped and fell on their icy driveway, covering the medical expenses and legal fees associated with the incident.

In another scenario, a renter's household insurance policy proved invaluable when their apartment building suffered a fire. The policy covered the cost of temporary housing and reimbursed them for the loss of their personal belongings, allowing them to quickly recover and get back on their feet.

Future Implications and Industry Insights

The household insurance industry is continuously evolving to address emerging risks and changing consumer needs. As climate change continues to impact weather patterns, insurers are adapting their policies to provide coverage for a wider range of natural disasters and extreme weather events.

Moreover, the rise of smart home technology and the Internet of Things (IoT) is shaping the future of household insurance. Insurers are exploring ways to leverage data from smart devices to offer more personalized and targeted coverage options. This could include discounts for homes with advanced security systems or incentives for adopting energy-efficient technologies.

FAQ

What is the difference between actual cash value and replacement cost coverage for personal property?

+

Actual cash value coverage reimburses you for the current value of your belongings, considering depreciation. Replacement cost coverage, on the other hand, provides reimbursement for the cost of replacing your items without deducting for depreciation.

How often should I review and update my household insurance policy?

+

It’s recommended to review your policy annually and make updates as necessary. Life changes, such as home renovations, acquiring valuable possessions, or changes in family size, can impact your coverage needs.

Can I bundle my household insurance with other policies to save money?

+

Yes, many insurers offer discounts when you bundle multiple policies, such as homeowners insurance with auto insurance. Bundling can provide cost savings and streamline your insurance needs.