Gap Policy Insurance

Gap insurance, or Guaranteed Asset Protection, is a specialized type of insurance designed to cover the gap between the actual cash value of a vehicle and the remaining balance owed on the loan or lease. This policy is particularly beneficial for individuals who finance or lease their vehicles, ensuring they are not left with a significant financial burden in the event of a total loss or theft. In this comprehensive guide, we will delve into the intricacies of Gap Policy Insurance, exploring its benefits, how it works, and why it is an essential consideration for vehicle owners.

Understanding the Need for Gap Insurance

The automotive industry is constantly evolving, with new models, features, and technologies being introduced regularly. As a result, the value of a vehicle tends to depreciate rapidly, especially during the initial years of ownership. This depreciation can lead to a situation where the outstanding loan amount exceeds the vehicle’s actual cash value, leaving the owner in a negative equity position.

Gap insurance steps in to address this issue, providing a safety net for drivers. It is especially crucial for those who make a low down payment, opt for long loan terms, or lease their vehicles. These scenarios often result in a higher risk of negative equity, as the vehicle's value decreases more rapidly than the loan balance.

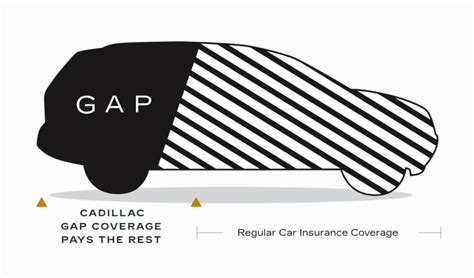

Furthermore, Gap insurance is highly relevant in the context of total loss or theft. In such unfortunate events, standard auto insurance policies typically cover only the vehicle's current market value, which may be significantly less than the outstanding loan amount. This leaves the vehicle owner responsible for the difference, often referred to as the "gap."

How Gap Insurance Works

Gap insurance works by covering the difference between the actual cash value (ACV) of the vehicle and the outstanding balance on the loan or lease. This coverage ensures that the vehicle owner is not left with a financial shortfall in the event of a total loss or theft.

When a vehicle is declared a total loss or stolen, the owner's standard auto insurance policy will typically provide compensation based on the ACV. However, if the ACV is less than the remaining loan balance, the owner is still responsible for paying off the loan. This is where Gap insurance comes into play.

Gap insurance policies are typically offered as an add-on to a standard auto insurance policy. The coverage is often available at the time of purchasing the vehicle, either from the dealership or through an insurance provider. It is essential to note that Gap insurance is a separate policy and is not automatically included in standard auto insurance.

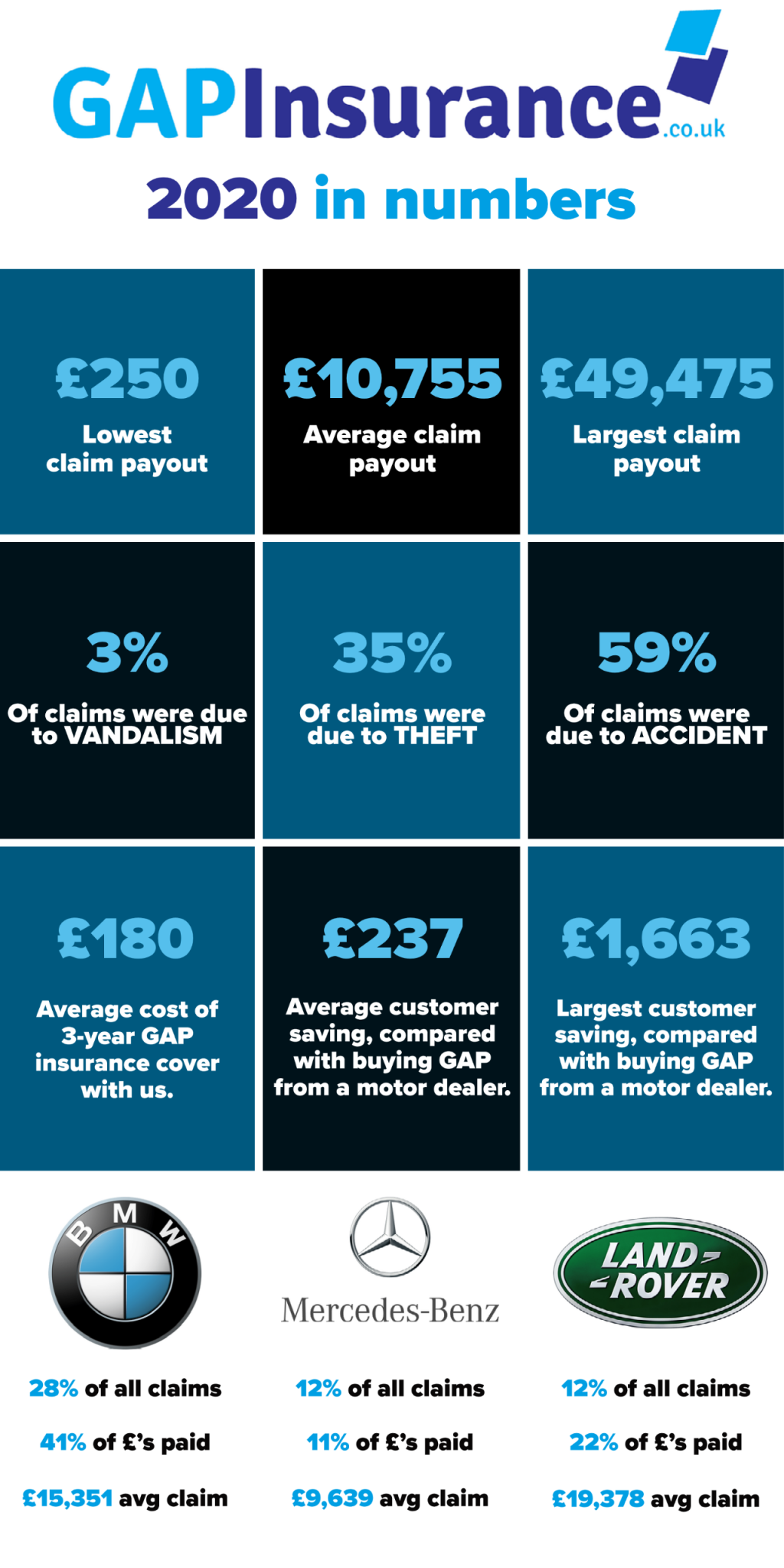

The cost of Gap insurance varies depending on several factors, including the type of vehicle, the loan term, and the coverage amount. Some insurance providers offer Gap insurance as a standalone policy, while others bundle it with other vehicle-related insurance products. It is advisable to shop around and compare quotes to find the most suitable and cost-effective Gap insurance option.

Key Benefits of Gap Insurance

- Financial Protection: Gap insurance provides peace of mind by ensuring that vehicle owners are not financially liable for the difference between the ACV and the outstanding loan balance.

- Rapid Depreciation Coverage: This insurance is particularly beneficial for new vehicles, which tend to depreciate rapidly during the initial years of ownership.

- Lease Protection: Gap insurance is highly advantageous for leaseholders, as it covers the gap between the lease buyout value and the vehicle’s ACV in case of total loss or theft.

- Avoid Negative Equity: By purchasing Gap insurance, vehicle owners can avoid the trap of negative equity, where the loan balance exceeds the vehicle’s value.

- Peace of Mind: With Gap insurance in place, drivers can focus on their journeys without worrying about the financial consequences of a total loss or theft.

When to Consider Gap Insurance

Gap insurance is an essential consideration for several scenarios:

New Vehicle Purchases

If you have recently purchased a new vehicle, especially with a substantial loan amount or a lengthy loan term, Gap insurance is highly recommended. New vehicles tend to depreciate rapidly, and this insurance provides an extra layer of protection against financial loss.

Lease Agreements

Individuals who lease their vehicles should strongly consider Gap insurance. In the event of a total loss or theft, the lease buyout value may exceed the vehicle’s ACV, leaving the lessee responsible for the difference. Gap insurance covers this gap, ensuring a stress-free lease experience.

High-Risk Occupations or Locations

If you work in a high-risk occupation or live in an area prone to theft or natural disasters, Gap insurance becomes even more critical. These factors increase the likelihood of a total loss or theft, making Gap insurance a prudent investment.

Gap Insurance and Loan Term Duration

The duration of your loan term can significantly impact the need for Gap insurance. Longer loan terms often result in higher levels of depreciation, making the vehicle’s value drop faster than the loan balance. In such cases, Gap insurance becomes an essential tool to protect against financial loss.

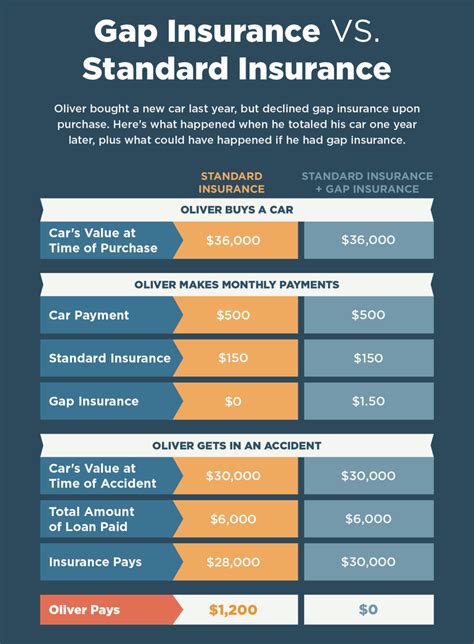

Example Scenario:

Imagine you purchase a new car with a loan term of 60 months (5 years). During the first year, the vehicle’s value may depreciate by 20% or more. If you were to experience a total loss during this period, your standard auto insurance policy would cover the ACV, which is likely significantly less than the remaining loan balance. This is where Gap insurance steps in to cover the difference, ensuring you are not left with a large financial burden.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of Gap insurance, let’s consider a real-world scenario. John recently purchased a new SUV with a loan amount of 40,000 and a loan term of 60 months. After one year, the SUV's value has depreciated to 32,000 due to market conditions and rapid depreciation.

Unfortunately, John's SUV is involved in a severe accident, and it is declared a total loss. His standard auto insurance policy offers compensation based on the ACV, which is $32,000. However, without Gap insurance, John would still owe the remaining loan balance of $38,000, resulting in a financial loss of $6,000.

With Gap insurance in place, John's policy covers the difference between the ACV and the outstanding loan balance. This ensures that he is not held financially responsible for the gap, and he can walk away from the situation without incurring additional debt.

Key Takeaways from the Scenario:

- Gap insurance is crucial for protecting against financial loss in the event of a total loss or theft.

- Rapid depreciation can significantly impact a vehicle’s value, making Gap insurance an essential consideration.

- Without Gap insurance, vehicle owners may be left with a substantial financial burden.

Future Implications and Industry Trends

The automotive industry is experiencing rapid changes, with electric vehicles (EVs) and autonomous driving technologies gaining prominence. These advancements have the potential to influence the landscape of Gap insurance.

As the market for EVs expands, insurance providers are likely to adapt their Gap insurance policies to accommodate the unique depreciation patterns of electric vehicles. Additionally, the rise of autonomous driving technologies may impact the frequency and nature of accidents, further influencing the need for Gap insurance.

Insurance providers are also exploring innovative ways to offer Gap insurance, such as bundling it with other vehicle-related insurance products or providing customizable policies based on individual needs and circumstances.

Key Industry Trends:

- EV Depreciation Considerations: Insurance providers are developing Gap insurance policies that account for the specific depreciation patterns of electric vehicles.

- Autonomous Driving Impact: The advent of autonomous driving may influence the frequency and severity of accidents, potentially impacting the need for Gap insurance.

- Bundled Insurance Packages: Insurance companies are offering Gap insurance as part of comprehensive vehicle insurance packages, providing convenience and cost-effectiveness for consumers.

Conclusion

Gap insurance is an invaluable tool for vehicle owners, offering protection against financial loss in the event of a total loss or theft. With the rapid depreciation of vehicles and the evolving nature of the automotive industry, Gap insurance provides a crucial safety net. By understanding the benefits, how it works, and when to consider it, vehicle owners can make informed decisions to safeguard their financial well-being.

FAQ

How long does Gap insurance coverage last?

+Gap insurance coverage typically lasts for the duration of the loan or lease term. However, some policies may have specific time limits, so it’s essential to review the policy details carefully.

Can I get Gap insurance after purchasing my vehicle?

+In most cases, Gap insurance is available for purchase at the time of buying the vehicle. However, some insurance providers may offer Gap insurance as an add-on policy even after the vehicle purchase. It’s best to check with your insurance provider for their specific offerings.

Does Gap insurance cover all types of vehicles?

+Gap insurance is commonly available for cars, trucks, SUVs, and motorcycles. However, the availability and terms may vary depending on the vehicle type and the insurance provider. It’s advisable to inquire with your insurance provider about the specific coverage options for your vehicle.