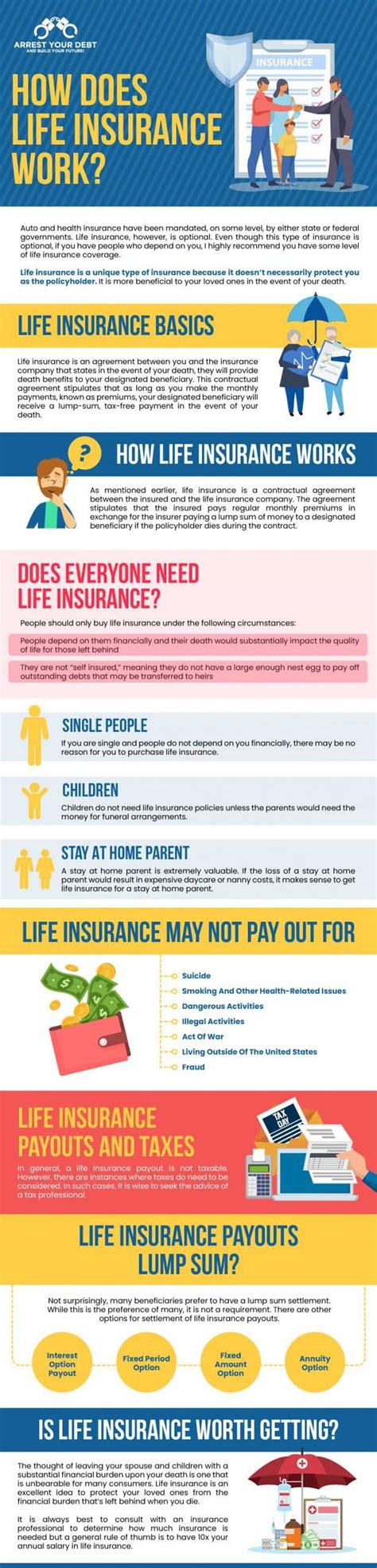

How Does A Life Insurance Work

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. It is a contract between an individual (the policyholder) and an insurance company, where the company promises to pay a sum of money to the designated beneficiaries upon the death of the insured person. Understanding how life insurance works is crucial for anyone looking to protect their family's future and ensure financial stability in times of uncertainty.

The Fundamentals of Life Insurance

Life insurance operates on a simple principle: it provides financial coverage to the insured individual’s beneficiaries in the event of their untimely demise. This coverage can be used to pay for various expenses, including funeral costs, outstanding debts, and long-term financial support for the family. The policyholder pays regular premiums to the insurance company, and in return, they receive a policy that outlines the coverage terms and conditions.

The primary purpose of life insurance is to mitigate the financial burden that arises when a primary income earner passes away. It ensures that the surviving family members can maintain their standard of living and meet their financial obligations without the deceased's income.

Key Components of a Life Insurance Policy

- Policyholder: The individual who purchases the life insurance policy and pays the premiums.

- Insured: The person whose life is insured under the policy. It is usually the policyholder, but it can also be someone else, such as a spouse or a child.

- Beneficiaries: The individuals or entities designated to receive the death benefit from the insurance company upon the insured’s passing. Beneficiaries can be named explicitly or left as flexible options, allowing the policyholder to update their choice over time.

- Premiums: The regular payments made by the policyholder to maintain the life insurance policy. Premiums can be paid monthly, quarterly, semi-annually, or annually, depending on the policy’s terms.

- Death Benefit: The sum of money paid out by the insurance company to the beneficiaries upon the insured’s death. The death benefit can be a fixed amount, a multiple of the insured’s income, or a customized amount based on the policyholder’s needs.

It's important to note that life insurance policies can vary significantly based on the type of policy chosen and the insurance company's terms. There are several types of life insurance policies available, each with its own unique features and benefits.

Types of Life Insurance Policies

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance. Each type serves different purposes and caters to specific needs.

Term Life Insurance

Term life insurance is a straightforward and affordable option that provides coverage for a specified period, known as the “term.” The policy covers the insured individual for a set number of years, typically ranging from 10 to 30 years. If the insured person passes away during the term, the beneficiaries receive the death benefit. However, if the term expires and the insured person is still alive, the policy ends, and no benefits are paid.

Term life insurance is often chosen by individuals who want temporary coverage to protect their family during specific life stages, such as when they have young children or significant financial obligations. It is ideal for covering short-term needs like mortgage payments or providing financial support during the children's education years.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the insured individual’s entire life, as long as the premiums are paid. This type of policy accumulates cash value over time, which can be accessed by the policyholder through loans or withdrawals. Permanent life insurance includes whole life, universal life, and variable life insurance policies.

- Whole Life Insurance: This policy offers a fixed death benefit and guaranteed cash value growth. Premiums remain level throughout the policy's lifetime, providing stability and long-term protection.

- Universal Life Insurance: Universal life policies offer more flexibility than whole life insurance. Policyholders can adjust their premiums and death benefits within certain limits, allowing for greater customization based on changing needs. The cash value component grows based on the policy's investment performance.

- Variable Life Insurance: Variable life insurance policies allow policyholders to invest their premiums in various investment options, such as stocks, bonds, or mutual funds. The death benefit and cash value are directly tied to the performance of these investments, providing potential for higher returns but also carrying more risk.

How Life Insurance Works: The Process

The process of obtaining and utilizing life insurance involves several key steps:

Application and Underwriting

To obtain a life insurance policy, the prospective policyholder must first complete an application. This application typically includes personal information, health history, lifestyle factors, and financial details. The insurance company then assesses the application through a process called underwriting, where they evaluate the risk associated with insuring the individual.

Underwriting involves reviewing the application and potentially conducting medical examinations or ordering medical records. Based on the assessment, the insurance company determines the policyholder's risk category and sets the premium rates accordingly. Individuals with higher health risks may pay higher premiums, while those with lower risks may receive more favorable rates.

Premium Payments

Once the policy is approved, the policyholder is responsible for paying regular premiums to maintain the life insurance coverage. Premium payments are typically made on a set schedule, as agreed upon in the policy contract. Missing premium payments can result in policy lapse, meaning the coverage is no longer in effect.

Benefit Payout

When the insured individual passes away, the beneficiaries must notify the insurance company and provide the necessary documentation, such as a death certificate. The insurance company then verifies the claim and initiates the payout process. The beneficiaries receive the death benefit, which can be a lump sum payment or paid out in installments, depending on the policy terms.

Policy Loans and Withdrawals

In the case of permanent life insurance policies, policyholders have the option to access the cash value through loans or withdrawals. Policy loans allow the policyholder to borrow against the policy’s cash value, with the loan amount and interest charged depending on the policy’s terms. Withdrawals, on the other hand, involve taking out a portion of the cash value, which reduces the policy’s death benefit and cash value accordingly.

Life Insurance as an Investment

While the primary purpose of life insurance is to provide financial protection, certain types of permanent life insurance policies can also serve as investment vehicles. The cash value component of these policies grows over time, and policyholders can use it to build wealth or supplement retirement income.

The investment potential of life insurance policies depends on the type of policy and the insurance company's investment performance. Whole life and universal life policies offer a guaranteed cash value growth rate, providing a stable and predictable investment option. Variable life insurance policies, on the other hand, offer the potential for higher returns but also carry more risk due to their dependence on market performance.

Choosing the Right Life Insurance Policy

Selecting the appropriate life insurance policy involves careful consideration of individual needs and financial goals. Here are some factors to keep in mind when choosing a life insurance policy:

- Coverage Needs: Assess your family's financial needs and determine the appropriate death benefit amount. Consider factors such as outstanding debts, mortgage payments, children's education expenses, and desired lifestyle maintenance.

- Policy Type: Decide between term life insurance and permanent life insurance based on your long-term financial goals. Term life insurance is suitable for temporary coverage needs, while permanent life insurance provides lifelong protection and potential investment opportunities.

- Premium Affordability: Evaluate your budget and determine how much you can comfortably afford to pay in premiums. Term life insurance tends to have lower premiums, making it more accessible for those on a tighter budget.

- Health and Lifestyle Factors: Be aware that your health and lifestyle choices can impact the premium rates and coverage availability. Individuals with health issues or risky hobbies may face higher premiums or policy exclusions.

- Rider Options: Explore additional rider options that can be added to your policy to enhance coverage. Common riders include waiver of premium, which waives premium payments if the insured becomes disabled, and accelerated death benefit, which allows access to a portion of the death benefit if the insured is diagnosed with a terminal illness.

Future of Life Insurance

The life insurance industry is continually evolving to meet the changing needs and expectations of policyholders. Technological advancements and shifting societal trends are shaping the future of life insurance in several ways.

Digital Transformation

The digital age has brought about significant changes in how life insurance is purchased and managed. Insurance companies are increasingly leveraging technology to streamline the application and underwriting process, making it more convenient and efficient for policyholders. Online applications, digital signature capabilities, and automated underwriting systems are becoming the norm, reducing the time and effort required to obtain a policy.

Personalized Coverage

Life insurance companies are also exploring ways to offer more personalized coverage options. By utilizing data analytics and customer insights, insurers can tailor policies to individual needs, providing flexible coverage that adapts to changing life stages and financial circumstances. This approach allows policyholders to have greater control over their coverage and make adjustments as their needs evolve.

Health and Wellness Integration

In recent years, there has been a growing focus on health and wellness in the life insurance industry. Some insurers are incentivizing policyholders to adopt healthier lifestyles by offering discounts or rewards for maintaining a healthy lifestyle. Additionally, the integration of wearable technology and health tracking devices allows insurers to gather real-time health data, potentially leading to more accurate risk assessment and personalized coverage options.

Simplified Policy Language

Recognizing the complexity of life insurance policies, insurers are making efforts to simplify policy language and make it more accessible to consumers. Clear and concise policy documents help policyholders understand their coverage and rights, ensuring they can make informed decisions about their insurance needs.

Conclusion

Life insurance is a vital tool for protecting the financial well-being of your loved ones. By understanding how life insurance works and exploring the various policy options available, you can make informed decisions to secure your family’s future. Whether you choose term life insurance for temporary coverage or permanent life insurance for lifelong protection and investment potential, having a life insurance policy provides peace of mind and ensures financial stability during life’s unexpected events.

Can I change the beneficiaries of my life insurance policy?

+Yes, you can typically change the beneficiaries of your life insurance policy at any time. Most policies allow you to update your beneficiary designations by completing a simple form provided by your insurance company. It’s important to keep your beneficiary information up-to-date to ensure the death benefit is distributed according to your wishes.

What happens if I miss a premium payment?

+Missing a premium payment can have different consequences depending on your policy type. Term life insurance policies may lapse if you miss a payment, meaning your coverage ends. Permanent life insurance policies often have a grace period, allowing you to make the missed payment within a certain timeframe to avoid policy lapse. It’s crucial to stay on top of your premium payments to maintain uninterrupted coverage.

Can I access the cash value of my permanent life insurance policy while I’m still alive?

+Yes, permanent life insurance policies with a cash value component allow policyholders to access the cash value through loans or withdrawals. However, it’s important to note that policy loans accrue interest, and withdrawals reduce the policy’s death benefit and cash value. It’s recommended to consult with a financial advisor before accessing your policy’s cash value to understand the potential impact on your overall financial situation.

How long does it take to receive the death benefit after the insured passes away?

+The time it takes to receive the death benefit can vary depending on several factors, including the insurance company’s processing time, the complexity of the claim, and the completeness of the required documentation. On average, it can take several weeks to a few months to receive the payout. It’s important for beneficiaries to provide all necessary documents promptly to expedite the process.