What Health Insurance Should I Get

When it comes to choosing health insurance, it can be a daunting task with numerous options and considerations. The right health insurance plan can provide peace of mind and financial protection, ensuring you receive the medical care you need without breaking the bank. This comprehensive guide aims to demystify the process and help you make an informed decision tailored to your specific needs.

Understanding Your Health Insurance Options

The health insurance market offers a wide array of plans, each with its own set of features and benefits. Broadly, these plans can be categorized into several types, including:

- HMO (Health Maintenance Organization) plans, which typically offer comprehensive coverage but require you to select a primary care physician (PCP) and use network providers.

- PPO (Preferred Provider Organization) plans, providing more flexibility with a larger network of providers and no need for a PCP, though out-of-network care may be more costly.

- EPO (Exclusive Provider Organization) plans, similar to PPOs but with a more restricted network, often excluding out-of-area care.

- POS (Point of Service) plans, combining features of HMOs and PPOs, offering comprehensive coverage within the network but allowing out-of-network care with higher out-of-pocket costs.

- Indemnity Plans, sometimes referred to as Fee-for-Service plans, offer the most flexibility but typically require you to pay upfront and then submit claims for reimbursement.

Each type of plan comes with its own set of advantages and disadvantages, and the best option for you will depend on your individual needs and preferences.

Evaluating Your Health and Lifestyle

Before selecting a health insurance plan, it's crucial to assess your health and lifestyle. Consider the following factors:

Health Status

If you or your family members have specific health conditions or regularly require medical care, you may benefit from a plan with lower out-of-pocket costs, such as an HMO or a PPO with a lower deductible.

Prescription Medication Needs

Review your prescription medication requirements. Some plans have more comprehensive prescription drug coverage, which can be vital if you rely on medications.

Preventive Care

Many health insurance plans now offer free preventive care services, such as annual check-ups, vaccinations, and screenings. Ensure your plan covers these essential services.

Lifestyle and Location

Consider your lifestyle and the providers you typically use. If you frequently travel or live in an area with limited healthcare options, a plan with a larger network, like a PPO, might be more suitable.

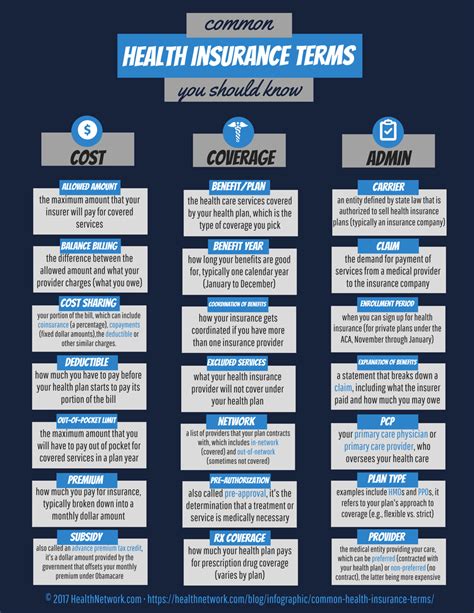

Assessing Your Budget and Financial Needs

Health insurance is a significant financial commitment, so it's important to understand the various costs associated with different plans.

Premiums

Premiums are the regular payments you make to maintain your health insurance coverage. These can vary significantly between plans, with some plans offering lower premiums but higher out-of-pocket costs, and vice versa.

Deductibles and Out-of-Pocket Costs

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Plans with higher deductibles often have lower premiums. Out-of-pocket costs also include co-pays (fixed amounts you pay for services) and coinsurance (a percentage of the cost of a service that you pay).

Maximum Out-of-Pocket Limit

Every health insurance plan has a maximum out-of-pocket limit, which is the most you would pay for covered services in a year. This limit can vary widely, so it's important to understand the potential financial risk.

Cost-Sharing Reduction Plans

If you have a low to moderate income, you may qualify for cost-sharing reduction plans, which lower your out-of-pocket costs. These plans can be particularly beneficial for those who anticipate needing frequent medical care.

Comparing Plan Benefits and Coverage

Health insurance plans offer a range of benefits and coverage options. It's essential to compare these to ensure you're getting the right plan for your needs.

Network of Providers

Review the network of healthcare providers associated with each plan. Ensure that your preferred doctors and specialists are included, and consider the quality and reputation of the providers.

Coverage for Specific Services

Some plans may have limitations on certain services or treatments. For example, mental health coverage, maternity care, or specialized procedures may be subject to different rules or restrictions.

Coverage for Pre-Existing Conditions

Under the Affordable Care Act, health insurance plans cannot deny coverage or charge more for pre-existing conditions. However, it's still important to understand how your plan handles these conditions and the potential costs involved.

Wellness Programs and Incentives

Many health insurance companies now offer wellness programs and incentives to encourage healthy behaviors. These can include discounts on gym memberships, rewards for reaching health goals, or reduced premiums for maintaining a healthy lifestyle.

Utilizing Online Tools and Resources

There are numerous online tools and resources available to help you navigate the complex world of health insurance. These can include:

- Health insurance marketplaces or exchanges, where you can compare plans and prices.

- Online calculators to estimate your out-of-pocket costs and premiums based on your income and health needs.

- Consumer reviews and ratings of health insurance plans and providers.

- Resources from government agencies, such as the Centers for Medicare & Medicaid Services, offering guidance and support.

The Importance of Reading the Fine Print

When selecting a health insurance plan, it's crucial to read the fine print and understand all the terms and conditions. This includes:

- Reviewing the plan's summary of benefits and coverage, which outlines what's included and excluded.

- Understanding the plan's rules for prior authorization, which may be required for certain procedures or treatments.

- Familiarizing yourself with the plan's appeal process in case you have issues with denied claims or services.

Seeking Professional Advice

If you're still unsure about which health insurance plan to choose, consider seeking advice from a professional. This could include:

- An insurance broker or agent who can provide unbiased advice and help you navigate the complexities of health insurance.

- A financial advisor who can assist with understanding the financial implications of different plans.

- A healthcare professional who can offer insights into the medical aspects of different plans and their potential impact on your health.

Frequently Asked Questions

How do I know if I'm eligible for cost-sharing reduction plans?

+Cost-sharing reduction plans are typically available to individuals and families with household incomes between 100% and 250% of the federal poverty level. You can use an online calculator or consult with a healthcare professional to determine your eligibility.

What happens if I don't have health insurance and need medical care?

+In the United States, you are required to have health insurance or pay a penalty. If you don't have insurance and require medical care, you may be responsible for paying the full cost of treatment, which can be extremely expensive. It's important to have health insurance to protect yourself financially.

Are there any government programs that can help with health insurance costs?

+Yes, there are several government programs that can assist with health insurance costs. These include Medicaid, which provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. The Children's Health Insurance Program (CHIP) offers low-cost health coverage to children in families that earn too much to qualify for Medicaid. Additionally, the Affordable Care Act (ACA) provides tax credits and cost-sharing reductions to help make health insurance more affordable for those who qualify.

Choosing the right health insurance plan is a critical decision that can significantly impact your health and financial well-being. By understanding your options, evaluating your needs, and comparing plans, you can make an informed choice. Remember, health insurance is not a one-size-fits-all proposition, so take the time to find the plan that best suits your unique circumstances.