Insurance For Foreign Travel

Planning a trip abroad often involves navigating the complexities of international travel, and one crucial aspect to consider is insurance coverage. While travel insurance is not a legal requirement, it offers essential protection against unforeseen circumstances that can arise during your journey. This comprehensive guide aims to delve into the world of foreign travel insurance, exploring its importance, the various types available, and how to make informed choices to ensure a safe and stress-free adventure.

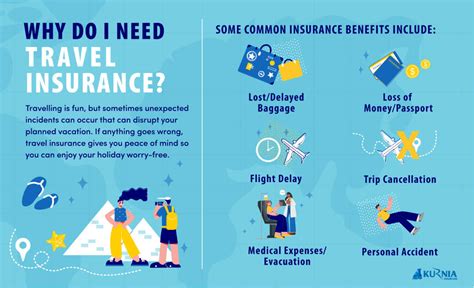

Understanding the Need for Foreign Travel Insurance

When embarking on a trip overseas, it's important to recognize that unexpected events can occur, from medical emergencies to trip cancellations or lost luggage. These incidents can result in significant financial burdens, especially when seeking medical treatment abroad or dealing with the aftermath of a canceled flight. Foreign travel insurance acts as a safety net, providing coverage for such situations and ensuring travelers can focus on enjoying their adventures without worrying about potential financial pitfalls.

The necessity of travel insurance becomes even more apparent when considering the unique challenges of international travel. Unlike domestic trips, international journeys often involve multiple countries, each with its own healthcare system, legal framework, and cultural norms. In such environments, having the right insurance can be a lifesaver, offering assistance and support tailored to the specific needs of the traveler.

Types of Foreign Travel Insurance

The market offers a range of foreign travel insurance options, each designed to cater to specific needs and preferences. Here's an overview of the primary types available:

Single Trip Insurance

As the name suggests, single trip insurance is ideal for those planning a one-off adventure. This type of insurance provides coverage for a specific journey, with policies typically valid for a defined period, such as a week, a month, or up to a year. It's a cost-effective choice for those who travel infrequently and prefer not to commit to long-term policies.

Annual Multi-Trip Insurance

For frequent travelers, annual multi-trip insurance offers a more convenient and often more economical solution. This policy provides coverage for an unlimited number of trips within a year, with each trip typically lasting up to 31 days. It's particularly beneficial for those who take multiple short trips annually, ensuring they're always protected without the hassle of purchasing individual policies for each journey.

Long-Stay Travel Insurance

Long-stay travel insurance is tailored for individuals planning extended trips, typically lasting over 31 days. This type of policy offers comprehensive coverage for the duration of the trip, providing peace of mind for travelers embarking on longer-term adventures, such as gap years, working holidays, or extended business trips.

Backpacker Travel Insurance

Backpacker travel insurance is designed for adventurous travelers who plan to explore multiple countries over an extended period. This policy often includes coverage for activities like hiking, skiing, and even extreme sports, making it an ideal choice for those seeking a more active and diverse travel experience.

Business Travel Insurance

Business travel insurance caters to individuals traveling for work-related purposes. It offers coverage for business-specific needs, such as protecting business equipment and providing coverage for meetings and conferences. This policy ensures that professionals can focus on their work without worrying about potential travel-related risks.

Key Considerations When Choosing Foreign Travel Insurance

Selecting the right foreign travel insurance policy involves careful consideration of several factors. Here are some key aspects to keep in mind:

Destination and Activities

The destination and activities planned for your trip play a significant role in determining the type of insurance needed. For example, if you're planning an adventure-filled trip involving extreme sports, you'll need a policy that covers such activities. Similarly, if you're traveling to a region known for its medical complexities, ensuring your policy offers robust medical coverage is essential.

Duration of Trip

The length of your trip is another crucial consideration. As mentioned earlier, different policies cater to various trip durations. Ensure you choose a policy that aligns with the timeframe of your journey, whether it's a short weekend getaway or an extended expedition.

Medical Coverage

Medical coverage is a critical aspect of any foreign travel insurance policy. It's essential to review the policy's details to understand the extent of medical coverage, including emergency medical treatment, repatriation, and pre-existing condition coverage. Ensure the policy provides adequate coverage for the region you're traveling to and any specific medical needs you may have.

Cancellation and Curtailment

Travel plans can change unexpectedly, and having coverage for trip cancellation or curtailment can provide financial protection. This aspect of insurance is particularly beneficial if you've made significant advance payments for your trip and need to cancel due to unforeseen circumstances.

Baggage and Personal Belongings

Travel insurance policies often include coverage for lost, stolen, or damaged baggage and personal belongings. Review the policy's limits and exclusions to ensure they align with the value of your possessions and the risks you may encounter during your trip.

Travel Delay and Disruption

Delays and disruptions are common in travel, and having coverage for such events can provide much-needed support. Look for policies that offer assistance in the event of flight delays, missed connections, or other travel-related disruptions.

How to Choose the Right Provider

Selecting the right foreign travel insurance provider is crucial to ensuring you receive the best coverage and support. Here are some tips to guide your choice:

Reputation and Financial Stability

Opt for reputable insurance companies with a strong track record in the travel insurance industry. Check their financial stability ratings to ensure they're in a position to honor their commitments, even in the face of significant claims.

Policy Terms and Conditions

Carefully review the policy's terms and conditions, paying close attention to the coverage limits, exclusions, and any specific conditions that may apply. Understand the fine print to avoid any surprises when making a claim.

Customer Service and Support

Assess the provider's customer service reputation and the level of support they offer. Look for companies with a 24/7 assistance hotline and a dedicated team to help with any travel-related emergencies or queries.

Online Reviews and Recommendations

Research online reviews and seek recommendations from fellow travelers to gain insights into the provider's performance and customer satisfaction levels. Real-world experiences can offer valuable perspectives on the provider's reliability and responsiveness.

The Claims Process

Understanding the claims process is essential to making an informed decision about foreign travel insurance. Here's an overview of what to expect:

Making a Claim

When an insured event occurs, you'll need to notify your insurance provider promptly. Most providers have dedicated claims departments, and you can initiate the process by contacting them via phone, email, or their online portal.

Required Documentation

To support your claim, you'll need to provide relevant documentation, such as medical reports, police reports in case of theft or loss, and any other evidence that substantiates your claim. Ensure you retain all original documents and provide clear copies to your insurer.

Assessment and Approval

Once your claim is submitted, the insurer will assess it based on the policy's terms and conditions. This process may involve further communication and the provision of additional information. If your claim is approved, the insurer will process the payment as outlined in the policy.

Appealing a Decision

If your claim is denied, you have the right to appeal the decision. Most insurers have an internal appeals process, and you can follow the steps outlined in your policy to initiate this process. It's important to carefully review the reasons for denial and provide any additional information that may support your appeal.

Frequently Asked Questions

What is the difference between single trip and annual multi-trip insurance?

+Single trip insurance covers a specific journey for a defined period, making it ideal for one-off adventures. Annual multi-trip insurance, on the other hand, provides coverage for an unlimited number of trips within a year, making it more cost-effective for frequent travelers.

Do I need to declare pre-existing medical conditions when purchasing travel insurance?

+Yes, it's important to declare any pre-existing medical conditions when purchasing travel insurance. Failure to disclose such conditions may result in your claim being denied, even if the condition is unrelated to the claim.

Can I extend my travel insurance policy if my trip duration changes?

+In most cases, you can extend your travel insurance policy if your trip duration changes. However, it's essential to notify your insurer promptly to ensure uninterrupted coverage. Additional premiums may apply for the extended period.

What happens if I need to cancel my trip due to unforeseen circumstances?

+If you need to cancel your trip due to unforeseen circumstances, you may be able to claim a refund for your prepaid expenses. However, this is subject to the terms and conditions of your policy, including any applicable excess amounts and the reason for cancellation.

How can I make a claim for lost or stolen luggage during my trip?

+To make a claim for lost or stolen luggage, you'll need to report the incident to the local police and obtain a police report. You'll then need to contact your insurance provider and provide them with the police report and a list of the items lost or stolen, along with their values.

In conclusion, foreign travel insurance is an essential aspect of any international journey, offering protection and peace of mind against a range of potential travel-related risks. By understanding the different types of insurance, key considerations, and the claims process, travelers can make informed decisions to ensure a safe and enjoyable adventure. Remember, the right insurance policy can be a traveler’s best friend, providing support and assistance when it matters most.