Pay Per Mile Auto Insurance

In the realm of automotive insurance, a novel concept known as Pay Per Mile (PPM) insurance has emerged, challenging the traditional insurance models and offering a fresh perspective on how drivers can manage their coverage costs. This innovative approach has captured the attention of many in the industry, prompting a closer examination of its benefits, mechanics, and potential impact on the future of automotive insurance.

Unlike conventional insurance plans that often charge a fixed premium regardless of how much or little a driver uses their vehicle, Pay Per Mile insurance operates on a usage-based model. This means that drivers pay for their insurance based on the actual miles they drive, providing a more personalized and cost-effective solution for those who may not travel frequently or who have specific driving patterns.

The idea behind Pay Per Mile insurance is straightforward: the less you drive, the less you pay. This model is particularly attractive to low-mileage drivers, such as those who work from home, retirees, or individuals with second homes in rural areas, as it offers a fairer pricing structure tailored to their unique driving habits.

How Pay Per Mile Insurance Works

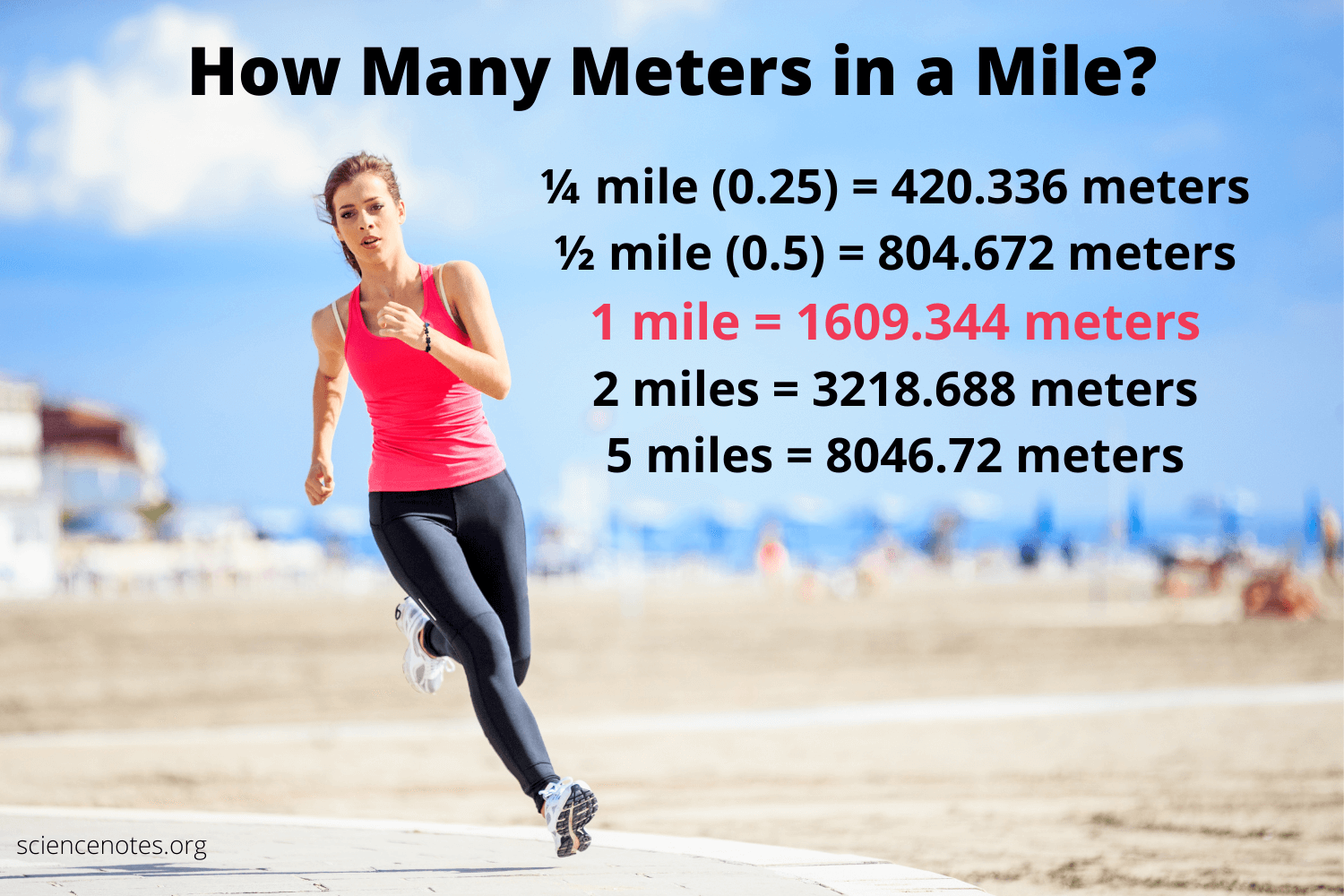

At its core, Pay Per Mile insurance operates through a simple mechanism. Drivers install a small device, often referred to as a telematics device or mileage tracking device, in their vehicle. This device is responsible for accurately recording the miles driven, typically using GPS technology. The collected data is then transmitted to the insurance company, either wirelessly or through manual syncing, providing a precise record of the vehicle's usage.

Once the insurance company receives the mileage data, they calculate the premium based on the agreed-upon rate per mile. This rate can vary depending on various factors, including the driver's location, the type of vehicle, and their individual driving history. Some insurance providers may also offer additional discounts or incentives based on the driver's behavior, such as safe driving practices or reducing mileage during peak hours.

The Benefits of Pay Per Mile Insurance

Pay Per Mile insurance brings a host of benefits to the table, especially for drivers with unique circumstances. Firstly, it offers a significant cost-saving opportunity for low-mileage drivers who may find themselves overpaying under traditional insurance plans. By paying only for the miles they actually drive, these drivers can experience substantial savings, often amounting to hundreds of dollars annually.

Secondly, Pay Per Mile insurance encourages safer driving practices. With the knowledge that their premium is directly tied to their mileage, drivers may be incentivized to drive less, thereby reducing the risk of accidents and contributing to overall road safety. This aspect of the model has garnered interest from both environmental and safety advocates, as it promotes eco-friendly driving behaviors and discourages excessive or unnecessary trips.

Additionally, Pay Per Mile insurance provides a level of flexibility that traditional plans often lack. Drivers can adjust their coverage on-the-go, allowing for greater control over their insurance costs. This is particularly beneficial for those with seasonal jobs, remote workers, or individuals who frequently travel for extended periods, as they can easily adapt their insurance coverage to match their changing driving needs.

Performance Analysis and Industry Impact

The performance of Pay Per Mile insurance has been a subject of interest and study within the automotive insurance industry. Early adopters of this model have reported positive outcomes, with many drivers experiencing substantial savings and a higher level of satisfaction with their insurance provider. These initial successes have led to a growing number of insurance companies exploring and implementing PPM plans, further diversifying the insurance landscape.

| Insurance Provider | Pay Per Mile Rate | Additional Benefits |

|---|---|---|

| Provider A | $0.04 per mile | Discount for safe driving habits |

| Provider B | $0.06 per mile | Mileage-based rewards program |

| Provider C | $0.05 per mile | Reduced rates for electric vehicles |

The impact of Pay Per Mile insurance extends beyond individual savings. It has the potential to reshape the entire insurance industry by forcing a shift towards a more personalized and data-driven approach. This shift could lead to more precise risk assessments, tailored coverage options, and a better understanding of customer needs, ultimately improving the overall customer experience.

Furthermore, the data collected through Pay Per Mile insurance can provide valuable insights into driving behaviors and patterns. Insurance companies can utilize this data to develop more accurate risk models, identify areas for improvement in their offerings, and potentially collaborate with other industries, such as automotive manufacturers, to enhance road safety and vehicle efficiency.

Future Implications and Potential Challenges

As Pay Per Mile insurance continues to gain traction, its future implications are intriguing. This model could pave the way for a more sustainable and equitable insurance system, especially as it aligns with the growing trend of remote work and the increasing adoption of electric vehicles. By offering a fairer pricing structure, it can attract a wider range of drivers, including those who have previously found insurance costs prohibitive.

However, challenges do exist. One of the primary concerns is the potential for privacy invasion, as the mileage tracking devices collect and transmit a vast amount of data. Ensuring the security and privacy of this data will be crucial for the long-term success and acceptance of Pay Per Mile insurance. Additionally, there may be resistance from drivers who are hesitant to have their driving habits monitored, especially if it could lead to increased premiums.

Another challenge lies in the implementation and adoption of the necessary technology. While the concept of Pay Per Mile insurance is straightforward, the practical implementation requires a robust infrastructure and seamless integration with existing insurance systems. This can be a complex and costly endeavor, especially for smaller insurance providers.

Frequently Asked Questions

How does Pay Per Mile insurance compare to traditional insurance plans in terms of cost?

+

Pay Per Mile insurance can offer significant cost savings for low-mileage drivers. The exact savings depend on various factors, including the driver’s location, vehicle type, and driving history. On average, drivers who qualify for Pay Per Mile plans can expect to save up to 40% on their insurance premiums compared to traditional plans.

Is my privacy at risk with Pay Per Mile insurance?

+

Insurance companies prioritize data security and privacy. The mileage tracking devices used in Pay Per Mile insurance are designed to collect only the necessary data for insurance purposes. This data is encrypted and securely transmitted to the insurance provider. However, it is essential to review the privacy policies of your chosen insurance company to ensure your comfort level with the data collection practices.

Can I switch between Pay Per Mile and traditional insurance plans?

+

Yes, you can typically switch between insurance plans as your circumstances change. If you find yourself driving more or less frequently, you may opt to switch between Pay Per Mile and traditional plans to ensure you’re getting the most cost-effective coverage for your current driving habits.

Are there any penalties for driving more miles than expected under Pay Per Mile insurance?

+

Most Pay Per Mile insurance plans are designed to be flexible and understand that driving patterns can change. While there may be instances where driving significantly more miles than expected could lead to a premium adjustment, many providers offer a grace period or allow for estimated mileage adjustments to accommodate unexpected travel needs.

What types of vehicles are eligible for Pay Per Mile insurance?

+

Pay Per Mile insurance is typically available for personal vehicles, including cars, SUVs, and motorcycles. However, the eligibility criteria can vary between insurance providers. Some providers may have restrictions on certain vehicle types or require specific vehicle features, such as GPS capabilities or compatibility with their mileage tracking system.