Coverage A Homeowners Insurance

When it comes to protecting your home and its contents, homeowners insurance is a vital aspect to consider. Coverage A, also known as Dwelling Coverage, is a fundamental component of homeowners insurance policies, providing essential protection for one of the most significant investments many individuals make: their homes. In this comprehensive guide, we will delve into the intricacies of Coverage A, exploring its purpose, what it covers, and how it safeguards homeowners from financial losses due to various perils. We will also discuss the importance of adequate coverage limits and provide insights into choosing the right policy for your specific needs.

Understanding Coverage A: The Foundation of Homeowners Insurance

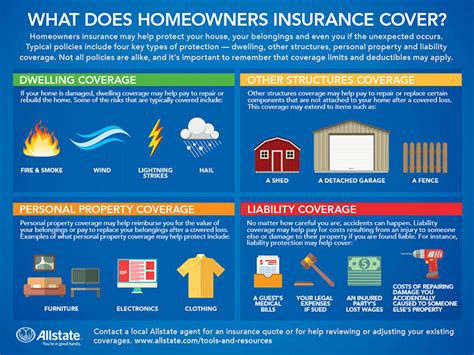

Coverage A, or Dwelling Coverage, is the cornerstone of a homeowners insurance policy. It serves as a financial safety net, ensuring that the physical structure of your home is protected against a wide range of unforeseen events and natural disasters. This coverage extends beyond the mere walls and roof of your house; it encompasses the entire dwelling, including any attached structures such as garages, porches, and decks.

Imagine your home as a castle, and Coverage A is the mighty wall that surrounds it, shielding it from potential harm. Whether it's a sudden fire, a devastating storm, or an unexpected burst pipe, Coverage A is there to help rebuild and repair your home, providing financial stability and peace of mind during challenging times.

What Does Coverage A Include?

Coverage A covers the physical structure of your home, which includes the following key elements:

- Walls and Foundations: From the exterior walls to the interior partitions, Coverage A ensures that your home's structural integrity is protected.

- Roofs: Whether it's a roof replacement after a severe hailstorm or repairs due to aging, Coverage A has you covered.

- Windows and Doors: From broken windows during a storm to damaged doors, this coverage ensures these essential features are protected.

- Plumbing and Electrical Systems: Coverage A extends to the vital systems that keep your home running smoothly, providing coverage for repairs or replacements.

- Attached Structures: Garages, carports, and even certain outdoor features like decks and patios are often included in Coverage A, ensuring comprehensive protection.

It's important to note that Coverage A typically provides coverage for both the dwelling itself and any additional structures on the insured property, offering a robust safety net for your entire residential space.

Determining the Right Coverage Limits: A Crucial Decision

Choosing the appropriate coverage limits for Coverage A is a critical aspect of homeowners insurance. Insufficient coverage limits can leave homeowners vulnerable to significant out-of-pocket expenses in the event of a claim, while excessive limits can result in unnecessary financial burden. It’s a delicate balance that requires careful consideration and assessment of your unique circumstances.

To determine the ideal coverage limits, it's essential to conduct a thorough home insurance needs assessment. This process involves evaluating the current replacement cost of your home, taking into account factors such as the cost of labor, materials, and any unique features or upgrades. Regular updates to this assessment are crucial, especially if you make significant improvements or renovations to your home.

A professional home insurance agent or an experienced home inspector can provide valuable insights and guidance during this assessment process. They can help you understand the specific coverage needs of your home and ensure that your policy limits align with your financial goals and risk tolerance.

Factors Influencing Coverage A Limits

Several factors come into play when determining the appropriate Coverage A limits for your homeowners insurance policy. These factors include:

- Replacement Cost vs. Actual Cash Value: Choosing between replacement cost coverage, which covers the full cost to rebuild your home, and actual cash value coverage, which accounts for depreciation, is a crucial decision. Replacement cost coverage is often recommended to ensure you receive the full value of your home without deductions for depreciation.

- Location and Risk Factors: The geographical location of your home plays a significant role in determining coverage limits. Areas prone to natural disasters or high crime rates may require higher limits to adequately protect against potential losses.

- Home Value and Improvements: The current market value of your home, as well as any recent improvements or renovations, should be considered when setting coverage limits. These factors can significantly impact the cost of rebuilding or repairing your home in the event of a covered loss.

- Personal Assets and Financial Goals: Your overall financial situation and long-term goals should also be taken into account. Ensuring that your Coverage A limits align with your ability to recover financially after a loss is essential.

The Importance of Comprehensive Coverage: Going Beyond the Basics

While Coverage A forms the foundation of your homeowners insurance policy, it’s essential to recognize that it is just one piece of the puzzle. To truly protect your home and its contents, additional coverage options should be considered to create a comprehensive insurance plan tailored to your specific needs.

Additional Coverage Considerations

Here are some key additional coverages to explore:

- Personal Property Coverage: Also known as Coverage C, this coverage protects your personal belongings, such as furniture, electronics, and clothing, from various perils. It ensures that if your possessions are damaged or stolen, you can replace them without incurring significant financial loss.

- Liability Coverage: Coverage E, or Personal Liability Coverage, provides protection in the event that someone is injured on your property or you are found legally responsible for causing harm to others. This coverage safeguards your financial well-being by covering legal expenses and potential settlements.

- Medical Payments Coverage: Coverage F, or Medical Payments Coverage, offers financial assistance for medical expenses incurred by guests or passersby who are injured on your property. This coverage is especially valuable as it can provide quick and efficient medical coverage without the need for a liability claim.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage, often referred to as Coverage G, provides financial assistance for temporary living expenses, such as hotel stays and meals, until you can return to your home.

By exploring these additional coverage options and tailoring them to your specific needs, you can create a robust homeowners insurance policy that provides comprehensive protection for your home and its contents.

Case Study: Real-Life Coverage A Claims

To illustrate the significance of Coverage A and its real-world applications, let’s examine a few case studies where this coverage played a crucial role in helping homeowners recover from significant losses.

Case Study 1: Fire Damage

Imagine a family living in a suburban neighborhood. One fateful night, a kitchen fire breaks out, spreading rapidly and causing extensive damage to their home. The fire department arrives promptly, but the fire has already taken its toll, leaving the family’s dwelling uninhabitable.

In this scenario, Coverage A steps in as a vital lifeline. With the appropriate coverage limits in place, the family can rely on their homeowners insurance policy to cover the cost of repairing or rebuilding their home. The policy provides the necessary funds to replace damaged walls, roofs, and other structural elements, ensuring that the family can restore their home to its pre-loss condition.

Case Study 2: Storm Damage

In a different part of the country, a severe thunderstorm rolls through, bringing heavy winds and hail. A homeowner’s roof sustains significant damage, with shingles torn off and water leaking into the attic. The interior of the home is also affected, with water damage to ceilings and walls.

Coverage A comes to the rescue once again. With adequate coverage limits, the homeowner can file a claim and receive compensation for the necessary repairs. The insurance policy covers the cost of replacing the damaged roof, repairing water-damaged interiors, and ensuring that the home is restored to its original condition.

Case Study 3: Burst Pipe

In a more subtle but no less impactful scenario, a homeowner discovers a burst pipe in their basement. The leak has gone unnoticed for some time, causing extensive water damage to the foundation and walls. The resulting mold and structural issues pose a significant threat to the home’s integrity.

In this case, Coverage A provides the necessary financial support to address the issue. The insurance policy covers the cost of repairing the damaged plumbing, mitigating the mold infestation, and reinforcing the affected structural elements. With Coverage A, the homeowner can restore their home to a safe and habitable condition.

Future Implications and Emerging Trends

As the insurance industry continues to evolve, homeowners can expect to see various trends and innovations shaping the landscape of Coverage A and homeowners insurance as a whole. Staying informed about these developments is crucial for making informed decisions about your insurance coverage.

Emerging Trends in Homeowners Insurance

Here are some key trends to watch out for:

- Technology Integration: The insurance industry is increasingly embracing technology to enhance the customer experience. From digital claim submissions to AI-powered risk assessments, technology is streamlining processes and improving overall efficiency.

- Personalized Coverage Options: Insurers are recognizing the importance of tailoring coverage to individual needs. With advanced data analytics, they can offer more personalized policies, ensuring that homeowners receive the coverage that best suits their unique circumstances.

- Climate Change Adaptation: As climate change continues to impact weather patterns, insurers are adapting their coverage options to address emerging risks. This includes offering enhanced coverage for natural disasters and promoting sustainable building practices to mitigate future losses.

- Smart Home Integration: The rise of smart home technology is influencing insurance coverage. Insurers are exploring ways to leverage smart home devices for risk assessment and mitigation, potentially offering discounts or enhanced coverage to homeowners who adopt these technologies.

By staying informed about these emerging trends, homeowners can make proactive decisions to ensure their insurance coverage remains up-to-date and effective in protecting their homes and assets.

FAQ

What happens if my Coverage A limits are insufficient in the event of a claim?

+If your Coverage A limits are insufficient, you may be responsible for paying out-of-pocket for any costs exceeding your policy limits. It’s crucial to regularly review and update your coverage limits to ensure they align with the current replacement cost of your home.

Can I customize my Coverage A limits based on my home’s unique features or location?

+Absolutely! Coverage A limits can be customized to reflect the specific needs of your home. Factors such as unique architectural features, high-value items, or location-specific risks can influence the coverage limits you choose. Working with an insurance professional can help you tailor your policy accordingly.

Are there any exclusions or limitations to Coverage A that I should be aware of?

+Yes, Coverage A typically has certain exclusions and limitations. It’s important to review your policy carefully to understand what perils are covered and which are excluded. Common exclusions may include damage caused by earthquakes, floods, or nuclear incidents. Understanding these exclusions is crucial for making informed decisions about additional coverage options.