Farm Bureau Texas Insurance

Farm Bureau Insurance Companies are a group of prominent American insurance companies with a strong presence across the United States, offering a range of insurance products to meet the diverse needs of its customers. Among its extensive network, Farm Bureau Texas Insurance stands out as a key player in the Lone Star State, catering to the unique insurance requirements of Texans. This article aims to delve deep into Farm Bureau Texas Insurance, exploring its history, products, services, and the impact it has on the Texas insurance landscape.

A Legacy of Service: Farm Bureau Texas Insurance’s Rich History

Farm Bureau Texas Insurance traces its roots back to 1937, a time when the Great Depression was still casting a long shadow over the United States. It was during this challenging era that a group of forward-thinking Texas farmers and ranchers recognized the critical need for affordable insurance coverage. These pioneers formed the Texas Farm Bureau Mutual Insurance Company, marking the birth of what we now know as Farm Bureau Texas Insurance.

The early days were marked by a spirit of community and mutual support. The company's initial focus was on providing comprehensive insurance solutions to the agricultural community, understanding their unique risks and challenges. Over the years, Farm Bureau Texas Insurance has expanded its horizons, evolving into a full-service insurance provider, catering to a wide range of customers, from individuals and families to businesses of all sizes.

A Comprehensive Range of Insurance Products

Farm Bureau Texas Insurance offers an extensive portfolio of insurance products, ensuring that Texans have access to the coverage they need, when they need it. Here’s a glimpse into some of the key insurance offerings:

Automobile Insurance

Farm Bureau Texas Insurance understands that Texans value their freedom and mobility. The company offers a range of auto insurance options, including liability, collision, comprehensive, and personal injury protection. With customizable coverage options and competitive rates, Farm Bureau Texas Insurance ensures that its customers can find an auto insurance plan that fits their specific needs and budget.

Homeowners Insurance

Texas is known for its diverse landscapes and weather patterns, from the humid coastal regions to the arid deserts. Farm Bureau Texas Insurance recognizes the unique challenges that come with insuring homes in such a varied climate. Their homeowners insurance policies offer protection against a wide range of perils, including fire, windstorm, and hail damage. With additional options for flood and earthquake coverage, Texans can rest easy knowing their homes are protected.

Farm and Ranch Insurance

Given its agricultural roots, Farm Bureau Texas Insurance has a deep understanding of the specific risks faced by farmers and ranchers. Their farm and ranch insurance policies are tailored to protect agricultural operations, covering everything from livestock and crops to equipment and structures. With comprehensive coverage and specialized endorsements, Farm Bureau Texas Insurance ensures that the agricultural community can focus on their operations with peace of mind.

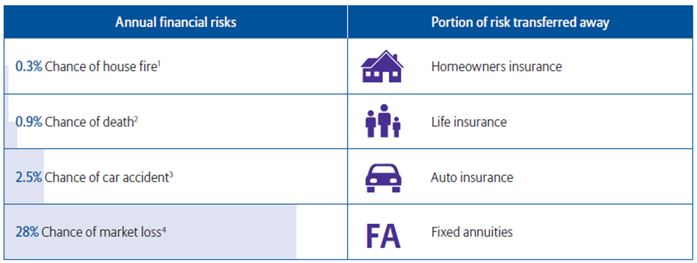

Life Insurance and Annuities

Farm Bureau Texas Insurance recognizes the importance of financial security and planning for the future. Their life insurance policies offer a range of options, from term life insurance to permanent life insurance, including whole life and universal life policies. Additionally, Farm Bureau Texas Insurance offers a variety of annuity products, providing customers with a stable source of income during retirement.

Exceptional Customer Service and Claims Support

At Farm Bureau Texas Insurance, customer service is a top priority. The company is dedicated to providing prompt, efficient, and friendly service to its policyholders. Whether it’s assisting with policy inquiries, offering advice on coverage options, or guiding customers through the claims process, Farm Bureau Texas Insurance aims to make the insurance experience as seamless as possible.

When it comes to claims, Farm Bureau Texas Insurance understands that timely and efficient resolution is crucial. Their claims team is highly trained and experienced in handling a wide range of insurance claims, from minor incidents to major catastrophes. With a network of preferred repair facilities and a commitment to fair and transparent claims handling, Farm Bureau Texas Insurance strives to make the claims process as stress-free as possible for its customers.

Community Engagement and Giving Back

Farm Bureau Texas Insurance is deeply rooted in the communities it serves. The company believes in giving back and making a positive impact on the lives of Texans. Through various initiatives and partnerships, Farm Bureau Texas Insurance supports local charities, educational programs, and community development projects. Their commitment to community engagement extends beyond financial contributions, with employees actively participating in volunteer activities and charitable events.

Educational Initiatives

Farm Bureau Texas Insurance recognizes the importance of financial literacy and insurance education. The company offers a range of educational resources and programs to help Texans understand their insurance options and make informed decisions. From online tools and resources to community workshops and seminars, Farm Bureau Texas Insurance is dedicated to empowering Texans with the knowledge they need to protect what matters most.

A Bright Future: Farm Bureau Texas Insurance’s Forward-Looking Approach

As the insurance landscape continues to evolve, Farm Bureau Texas Insurance remains committed to staying ahead of the curve. The company is dedicated to embracing innovation and technology to enhance the customer experience. From digital tools that simplify the insurance journey to advanced data analytics that improve risk assessment and claims handling, Farm Bureau Texas Insurance is continuously evolving to meet the changing needs of its customers.

Moreover, Farm Bureau Texas Insurance is committed to sustainability and environmental stewardship. The company is actively working to reduce its environmental impact, from adopting eco-friendly practices in its operations to supporting initiatives that promote sustainability and conservation. By aligning its business practices with environmental responsibilities, Farm Bureau Texas Insurance is setting a positive example for the insurance industry.

Conclusion: Farm Bureau Texas Insurance, a Trusted Partner for Texans

Farm Bureau Texas Insurance has a long and proud history of serving the people of Texas. With a comprehensive range of insurance products, exceptional customer service, and a commitment to community engagement, Farm Bureau Texas Insurance has earned its place as a trusted partner for Texans. As the company continues to innovate and adapt, it remains dedicated to providing the protection and peace of mind that Texans deserve.

How can I contact Farm Bureau Texas Insurance for inquiries or claims?

+Farm Bureau Texas Insurance offers various channels for communication. You can reach out to them via phone, email, or through their website’s contact form. Additionally, they have a network of local agents who are available to provide personalized assistance.

What sets Farm Bureau Texas Insurance apart from other insurance providers in the state?

+Farm Bureau Texas Insurance’s unique history and deep roots in the agricultural community set them apart. Their understanding of the specific needs and challenges of Texans, coupled with their comprehensive range of insurance products and exceptional customer service, make them a preferred choice for many.

How can I get a quote for Farm Bureau Texas Insurance’s products and services?

+Getting a quote from Farm Bureau Texas Insurance is easy. You can request a quote online through their website, or you can contact a local agent who can provide you with a personalized quote based on your specific needs and circumstances.