Best Health Insurance For Maternity

Choosing the right health insurance coverage is crucial, especially when considering important life events such as pregnancy and maternity care. With the rising costs of healthcare and the unique needs associated with pregnancy, selecting an insurance plan that provides comprehensive maternity benefits can make a significant difference in your overall experience and financial well-being.

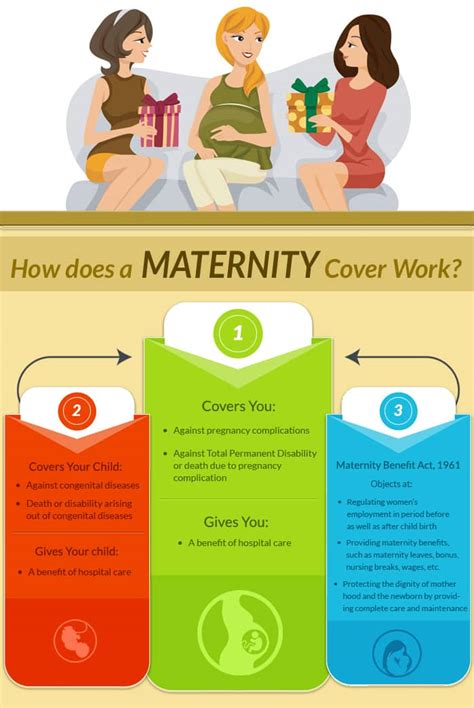

Understanding Maternity Benefits in Health Insurance

Maternity benefits are an essential component of health insurance plans, designed to cover the medical expenses associated with pregnancy, childbirth, and postnatal care. These benefits typically include prenatal care, labor and delivery, and newborn care. However, the extent of coverage can vary significantly between insurance providers and plan types.

When evaluating health insurance plans for maternity coverage, it's crucial to assess the following factors:

- Pregnancy-Related Services: Look for plans that cover a wide range of services, including prenatal check-ups, ultrasound scans, genetic testing, and specialized care for high-risk pregnancies.

- Delivery Options: Ensure the plan covers your preferred delivery method, whether it's a hospital birth, home birth, or a birth center. Also, check for coverage of potential complications during childbirth.

- Postpartum Care: Postnatal care is vital for both mother and baby. Verify that the plan covers postpartum visits, breastfeeding support, and mental health services for new mothers.

- Newborn Coverage: Inquire about the coverage period for newborns. Some plans offer coverage from birth, while others may require a separate enrollment process for the baby.

- Prescription Drugs: Prescription medications are often necessary during pregnancy and the postpartum period. Check if the plan covers common prenatal vitamins and postpartum medications.

Top Health Insurance Providers for Maternity Care

Several health insurance providers offer exceptional maternity benefits, ensuring that expectant mothers receive the necessary care throughout their pregnancy journey. Here’s an overview of some of the best providers in this category:

Aetna

Aetna’s health insurance plans are renowned for their comprehensive maternity coverage. The plans typically include:

- Prenatal Care: Coverage for regular check-ups, blood tests, and ultrasounds.

- Delivery: Hospital stays, cesarean sections, and pain management during labor.

- Postpartum Care: Breastfeeding support, postpartum depression screening, and newborn care up to 30 days.

- Wellness Programs: Aetna’s programs offer resources and guidance for a healthy pregnancy, including nutrition advice and exercise routines.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a leading provider of health insurance, and its plans often stand out for their robust maternity benefits. BCBS plans typically cover:

- Pregnancy-Related Services: Prenatal care, genetic testing, and specialized care for high-risk pregnancies.

- Delivery Options: Hospital births, birthing center deliveries, and home births.

- Postpartum Care: Breastfeeding support, lactation consultant visits, and postpartum mental health services.

- Newborn Care: BCBS plans often provide coverage for newborns for the first 30 days without additional enrollment.

UnitedHealthcare

UnitedHealthcare offers a range of health insurance plans that prioritize maternity care. Their plans typically include:

- Comprehensive Prenatal Care: Coverage for routine check-ups, laboratory tests, and ultrasound scans.

- Delivery and Postpartum: Hospital stays, anesthesia during delivery, and postpartum visits for up to 60 days.

- Newborn Care: UnitedHealthcare plans often cover newborn expenses for the first 31 days after birth.

- Maternity Resources: UnitedHealthcare provides access to educational resources, support groups, and online tools to help manage pregnancy and childbirth.

Cigna

Cigna’s health insurance plans emphasize preventative care, making them an excellent choice for expectant mothers. Here’s what their maternity benefits typically entail:

- Prenatal Care: Coverage for routine visits, laboratory tests, and prenatal vitamins.

- Delivery: Hospital stays, cesarean sections, and pain management options.

- Postpartum Care: Breastfeeding support, postpartum depression screening, and mental health services.

- Newborn Care: Cigna plans often provide coverage for newborns for the first 30 days.

Maximizing Maternity Benefits

To make the most of your health insurance’s maternity benefits, consider the following tips:

- Understand Your Plan: Familiarize yourself with the specifics of your insurance plan, including coverage limits, exclusions, and any required pre-authorizations.

- Choose In-Network Providers: Opt for in-network healthcare providers to minimize out-of-pocket expenses. Check if your chosen hospital and doctor are in your insurance network.

- Plan Early: Reach out to your insurance provider before getting pregnant to understand your coverage and any necessary steps to ensure a smooth pregnancy journey.

- Attend Regular Check-Ups: Prenatal care is vital for a healthy pregnancy. Attend all recommended check-ups and screenings to monitor your health and the baby’s development.

- Consider Wellness Programs: Many insurance providers offer wellness programs specifically for pregnant women. These programs can provide valuable resources and support during your pregnancy.

Conclusion: Empowering Expectant Mothers

Choosing the right health insurance plan with comprehensive maternity benefits is a crucial step in ensuring a healthy and financially manageable pregnancy journey. By understanding the available options and the specific benefits offered by top providers, expectant mothers can make informed decisions to prioritize their well-being and that of their newborns.

Remember, while this article provides an overview of some excellent options, it's always recommended to consult with insurance experts and healthcare professionals to tailor your coverage to your unique needs.

Frequently Asked Questions

How much does maternity coverage typically cost in health insurance plans?

+The cost of maternity coverage can vary significantly depending on the insurance provider, the specific plan, and individual factors like age and location. On average, plans with comprehensive maternity benefits may have slightly higher premiums compared to those with basic coverage. However, the long-term financial benefits and peace of mind they offer during pregnancy can outweigh the increased costs.

Are there any health insurance plans that cover fertility treatments?

+Yes, some health insurance plans do offer coverage for fertility treatments, including in-vitro fertilization (IVF) and other assisted reproductive technologies. However, the extent of coverage can vary, and not all plans include these benefits. It’s crucial to carefully review the plan details or consult with an insurance expert to understand the specific coverage for fertility treatments.

Can I switch health insurance plans during pregnancy?

+Switching health insurance plans during pregnancy is possible, but it may come with challenges. If you’re switching to a plan with different network providers, you may need to find new healthcare professionals who accept your new insurance. Additionally, pre-existing conditions, including pregnancy, may not be covered immediately upon switching plans. It’s essential to carefully review the new plan’s coverage and consult with insurance experts to ensure a smooth transition.

Are there any discounts or incentives for enrolling in health insurance plans with maternity benefits?

+Some health insurance providers offer discounts or incentives for enrolling in plans with maternity benefits. These incentives can include reduced premiums, waivers for certain deductibles during pregnancy, or access to exclusive maternity-focused wellness programs. It’s worth exploring these options and comparing different plans to find the best value for your needs.

What should I do if I’m denied coverage for a pregnancy-related expense?

+If you’re denied coverage for a pregnancy-related expense, it’s important to first review your insurance policy to understand the specific reasons for the denial. You may need to provide additional documentation or medical records to support your claim. If the denial still stands, you can seek assistance from insurance experts or consumer advocacy groups who can guide you through the appeals process. It’s crucial to act promptly and persistently to ensure you receive the coverage you’re entitled to.