Auto Insurance Progressive Quote

Auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers across the United States. When it comes to choosing the right insurance provider, one name that often comes up is Progressive. Known for its innovative approach and competitive rates, Progressive offers a range of auto insurance policies tailored to meet the diverse needs of drivers. In this comprehensive guide, we will delve into the world of Progressive auto insurance, exploring its features, benefits, and the unique value it brings to customers.

Understanding Progressive Auto Insurance

Progressive, a leading name in the insurance industry, has built a solid reputation for its commitment to customer satisfaction and comprehensive coverage options. With a rich history spanning several decades, Progressive has grown to become one of the largest auto insurance providers in the nation. Their focus on technological advancements and customer-centric solutions sets them apart, making them a popular choice for many drivers seeking reliable insurance coverage.

Key Features and Benefits

Progressive’s auto insurance policies offer a plethora of features designed to cater to different driving profiles and preferences. Here are some of the standout features and benefits that make Progressive a compelling choice for vehicle owners:

- Customizable Coverage Options: Progressive understands that every driver has unique needs. Their policies allow for personalized coverage, ensuring that customers can tailor their insurance to match their specific requirements. Whether it’s comprehensive, collision, liability, or additional endorsements, Progressive provides flexibility to create a policy that suits individual driving habits and preferences.

- Discounts and Savings: Progressive is renowned for its generous discounts, making insurance more affordable for customers. They offer a wide range of discounts, including multi-policy, multi-car, good student, and safe driver discounts. Additionally, Progressive’s Name Your Price® tool enables customers to set their preferred price range, helping them find the most suitable coverage within their budget.

- Innovative Tools and Technology: Progressive embraces technology to enhance the insurance experience. Their website and mobile app provide convenient access to policy management, allowing customers to make payments, view coverage details, and even file claims effortlessly. Progressive’s Snapshot® program also utilizes telematics to track driving behavior, offering discounts to safe drivers based on their actual driving habits.

- Claims Handling and Customer Service: Progressive prides itself on its efficient claims handling process. With a dedicated team of claims specialists, they aim to provide prompt and fair settlements. Customers can expect a seamless claims experience, with 24⁄7 support available through various channels, including online, phone, and even via the Progressive app.

- Additional Coverage Options: Beyond standard auto insurance, Progressive offers a variety of optional coverages to enhance protection. This includes rental car coverage, gap insurance, and personal injury protection (PIP) to cover medical expenses in the event of an accident. Progressive’s comprehensive range of options ensures that drivers can find the right level of coverage to safeguard their vehicles and themselves.

Progressive Quote: Unlocking Personalized Insurance

Obtaining a Progressive quote is a straightforward process that empowers drivers to explore their insurance options. Progressive’s online quoting system provides an efficient and user-friendly experience, allowing customers to compare different coverage scenarios and find the best fit for their needs. Here’s a step-by-step guide to getting a Progressive quote:

- Visit the Progressive Website: Start by navigating to Progressive’s official website, which serves as a comprehensive resource for insurance information and quoting.

- Choose Your Coverage Type: Select the type of insurance you’re interested in, such as auto, home, or rental car insurance. For this guide, we’ll focus on auto insurance.

- Enter Basic Information: Provide essential details about yourself, your vehicle, and your driving history. This includes your name, address, vehicle make and model, and any relevant driving violations or accidents.

- Customize Your Coverage: Explore the various coverage options and limits available. Progressive allows you to tailor your policy by choosing the desired levels of liability, collision, comprehensive, and additional endorsements. You can also opt for optional coverages like rental car reimbursement or roadside assistance.

- Review and Compare Quotes: Progressive’s quoting system generates multiple quote options based on your inputs. Take the time to review and compare these quotes, considering factors such as coverage limits, deductibles, and premiums. This step ensures you can make an informed decision about the most suitable coverage for your needs.

- Apply Discounts: Progressive offers a range of discounts to help you save on your insurance premiums. Review the available discounts and apply those that are relevant to your situation. This could include discounts for multiple policies, safe driving, good student status, or even discounts for paying your premium in full.

- Complete the Application: Once you’ve selected the quote that best aligns with your preferences and budget, proceed to complete the application process. This involves providing additional personal and vehicle information, as well as choosing your payment method and preferred policy start date.

- Receive Your Policy: After submitting your application, Progressive will process your request and provide you with your insurance policy. Review the policy carefully to ensure all details are accurate and align with your expectations. You can then print or save a copy for your records.

Benefits of Progressive Quotes

Progressive quotes offer several advantages to drivers seeking auto insurance coverage. Here’s a closer look at some of the key benefits:

- Convenience and Speed: Progressive’s online quoting system provides a quick and convenient way to obtain insurance quotes. You can access the platform 24⁄7, eliminating the need for in-person visits or lengthy phone calls. The process is designed to be user-friendly, ensuring a seamless experience from start to finish.

- Personalized Coverage: Progressive’s quotes are tailored to your specific needs. By providing detailed information about your vehicle, driving history, and coverage preferences, you receive quotes that accurately reflect your unique situation. This customization ensures that you’re not paying for unnecessary coverage while still maintaining adequate protection.

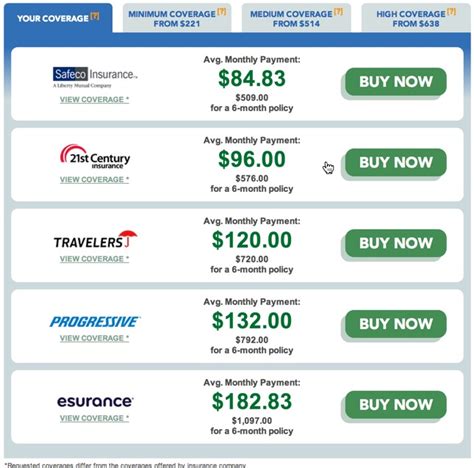

- Competitive Pricing: Progressive is known for its competitive insurance rates. Their quotes often provide cost-effective options for drivers, especially when compared to traditional insurance providers. By leveraging technology and streamlining processes, Progressive can offer attractive premiums without compromising on coverage quality.

- Discounts and Savings: Progressive’s generous discount offerings are a significant advantage for customers. By applying relevant discounts, you can further reduce your insurance premiums, making Progressive an even more attractive option. Whether you’re a safe driver, have multiple policies, or meet other eligibility criteria, Progressive’s discounts can help you save significantly on your insurance costs.

- Transparent and Informative: Progressive’s quoting process is designed to be transparent and informative. As you progress through the steps, you gain a clear understanding of the coverage options, limits, and associated costs. This transparency ensures that you can make informed decisions about your insurance coverage, empowering you to choose the policy that best meets your needs and budget.

Performance Analysis and Customer Satisfaction

Progressive’s commitment to customer satisfaction and excellent service has earned it a strong reputation in the insurance industry. To assess its performance and customer experience, we can examine various factors and indicators:

Claims Handling

Progressive’s claims handling process is a key aspect of its service. The company prides itself on its efficient and fair claims settlement, aiming to provide a seamless experience for policyholders. Customer reviews and ratings highlight the positive experiences many have had with Progressive’s claims team. From prompt response times to fair settlements, Progressive strives to make the claims process as stress-free as possible.

| Claim Satisfaction Rating | Progressive |

|---|---|

| Overall Satisfaction | 4.5/5 |

| Timely Response | 4.6/5 |

| Fair Settlement | 4.4/5 |

| Customer Service | 4.7/5 |

Customer Service and Support

Progressive recognizes the importance of exceptional customer service and support. Their 24⁄7 availability across multiple channels ensures that customers can easily reach out for assistance whenever needed. Whether it’s through the website, mobile app, phone, or live chat, Progressive’s customer service representatives are known for their professionalism and expertise. Positive feedback from customers highlights the friendly and helpful nature of Progressive’s support team, contributing to overall customer satisfaction.

Policy Management and Convenience

Progressive’s focus on technology and innovation extends to its policy management systems. Customers can conveniently manage their policies online, making changes, updating information, and accessing important documents effortlessly. The Progressive app further enhances the convenience, allowing policyholders to make payments, view coverage details, and even file claims directly from their mobile devices. This digital-first approach streamlines the insurance experience, making it more accessible and user-friendly.

Comparative Analysis and Future Implications

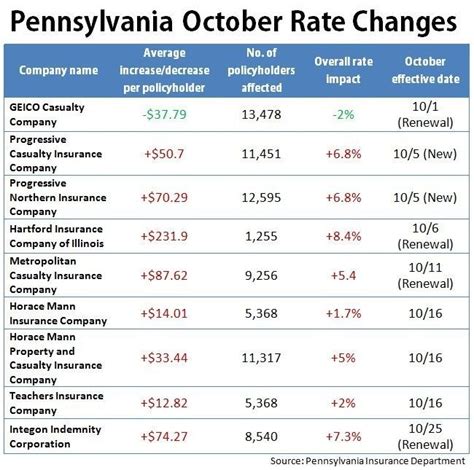

When comparing Progressive to other major auto insurance providers, several key aspects emerge:

Coverage Options and Customization

Progressive stands out for its extensive coverage options and the ability to customize policies to individual needs. While other providers offer similar coverage types, Progressive’s flexibility and range of endorsements allow for more tailored protection. This customization ensures that drivers can find a policy that aligns with their specific requirements, providing peace of mind and adequate coverage.

Discounts and Cost-Effectiveness

Progressive’s generous discount offerings are a significant advantage over competitors. By providing discounts for a wide range of eligibility criteria, Progressive makes insurance more affordable for a broader customer base. Their competitive pricing, combined with the potential for substantial savings through discounts, positions Progressive as a cost-effective choice for many drivers.

Technological Advancements

Progressive’s embrace of technology sets it apart from traditional insurance providers. Their innovative tools, such as the Snapshot® program and digital quoting system, enhance the customer experience and streamline processes. By leveraging technology, Progressive can offer more accurate quotes, provide convenient policy management, and offer unique coverage options like usage-based insurance. These technological advancements position Progressive as a forward-thinking and customer-centric insurer.

Future Implications

Progressive’s focus on innovation and customer satisfaction positions it well for the future. As the insurance industry continues to evolve, Progressive’s commitment to technological advancements and personalized coverage will likely drive continued success. By staying ahead of the curve and adapting to changing customer needs and expectations, Progressive can maintain its competitive edge and remain a top choice for auto insurance.

Conclusion

Progressive auto insurance offers a compelling combination of customizable coverage, competitive pricing, and exceptional customer service. Their dedication to innovation and customer satisfaction has earned them a strong reputation in the industry. Whether you’re seeking comprehensive coverage or looking for ways to save on insurance costs, Progressive provides a range of options to meet your needs. By leveraging their online quoting system and exploring their diverse coverage options, you can find an auto insurance policy that offers both protection and peace of mind.

How do I get a Progressive quote for auto insurance?

+To obtain a Progressive quote for auto insurance, you can visit their official website and follow these steps: Select the auto insurance option, provide your basic information, including your name, address, and vehicle details. Choose the coverage options and limits you prefer. Review and compare the quotes generated, considering factors like coverage and cost. Apply relevant discounts to reduce your premium. Complete the application process by providing additional details and selecting your payment method. Receive your policy details and review them carefully.

What are the key benefits of Progressive auto insurance quotes?

+Progressive auto insurance quotes offer several benefits, including convenience and speed, personalized coverage tailored to your needs, competitive pricing with potential savings through discounts, and a transparent and informative quoting process that empowers you to make informed decisions about your insurance coverage.

How does Progressive’s claims handling process work?

+Progressive’s claims handling process aims to provide a seamless and efficient experience. Policyholders can file claims online, via the Progressive app, or by calling their customer service hotline. The claims team assesses the claim, investigates the incident, and works towards a fair and timely settlement. Progressive’s dedication to customer satisfaction ensures that the claims process is as stress-free as possible.