Auto Insurance Direct

The Ultimate Guide to Auto Insurance: Navigating Coverage and Policies with Auto Insurance Direct

In the vast landscape of insurance providers, Auto Insurance Direct stands out as a trusted partner for individuals seeking comprehensive auto insurance coverage. This guide aims to provide an in-depth exploration of the services, benefits, and unique offerings of Auto Insurance Direct, empowering you to make informed decisions about your automotive insurance needs.

Auto Insurance Direct has established itself as a leading name in the insurance industry, known for its dedication to customer satisfaction and innovative approaches to coverage. With a focus on tailoring policies to individual requirements, the company has become a go-to source for drivers seeking both affordability and extensive protection.

Understanding Auto Insurance Direct's Comprehensive Coverage Options

Auto Insurance Direct offers a diverse range of coverage options, designed to address the unique needs of its diverse clientele. From liability insurance to comprehensive and collision coverage, the company ensures that drivers can select the protection that aligns with their driving habits and preferences.

Liability Coverage

Liability insurance is a cornerstone of any auto insurance policy, and Auto Insurance Direct provides multiple tiers of this coverage. This type of insurance safeguards policyholders against financial losses arising from accidents they cause, covering both bodily injury and property damage claims. Auto Insurance Direct offers liability limits that cater to a wide range of budgets and risk profiles, ensuring that drivers can select the level of protection that best suits their needs.

| Liability Coverage Type | Coverage Details |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for individuals injured in an accident caused by the policyholder. |

| Property Damage Liability | Provides compensation for damage to other vehicles or property in an accident caused by the policyholder. |

Comprehensive and Collision Coverage

In addition to liability insurance, Auto Insurance Direct offers comprehensive and collision coverage options. These types of insurance provide protection for the policyholder's own vehicle in a variety of scenarios.

- Comprehensive Coverage: This insurance covers damage to the vehicle resulting from non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals. It offers peace of mind for drivers concerned about unexpected events that could damage their vehicle.

- Collision Coverage: Specifically designed for accidents, this insurance covers the cost of repairs or replacement of the policyholder's vehicle in the event of a collision, regardless of fault. It ensures that drivers can get their vehicle back on the road quickly and efficiently.

The Benefits of Choosing Auto Insurance Direct

Auto Insurance Direct stands out in the market for its commitment to customer service and its range of additional benefits, which include:

Customizable Policies

Auto Insurance Direct understands that every driver has unique needs and circumstances. That's why the company offers highly customizable policies, allowing policyholders to tailor their coverage to their specific requirements. Whether it's adjusting liability limits, adding endorsements for specific coverage needs, or selecting additional services like rental car reimbursement, Auto Insurance Direct empowers drivers to create a policy that fits their lifestyle perfectly.

Discounts and Savings

The company is dedicated to providing affordable insurance solutions. To this end, Auto Insurance Direct offers a variety of discounts to help policyholders save on their premiums. These discounts include:

- Multi-Policy Discount: Policyholders who bundle their auto insurance with other types of insurance, such as homeowners or renters insurance, can often qualify for significant savings.

- Good Driver Discount

- Safe Vehicle Discount: Vehicles equipped with advanced safety features, such as anti-lock brakes or collision avoidance systems, may be eligible for discounted rates.

- Pay-in-Full Discount: Policyholders who choose to pay their premiums in full at the beginning of the policy term often receive a discount as a reward for their commitment.

Excellent Customer Service

Auto Insurance Direct prides itself on its exceptional customer service. The company's dedicated team of professionals is always available to assist policyholders with any questions or concerns they may have. Whether it's helping to navigate the claims process, offering advice on coverage options, or providing assistance in the event of an accident, Auto Insurance Direct ensures that its customers receive the support they need, when they need it.

Auto Insurance Direct's Innovative Features and Add-Ons

In addition to its core coverage options, Auto Insurance Direct offers a range of innovative features and add-ons that enhance the overall customer experience and provide additional peace of mind.

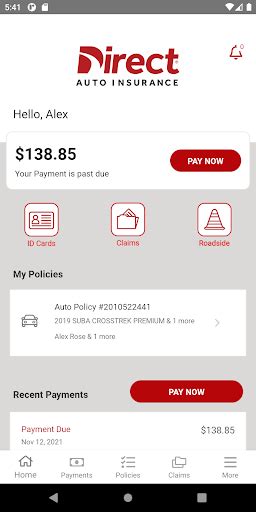

Digital Claims Management

Auto Insurance Direct has embraced digital technology to streamline the claims process. Policyholders can now file claims online or through the company's mobile app, uploading photos and providing details of the incident directly from their device. This digital approach not only simplifies the claims process but also accelerates the timeline for resolving claims, ensuring that policyholders receive their payouts quickly and efficiently.

Roadside Assistance

Auto Insurance Direct understands that breakdowns and emergencies can happen anytime, anywhere. That's why the company offers optional roadside assistance coverage, providing policyholders with peace of mind on the road. This add-on service includes towing, flat tire changes, jump starts, and other emergency services, ensuring that drivers can get back on the road with minimal disruption to their day.

Usage-Based Insurance (UBI)

Auto Insurance Direct is at the forefront of the UBI movement, offering policyholders the opportunity to save on their premiums based on their driving behavior. Through the use of telematics devices or smartphone apps, the company tracks driving habits such as miles driven, time of day, and braking and acceleration patterns. Policyholders who demonstrate safe driving habits may be eligible for discounted rates, making auto insurance more affordable and incentivizing responsible driving behavior.

Auto Insurance Direct's Commitment to Community and Sustainability

Beyond its focus on customer service and innovative coverage options, Auto Insurance Direct is dedicated to making a positive impact on the communities it serves and the environment. The company actively engages in initiatives that promote sustainability and social responsibility.

Sustainable Practices

Auto Insurance Direct is committed to reducing its environmental footprint. The company has implemented a range of sustainable practices, including paperless billing and digital document management, to minimize its impact on the planet. Additionally, Auto Insurance Direct encourages policyholders to adopt eco-friendly driving habits, such as carpooling and utilizing public transportation, as part of its ongoing efforts to promote sustainability.

Community Engagement

Auto Insurance Direct believes in giving back to the communities where its policyholders live and work. The company actively supports local initiatives and charities, sponsoring events and organizations that promote education, health, and social welfare. By engaging with the community, Auto Insurance Direct strengthens its commitment to social responsibility and makes a positive impact on the lives of its policyholders and their neighbors.

The Future of Auto Insurance with Auto Insurance Direct

As the auto insurance industry continues to evolve, Auto Insurance Direct remains at the forefront of innovation and customer-centric practices. The company's dedication to staying abreast of industry trends and technological advancements ensures that policyholders can access the latest coverage options and benefit from the most efficient claims processes.

With a focus on continuous improvement, Auto Insurance Direct is poised to deliver even more comprehensive and personalized insurance solutions in the future. Whether it's through expanded coverage options, further enhancements to its digital platforms, or the introduction of new services, Auto Insurance Direct is committed to meeting the changing needs of its policyholders and ensuring they have the protection they deserve.

How can I get a quote from Auto Insurance Direct?

+

Getting a quote from Auto Insurance Direct is simple. You can visit their website and use the online quote tool, which guides you through a series of questions about your vehicle, driving history, and coverage needs. Alternatively, you can call their customer service team, who will be happy to provide you with a personalized quote over the phone.

What factors influence the cost of my auto insurance policy with Auto Insurance Direct?

+

The cost of your auto insurance policy with Auto Insurance Direct is influenced by several factors, including your age, gender, driving record, the type of vehicle you drive, and the coverage limits you choose. Additionally, the company may consider your credit score and the number of miles you drive annually. By providing accurate information during the quote process, you can ensure you receive an accurate estimate of your premium costs.

Does Auto Insurance Direct offer any discounts for students or seniors?

+

Yes, Auto Insurance Direct offers discounts for both students and seniors. Students may qualify for a Good Student Discount if they maintain a certain GPA, while seniors may be eligible for a Senior Driver Discount based on their age and driving record. These discounts are just one way Auto Insurance Direct rewards its policyholders for their responsible behavior and loyalty.