Missouri Insurance

Missouri, located in the heart of the United States, boasts a diverse landscape ranging from rolling hills and fertile plains to the iconic Ozark Mountains. Beyond its natural beauty, Missouri is home to a thriving economy, with a strong agricultural sector, robust manufacturing industries, and a vibrant healthcare system. As such, understanding the nuances of insurance in Missouri is crucial for individuals and businesses alike, to navigate the unique risks and opportunities that this state presents.

Understanding Missouri’s Insurance Landscape

The insurance industry in Missouri is governed by a comprehensive set of regulations and laws, which aim to protect consumers and ensure a stable and competitive market. These regulations cover various aspects, from the types of insurance available to the specific requirements for policyholders and insurers.

Missouri's Department of Commerce and Insurance (DCI) plays a pivotal role in overseeing the insurance sector. It enforces laws, ensures compliance, and provides resources to help consumers make informed decisions. The DCI's website offers a wealth of information on various insurance topics, making it a valuable resource for anyone looking to learn more about insurance in the state.

Key Insurance Types in Missouri

Missouri residents have access to a wide range of insurance options, each designed to address specific needs and risks. Some of the most common types of insurance in the state include:

- Auto Insurance: Missouri requires all vehicle owners to carry liability insurance, which covers bodily injury and property damage caused by the policyholder. Other optional coverages, such as collision and comprehensive insurance, can provide additional protection.

- Homeowners Insurance: This type of insurance is crucial for homeowners, as it provides coverage for the structure of the home, personal belongings, and liability protection. Renters can also opt for renters insurance to protect their possessions.

- Health Insurance: With a focus on providing accessible and affordable healthcare, Missouri offers various health insurance options, including individual and family plans, as well as Medicaid and Medicare for eligible residents.

- Life Insurance: Life insurance policies are an essential tool for financial planning and can provide a safety net for loved ones in the event of an unexpected passing.

- Business Insurance: From small startups to large corporations, businesses in Missouri can choose from a range of insurance options to protect their operations, assets, and employees.

The Importance of Insurance in Missouri

Insurance plays a critical role in Missouri’s society and economy. For individuals, insurance provides peace of mind and financial security, protecting against unforeseen events and ensuring access to essential services like healthcare. For businesses, insurance is a vital tool for managing risks, from property damage to liability claims, and it can also enhance a company’s reputation and credibility.

Moreover, the insurance industry contributes significantly to Missouri's economy. It provides jobs, stimulates economic growth, and supports various sectors, including healthcare, construction, and financial services. The industry's presence also attracts investment and fosters innovation, benefiting the state's economy as a whole.

Case Study: The Impact of Insurance on Missouri’s Agriculture Sector

Missouri’s agriculture sector is a prime example of how insurance can make a substantial difference in the state’s economy. Farmers and agricultural businesses face unique risks, from crop failures due to adverse weather conditions to liability issues related to farm equipment and livestock. Insurance provides a crucial safety net for these businesses, allowing them to recover from losses and continue their operations.

For instance, crop insurance protects farmers against potential losses due to natural disasters or price fluctuations. It provides financial stability, ensuring that farmers can continue to produce food and support their communities. Similarly, liability insurance for farms helps protect against lawsuits and claims, which can be costly and detrimental to a farm's operations.

Furthermore, insurance encourages innovation and sustainable practices in agriculture. With the right insurance coverage, farmers can invest in new technologies, adopt sustainable farming methods, and explore new markets with confidence, knowing that they are protected against potential risks.

Navigating Missouri’s Insurance Market

While Missouri offers a wide range of insurance options, navigating the market can be complex. Understanding the specific requirements, regulations, and options available is crucial for making informed decisions.

Researching and Comparing Policies

When researching insurance policies in Missouri, it’s essential to consider various factors. These include the coverage limits, deductibles, and any additional benefits or exclusions. Comparing multiple policies from different insurers can help consumers find the best value for their needs.

Online resources, such as insurance comparison websites and the DCI's consumer guides, can be valuable tools for researching and comparing policies. These resources provide detailed information on different insurance options, helping consumers make informed choices.

Working with Insurance Agents

Insurance agents play a crucial role in helping consumers navigate the complex world of insurance. They can provide personalized advice, answer questions, and guide individuals and businesses through the process of selecting the right insurance coverage.

Missouri is home to a large number of independent insurance agents, who represent multiple insurance companies and can offer a wide range of options. These agents can provide valuable insights into local market conditions, risks, and opportunities, ensuring that their clients receive the most appropriate coverage.

Understanding Insurance Claims

In the event of an insurance claim, understanding the process and your rights is crucial. Missouri’s insurance regulations outline the steps for filing claims and the responsibilities of both policyholders and insurers. It’s important to document all relevant information, communicate with your insurance company, and understand the timeline for processing claims.

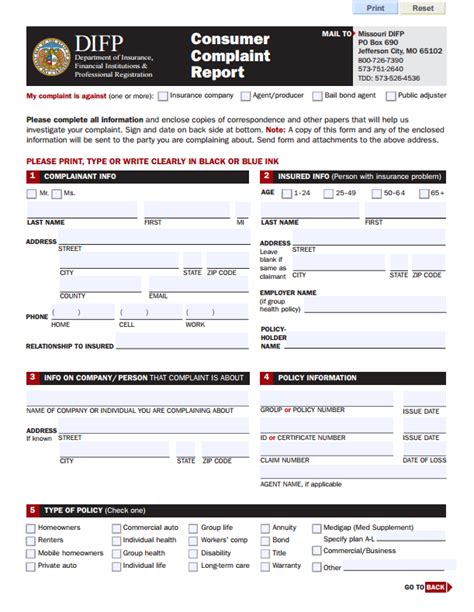

In cases where there is a dispute or disagreement over a claim, Missouri's insurance regulations provide avenues for resolution. This includes the option to file a complaint with the DCI or to seek mediation or arbitration services.

Future Trends and Innovations in Missouri’s Insurance Sector

The insurance industry in Missouri, like in many other states, is evolving rapidly. Technological advancements, changing consumer preferences, and emerging risks are shaping the future of insurance.

Technological Advancements

The integration of technology is transforming the insurance industry in Missouri. From digital applications for policy management to the use of data analytics for risk assessment, technology is enhancing efficiency, accuracy, and customer experience.

For instance, digital platforms and mobile apps are making it easier for consumers to manage their insurance policies, file claims, and access real-time information. These tools can also improve communication between insurers and policyholders, ensuring a faster and more transparent claims process.

Changing Consumer Preferences

Missouri’s consumers are becoming increasingly savvy and demanding when it comes to insurance. They seek personalized coverage, transparent pricing, and convenient digital options. Insurance companies in the state are adapting to these changing preferences by offering flexible policies, tailored coverage options, and digital services.

Emerging Risks and Opportunities

Missouri, like other regions, faces emerging risks such as climate change, cyber threats, and the impact of new technologies. These risks present challenges but also opportunities for the insurance industry to innovate and provide solutions.

For example, with the increasing frequency and severity of natural disasters, insurers in Missouri are developing innovative solutions, such as parametric insurance, to provide rapid payouts in the event of a catastrophe. Similarly, the rise of cyber threats has led to the development of specialized cyber insurance policies, protecting businesses and individuals from the financial fallout of a cyberattack.

Conclusion: A Comprehensive Guide to Missouri Insurance

Understanding Missouri’s insurance landscape is crucial for anyone living or doing business in the state. From auto and homeowners insurance to health and life coverage, insurance provides financial security and peace of mind. By researching, comparing policies, and working with insurance agents, Missourians can make informed decisions to protect their assets, their health, and their future.

As the insurance industry continues to evolve, embracing technological advancements and adapting to changing consumer preferences, Missouri's residents and businesses can expect a more efficient, personalized, and innovative insurance market. This guide aims to provide a comprehensive overview, helping readers navigate the complex world of insurance in Missouri with confidence and clarity.

What are the mandatory insurance requirements in Missouri for vehicle owners?

+Missouri requires vehicle owners to carry liability insurance with minimum limits of 25,000 for bodily injury per person, 50,000 for bodily injury per accident, and $10,000 for property damage. This coverage is mandatory to ensure that drivers can compensate others for damages caused in an accident.

How can I find affordable health insurance in Missouri?

+Missouri offers various options for affordable health insurance. You can explore plans through the Health Insurance Marketplace (also known as the Affordable Care Act or ACA) during open enrollment periods. Additionally, Medicaid is available to eligible low-income residents, and Medicare provides coverage for seniors and certain disabled individuals.

What resources are available to help me understand my insurance options in Missouri?

+The Missouri Department of Commerce and Insurance (DCI) provides a wealth of resources to help consumers understand their insurance options. Their website offers detailed guides, FAQs, and consumer tools to compare rates and understand coverage. Additionally, independent insurance agents can provide personalized advice based on your specific needs.