Medical Insurance Illinois

Medical insurance, also known as health insurance, is an essential aspect of modern healthcare systems. It provides financial protection and access to medical services for individuals and families, ensuring that they can receive necessary care without facing significant financial burdens. In the state of Illinois, the healthcare landscape is diverse, offering a range of insurance options to cater to the needs of its residents. This article aims to delve into the specifics of medical insurance in Illinois, exploring the various plans, coverage, and benefits available to residents, as well as the unique aspects of healthcare in this vibrant state.

Understanding Medical Insurance in Illinois

Illinois, being the fifth most populous state in the United States, boasts a robust healthcare system with numerous providers and a diverse range of medical insurance plans. The state’s insurance market is regulated by the Illinois Department of Insurance, which ensures that insurers comply with state laws and provide fair and transparent coverage options to residents.

The healthcare landscape in Illinois is influenced by both federal and state policies. The Affordable Care Act (ACA), a federal legislation, has had a significant impact on the availability and affordability of health insurance in the state. Illinois has embraced the ACA, and as a result, residents have access to a variety of insurance plans, including those offered through the Health Insurance Marketplace, where individuals and families can shop for and enroll in coverage during the open enrollment period.

Key Players in Illinois’ Medical Insurance Market

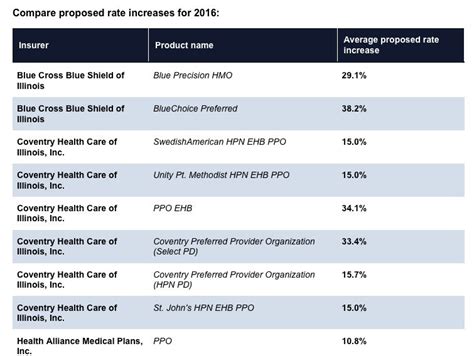

The medical insurance market in Illinois is dominated by several major insurers, each offering a range of plans to cater to different needs and budgets. Some of the prominent players include:

- Blue Cross Blue Shield of Illinois: One of the largest insurers in the state, BCBSIL offers a comprehensive range of plans, including individual, family, and employer-sponsored coverage. They are known for their extensive network of healthcare providers and innovative wellness programs.

- UnitedHealthcare: With a strong presence nationwide, UnitedHealthcare provides a wide array of insurance options in Illinois. Their plans often include additional benefits such as dental and vision coverage, making them appealing to families.

- HealthLink: Focused on providing affordable healthcare options, HealthLink offers insurance plans specifically tailored to Illinois residents. They collaborate with local healthcare providers to ensure accessible and cost-effective care.

- Cigna: Cigna’s presence in Illinois offers a variety of health plans, including PPO, HMO, and POS options. They emphasize personalized care and provide tools to help members manage their health and expenses.

Each insurer offers a unique set of plans with varying deductibles, copays, and coverage limits. Understanding these differences is crucial for individuals and families to choose the plan that best suits their healthcare needs and financial situations.

Types of Medical Insurance Plans in Illinois

Illinois residents have access to several types of medical insurance plans, each with its own structure and benefits. The choice of plan depends on individual preferences, healthcare needs, and financial considerations.

- Health Maintenance Organization (HMO): HMO plans typically have lower premiums but require members to choose a primary care physician (PCP) and obtain referrals for specialist visits. They often have a more limited network of providers.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility, allowing members to visit any healthcare provider without referrals. However, they generally have higher premiums and out-of-pocket costs.

- Point of Service (POS): POS plans combine features of both HMO and PPO plans. Members can choose between in-network and out-of-network providers, with varying levels of cost-sharing depending on their selection.

- Exclusive Provider Organization (EPO): EPO plans are similar to PPO plans but with a more restricted network of providers. Members usually have lower out-of-pocket costs when using in-network providers.

- High-Deductible Health Plans (HDHP): HDHPs have higher deductibles but lower premiums. They are often paired with Health Savings Accounts (HSAs) to help members save for healthcare expenses on a tax-advantaged basis.

When selecting a plan, it's essential to consider not only the premium and deductible but also the plan's network of providers, coverage for specific medical conditions or treatments, and any additional benefits or wellness programs offered.

Coverage and Benefits: A Comprehensive Overview

Medical insurance plans in Illinois provide coverage for a wide range of healthcare services, ensuring that residents have access to essential medical care. The level of coverage can vary significantly between plans, so it’s crucial to understand what is included and what may be excluded.

Essential Health Benefits

Under the Affordable Care Act, all health insurance plans sold in Illinois must include Essential Health Benefits (EHBs). These benefits cover a range of services, including:

- Ambulatory patient services (outpatient care)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services

- Pediatric services

It's important to note that while these benefits are considered essential, the specific coverage and cost-sharing for each service can vary between plans.

Additional Coverage Options

In addition to the essential benefits, many medical insurance plans in Illinois offer optional coverage for specialized services or treatments. These may include:

- Dental and Vision Coverage: Some plans include basic dental and vision benefits, providing coverage for routine check-ups, cleanings, and vision exams. These benefits can be particularly valuable for families with children.

- Alternative Medicine: Certain plans offer coverage for alternative or complementary medicine practices such as acupuncture, chiropractic care, or massage therapy.

- Wellness Programs: Many insurers in Illinois promote healthy lifestyles by offering wellness programs. These programs may include discounts on gym memberships, weight loss programs, smoking cessation support, or incentives for achieving certain health goals.

- Telehealth Services: With the rise of virtual healthcare, many plans now include coverage for telehealth services, allowing members to consult with healthcare providers remotely.

Out-of-Pocket Costs and Cost-Sharing

Understanding the out-of-pocket costs associated with medical insurance is crucial. These costs typically include deductibles, copayments, and coinsurance. Deductibles are the amount a member must pay out of pocket before the insurance coverage kicks in. Copayments are fixed amounts paid for specific services, such as doctor visits or prescription medications. Coinsurance refers to the percentage of the cost of a service that the member must pay after meeting the deductible.

The choice of plan affects the out-of-pocket costs. Plans with lower premiums often have higher deductibles and out-of-pocket limits, while plans with higher premiums may have lower deductibles and more favorable cost-sharing arrangements.

| Plan Type | Average Deductible | Average Out-of-Pocket Limit |

|---|---|---|

| HMO | $1,500 - $3,000 | $6,000 - $8,000 |

| PPO | $2,000 - $4,000 | $6,000 - $10,000 |

| EPO | $2,000 - $3,500 | $6,500 - $8,500 |

| HDHP | $3,000 - $6,000 | $6,000 - $13,000 |

It's important to review these costs carefully when choosing a plan, as they can significantly impact the overall affordability of healthcare.

Navigating the Healthcare System: A Resident’s Guide

Understanding how to navigate the healthcare system in Illinois is crucial for residents to make the most of their medical insurance coverage. Here are some key considerations and tips to ensure a smooth healthcare experience.

Choosing the Right Healthcare Provider

When selecting a healthcare provider, it’s essential to consider their network status within your insurance plan. In-network providers are those with whom your insurance company has negotiated rates, ensuring that your out-of-pocket costs are lower. Out-of-network providers may result in higher costs or may not be covered by your plan.

Research the network of providers offered by your insurance plan and choose a primary care physician (PCP) who aligns with your healthcare needs and preferences. Your PCP can serve as your healthcare advocate, coordinating your care and providing referrals to specialists when necessary.

Understanding Your Plan’s Benefits and Limitations

Take the time to thoroughly review your insurance plan’s summary of benefits and coverage. This document outlines what is covered, any exclusions, and the specific cost-sharing arrangements. It’s crucial to understand:

- Your plan’s deductible and how it applies to different services.

- Copayments and coinsurance rates for various healthcare services.

- Any limitations or exclusions for specific treatments or conditions.

- Prescription drug coverage and any restrictions on brand-name medications.

- Any additional benefits or wellness programs offered by your insurer.

By familiarizing yourself with these details, you can make informed decisions about your healthcare and avoid unexpected expenses.

Utilizing Preventive Care Services

Preventive care is an essential component of healthcare, and many insurance plans in Illinois cover these services at little to no cost to members. These services include routine check-ups, immunizations, cancer screenings, and counseling for various health concerns.

Take advantage of these preventive care services to maintain your health and catch potential issues early on. Many insurers also offer incentives or rewards for completing certain preventive measures, so be sure to explore these opportunities.

Managing Chronic Conditions and Special Needs

If you have a chronic condition or special healthcare needs, it’s crucial to choose an insurance plan that provides adequate coverage for your specific requirements. Many plans offer specialized programs or case management services to support individuals with complex healthcare needs.

Consider the following when choosing a plan:

- Coverage for medications and treatments specific to your condition.

- Access to specialists or specialized facilities.

- Availability of case management or care coordination services.

- Support programs for managing chronic conditions.

Appealing Insurance Decisions

In some cases, insurance companies may deny coverage for certain services or treatments. If you believe your insurance company has made an incorrect decision, you have the right to appeal. The appeals process typically involves a review by an independent party to ensure fairness.

Familiarize yourself with your insurance plan's appeals process and the timelines involved. If necessary, seek assistance from patient advocacy groups or legal professionals who specialize in healthcare matters.

The Future of Medical Insurance in Illinois

The landscape of medical insurance in Illinois is continually evolving, influenced by federal and state policies, advancements in healthcare technology, and changing consumer needs. As the state strives to improve access to healthcare and reduce costs, several key trends and initiatives are shaping the future of medical insurance in Illinois.

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue in Illinois. Many insurers are expanding their coverage for virtual care, recognizing its potential to improve access to healthcare, especially in rural areas, and reduce the burden on in-person healthcare facilities.

As telehealth becomes more integrated into the healthcare system, insurers are exploring innovative ways to utilize virtual technology for preventive care, chronic disease management, and even mental health services. This shift towards virtual care has the potential to enhance the efficiency and accessibility of healthcare for Illinois residents.

Value-Based Care and Payment Models

Illinois, like many other states, is transitioning towards value-based care models, which focus on the quality and outcomes of healthcare rather than the quantity of services provided. This shift aims to improve patient health while reducing costs by incentivizing providers to deliver efficient, high-quality care.

Insurers in Illinois are increasingly adopting value-based payment models, such as Accountable Care Organizations (ACOs) and Bundled Payment Programs. These models encourage healthcare providers to work together to coordinate patient care, improve health outcomes, and reduce unnecessary healthcare utilization.

Addressing Social Determinants of Health

Recognizing that social factors, such as housing instability, food insecurity, and poverty, significantly impact health outcomes, Illinois is taking steps to address these social determinants of health. Insurers and healthcare providers are collaborating to develop programs and initiatives that address these underlying issues, with the goal of improving overall population health.

This holistic approach to healthcare aims to create a more equitable and sustainable healthcare system in Illinois, where residents have the resources and support they need to maintain good health beyond the confines of traditional medical care.

Advancements in Technology and Data Analytics

The healthcare industry is rapidly embracing technology and data analytics to improve efficiency and personalize healthcare. In Illinois, insurers are leveraging these advancements to enhance member engagement, streamline administrative processes, and provide more tailored coverage options.

From mobile apps that track health metrics and provide personalized recommendations to predictive analytics that identify high-risk individuals and intervene early, technology is transforming the way healthcare is delivered and experienced in Illinois.

Community-Based Initiatives

Illinois is fostering community-based initiatives to improve access to healthcare and promote health equity. These initiatives often involve collaborations between insurers, healthcare providers, and community organizations to address specific health needs within different populations or geographic areas.

Examples of community-based initiatives include:

- Mobile health clinics that provide basic healthcare services to underserved areas.

- Community health worker programs that provide education, support, and navigation assistance to individuals with complex healthcare needs.

- Partnerships with local businesses to offer wellness programs and health education to employees.

By investing in these community-based initiatives, Illinois aims to create a healthcare system that is responsive to the unique needs of its diverse population.

How do I choose the right medical insurance plan for my needs in Illinois?

+When selecting a medical insurance plan in Illinois, consider your healthcare needs, the network of providers, and the cost-sharing arrangements. Evaluate plans based on your specific requirements, whether it’s coverage for a chronic condition, access to a particular specialist, or the inclusion of dental and vision benefits. Compare premiums, deductibles, and out-of-pocket limits to find a plan that aligns with your budget and healthcare needs.

What is the open enrollment period for medical insurance in Illinois, and can I enroll outside of it?

+The open enrollment period for medical insurance in Illinois typically runs from November 1st to December 15th each year. However, you may qualify for a Special Enrollment Period if you experience certain life events, such as losing other health coverage, getting married, or having a baby. During these special enrollment periods, you can enroll in a new plan outside of the standard open enrollment timeframe.

Are there any financial assistance programs available for medical insurance in Illinois?

+Yes, Illinois offers financial assistance programs to help residents afford medical insurance. The state provides subsidies and tax credits to individuals and families with low to moderate incomes. These subsidies can significantly reduce the cost of premiums, making healthcare more accessible to those who need it.