Renters Insurance Quote

Understanding Renters Insurance: Protecting Your Possessions and Peace of Mind

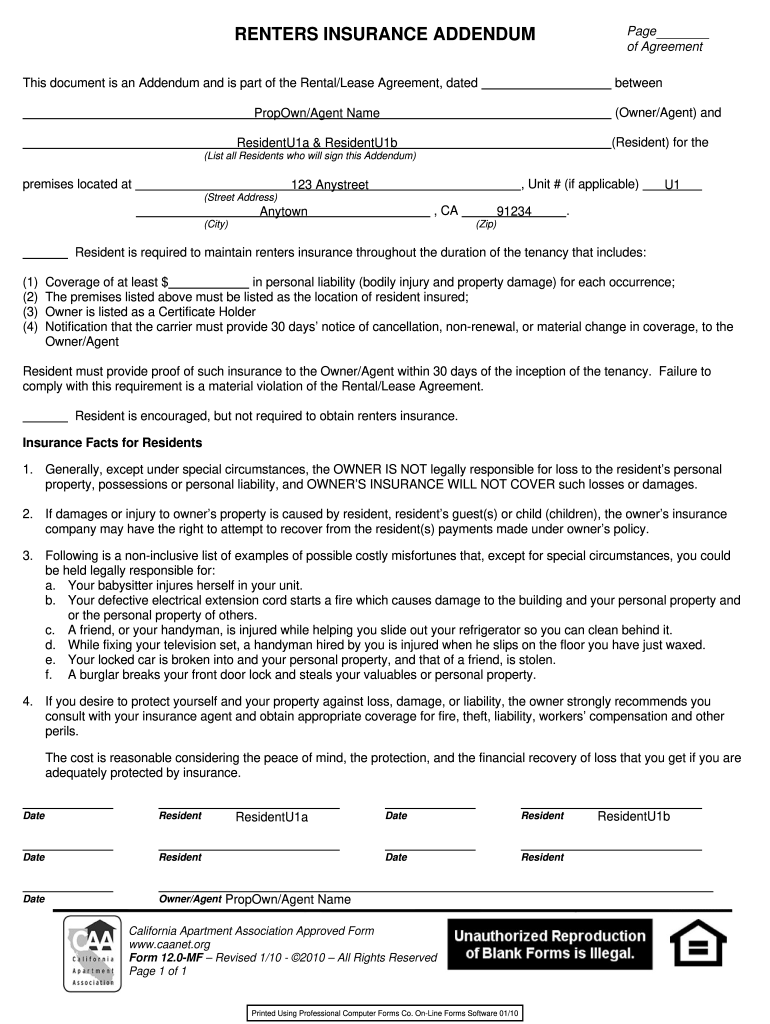

In the world of rental properties, one often-overlooked aspect is the importance of renters insurance. This essential coverage safeguards tenants from a wide range of potential losses and liabilities, offering peace of mind and financial protection. With an increasing number of individuals choosing the rental lifestyle, understanding the value of renters insurance is crucial.

Renters insurance is a type of property insurance specifically tailored for individuals who lease or rent their living spaces. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on the tenant's personal belongings and potential liability risks. It acts as a safety net, ensuring that even if your rented home suffers damage or loss, your personal items and well-being are adequately covered.

The Importance of Renters Insurance: Unraveling the Benefits

Renters insurance is more than just a policy; it's a comprehensive protection plan designed to address various scenarios that could potentially disrupt your daily life. From protecting your belongings against theft or damage to covering medical expenses for injuries that occur on your rented premises, renters insurance is a versatile tool that provides financial security and peace of mind.

Protection Against Property Loss

One of the primary advantages of renters insurance is the protection it offers for your personal belongings. Whether you're a student living in a dorm, a young professional renting an apartment, or a family residing in a rental home, your possessions are valuable. Renters insurance provides coverage for a wide range of items, including furniture, electronics, clothing, and even collectibles. In the unfortunate event of a fire, theft, or other covered perils, renters insurance ensures you're not left financially burdened.

| Perils Covered | Coverage Details |

|---|---|

| Fire | Protection against fire damage, including smoke damage. |

| Theft | Coverage for stolen items, both inside and outside the rental property. |

| Vandalism | Protection against intentional damage to your belongings. |

| Water Damage | Coverage for damage caused by plumbing issues, leaking roofs, or other water-related incidents. |

Liability Protection

Renters insurance also provides liability coverage, which is crucial in today's litigious society. If someone is injured while on your rented property, renters insurance can help cover the medical expenses and potential legal costs. This coverage extends beyond your immediate guests, offering protection if, for instance, a delivery person or service worker is injured on your premises.

Additionally, renters insurance can provide coverage for personal liability outside your rented home. For instance, if you accidentally cause damage to someone else's property or are found responsible for an injury, your renters insurance policy may step in to cover the associated costs.

Additional Living Expenses

In the event of a covered loss that renders your rental property uninhabitable, renters insurance often includes additional living expenses coverage. This provision ensures you have the financial means to secure temporary housing and cover related expenses, such as meals and transportation, until you can return to your rented home.

Obtaining a Renters Insurance Quote: The Process Explained

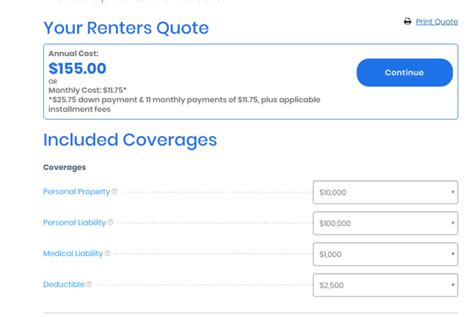

Securing a renters insurance quote is a straightforward process that can be completed online or with the assistance of an insurance agent. The quote you receive will be tailored to your specific needs and circumstances, ensuring you get the right level of coverage at a competitive price.

Factors Influencing Renters Insurance Quotes

Several factors come into play when determining the cost of renters insurance. Understanding these factors can help you make informed decisions about your coverage and potentially save money.

- Coverage Limits: The value of your personal belongings and the amount of liability coverage you require are key considerations. Higher coverage limits typically result in higher premiums.

- Deductibles: Choosing a higher deductible can lower your premium, but it means you'll pay more out of pocket if you need to file a claim.

- Location: The cost of renters insurance can vary based on your rental property's location. Areas with higher crime rates or a history of natural disasters may have higher premiums.

- Policy Add-ons : Additional coverage options, such as personal property replacement cost or identity theft protection, can increase your premium but provide enhanced protection.

Online Quote Process

Obtaining a renters insurance quote online is a convenient and efficient process. Many insurance providers offer online quote tools that guide you through a series of questions to assess your coverage needs. Here's a step-by-step guide:

- Visit the insurance provider's website and locate the renters insurance quote tool.

- Enter your personal information, including your name, date of birth, and contact details.

- Provide details about your rental property, such as the type of dwelling (apartment, condo, house), the square footage, and the year it was built.

- Estimate the value of your personal belongings and select the desired coverage limits.

- Choose your preferred deductible amount and any additional coverage options you wish to include.

- Review the quote and customize it to fit your needs. You can often adjust coverage limits and deductibles to find the right balance between cost and protection.

- Complete the purchase process or save the quote for later review.

Working with an Insurance Agent

While online quotes are convenient, working with an insurance agent can provide personalized guidance and expertise. An agent can help you navigate the complexities of renters insurance, ensuring you have the right coverage for your unique situation.

- Contact a local insurance agency or an independent insurance broker.

- Provide the agent with information about your rental property and your personal belongings.

- Discuss your coverage needs and any specific concerns or risks you want to address.

- The agent will then present you with customized renters insurance quotes from various providers.

- Review the quotes together, comparing coverage limits, deductibles, and additional features.

- Select the policy that best meets your needs and budget.

Conclusion: Empowering Your Rental Journey with Renters Insurance

Renters insurance is an invaluable tool for anyone leasing a living space. It provides protection against a wide range of potential risks, ensuring your personal belongings are safeguarded and your liability is covered. Whether you're a first-time renter or a seasoned tenant, understanding the benefits and obtaining a tailored renters insurance quote is a critical step towards securing your financial well-being and peace of mind.

Remember, your rental journey doesn't have to be fraught with uncertainty. With the right renters insurance coverage, you can focus on creating memories and living your best life in your rented home.

How much does renters insurance typically cost?

+The cost of renters insurance can vary based on several factors, including coverage limits, deductibles, location, and the value of your personal belongings. On average, renters insurance policies range from 15 to 30 per month, but this can be higher or lower depending on your specific circumstances.

Does renters insurance cover natural disasters like floods or earthquakes?

+Standard renters insurance policies typically do not cover damage caused by natural disasters such as floods or earthquakes. However, you can often purchase additional coverage or endorsements to protect against these specific perils. It’s essential to review your policy’s exclusions and consider your risk tolerance when deciding on additional coverage.

What happens if I need to file a claim with my renters insurance?

+If you need to file a claim with your renters insurance, the first step is to contact your insurance provider and provide them with the details of the incident. They will guide you through the claims process, which may involve completing a claim form, providing documentation of the loss or damage, and possibly arranging for an inspection. It’s important to act promptly and follow the insurer’s instructions to ensure a smooth claims process.